Which Of The Following Is Not A Dividend Option

Navigating the world of investments can be complex, especially when it comes to understanding the nuances of dividends. For investors, choosing the right dividend option is crucial for maximizing returns and aligning with their financial goals.

This article delves into the various dividend options available to shareholders and identifies one that is *not* a typical or legitimate method of dividend distribution. Understanding which options are valid is essential for protecting investments and making informed decisions.

Understanding Dividend Options

Dividends are a portion of a company's profits distributed to its shareholders, often as cash payments. These payments represent a return on investment and can be a significant source of income for investors.

However, dividends can be distributed in various forms, each with its own implications for shareholders.

Common Dividend Distribution Methods

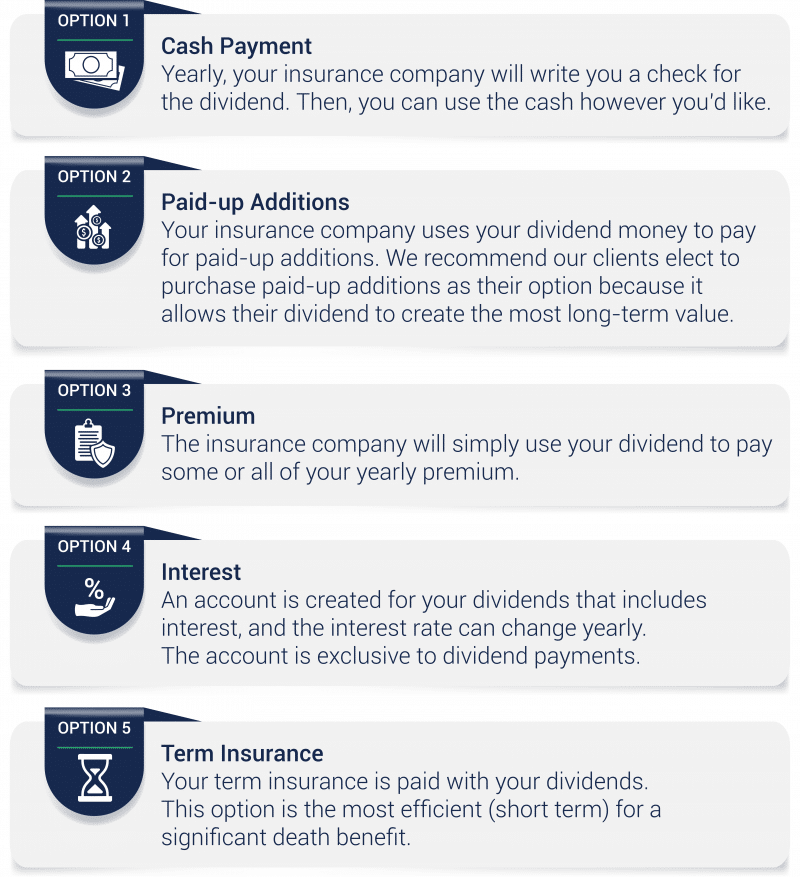

The most prevalent dividend options include cash dividends, stock dividends, and property dividends.

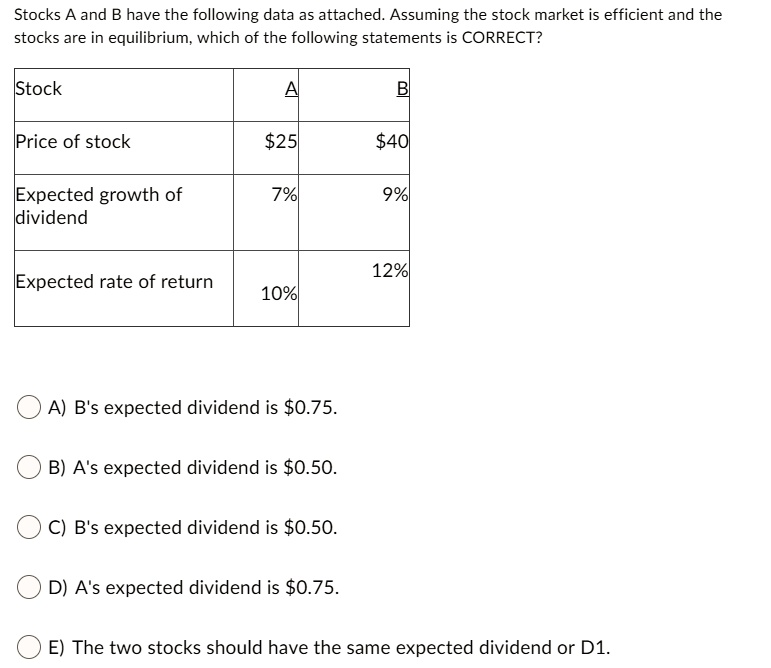

Cash dividends are the most common and involve the company paying shareholders a specific amount of cash per share owned. This is a straightforward and widely accepted method.

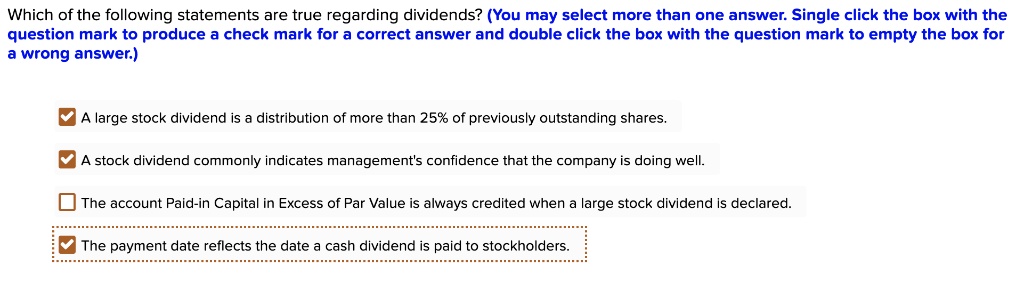

Stock dividends, also known as scrip dividends, involve the company distributing additional shares of its stock to existing shareholders. This increases the number of shares outstanding but doesn't change the company's overall value.

Property dividends are less common and involve distributing assets other than cash or stock, such as real estate or securities held by the company. These are typically valued at their fair market value.

Another important aspect is the dividend reinvestment plan (DRIP). This allows shareholders to automatically reinvest their cash dividends to purchase additional shares of the company’s stock, often without brokerage fees.

The Distractor: Illiquid Asset Dividends

While the aforementioned methods are standard practice, one option that is *not* a typical or recommended dividend distribution method involves paying dividends in the form of illiquid assets that are difficult to value or sell.

Imagine a company trying to distribute dividends in the form of specialized equipment or obscure intellectual property. This would be problematic.

Such distributions pose significant challenges for shareholders. They may not be able to easily convert these assets into cash, and determining the fair market value can be difficult and costly.

Why Illiquid Asset Dividends Are Problematic

The primary issue with illiquid asset dividends is the lack of liquidity. Shareholders generally prefer cash or easily tradable assets.

Receiving an asset that is difficult to sell defeats the purpose of a dividend, which is to provide a return that can be used or reinvested as the shareholder sees fit.

Valuation issues also arise, as determining the fair market value of specialized or obscure assets can be subjective and require expert appraisal. This lack of transparency can lead to disputes and erode shareholder trust.

Furthermore, distributing illiquid assets can be a sign of financial distress within the company. It may indicate a lack of cash reserves to pay traditional dividends.

Impact on Investors

Investors who receive illiquid asset dividends may find themselves in a difficult position. They may incur additional costs to sell the assets or be forced to accept a lower price due to the lack of market demand.

This can significantly reduce the value of the dividend and potentially lead to financial losses. Shareholders should scrutinize any company attempting to distribute dividends in this manner.

It is important to understand the implications before accepting such distributions. Due diligence is paramount.

Conclusion

While cash dividends, stock dividends, property dividends, and dividend reinvestment plans are all common and legitimate methods of distributing profits to shareholders, illiquid asset dividends are not. They represent a problematic and potentially detrimental option for investors.

Understanding the difference between these options is crucial for making informed investment decisions and protecting your financial interests. Always prioritize transparency, liquidity, and ease of valuation when evaluating dividend distributions.

By staying informed and vigilant, investors can navigate the complexities of the stock market and ensure they receive fair and beneficial returns on their investments.