Which Of The Following Is True About The Closing Process

The real estate closing process, often perceived as a straightforward culmination of weeks or months of effort, is actually a complex series of legal and financial steps. Misconceptions about what is true and what is not regarding the closing process can lead to unnecessary stress, delays, and even financial pitfalls for both buyers and sellers.

Understanding the truth behind key aspects of closing, such as funding timelines, legal responsibilities, and potential costs, is crucial for a smooth and successful transaction. This article aims to clarify common uncertainties and provide accurate information about the closing process, enabling individuals to navigate this critical stage with confidence.

Key Misconceptions and Realities of the Closing Process

One prevalent myth is that the closing date is always firm. While the closing date is the target completion date, it is subject to change due to various factors.

These factors include appraisal issues, lender delays, title defects, and unforeseen problems discovered during the final walkthrough. According to the National Association of Realtors (NAR), a significant percentage of closings experience delays, underscoring the importance of flexibility and proactive communication.

Funding and Escrow: Separating Fact from Fiction

Another common misunderstanding revolves around the timing of fund transfers. Many believe that funds are transferred immediately upon signing the closing documents.

In reality, there's often a waiting period, particularly with electronic transfers, for the funds to be verified and cleared. The Consumer Financial Protection Bureau (CFPB) emphasizes the importance of understanding the lender's funding timeline to avoid potential penalties or delays in receiving keys.

Escrow accounts are also frequently misunderstood. Escrow accounts hold funds, such as earnest money or property tax reserves, and are managed by a neutral third party.

It's untrue that the escrow company automatically releases funds upon the seller's request. The escrow company is obligated to disburse funds according to the terms outlined in the purchase agreement, protecting both buyer and seller.

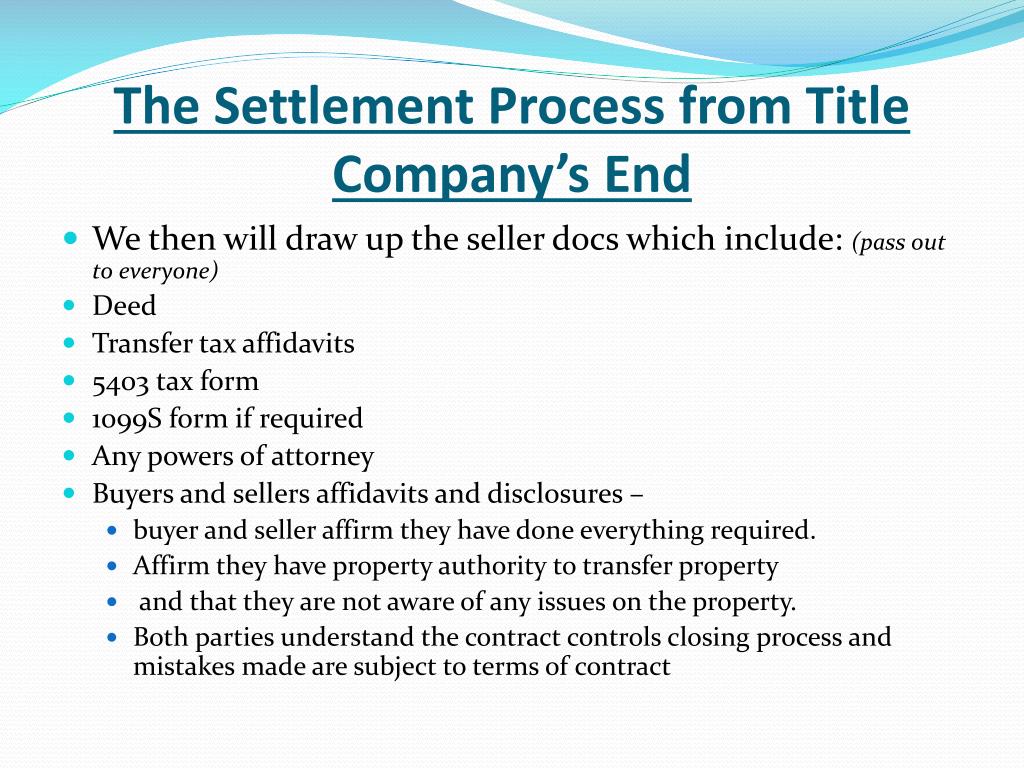

Legal Responsibilities and Title Insurance: What's Actually True?

A significant aspect of closing involves legal documentation and title insurance. It's a misconception that the buyer is solely responsible for all legal aspects of the transaction.

Both buyer and seller have legal responsibilities, often involving attorneys or real estate agents to ensure compliance with state and federal laws. Sellers must disclose any known defects with the property, while buyers must conduct due diligence to uncover any potential issues.

Title insurance protects the buyer from potential claims against the property, such as prior liens or ownership disputes. It's often believed that title insurance is a one-time fee that protects the homeowner indefinitely.

While it's true that the premium is paid only once, the coverage protects against defects existing prior to the policy's effective date. It doesn't cover issues that arise after the policy is issued.

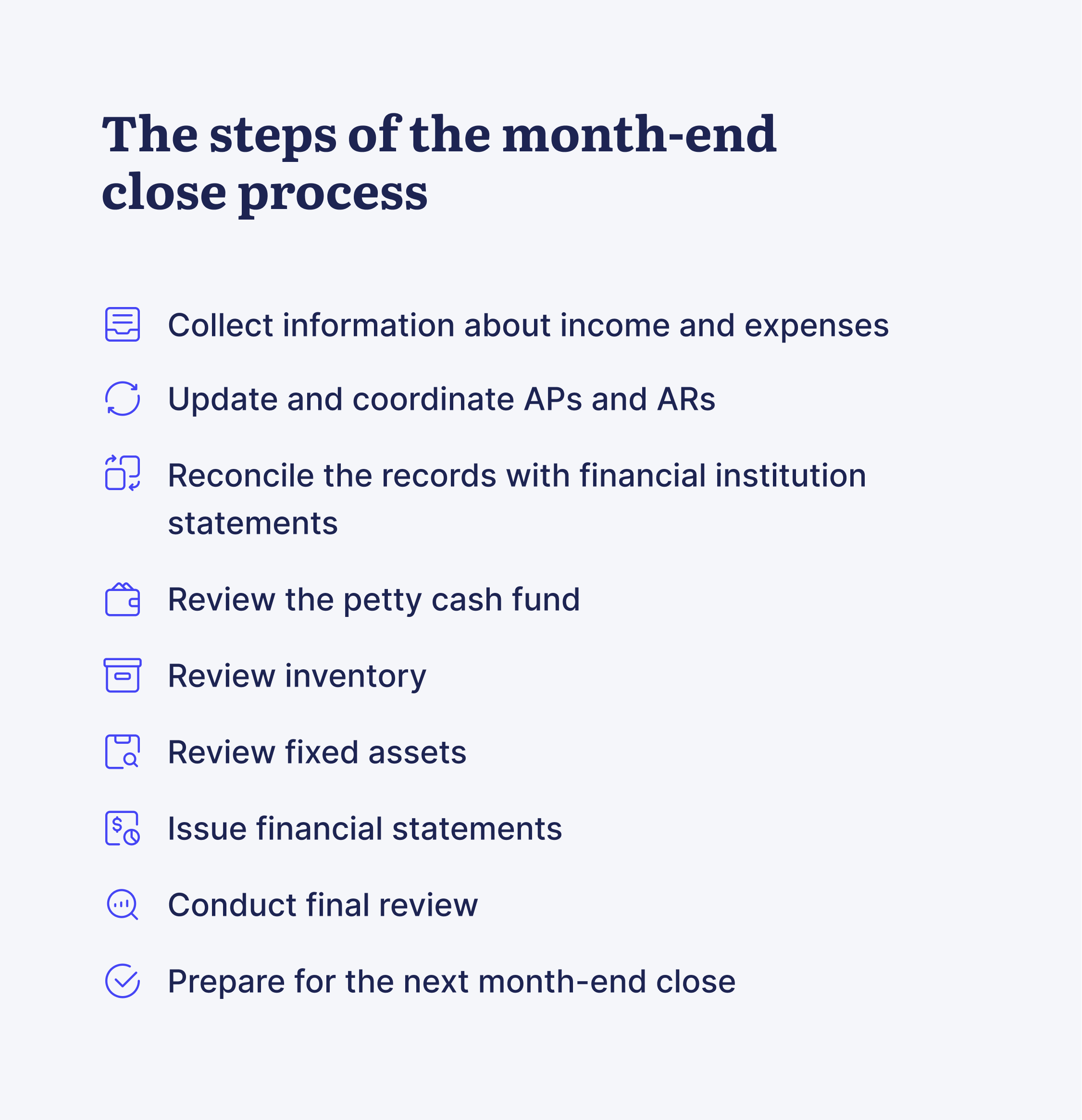

Costs Associated with Closing: Beyond the Down Payment

Closing costs are often underestimated by first-time homebuyers. Many believe that the down payment is the primary expense.

However, closing costs can include appraisal fees, lender fees, title insurance, recording fees, and transfer taxes. The CFPB provides resources to help homebuyers estimate closing costs and understand the various fees involved.

Sellers also incur costs, such as real estate commissions, transfer taxes, and attorney fees. It is not true that sellers always pay the same commission rate.

Commission rates are negotiable and can vary depending on the agent, the market, and the services provided. Understanding the breakdown of closing costs is essential for both buyers and sellers to budget effectively.

Human-Interest Angle: Avoiding Common Closing Pitfalls

Consider the story of Sarah Miller, a first-time homebuyer who almost lost her dream home due to a misunderstanding about the closing timeline. She assumed the funds would be immediately available upon signing, but a bank processing delay caused a last-minute scramble to secure the funds and avoid a breach of contract.

Her experience highlights the importance of proactive communication with lenders and understanding the specific requirements of the closing process. David Johnson, a real estate attorney, emphasizes the need for clear communication and professional guidance throughout the closing process to avoid such stressful situations.

He states that "Having a knowledgeable real estate agent and attorney can help buyers and sellers navigate the complexities of closing and avoid common pitfalls." This underscores the importance of seeking expert advice and being prepared for potential challenges.

Conclusion: Navigating the Closing Process with Confidence

In conclusion, the real estate closing process involves numerous steps and potential challenges that require careful attention to detail. By understanding the truths behind common misconceptions about funding, legal responsibilities, and closing costs, individuals can navigate this complex process with greater confidence.

Proactive communication with lenders, real estate agents, and attorneys is crucial to ensure a smooth and successful closing. By being informed and prepared, buyers and sellers can minimize stress and achieve their real estate goals.