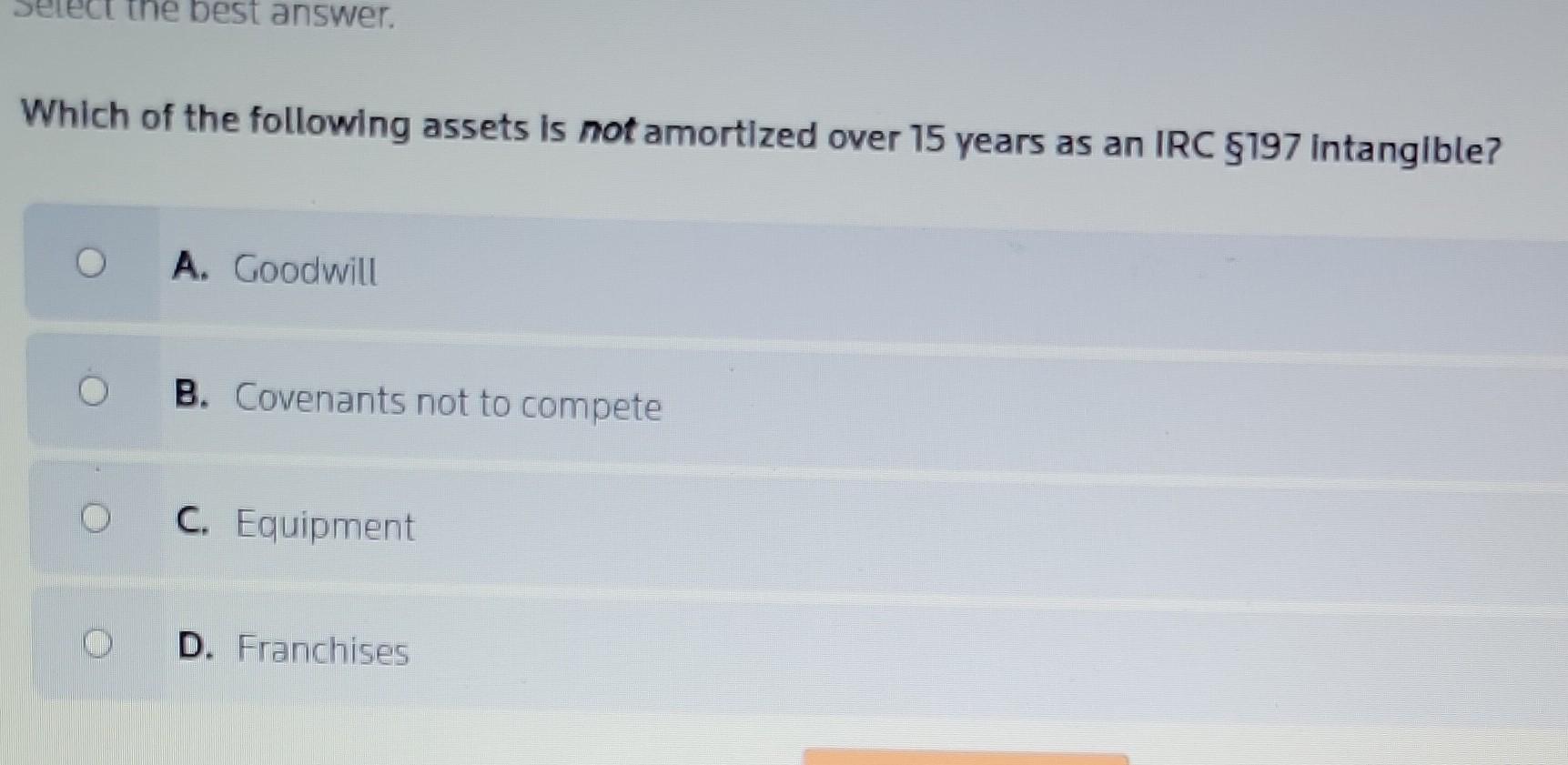

Which Of The Following Intangible Assets Is Not Amortized

The world of finance is governed by intricate rules and regulations, particularly when it comes to accounting for assets. Among these rules, the treatment of intangible assets often causes confusion, especially regarding amortization. Understanding which intangible assets are subject to amortization and which are not is critical for accurate financial reporting and investment decisions.

This article delves into the complex landscape of intangible assets, clarifying the distinction between those that are amortized and those that are not. We will explore the underlying principles governing amortization, the specific types of intangible assets, and the factors determining their treatment under accounting standards. Accurate categorization of these assets directly impacts a company's financial statements, affecting reported earnings, asset values, and ultimately, investor confidence.

Understanding Intangible Assets

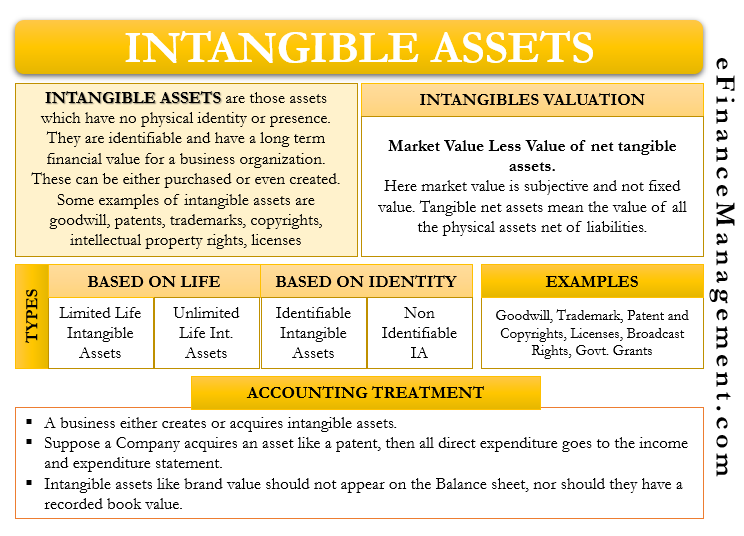

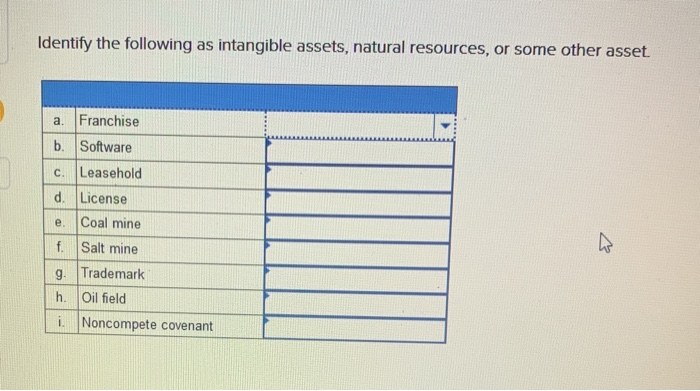

Intangible assets are non-physical assets that provide economic value to a company. These can include a wide array of items, ranging from patents and trademarks to goodwill and brand recognition. Their value stems from the rights and privileges they confer, rather than their physical substance.

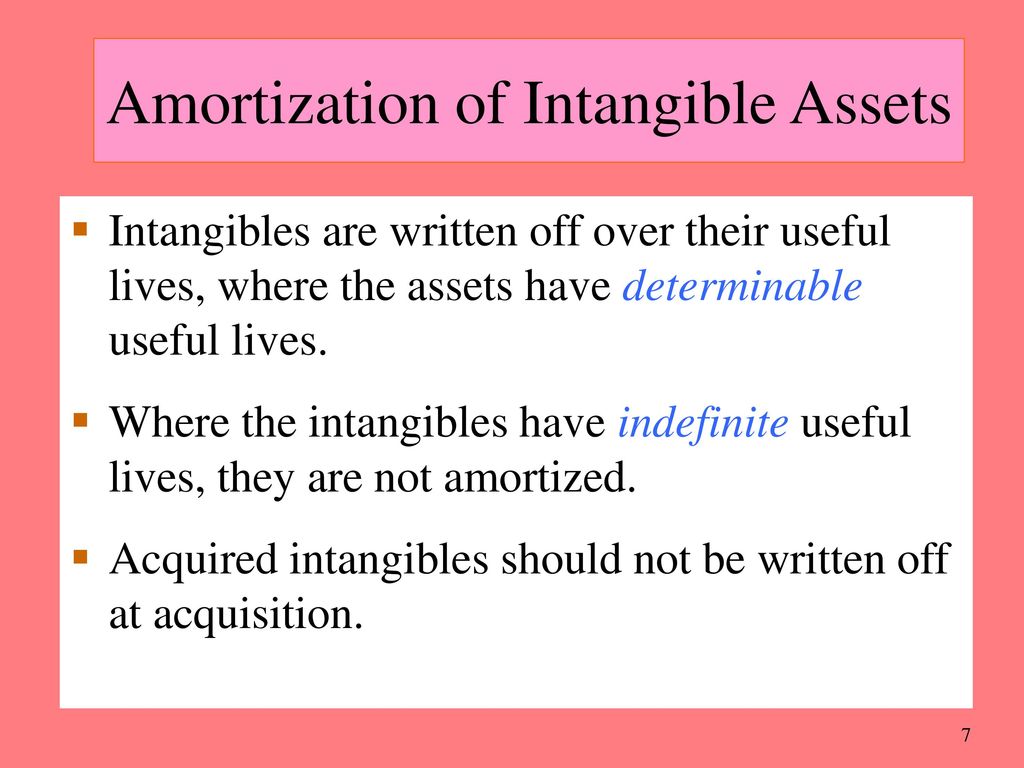

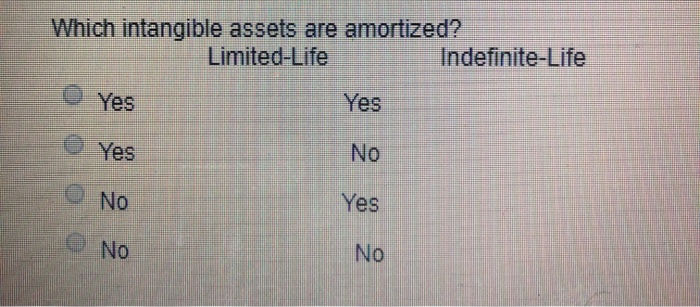

The way these assets are accounted for differs significantly based on their nature and expected lifespan. Some intangible assets have a defined useful life, while others are considered to have an indefinite life. This distinction is central to determining whether or not they are amortized.

Amortization vs. Impairment

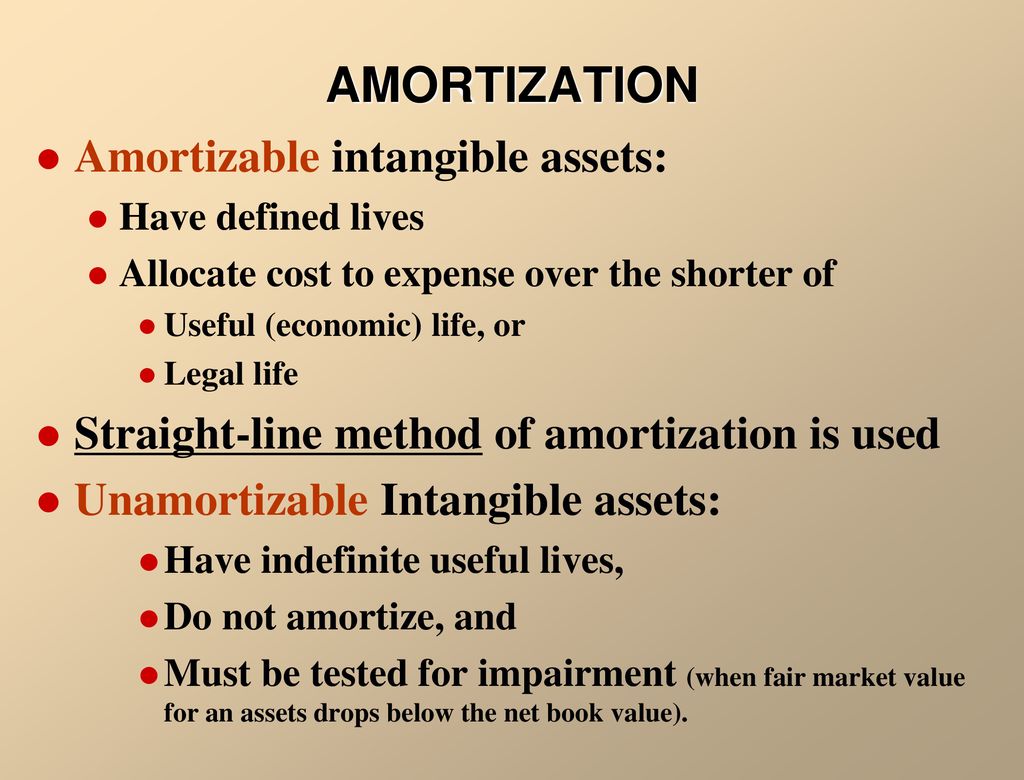

Amortization is the systematic allocation of the cost of an intangible asset over its estimated useful life. This is similar to depreciation for tangible assets like equipment or buildings. Amortization reflects the gradual consumption of the asset's economic benefits over time.

Assets not subject to amortization are tested for impairment. Impairment occurs when the carrying amount of an asset exceeds its recoverable amount. In such cases, the asset's value is written down to its fair value, resulting in a loss recognized on the income statement.

Intangible Assets Subject to Amortization

Intangible assets with a finite useful life are amortized over that life. The amortization method used should reflect the pattern in which the asset's economic benefits are consumed. Common examples of amortizable intangible assets include:

- Patents: Patents grant exclusive rights to an invention for a specific period, usually 20 years. The cost of the patent is amortized over its legal life or its estimated useful life, whichever is shorter.

- Copyrights: Copyrights protect original works of authorship. Their cost is amortized over their legal life, or a shorter estimated useful life.

- Franchises: Franchise agreements often grant businesses the right to operate under a specific brand for a defined period. The cost of the franchise is amortized over the term of the agreement.

- Leasehold Improvements: These are improvements made to leased property. Leasehold improvements are amortized over the shorter of the lease term or the useful life of the improvement.

Intangible Assets Not Subject to Amortization

The key intangible asset category not subject to amortization is those with an indefinite useful life. These assets are assumed to provide economic benefits indefinitely, and therefore, their cost is not systematically allocated over time. Instead, they are tested for impairment at least annually.

The most prominent example is goodwill. Goodwill arises in a business combination (acquisition) when the purchase price exceeds the fair value of the identifiable net assets acquired. It represents the future economic benefits arising from assets that are not individually identified and separately recognized.

Another common example is trademarks with indefinite lives. Trademarks can have an indefinite life if the company intends to renew them continuously and can demonstrate the ability to do so. Brands, if they have an indefinite life, are also not amortized.

Factors Determining Useful Life

Determining whether an intangible asset has a finite or indefinite life is a complex judgment. Several factors are considered, including:

- Legal, regulatory, or contractual provisions limiting the asset's useful life.

- Renewal or extension provisions affecting the asset's life.

- The effects of obsolescence, demand, competition, and other economic factors.

- The expected performance of the asset and the stability of the industry.

If, after considering these factors, it is not possible to reliably estimate the useful life of an intangible asset, it is considered to have an indefinite life.

Accounting Standards and Guidance

The accounting standards governing intangible assets vary depending on the jurisdiction. In the United States, the relevant standard is generally accepted accounting principles (GAAP), specifically ASC 350, Intangibles - Goodwill and Other.

The International Financial Reporting Standards (IFRS) also provide guidance on intangible assets. Companies must adhere to the relevant standards in their reporting jurisdiction.

Implications for Financial Reporting

The distinction between amortizable and non-amortizable intangible assets has significant implications for financial reporting. Amortization expense reduces net income over time, while impairment charges can result in large, one-time write-downs. Therefore, accurate categorization is essential for presenting a fair and transparent view of a company's financial performance.

Companies are required to disclose information about their intangible assets in their financial statements, including the method of amortization, the estimated useful lives, and the amount of amortization expense. These disclosures provide valuable insights to investors and analysts.

Forward-Looking Considerations

The accounting for intangible assets is an evolving area. As the economy becomes increasingly knowledge-based, intangible assets are becoming more significant. Consequently, the accounting standards boards are continuously reviewing and updating the guidance in this area.

Companies should stay informed about the latest developments in accounting standards and ensure that they have the expertise to properly account for their intangible assets. This includes regularly assessing the useful lives of their intangible assets and testing for impairment when necessary. Failure to do so can lead to material misstatements in their financial statements.

In conclusion, understanding which intangible assets are not amortized, like goodwill and indefinite-lived trademarks, is crucial for accurate financial reporting. Proper categorization and adherence to accounting standards are essential for maintaining transparency and providing reliable information to investors.

+if+the+asset+is+to+be+amortized+over+its+useful+life+or+(b)+if+the+asset+is+not+amortized+but+only+subject+to+an+annual+impairment+test:.jpg)