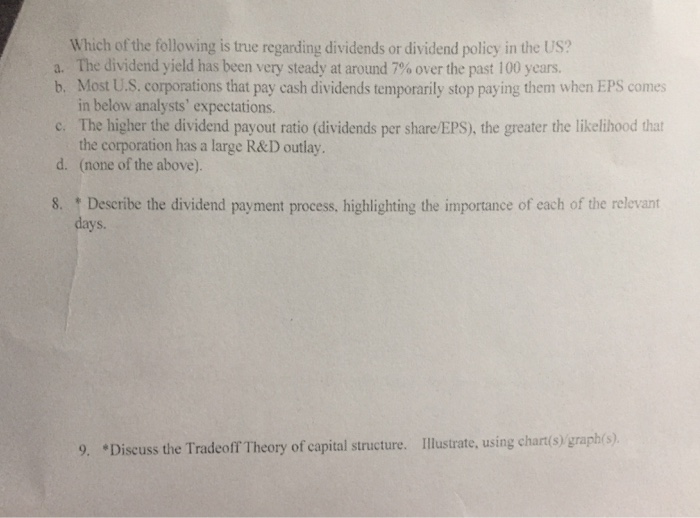

Which Of The Following Is True Concerning Dividends

Imagine a warm summer evening, lemonade in hand, as you check your investment portfolio. A little green number catches your eye: a dividend payment. It's like a mini-reward for trusting a company with your capital, a small but tangible return that brightens your day. But what exactly are dividends, and how do they work?

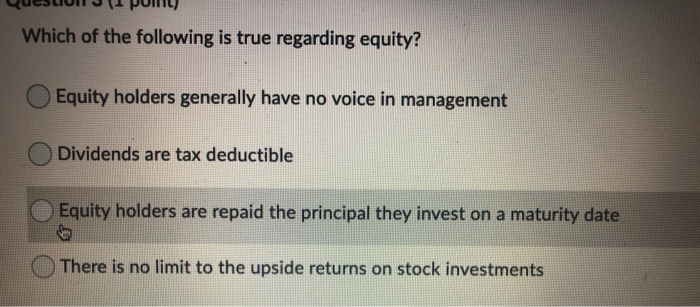

Understanding dividends is crucial for any investor, whether seasoned or just starting. Dividends are essentially a portion of a company's profits distributed to its shareholders, representing a direct return on investment. Navigating the complexities surrounding dividends requires a clear grasp of key concepts and a discerning eye for detail, a goal this article aims to achieve.

The Basics of Dividends

At their core, dividends are a way for companies to share their success with their owners – the shareholders. When a company generates profits, it has several options: reinvest in the business, pay down debt, acquire other companies, or distribute cash to shareholders as dividends.

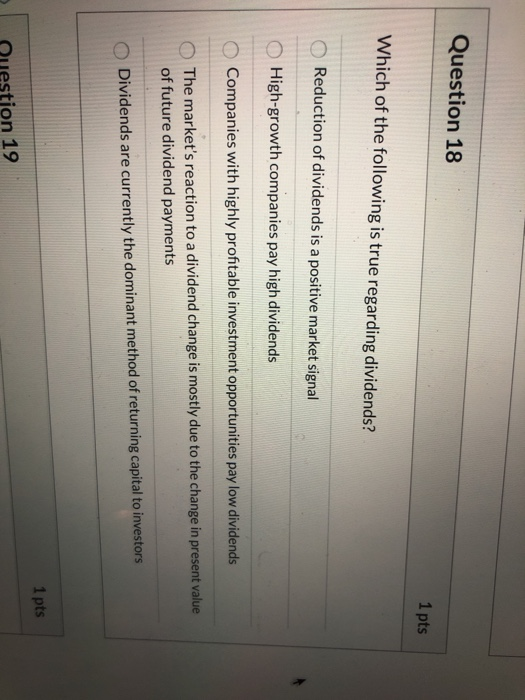

Not all companies pay dividends. Often, younger, growth-oriented companies prefer to reinvest profits to fuel further expansion. More established, mature companies are more likely to consistently pay dividends as a way to attract and retain investors.

Cash Dividends

The most common type is the cash dividend, a direct payment of cash to shareholders, typically paid quarterly. The amount is usually expressed as a per-share amount, meaning you'll receive that amount for each share you own.

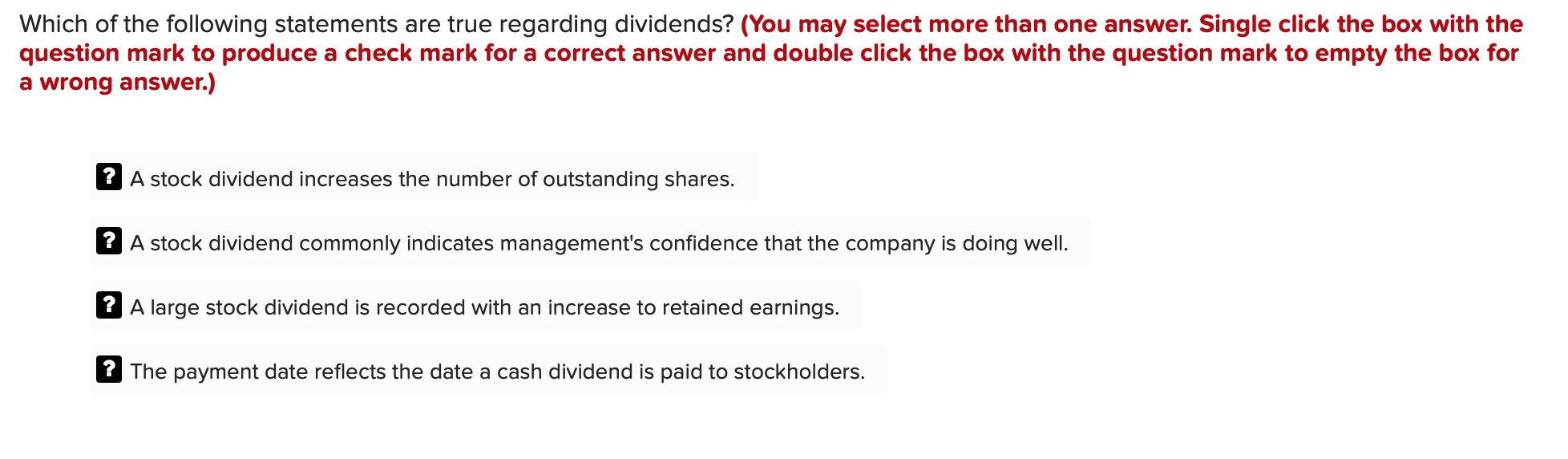

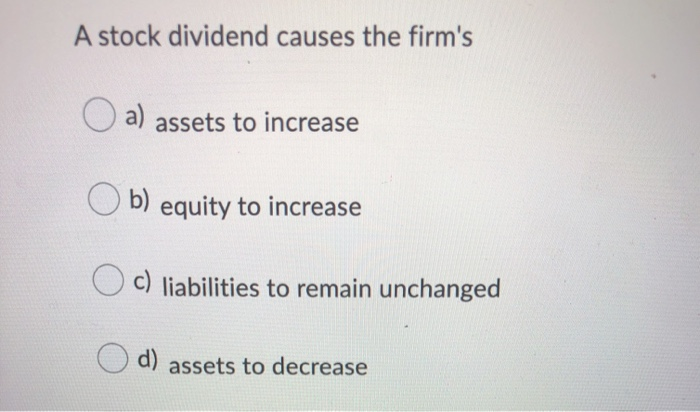

Stock Dividends

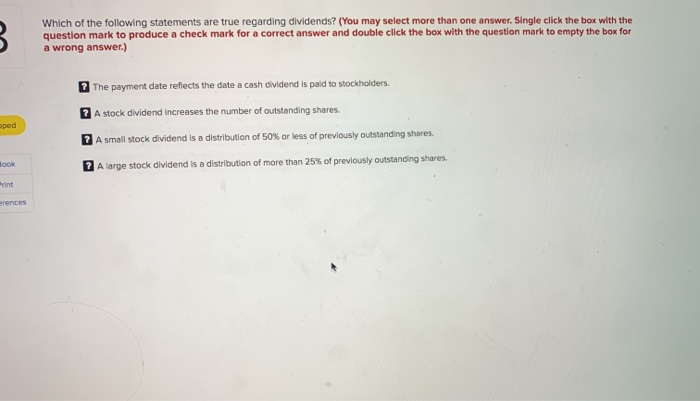

A stock dividend involves distributing additional shares of the company's stock to existing shareholders. This increases the number of shares outstanding but doesn't change the company's overall value. It can be a way to reward shareholders without using cash.

Other Forms of Dividends

Less commonly, companies might issue property dividends, distributing assets like real estate or equipment. Another possibility is a scrip dividend, a promise to pay dividends at a later date, often with interest.

Key Dividend Dates

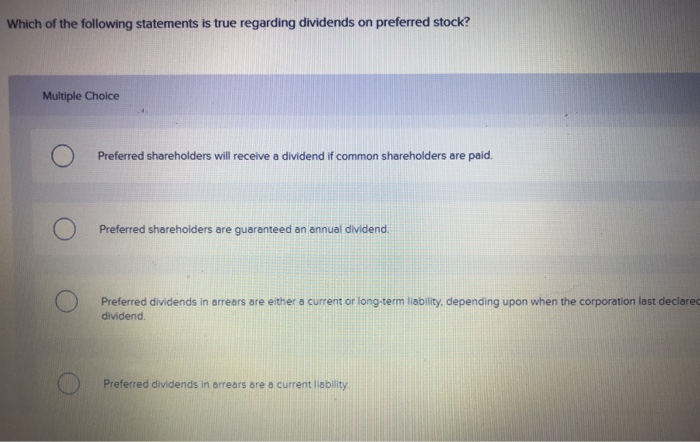

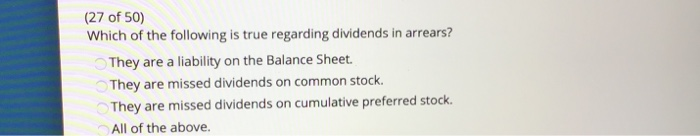

Several crucial dates revolve around dividend payments. Understanding these dates is essential for investors who want to receive dividends from their stock holdings.

Declaration Date

This is the date when the company's board of directors officially declares a dividend. The announcement will specify the amount of the dividend, the record date, and the payment date.

Record Date

The record date determines who is eligible to receive the dividend. To receive the dividend, you must be a registered shareholder on this date.

Ex-Dividend Date

The ex-dividend date is typically one business day before the record date. If you purchase the stock on or after the ex-dividend date, you will not receive the dividend.

Payment Date

The payment date is when the company actually distributes the dividend to shareholders. This is the day the money shows up in your brokerage account.

Dividend Yield: A Key Metric

Dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It's calculated by dividing the annual dividend per share by the stock's price per share.

A higher dividend yield can be attractive to investors seeking income. However, it's important to consider the company's financial health and sustainability of the dividend before making any investment decisions.

Factors Influencing Dividend Decisions

Companies consider various factors when deciding whether to pay dividends and how much to distribute. Profitability is a key driver, but so is the company's cash flow.

Future investment opportunities also play a role. A company with significant growth prospects might choose to reinvest more profits rather than pay dividends.

The company's debt levels and financial stability are also important considerations. A company with high debt might prioritize paying down its debt before distributing dividends.

Tax Implications of Dividends

Dividends are generally taxable income. The tax rate can vary depending on the type of dividend and the investor's income bracket.

Qualified dividends are taxed at lower rates than ordinary income for many investors. To qualify, the stock must be held for a certain period, typically more than 60 days during the 121-day period surrounding the ex-dividend date.

It's always a good idea to consult with a tax advisor to understand the specific tax implications of dividends in your individual circumstances.

The Signaling Effect of Dividends

Dividend policies can send important signals to the market. Increasing dividends often signals management's confidence in the company's future prospects.

Conversely, cutting or eliminating dividends can signal financial distress or a change in the company's strategy. Such decisions can negatively impact the stock price.

Dividends and Reinvestment

Many investors choose to reinvest their dividends, using them to purchase additional shares of the company's stock. This strategy, known as dividend reinvestment (DRIP), can accelerate wealth accumulation over time through the power of compounding.

DRIPs can be a convenient and cost-effective way to increase your ownership in a company. They often involve little or no transaction fees.

Risks Associated with Dividends

While dividends can be attractive, they are not guaranteed. Companies can reduce or eliminate dividends at any time, especially during economic downturns or periods of financial difficulty.

Relying solely on dividend income can also be risky. Diversifying your investment portfolio across different asset classes and sectors is essential.

The Importance of Due Diligence

Before investing in a dividend-paying stock, conduct thorough research on the company's financial health, business model, and industry outlook. Look for companies with a history of consistently paying and increasing dividends, but also ensure that the dividend payout ratio is sustainable.

Consider the company's overall financial strategy and management's commitment to returning value to shareholders. Don't solely focus on the dividend yield; assess the company's long-term prospects.

Conclusion

Dividends represent a tangible connection between a company's success and the investor’s returns. By understanding the intricacies of dividend policies, key dates, tax implications, and the underlying factors driving dividend decisions, investors can make informed choices that align with their financial goals.

As you sip your lemonade and review your portfolio, remember that dividends are more than just a cash payment. They are a reflection of a company's performance, a signal of its financial health, and a potential source of long-term wealth creation. Embrace the knowledge, conduct your due diligence, and let those little green numbers brighten your financial future.