How To Get Out Of A Failing Business

The scent of burnt coffee beans still clung to the air, a ghostly reminder of bustling mornings. Now, the chairs were stacked, the espresso machine silent, and Sarah stared out the rain-streaked window of her once-dreamed-of cafe, "The Daily Grind." The vibrant mural she'd commissioned felt mocking now, its cheerful colors a stark contrast to the gray cloud hanging over her spirit.

Knowing when and how to gracefully exit a failing business is a critical skill for any entrepreneur. While the initial vision may have been bright, recognizing the signs of decline and implementing a strategic exit plan can save you from further financial and emotional distress. It's about acknowledging reality, protecting your future, and learning from the experience.

Recognizing the Warning Signs

Before considering an exit strategy, it's vital to honestly assess the business's condition. Are you experiencing consistently declining revenue? Are profits shrinking despite your best efforts? These are classic indicators of deeper problems.

Cash flow crunches, difficulty paying vendors, and increasing debt are also major red flags. According to the Small Business Administration (SBA), a thorough financial review is the first step in determining the true health of your company.

Beyond the numbers, consider the emotional toll. Are you losing sleep? Is your passion waning? Burnout can cloud judgment and hinder your ability to make sound decisions.

Exploring Your Options

Once you've acknowledged the situation, explore your exit options. Selling the business, even at a loss, might be the most straightforward route.

Consider engaging a business broker to help find potential buyers and navigate the sale process. A broker can assess your business's value and market it effectively to the right audience.

Another option is to liquidate assets. This involves selling off equipment, inventory, and other assets to recoup some of your investment.

However, liquidation often results in lower returns than selling the business as a whole. Finally, in some cases, bankruptcy might be the only viable option. This is a difficult decision, but it can provide legal protection and a path to rebuilding.

Debt and Legal Considerations

Navigating debt is a crucial aspect of exiting a failing business. Consult with a financial advisor to understand your obligations and explore options for debt restructuring or negotiation.

Understanding your legal obligations is equally important. Consult with an attorney to ensure you comply with all applicable laws and regulations during the exit process.

This includes understanding your responsibilities to employees, creditors, and other stakeholders. Ignoring these considerations can lead to legal complications down the road.

Learning and Moving Forward

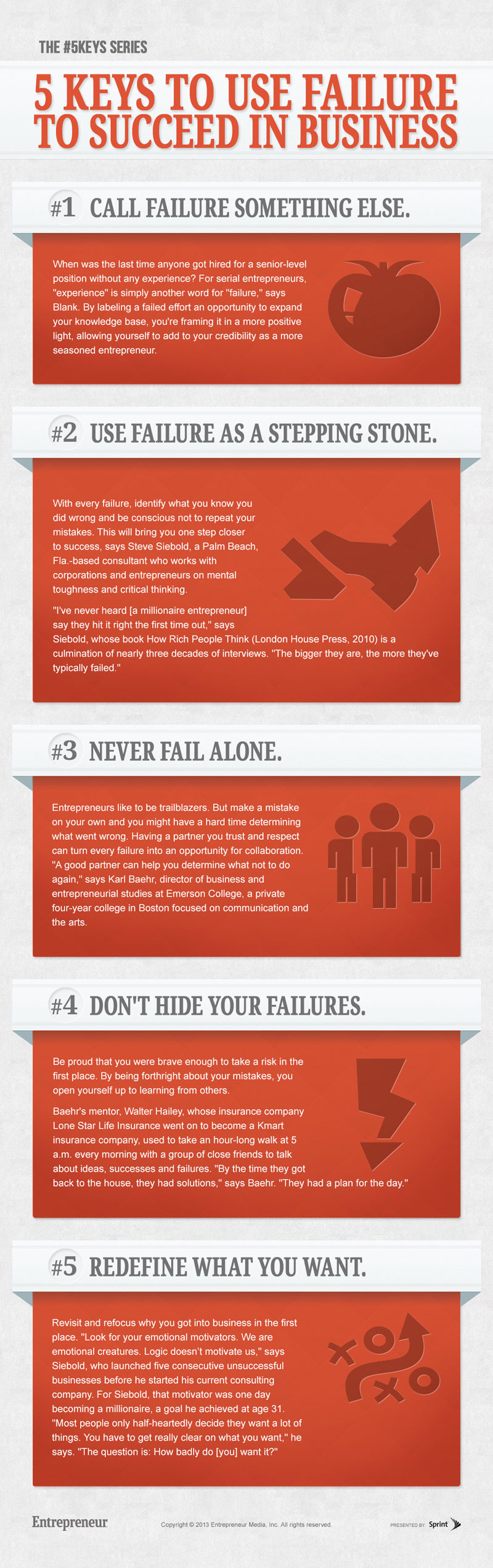

Exiting a failing business is undoubtedly a challenging experience. However, it's also an opportunity for growth and learning.

Take time to reflect on what went wrong. Did you misjudge the market? Were there management missteps? Identifying the root causes of failure can prevent repeating the same mistakes in future ventures.

Sarah, after closing "The Daily Grind," enrolled in a business course to sharpen her skills in financial management and marketing. She also connected with other entrepreneurs to learn from their experiences.

Don't be afraid to seek support from mentors, coaches, or therapists. The emotional toll of business failure can be significant, and having a support system can help you process the experience and move forward with confidence.

Remember that failure is not the opposite of success; it's a stepping stone towards it. Many successful entrepreneurs have faced setbacks along the way. The key is to learn from those experiences and use them to fuel your future endeavors. Embrace the lessons, rebuild your confidence, and dare to dream again.

.jpg)