Which Of The Following Is Not A Source Of Assets

A surprising number of individuals struggle to differentiate between true asset sources and mere liabilities or financial drains. Financial literacy advocates are raising concerns about widespread misconceptions surrounding asset creation and management. Misunderstanding the fundamental nature of assets can lead to poor financial decisions and long-term instability.

This article clarifies the definition of an asset source and identifies common misconceptions. We'll explore why distinguishing true assets from liabilities is crucial for financial health. The information presented aims to equip readers with the knowledge to make informed decisions about their financial resources.

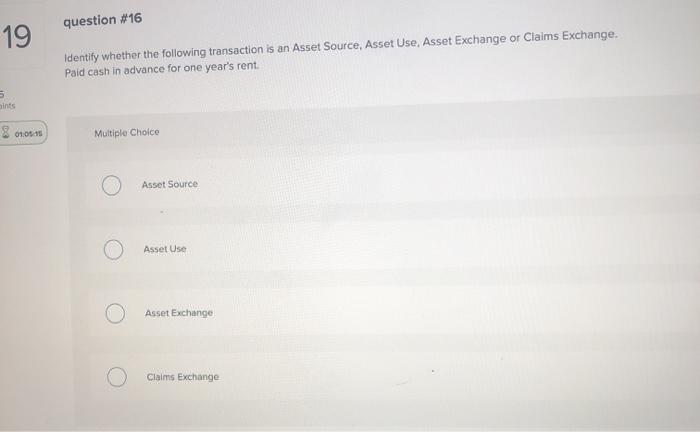

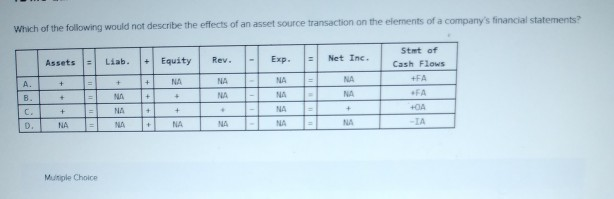

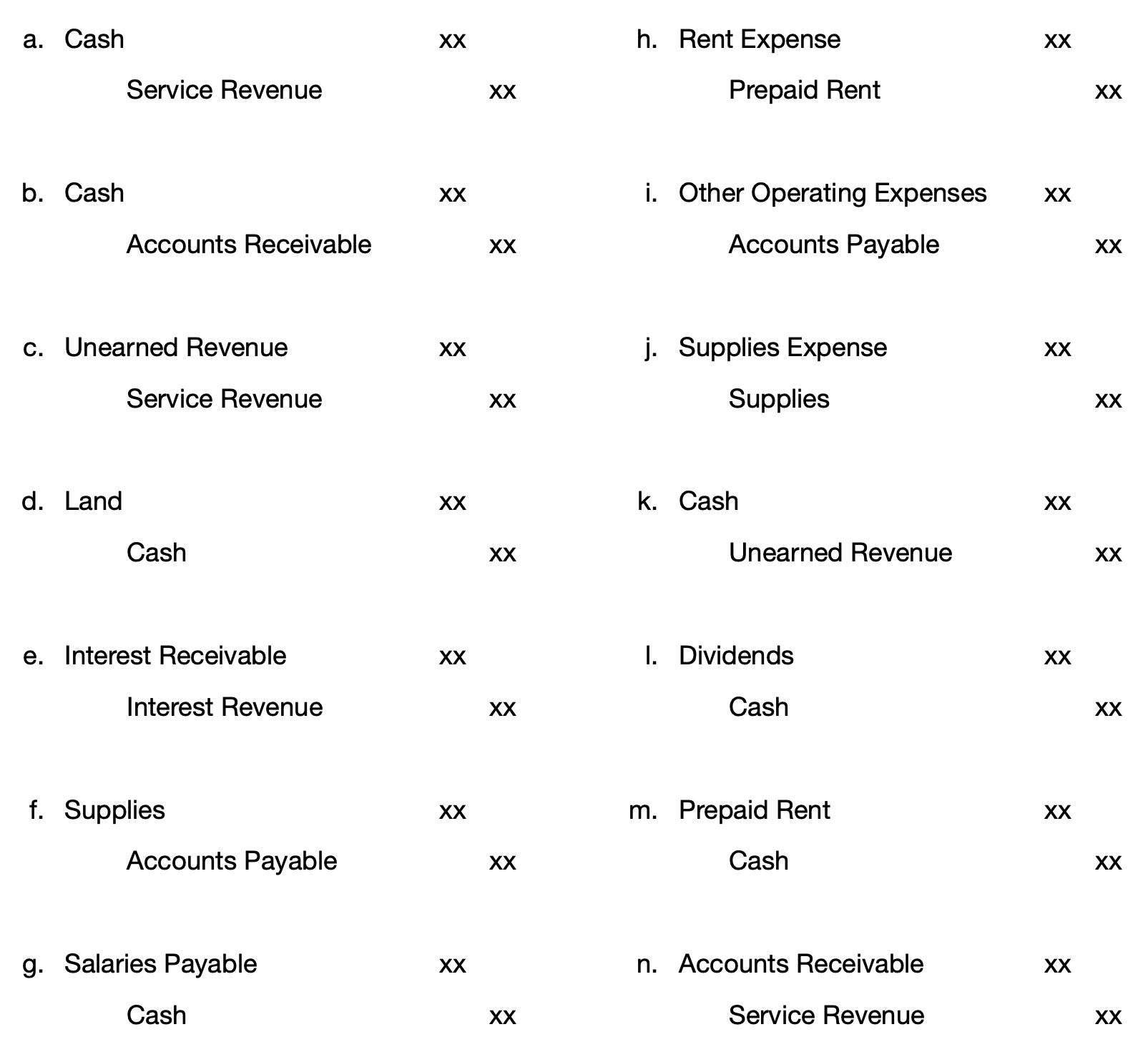

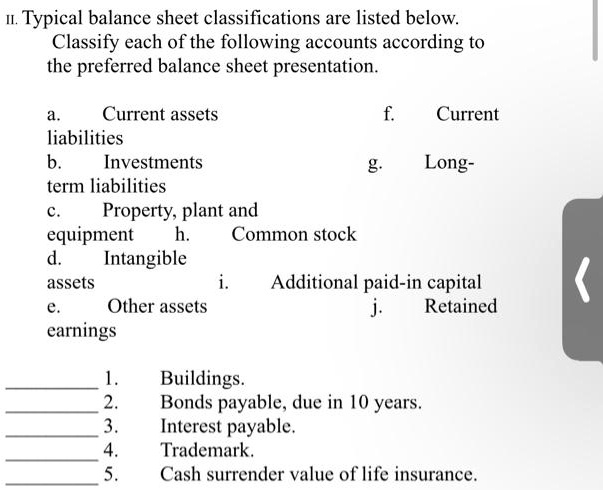

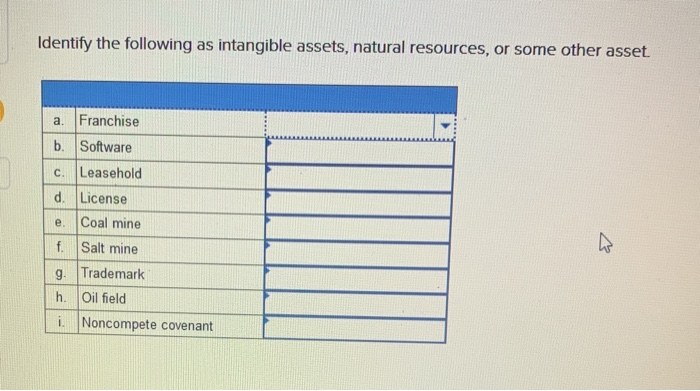

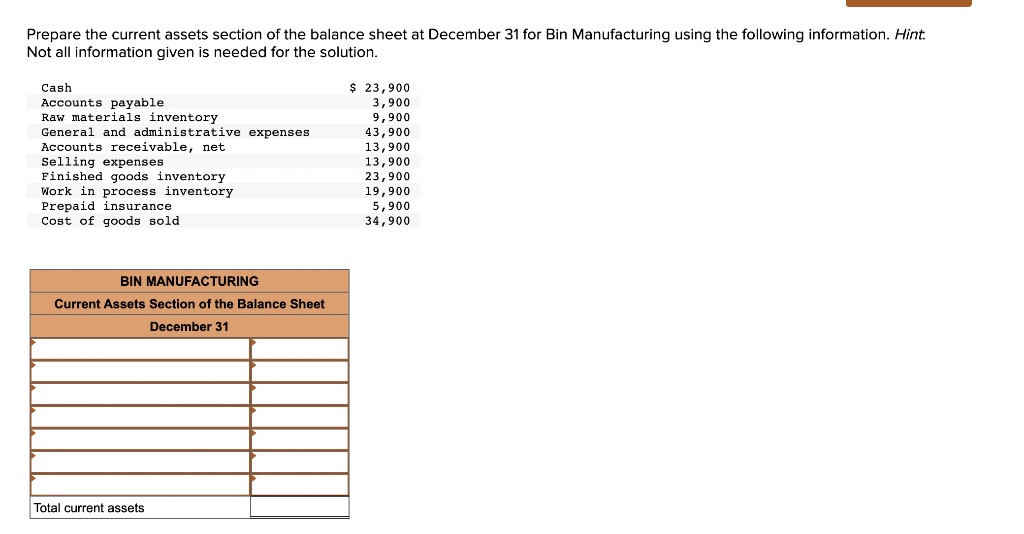

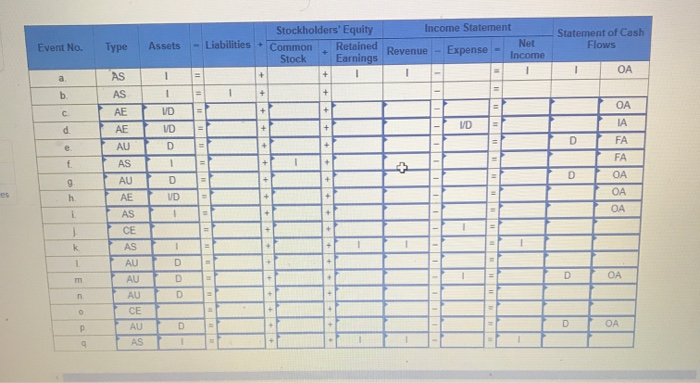

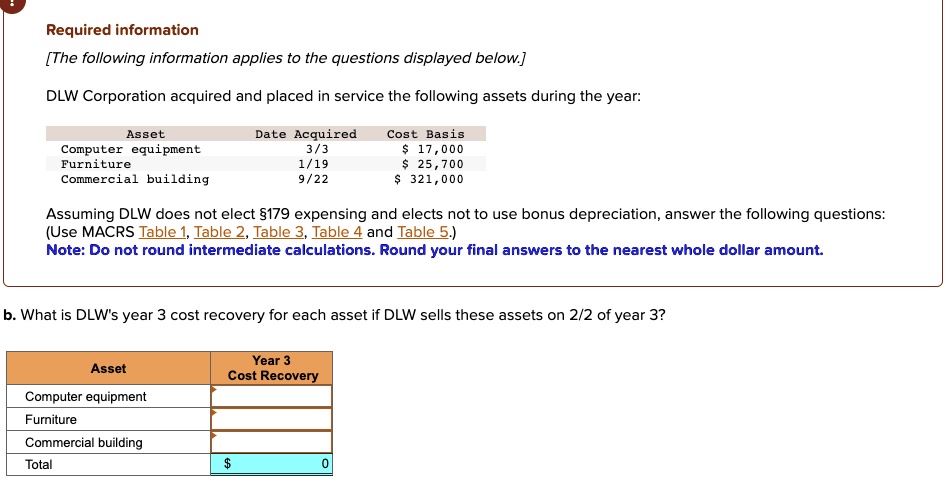

Defining Asset Sources

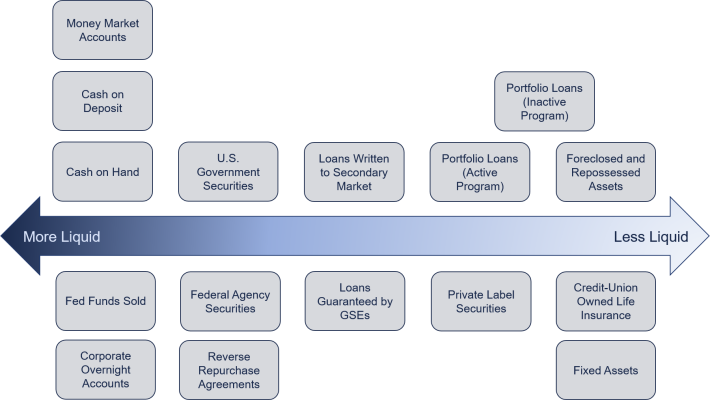

An asset source is anything that consistently generates income, appreciates in value, or provides significant utility without requiring ongoing financial investment to maintain its function. It actively contributes to one's overall financial well-being. Key examples include income-generating properties, stocks and bonds with consistent returns, and a thriving business.

Common Misconceptions

One frequent misconception revolves around the idea that all possessions are assets. Many confuse items with high initial purchase prices, like luxury cars or designer clothing, as assets. These items typically depreciate rapidly and require ongoing maintenance costs.

Another widespread misconception is thinking a primary residence is always a profitable asset. While a home can appreciate in value over time, it also incurs significant expenses like mortgage payments, property taxes, and maintenance fees. The equity built in a home is only realized upon sale, and even then, profit is contingent on market conditions.

So, What Isn't an Asset Source?

Anything that consistently drains financial resources without generating comparable income or appreciating significantly is not an asset. This includes liabilities like credit card debt, personal loans, and depreciating possessions. These detract from overall net worth rather than contributing to it.

Specifically, items like expensive vehicles are often incorrectly considered assets. Cars generally lose value quickly and require ongoing costs for insurance, fuel, and repairs. While they provide utility, their financial impact is overwhelmingly negative over their lifespan.

Similarly, subscription services that are underutilized also don't qualify as assets. Streaming services, gym memberships, or software subscriptions that aren't actively used represent wasted financial resources. These are expenses, not investments.

The Importance of Understanding Assets

The ability to differentiate between true assets and liabilities is crucial for building wealth and achieving financial security. Prioritizing the acquisition of income-generating assets allows for a more stable and prosperous financial future. Conversely, accumulating liabilities without a clear path to repayment can lead to debt cycles and financial hardship.

Financial advisors consistently emphasize the importance of asset allocation and diversification. Spreading investments across various asset classes can mitigate risk and maximize potential returns. Understanding which resources truly contribute to net worth allows for more effective financial planning.

Real-World Examples

Consider two individuals: Sarah and Mark. Sarah invests in a rental property that generates monthly income after covering expenses. Mark purchases a new luxury car that requires substantial monthly payments and depreciates in value rapidly. Sarah is building a true asset, while Mark is accumulating a liability.

Another example involves Emily, who invests in stocks that pay dividends. Compare this to David, who consistently overspends on non-essential items using credit cards. Emily is growing her wealth through an asset source, while David is accumulating debt that erodes his financial stability.

The Role of Financial Literacy

Boosting financial literacy is crucial for empowering individuals to make informed financial decisions. Educational programs, workshops, and online resources can provide the necessary knowledge and skills. Increased financial literacy leads to better asset management and reduced financial vulnerability.

Organizations like the National Financial Educators Council and the Financial Planning Association offer valuable resources for improving financial literacy. Consulting with a qualified financial advisor can also provide personalized guidance and support.

Furthermore, schools and universities are increasingly incorporating financial literacy into their curricula. This ensures that future generations are equipped with the tools to navigate the complexities of the modern financial landscape.

"Financial literacy is not just about managing money; it's about empowering people to make informed choices and achieve their financial goals,"says Ted Beck, President of the National Endowment for Financial Education (NEFE).

Conclusion

Distinguishing between true asset sources and liabilities is fundamental to financial success. Focusing on acquiring income-generating assets while minimizing financial drains is essential for building wealth and achieving long-term financial stability. Continuous learning and seeking professional advice are crucial for making informed financial decisions and securing a brighter financial future.

![Which Of The Following Is Not A Source Of Assets [Solved] Common categories of a classified balance | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/04/660a5f0c399e9_724660a5f0c361ff.jpg)