Which Of The Following Accounts Is Increased By A Debit

For those navigating the world of accounting, understanding the fundamental principles of debits and credits is essential. A common question arises: which types of accounts increase when a debit entry is made? This article aims to clarify this crucial concept, drawing on established accounting practices and resources.

At the heart of accounting lies the double-entry bookkeeping system. This system dictates that every financial transaction affects at least two accounts. Knowing which accounts are impacted by debits and credits is key to accurately recording these transactions.

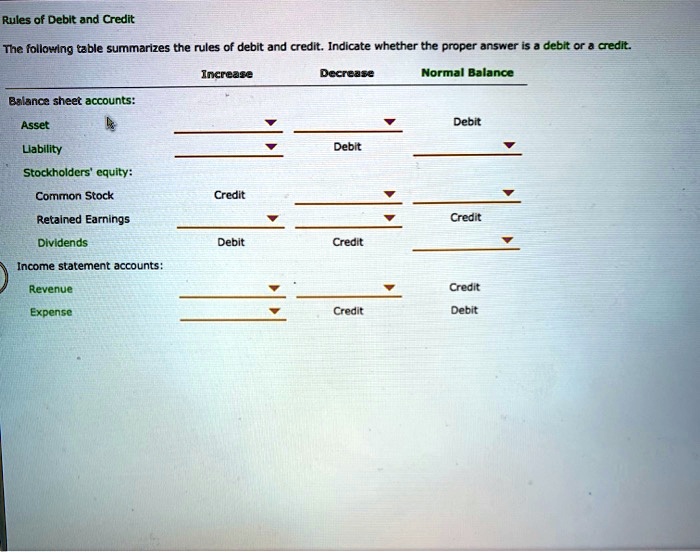

The Accounting Equation and Debits/Credits

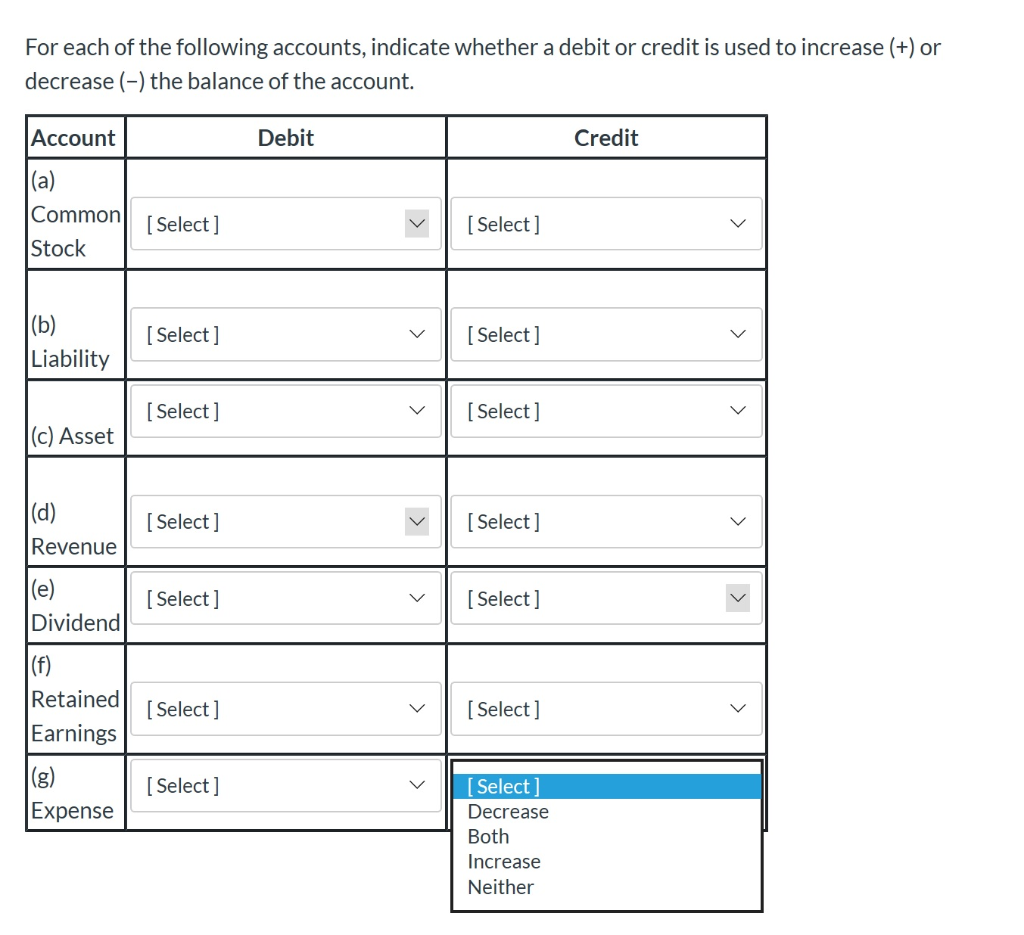

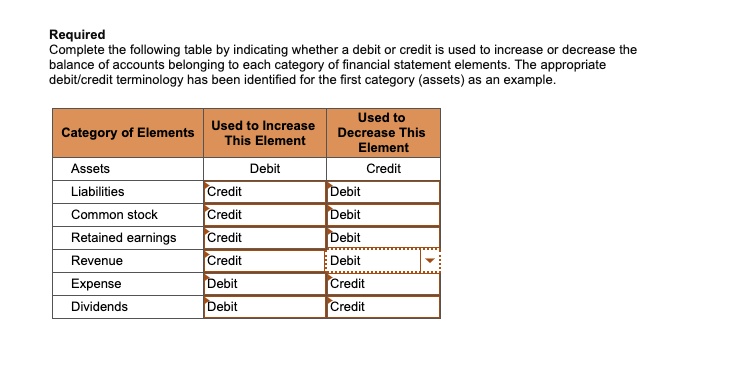

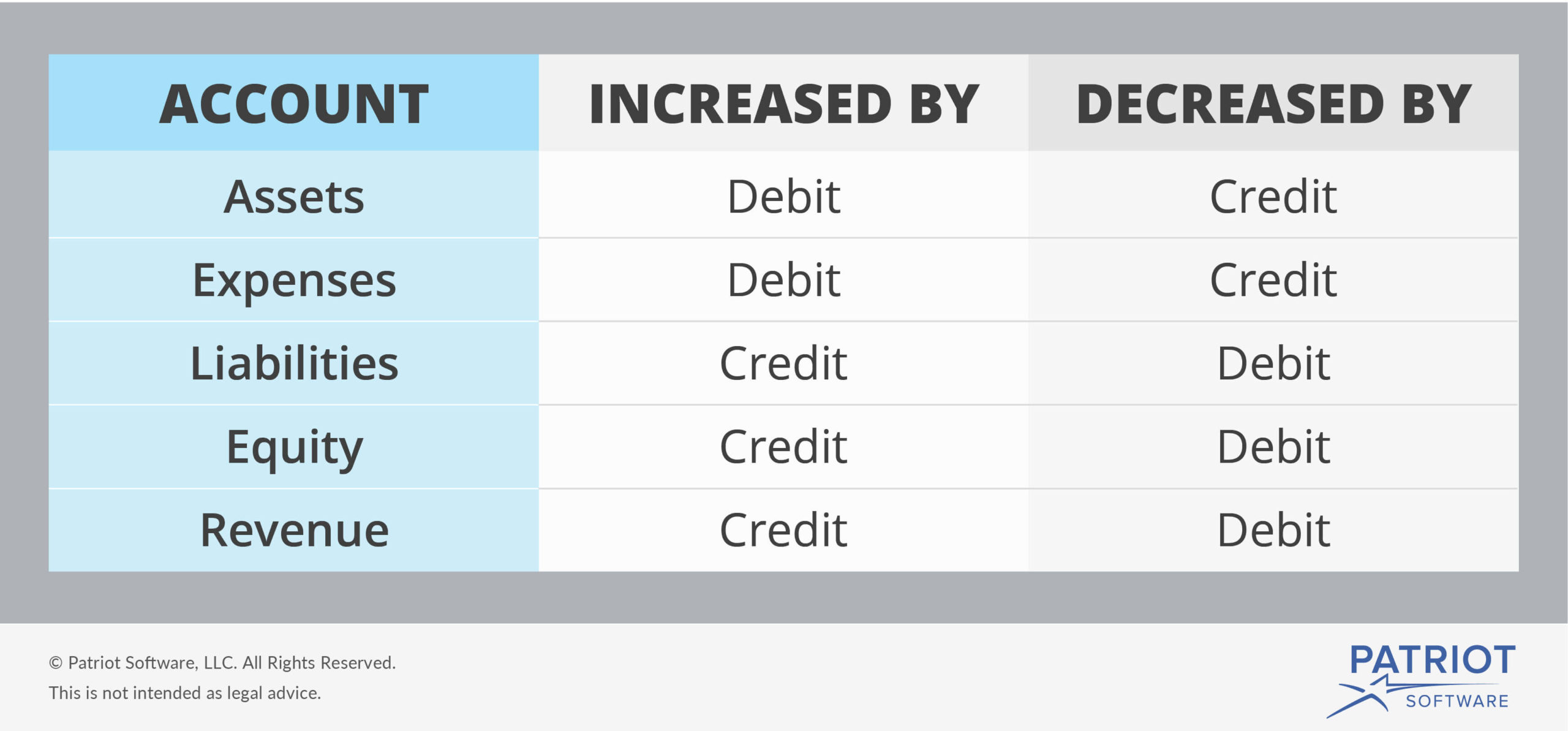

The basic accounting equation is the foundation of this system: Assets = Liabilities + Equity. Debits and credits are used to increase or decrease these accounts.

Understanding the effects of debits and credits requires recognizing how they impact each side of the equation. Assets, being on the left side, increase with a debit and decrease with a credit.

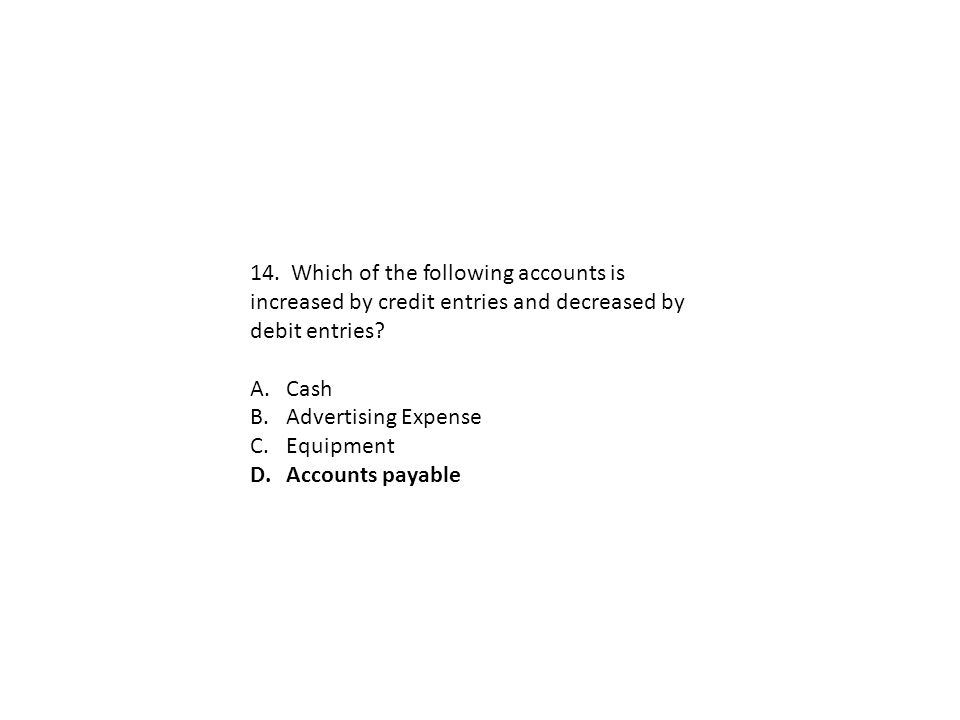

Conversely, Liabilities and Equity, residing on the right side, increase with a credit and decrease with a debit.

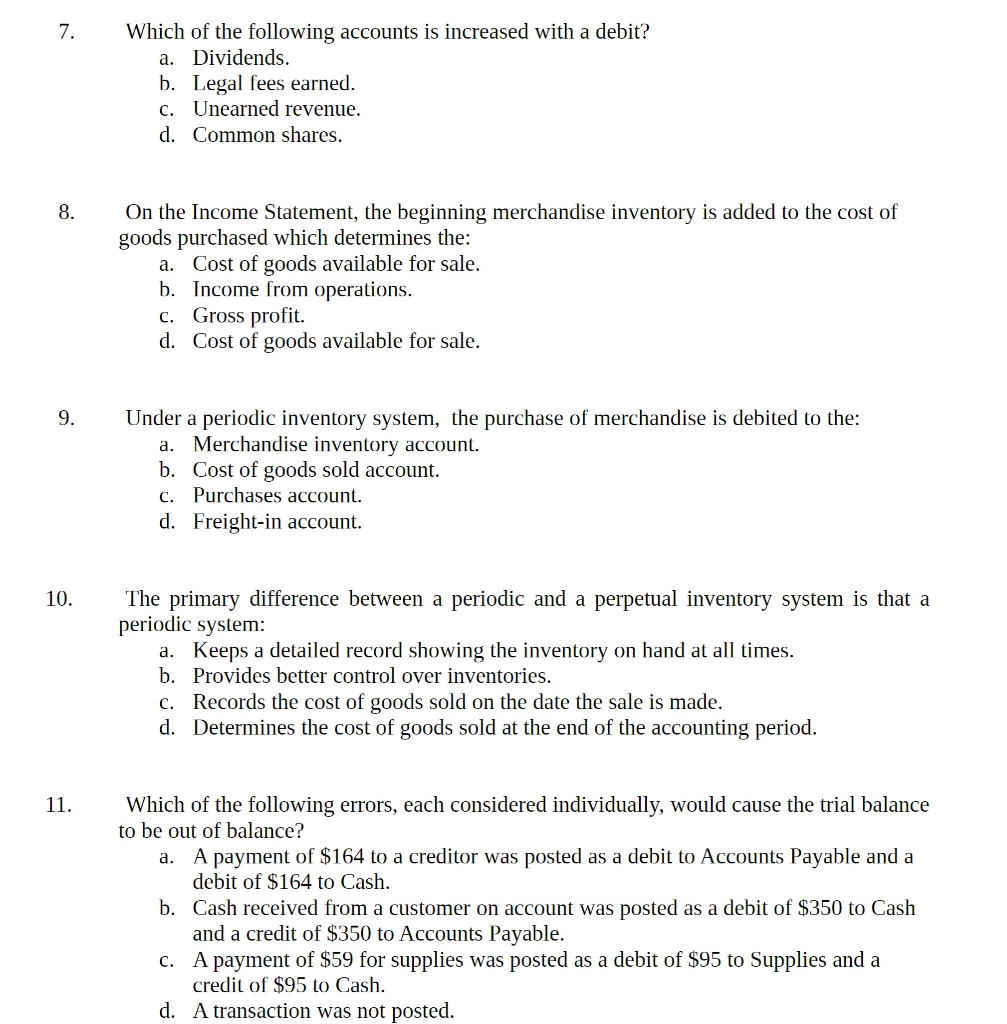

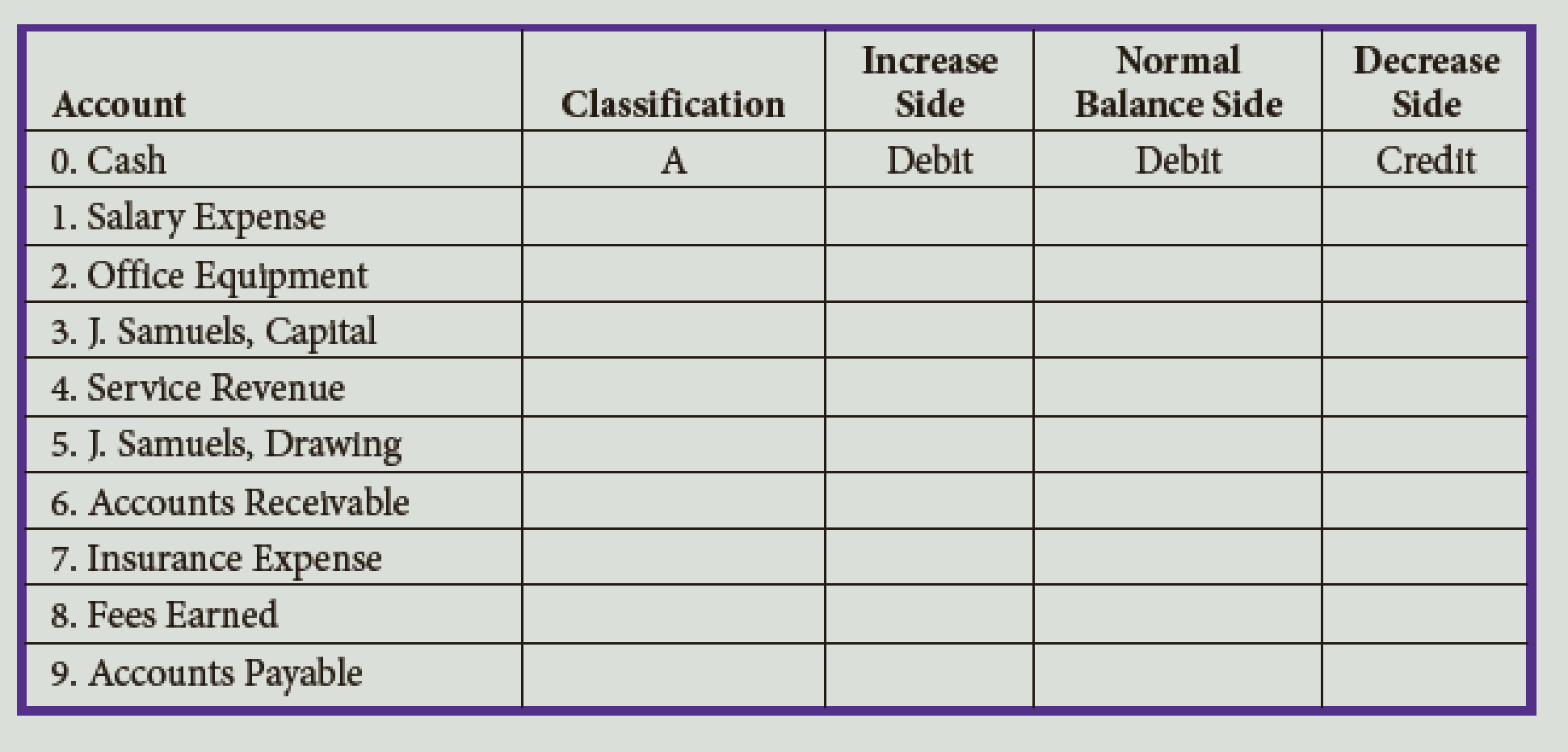

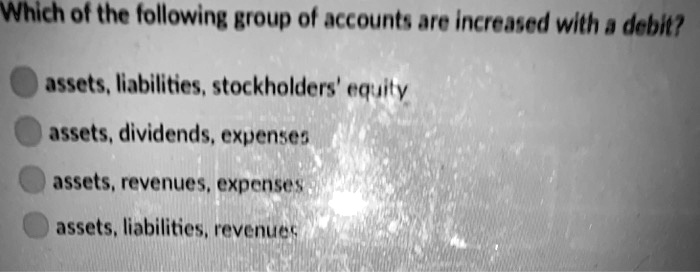

Accounts Increased by a Debit

A debit increases specific types of accounts. Primarily, these include Asset accounts and Expense accounts.

Assets encompass resources owned by a company, such as cash, accounts receivable, inventory, and equipment. When a company receives cash, the cash account (an asset) is debited, reflecting the increase in this resource.

Expense accounts represent the costs incurred by a company in generating revenue. Salaries, rent, and utilities are examples of expenses that are increased with a debit entry.

The Impact of Debits on Specific Account Types

Delving deeper, let's examine specific account types: Cash, Accounts Receivable, Inventory, and Expenses.

Cash, as mentioned earlier, is a quintessential asset account. A debit to cash signifies an increase in the company’s cash balance.

Accounts Receivable represents money owed to the company by its customers. When a sale is made on credit, accounts receivable is debited, reflecting the amount owed.

Inventory, another asset, represents the goods a company holds for sale. A debit to inventory occurs when a company purchases or manufactures more goods.

Expenses, such as rent expense or salary expense, are debited when those costs are incurred. This decreases the company's profitability.

Examples in Practice

Consider a scenario where a company purchases equipment for $10,000. The journal entry would involve a debit to the equipment account (an asset) and a credit to the cash account (assuming cash payment).

Another example: paying employee salaries of $5,000. The journal entry would debit the salary expense account and credit the cash account.

These examples illustrate the core principle: debits increase asset and expense accounts, while credits decrease them.

Why This Knowledge Matters

Understanding which accounts are increased by debits is crucial for accurate financial record-keeping. Properly recording transactions ensures the integrity of financial statements.

Accurate financial statements are essential for informed decision-making by stakeholders. Investors, creditors, and management rely on these statements to assess a company's financial health and performance.

Errors in debit and credit entries can lead to significant discrepancies in financial reporting. This can result in inaccurate assessments and potentially detrimental business decisions.

Resources and Further Learning

Numerous resources are available for those seeking to deepen their understanding of accounting principles. The Financial Accounting Standards Board (FASB) provides authoritative guidance on accounting standards.

Textbooks, online courses, and professional certifications offer comprehensive learning opportunities. Consult reputable sources and seek guidance from experienced accounting professionals.

Continual learning and staying abreast of accounting updates are essential. The accounting landscape is constantly evolving, requiring professionals to adapt and refine their knowledge.

In conclusion, a debit increases asset and expense accounts. Mastering this concept is fundamental for accurate bookkeeping and sound financial management.