Which Of The Following Assets Are Amortized

In the world of finance and accounting, understanding how assets are managed is crucial for accurate financial reporting and effective business planning. One key concept is amortization, the systematic allocation of the cost of an intangible asset over its useful life. But which assets qualify for this treatment, and why is it so important to distinguish them from assets subject to depreciation or other expense recognition methods?

This article will explore the types of assets that are typically amortized, providing clarity on the rules and guidelines that govern this accounting practice. We'll delve into the specific characteristics that make an asset eligible for amortization, as well as the implications for businesses and investors alike.

Defining Amortization: A Closer Look

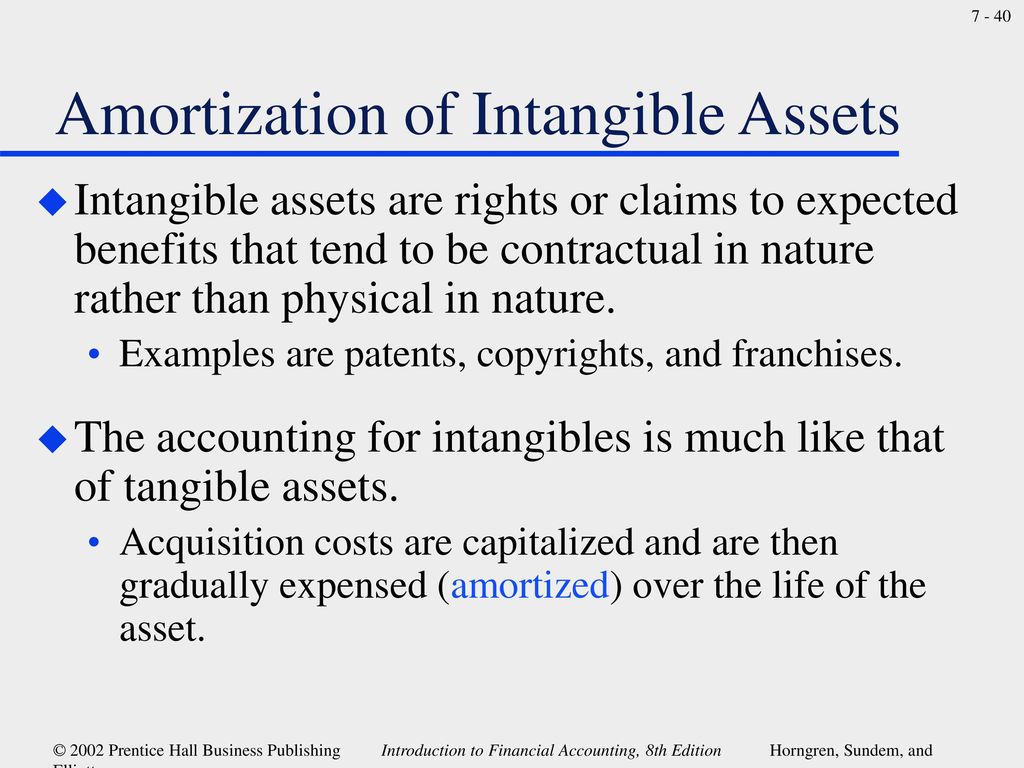

Amortization is the process of spreading out the cost of an intangible asset over its useful life. Unlike depreciation, which applies to tangible assets like buildings or equipment, amortization is specifically used for intangible assets, which lack physical substance.

The goal of amortization is to match the expense of the asset with the revenue it generates over time, providing a more accurate picture of a company's profitability.

Key Intangible Assets Subject to Amortization

Several types of intangible assets are commonly subject to amortization. These assets share the characteristic of having a limited useful life, meaning their value to the company decreases over time.

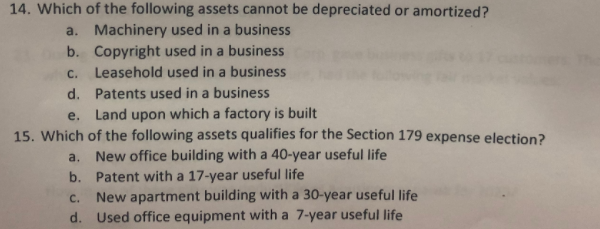

Patents

A patent grants an inventor exclusive rights to an invention for a specific period, usually 20 years from the date of application. The cost of obtaining a patent, including legal fees and application costs, can be amortized over the patent's legal life or its estimated useful life, whichever is shorter.

This reflects the fact that the economic benefits of the patent will diminish as competitors develop alternative technologies or the patent nears its expiration date.

Copyrights

Copyrights protect original works of authorship, such as literary, musical, and artistic creations. The cost of acquiring a copyright can be amortized over its legal life, which is typically the life of the author plus 70 years, or its estimated useful life if shorter.

Factors that can influence the useful life of a copyright include the popularity of the work and the potential for obsolescence.

Trademarks and Trade Names (with Limited Lives)

While many trademarks and trade names have indefinite lives and are therefore not amortized, some may have limited legal or contractual lives. If a trademark or trade name has a defined expiration date, its cost can be amortized over that period.

Renewable trademarks are generally considered to have indefinite lives and are instead subject to impairment testing.

Franchises

Franchises grant the franchisee the right to operate a business under the franchisor's brand and system. The cost of acquiring a franchise is typically amortized over the term of the franchise agreement.

If the franchise agreement is renewable and the franchisee expects to renew it, the amortization period may be extended, but only if renewal is reasonably certain.

Leasehold Improvements

While technically relating to a tangible asset (the leased property), leasehold improvements are amortized because their value is tied to the lease. Leasehold improvements are enhancements made to a leased property by the tenant.

The cost of these improvements is amortized over the shorter of the lease term or the useful life of the improvement.

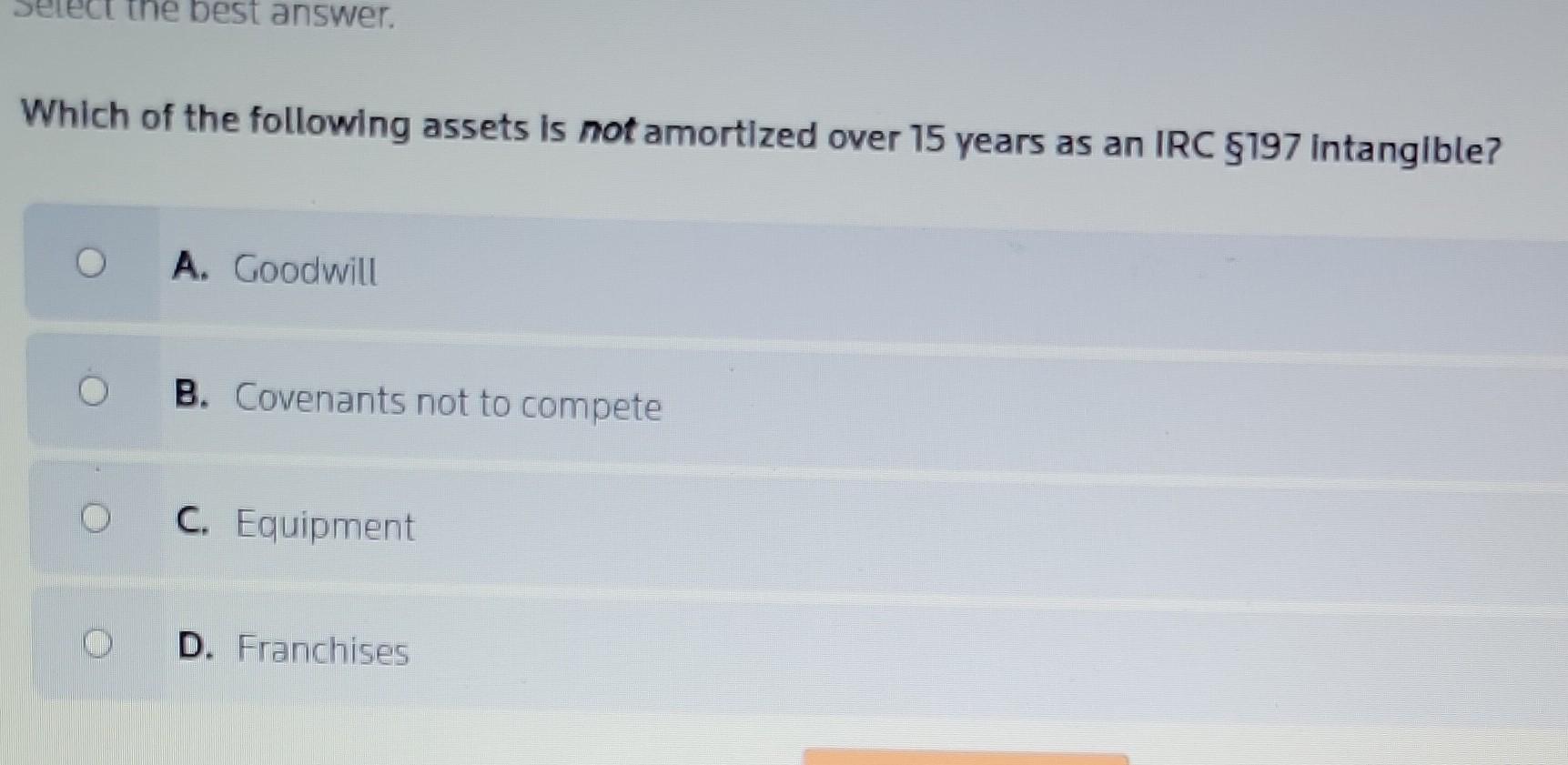

Assets NOT Subject to Amortization

It's equally important to know which assets are not amortized. These generally include intangible assets with indefinite lives.

Goodwill, for example, is not amortized but is instead tested for impairment annually. Similarly, trademarks and trade names with indefinite lives are also subject to impairment testing, not amortization.

The Significance of Amortization

Amortization plays a vital role in providing a true and fair view of a company's financial performance. By systematically allocating the cost of intangible assets, it prevents large, one-time expenses that could distort earnings.

It also helps investors and analysts to better understand the long-term value of a company's assets and its ability to generate future profits. Proper amortization ensures financial statements accurately reflect the economic reality of the business.

Impact on Businesses and Investors

The correct application of amortization principles can significantly impact a company’s financial statements. It affects reported earnings, asset values on the balance sheet, and various financial ratios used by investors and analysts.

Understanding amortization is crucial for making informed investment decisions and assessing the true financial health of a company.

In conclusion, amortization is a critical accounting practice for intangible assets with finite useful lives. Properly identifying and amortizing these assets is essential for accurate financial reporting, sound business planning, and informed investment decisions. By understanding the rules and guidelines surrounding amortization, businesses and investors can gain a clearer picture of a company's financial health and long-term prospects.

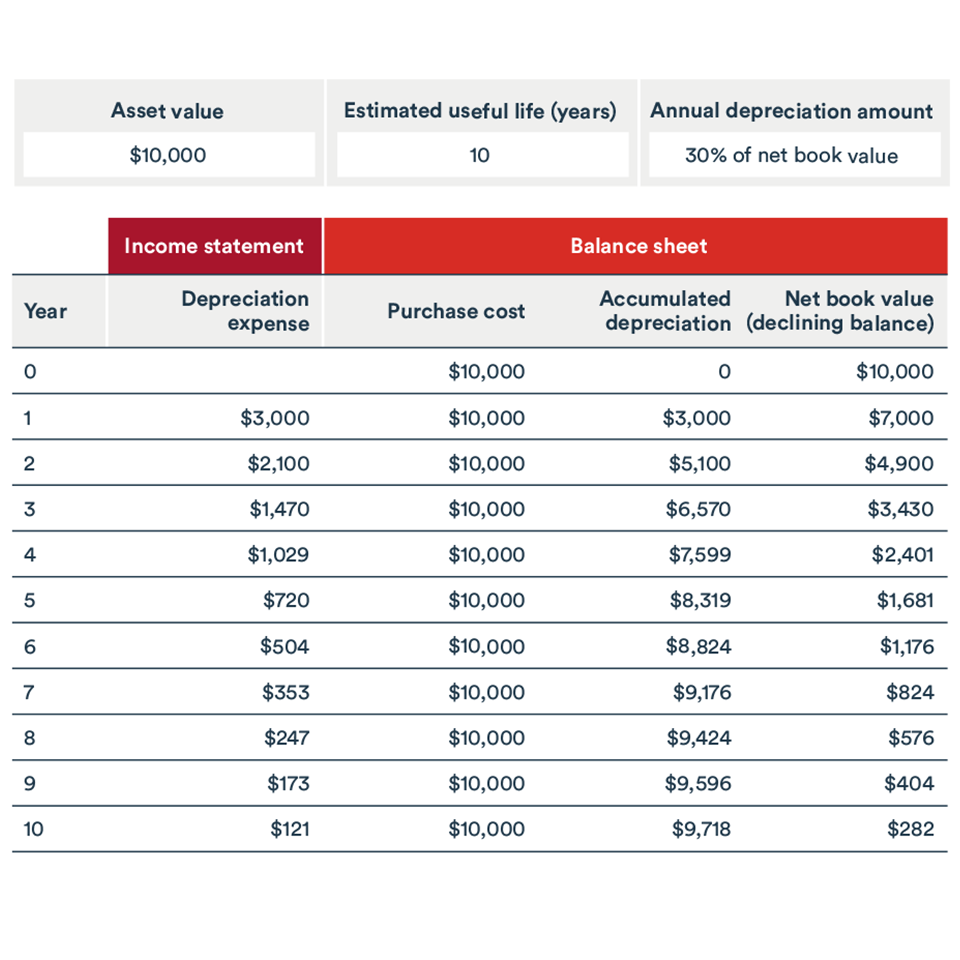

.+The+printing+equipment+is+fully+amortized+with+a+net+book+value+of+0..jpg)