Which Of The Following Is An Example Of Revenue

Understanding revenue is fundamental to grasping the financial health of any organization, from small businesses to multinational corporations. Revenue, at its core, represents the income generated from normal business operations, primarily through the sale of goods and services. However, pinpointing what precisely constitutes revenue can sometimes be nuanced, leading to confusion for those not deeply versed in accounting principles.

This article aims to clarify the concept of revenue by providing concrete examples and differentiating it from related financial terms like profit. We will explore various revenue streams and their significance in assessing a company's financial performance, relying on established accounting practices and reputable sources to ensure accuracy and clarity.

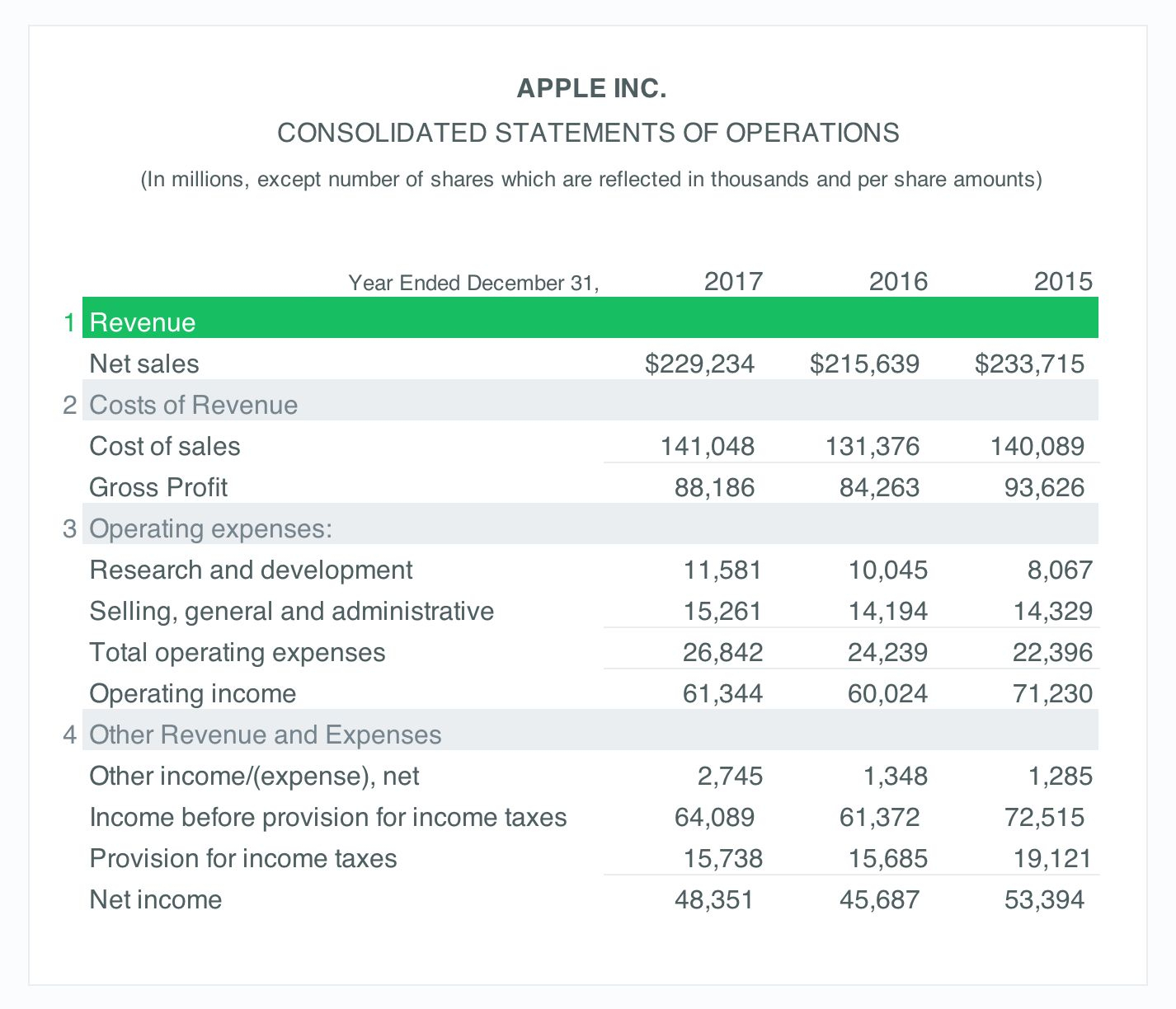

Defining Revenue: The Top Line

Revenue, often referred to as the "top line" on an income statement, is the total amount of money a company receives from its primary business activities. It's the starting point for calculating a company's profitability. In essence, revenue is the gross income before any expenses are deducted.

Consider a bakery that sells cakes and pastries. The total amount of money the bakery receives from selling these goods over a specific period, say a month, is its revenue for that month.

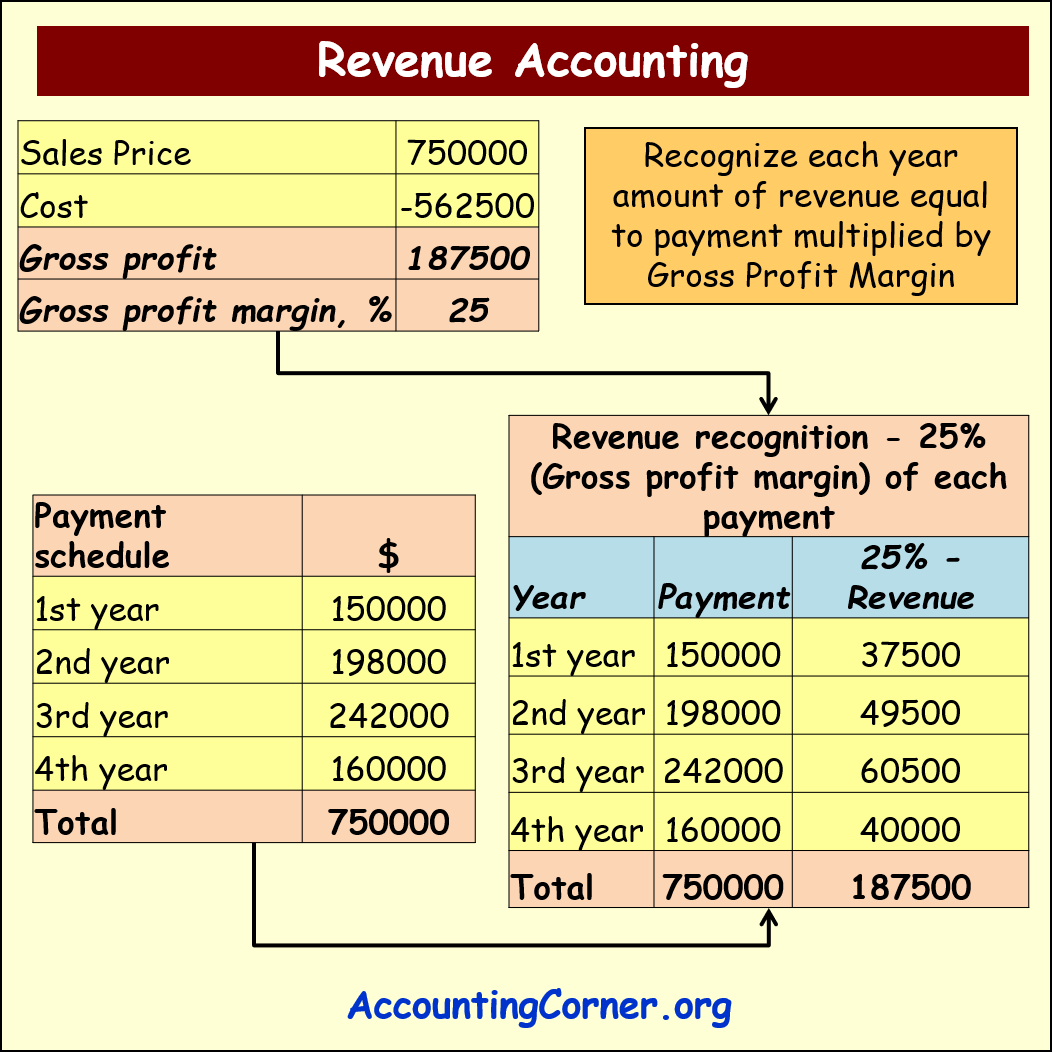

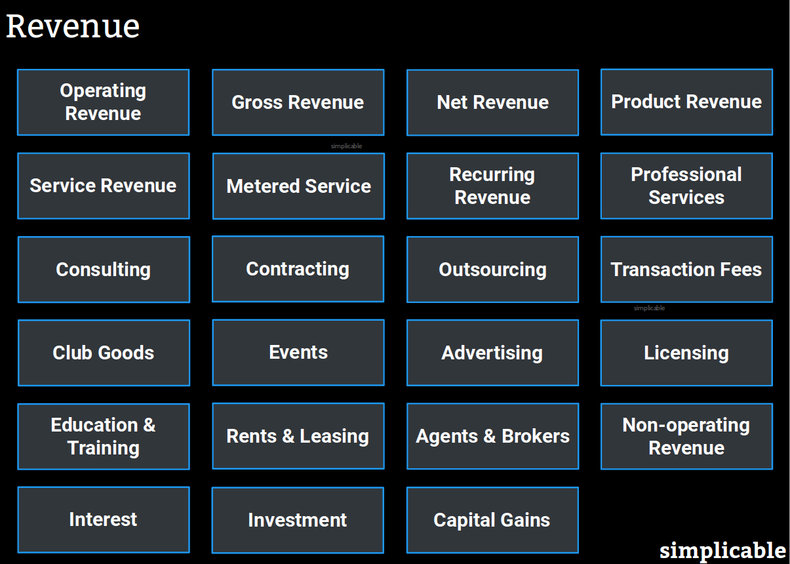

Examples of Revenue Streams

Revenue streams can vary significantly depending on the nature of the business. Here are some common examples:

Sales Revenue: This is perhaps the most common type of revenue, generated from selling goods or merchandise. For example, a retail store's revenue is the total value of all the products it sells to customers.

Service Revenue: This revenue is derived from providing services, such as consulting, cleaning, or transportation. An accounting firm, for example, generates service revenue by offering tax preparation and auditing services.

Subscription Revenue: Increasingly popular, this model generates revenue through recurring payments for access to a product or service. Think of Netflix, which earns subscription revenue from its monthly streaming subscriptions.

Interest Revenue: This type of revenue is earned from investments or lending activities. A bank earns interest revenue on the loans it provides to customers.

Rental Revenue: Revenue earned from renting out property or equipment. A landlord earns rental revenue from tenants who pay rent to live in their properties.

Advertising Revenue: This is earned from displaying advertisements on a website, app, or other platform. Google, for example, generates significant advertising revenue from its search engine and other online platforms.

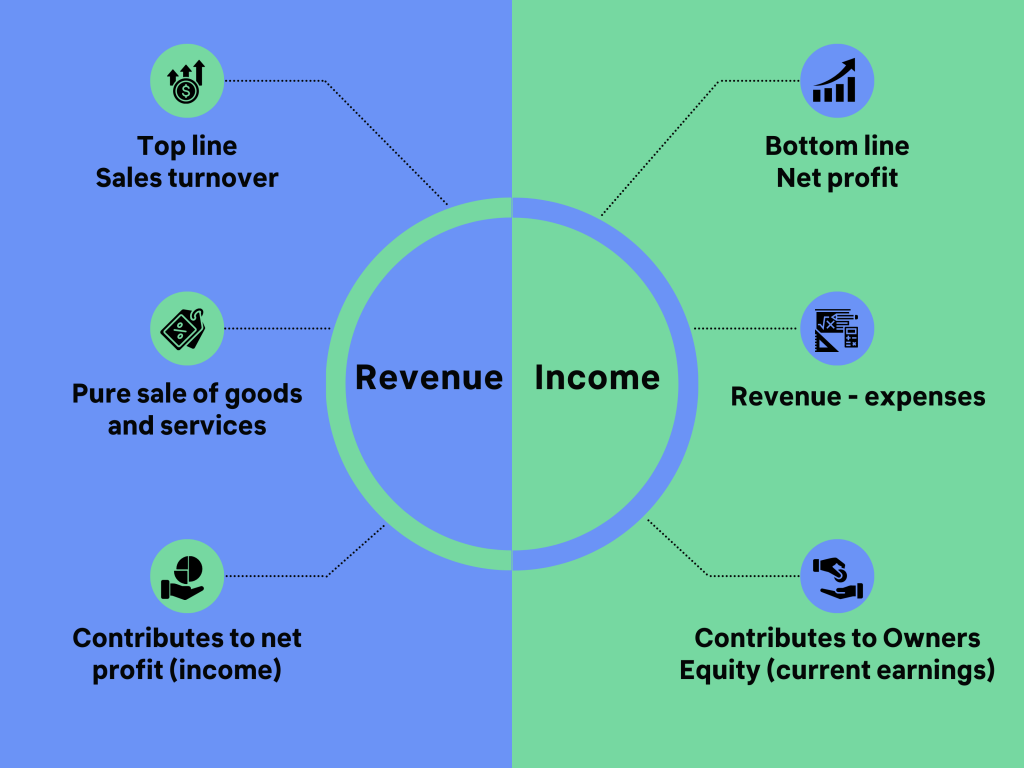

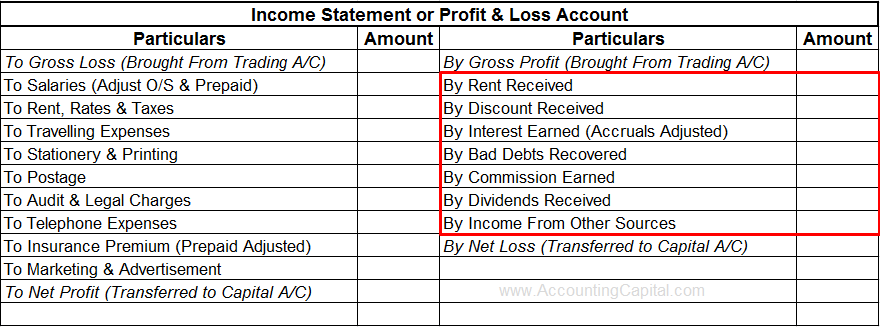

Differentiating Revenue from Profit

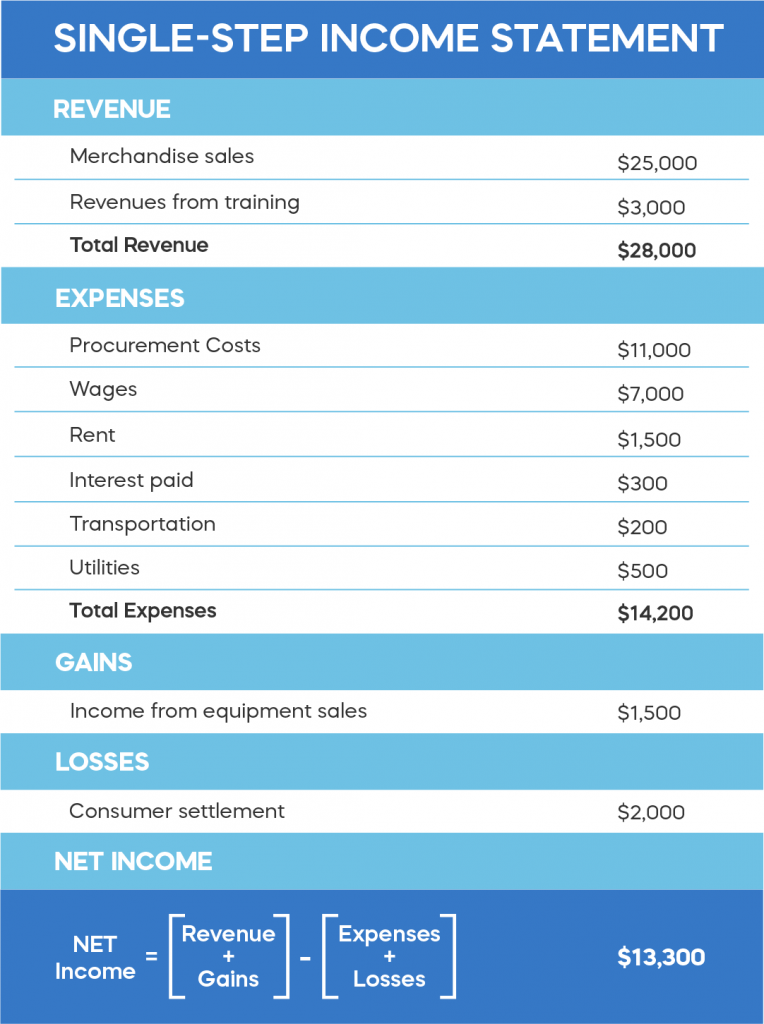

It's crucial to distinguish between revenue and profit. Revenue is the total income before expenses, while profit is the income after expenses have been deducted.

Profit provides a more accurate picture of a company's financial performance. Profit can be further broken down into gross profit (revenue minus the cost of goods sold) and net profit (revenue minus all expenses, including taxes and interest).

"Revenue is vanity, profit is sanity, but cash is king." - Anonymous

This quote succinctly captures the importance of understanding all three financial metrics, but highlights that generating revenue alone doesn't guarantee financial success.

Why Revenue Matters

Revenue is a key indicator of a company's ability to attract customers and generate demand for its products or services. A growing revenue stream often signals a healthy and thriving business.

Analyzing revenue trends over time can reveal valuable insights into a company's performance. Declining revenue might indicate challenges such as increased competition or changing consumer preferences.

Furthermore, revenue figures are often used by investors and analysts to assess a company's potential for future growth and profitability. Companies with strong revenue growth are often viewed as more attractive investment opportunities.

Factors Affecting Revenue

Numerous factors can influence a company's revenue. These include economic conditions, competition, pricing strategies, marketing efforts, and product innovation.

For example, a recession can lead to decreased consumer spending, which can negatively impact revenue for many businesses. Similarly, the introduction of a new, innovative product by a competitor can erode a company's market share and reduce its revenue.

Effective pricing strategies and marketing campaigns can help companies boost revenue by attracting new customers and increasing sales volume.

Conclusion

Revenue is a fundamental financial metric that reflects the total income a company generates from its core business activities. It is a crucial indicator of a company's financial health and ability to attract customers.

Understanding the different types of revenue streams and how they contribute to a company's overall financial performance is essential for investors, analysts, and business owners alike. By carefully analyzing revenue trends and comparing them to other financial metrics, stakeholders can gain valuable insights into a company's prospects and make informed decisions.

While revenue is not the sole determinant of success, it serves as a vital foundation for profitability and long-term growth. Ignoring revenue trends or failing to understand its significance can have serious consequences for any business.

![Which Of The Following Is An Example Of Revenue [Solved] According to the revenue recognition prin | SolutionInn](https://s3.amazonaws.com/si.experts.images/answers/2024/05/665986422ae19_105665986419d62a.jpg)