Which Of The Following Are Rights Of Common Stock Holders

Imagine strolling through a vibrant farmer's market, each stall brimming with colorful produce, handcrafted goods, and the promise of a fruitful harvest. Now, picture each stall representing a company listed on the stock exchange, and you, a proud common shareholder, holding a basket brimming with the potential for growth and participation. But what exactly does that basket of ownership entitle you to? What rights do you, as a common stockholder, truly possess?

This article will explore the fundamental rights afforded to common stockholders, cutting through the complexities of the financial world to illuminate the privileges and responsibilities that come with owning a piece of a company. Understanding these rights is crucial for every investor, enabling informed decision-making and active participation in the corporate governance process.

The Foundation: Ownership and its Privileges

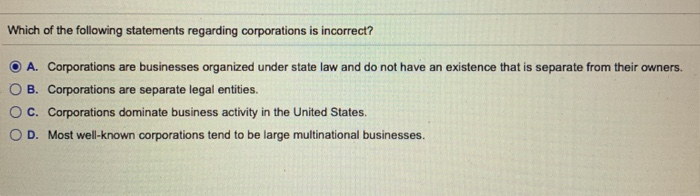

At its core, owning common stock signifies partial ownership in a company. This ownership, however small or large, comes with specific rights designed to protect the shareholder's investment and ensure accountability within the corporation.

These rights are not mere suggestions; they are legally binding entitlements, carefully crafted to foster a fair and transparent environment for both the company and its investors.

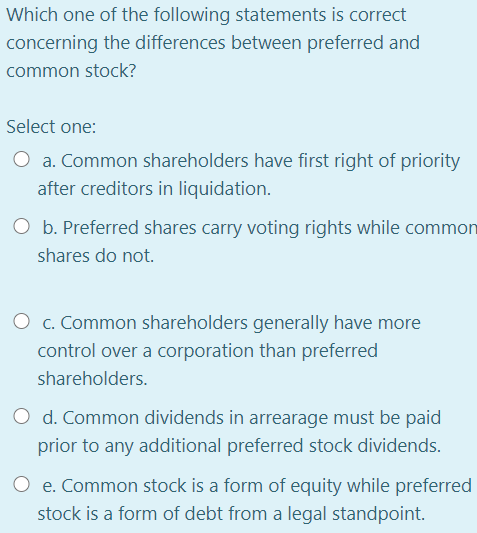

The Right to Vote

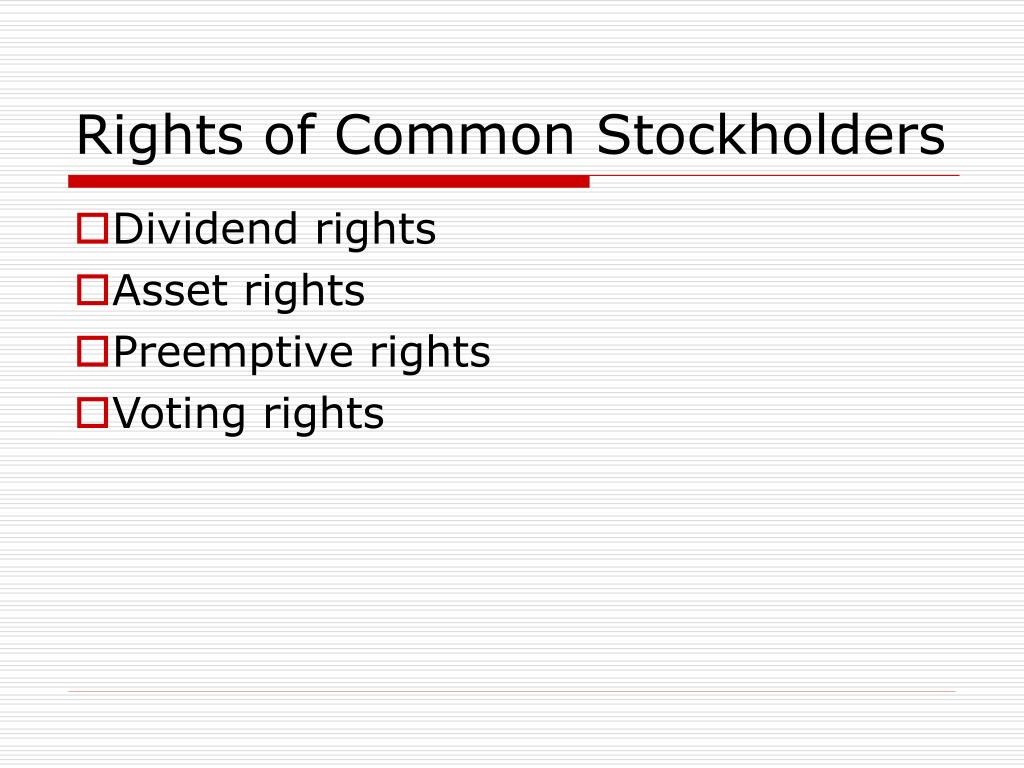

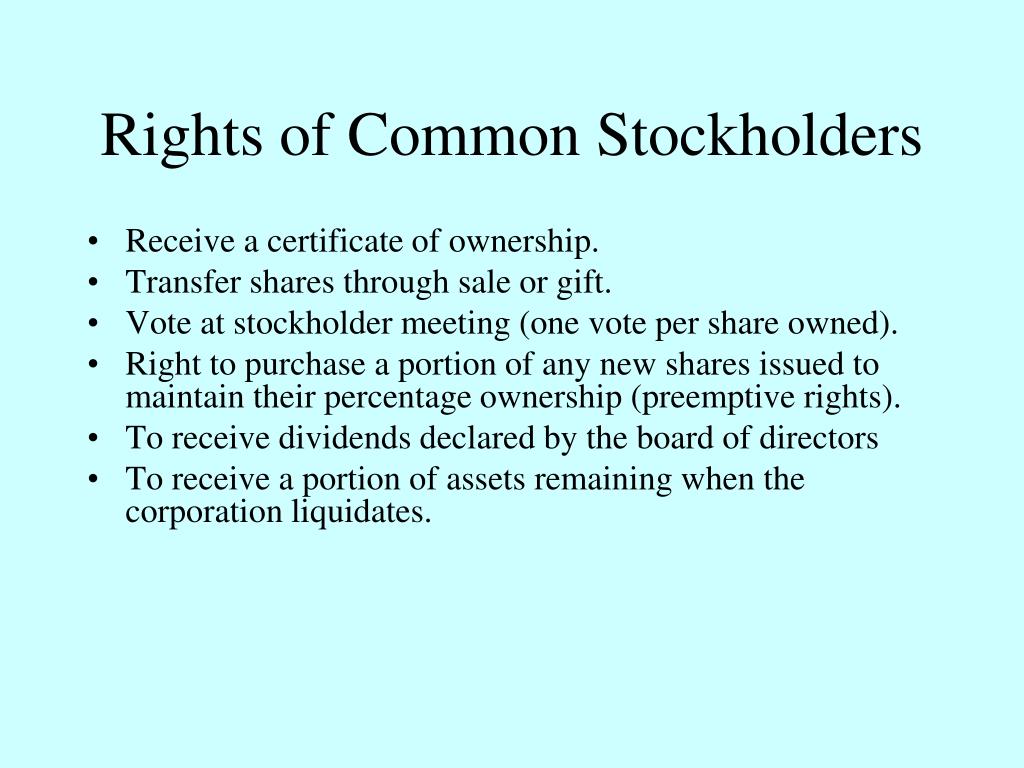

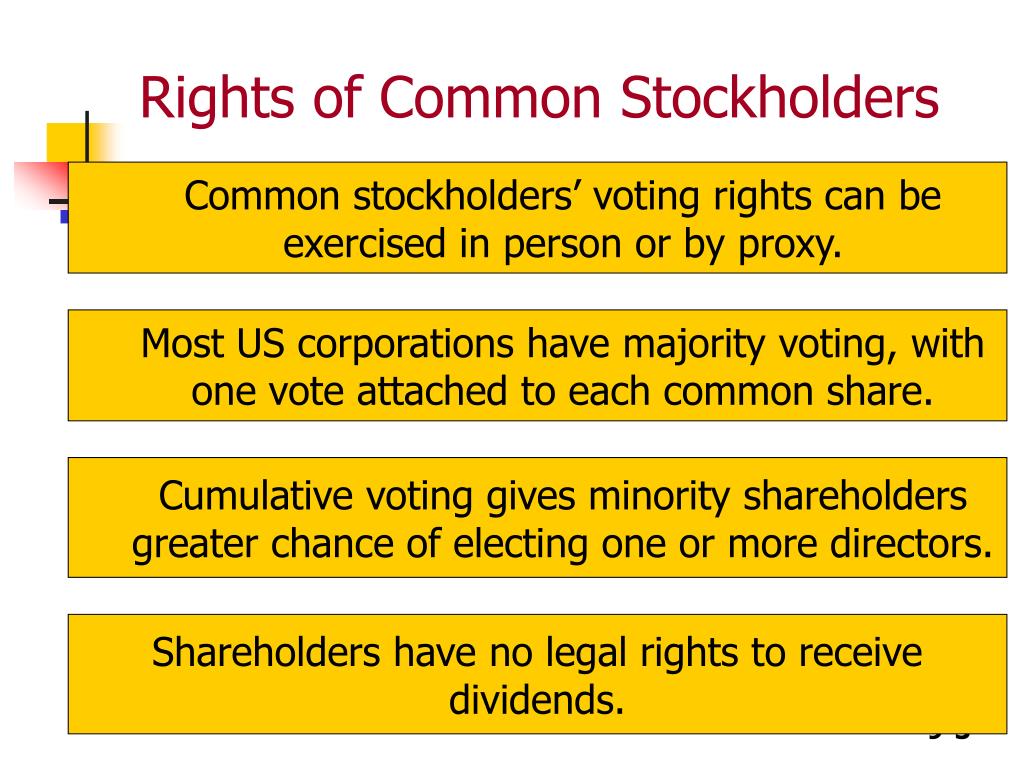

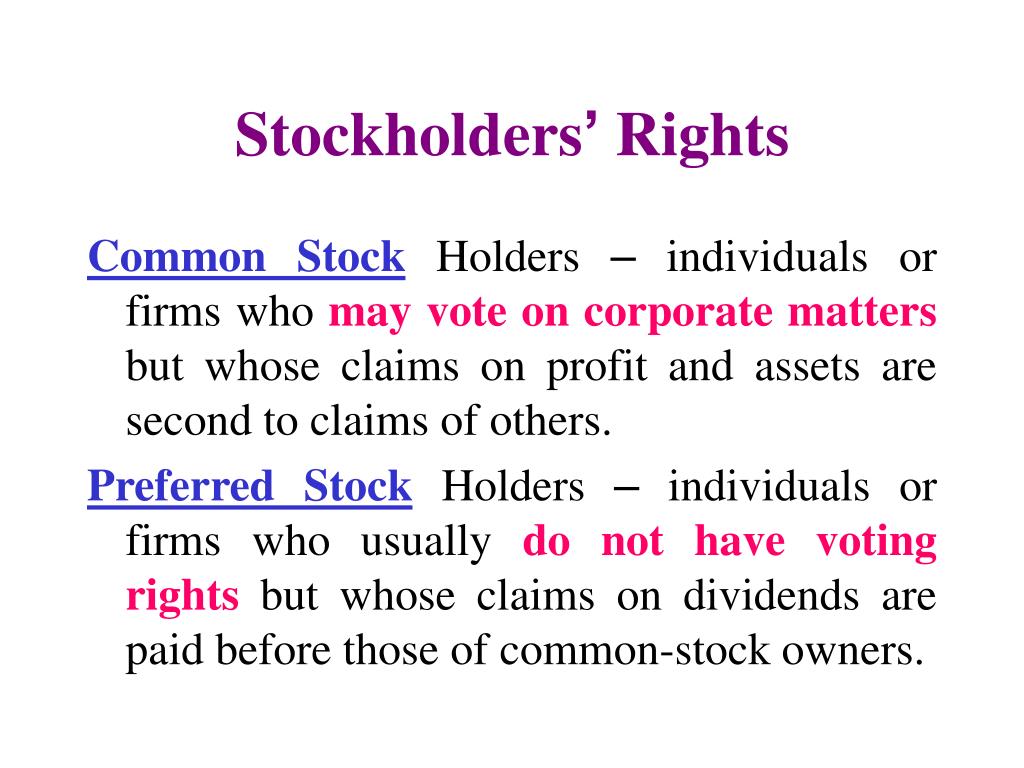

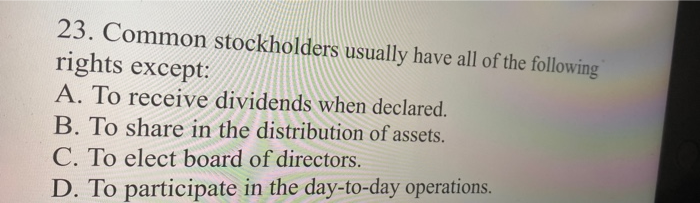

One of the most significant rights is the right to vote on key company matters. This democratic principle allows common stockholders to influence the direction and governance of the corporation.

Typically, each share of common stock translates to one vote, allowing shareholders to elect the board of directors, approve major corporate actions like mergers and acquisitions, and weigh in on executive compensation packages.

Proxy voting, often conducted online or by mail, enables shareholders to participate even if they cannot attend shareholder meetings in person. The Securities and Exchange Commission (SEC) mandates companies to provide shareholders with proxy statements containing detailed information about the matters to be voted on.

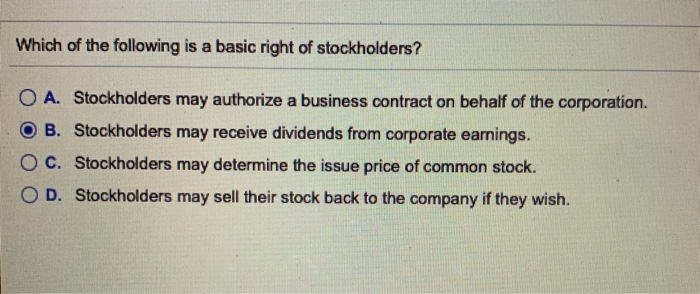

The Right to Receive Dividends

When a company generates profits, it may choose to distribute a portion of those earnings to its shareholders in the form of dividends. While not guaranteed, dividends are a tangible return on investment.

The decision to declare dividends lies with the board of directors, who carefully consider the company's financial health, reinvestment opportunities, and overall strategy. Preferred stockholders typically have priority over common stockholders in receiving dividends.

Dividend payments can be in the form of cash, additional shares of stock, or even company assets. A consistent history of dividend payments can be a sign of a financially stable and shareholder-friendly company.

The Right to Inspect Corporate Books and Records

To ensure transparency and accountability, common stockholders have the right to access certain corporate books and records. This right is not unlimited, however, and is subject to reasonable restrictions.

Shareholders typically need to demonstrate a legitimate purpose for inspecting the records, such as investigating potential mismanagement or irregularities. They cannot use this right to harass the company or disrupt its operations.

State laws often govern the specific requirements for exercising this right, outlining the types of records accessible and the procedures for requesting access.

The Right to Sue for Wrongful Acts

In cases of corporate misconduct or breaches of fiduciary duty by officers and directors, common stockholders have the right to sue the company. This right serves as a crucial safeguard against mismanagement and self-dealing.

These lawsuits, often filed as derivative actions, aim to recover damages on behalf of the corporation and hold wrongdoers accountable. Shareholders must typically demonstrate that they have made a demand on the board of directors to take action before filing a lawsuit.

Successful lawsuits can result in financial compensation for the company, changes in corporate governance practices, and the removal of negligent or corrupt officers and directors. This right is vital for protecting shareholder value and promoting ethical corporate behavior.

The Right to Certain Information

Companies are obligated to provide shareholders with regular reports and disclosures about their financial performance, business operations, and significant events. This information is crucial for making informed investment decisions.

The SEC mandates that publicly traded companies file annual reports (Form 10-K), quarterly reports (Form 10-Q), and current reports (Form 8-K) containing detailed information about their financial condition and operations.

Shareholders can access these reports online through the SEC's EDGAR database, ensuring transparency and access to critical information.

Preemptive Rights (Not Always Guaranteed)

Preemptive rights, while not universally guaranteed, give existing shareholders the option to purchase new shares of stock before they are offered to the public. This right helps shareholders maintain their proportional ownership stake in the company.

If a company issues new shares, shareholders with preemptive rights have the opportunity to buy a number of shares proportional to their existing holdings. This prevents dilution of their ownership and potential loss of voting power.

Whether or not a company grants preemptive rights depends on state law and the company's charter. It's essential for investors to understand whether or not their shares carry this particular privilege.

Understanding Limitations and Responsibilities

While common stockholders enjoy significant rights, it's crucial to understand that these rights are not absolute. They are subject to certain limitations and restrictions.

For example, the board of directors has broad authority to manage the company's affairs, and their decisions are generally protected by the business judgment rule, which shields them from liability unless they act in bad faith or with gross negligence.

Furthermore, shareholders have a responsibility to exercise their rights responsibly and in good faith. They should not use their ownership stake to harm the company or disrupt its operations.

A Final Reflection

Owning common stock is more than just holding a piece of paper; it represents a stake in a dynamic entity, a partnership, if you will, with the company's management and fellow investors. It is a ticket to participate, to voice your opinion, and to share in the company's successes – and occasionally, to shoulder the burden of its challenges.

Understanding and exercising your rights as a common stockholder is essential for protecting your investment and promoting good corporate governance. Active participation, informed voting, and diligent monitoring are not just privileges, but responsibilities that contribute to a healthier and more sustainable financial ecosystem. By embracing these responsibilities, shareholders can help ensure that their investments, and the companies they support, flourish for years to come. Always remember to consult with a financial advisor before making any investment decisions.