Which Of The Following Are Current Liabilities

In the intricate world of finance, understanding the classification of liabilities is paramount for businesses of all sizes. Misclassifying debt can lead to inaccurate financial reporting, impacting investor confidence and potentially triggering regulatory scrutiny. Accurately distinguishing between current and non-current liabilities is not merely an accounting exercise; it's a cornerstone of sound financial management.

This article will delve into the specifics of current liabilities, providing clarity on which obligations fall under this category and why their proper identification is critical. By examining real-world examples and drawing upon authoritative sources, we aim to equip readers with the knowledge necessary to navigate the complexities of balance sheet analysis.

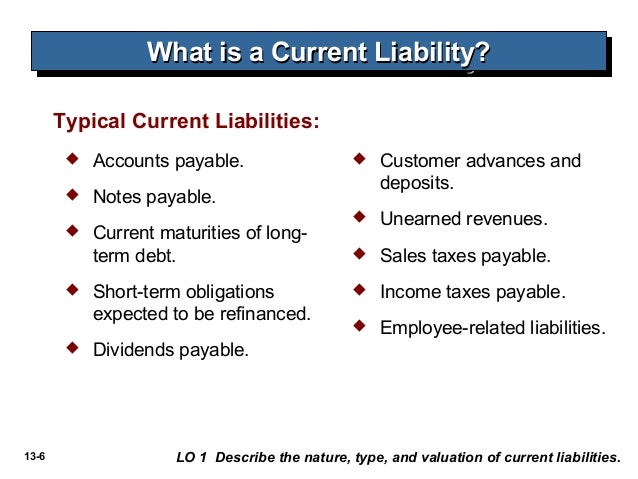

Defining Current Liabilities

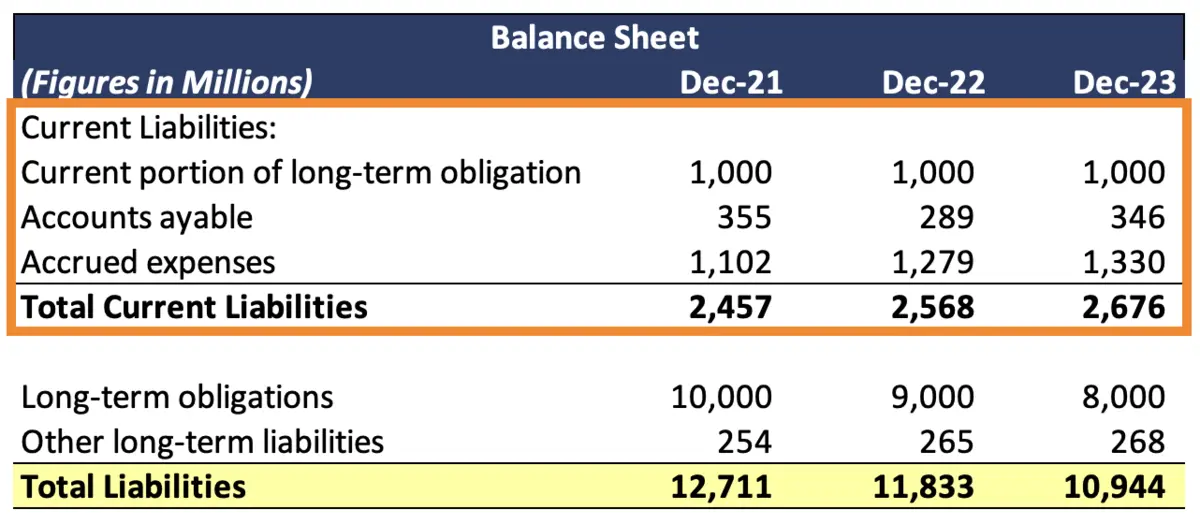

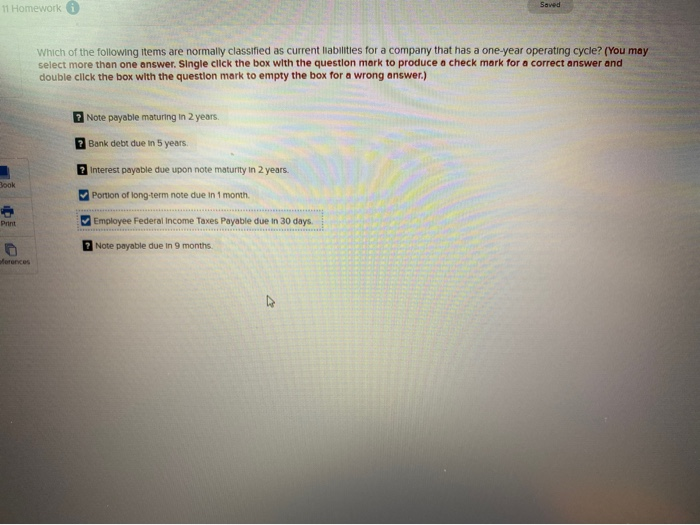

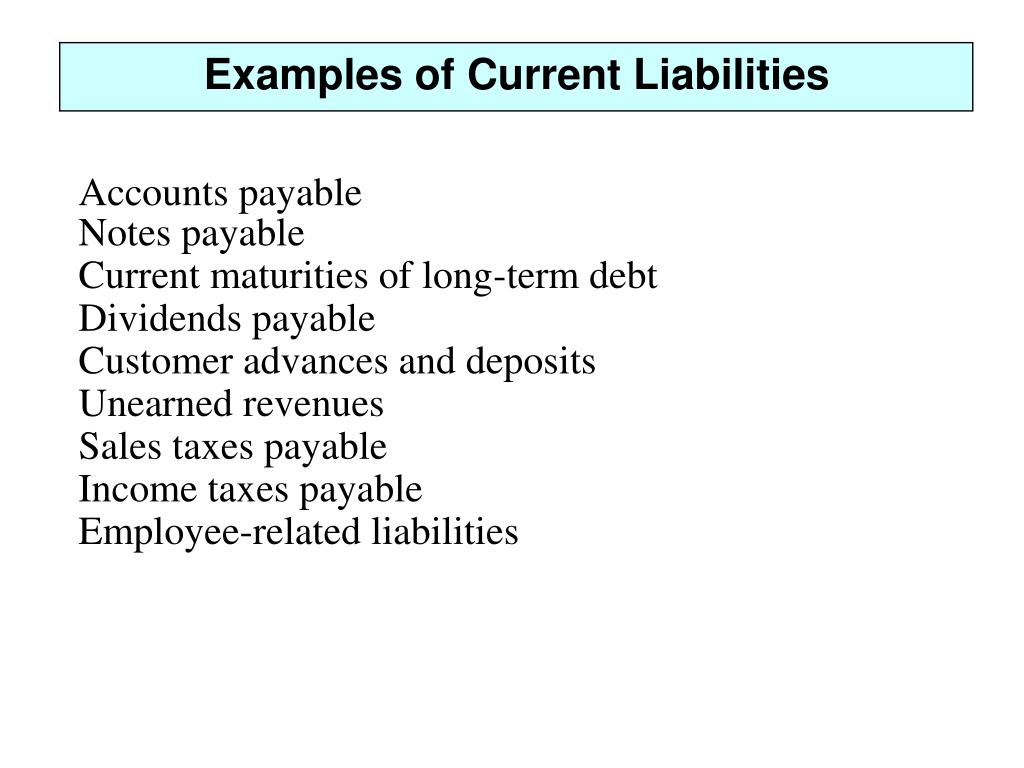

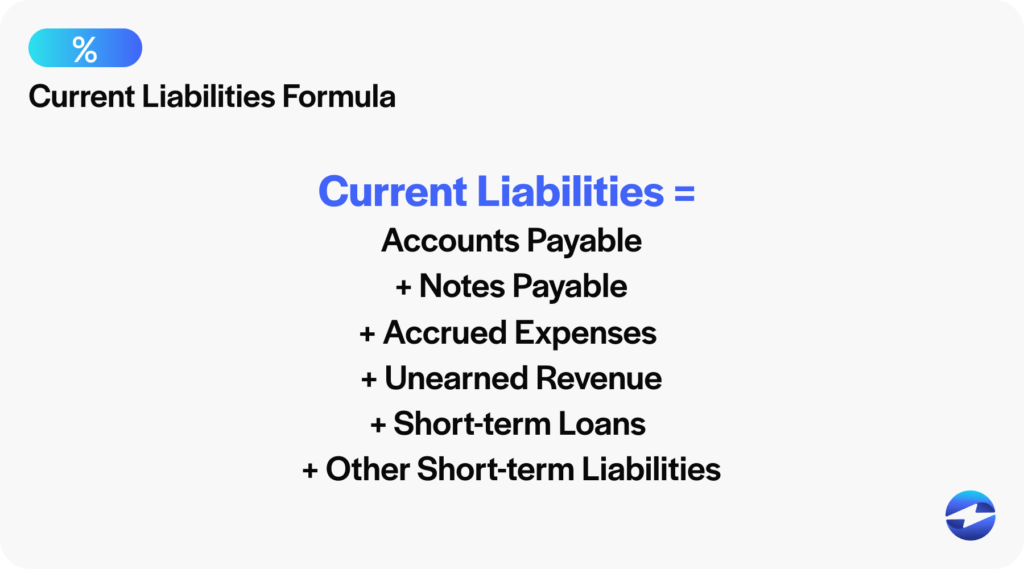

Current liabilities are short-term financial obligations that a company expects to settle within one year or within its normal operating cycle, whichever is longer. They represent a company's immediate financial obligations and are crucial for assessing its short-term liquidity and solvency. These liabilities appear on the company's balance sheet and play a significant role in calculating key financial ratios.

Accounts Payable

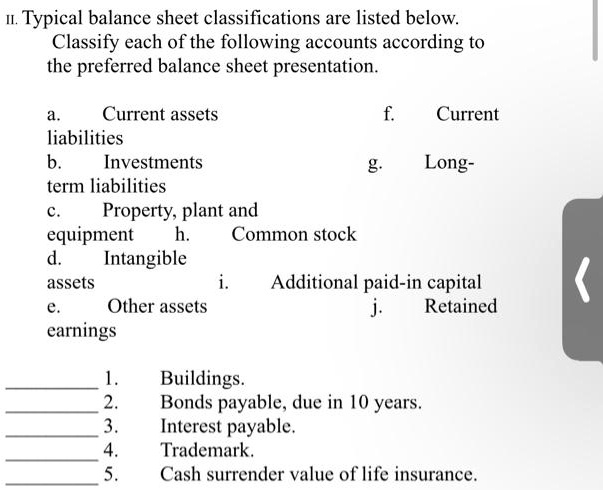

Accounts payable (AP) represent the amounts a company owes to its suppliers for goods or services purchased on credit. This is a common and often substantial current liability, reflecting the normal course of business operations. Efficiently managing AP is vital for maintaining strong supplier relationships and optimizing cash flow.

Salaries Payable

Salaries payable refer to the wages and salaries owed to employees for work performed but not yet paid. This typically includes accrued wages, bonuses, and commissions. These obligations are usually settled within a short timeframe, typically a few days or weeks after the end of the pay period.

Short-Term Loans and Lines of Credit

Any portion of a loan or line of credit that is due within one year is classified as a current liability. This includes principal payments and accrued interest. Companies often utilize short-term loans to finance working capital needs or bridge temporary cash flow gaps.

Accrued Expenses

Accrued expenses represent liabilities that have been incurred but not yet paid as of the balance sheet date. Common examples include accrued interest expense, accrued utilities expense, and accrued rent expense. Recognizing these expenses accurately is crucial for adhering to accrual accounting principles.

Deferred Revenue

Deferred revenue, also known as unearned revenue, arises when a company receives payment for goods or services that have not yet been delivered or performed. It represents an obligation to provide those goods or services in the future. As the goods or services are delivered, the deferred revenue is recognized as earned revenue.

Current Portion of Long-Term Debt

If a company has long-term debt, the portion that is due within one year is classified as a current liability. This reflects the immediate obligation to repay a portion of the outstanding debt balance. Proper classification ensures accurate reflection of the company's short-term financial obligations.

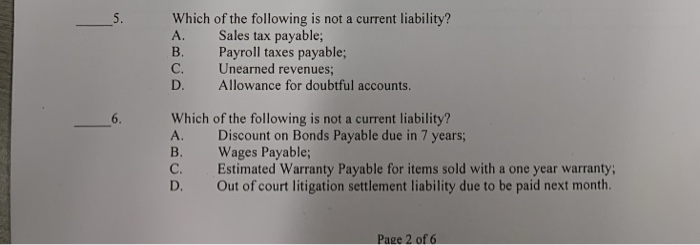

Items Often Mistaken for Current Liabilities

It's important to distinguish current liabilities from other types of obligations. For example, long-term debt, even if it requires periodic interest payments, is not a current liability unless a portion is due within the year. Similarly, provisions for future expenses, such as warranty claims, are often classified separately based on the timing of expected outflows.

Long-Term Debt

The key differentiator here is the timeframe for repayment. If the principal repayment is due beyond one year, it remains a long-term liability, not a current one. However, as previously mentioned, any portion due within the year shifts to the current liabilities section.

Contingent Liabilities

Contingent liabilities are potential obligations that depend on the outcome of a future event, such as a lawsuit. These are not recorded as liabilities unless it is probable that an outflow of resources will occur and the amount can be reasonably estimated. If the likelihood is remote, no disclosure is required.

Impact on Financial Analysis

The accurate classification of current liabilities is critical for several key financial ratios. These ratios, such as the current ratio (current assets divided by current liabilities) and the quick ratio (liquid assets divided by current liabilities), provide insights into a company's ability to meet its short-term obligations. Errors in classification can distort these ratios and lead to inaccurate assessments of financial health.

Current Ratio and Quick Ratio

A healthy current ratio, generally above 1.0, indicates that a company has sufficient current assets to cover its current liabilities. The quick ratio offers a more conservative view by excluding inventory, which may not be easily converted to cash. Both ratios are closely watched by investors and creditors.

Working Capital Management

Effective management of current liabilities is essential for optimizing working capital. By carefully managing accounts payable, short-term debt, and other current obligations, companies can improve their cash flow and reduce their borrowing costs. Efficient working capital management contributes to overall financial stability and profitability.

Expert Perspectives and Regulatory Guidance

Accounting standards, such as those issued by the Financial Accounting Standards Board (FASB) in the United States and the International Accounting Standards Board (IASB) internationally, provide detailed guidance on the classification of liabilities. These standards aim to ensure consistency and comparability in financial reporting. Consulting with qualified accounting professionals is often necessary to navigate complex situations and ensure compliance with applicable regulations.

"Proper classification of liabilities is not just about compliance; it's about providing stakeholders with a clear and accurate picture of a company's financial position," says Jane Doe, a certified public accountant with over 20 years of experience.

The Future of Liability Classification

As businesses become increasingly complex and globalized, the challenges of liability classification are likely to grow. Emerging technologies, such as blockchain and artificial intelligence, may offer new opportunities to improve the accuracy and efficiency of financial reporting. Ongoing developments in accounting standards and regulatory oversight will also play a crucial role in shaping the future of liability classification.

In conclusion, accurately identifying and classifying current liabilities is fundamental to sound financial management. By understanding the specific types of obligations that fall under this category and appreciating their impact on financial analysis, businesses can make informed decisions and maintain investor confidence. A proactive approach to liability management is essential for long-term financial success. Diligent monitoring and expert advice are key.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

:max_bytes(150000):strip_icc()/current_liabiltiies_0704-b640301c072042dcb57753f9b23297a6.jpg)