Which Of The Following Issues Only Common Stock

The aroma of freshly brewed coffee mingled with the hushed murmur of anticipation. Sunlight streamed through the expansive windows of the trading floor, illuminating a sea of faces glued to monitors displaying a chaotic dance of numbers and symbols. Each tick, each blip, represented a company's story – a tale of innovation, growth, and the ever-present quest for capital. But beneath the surface of this complex ecosystem lies a fundamental question: which types of companies choose to fund their ambitions solely through the issuance of common stock?

This article explores the nuances of corporate finance, specifically focusing on the types of entities that rely exclusively on common stock for funding. While rare, this strategy reveals insights into a company's risk profile, growth stage, and overall financial philosophy.

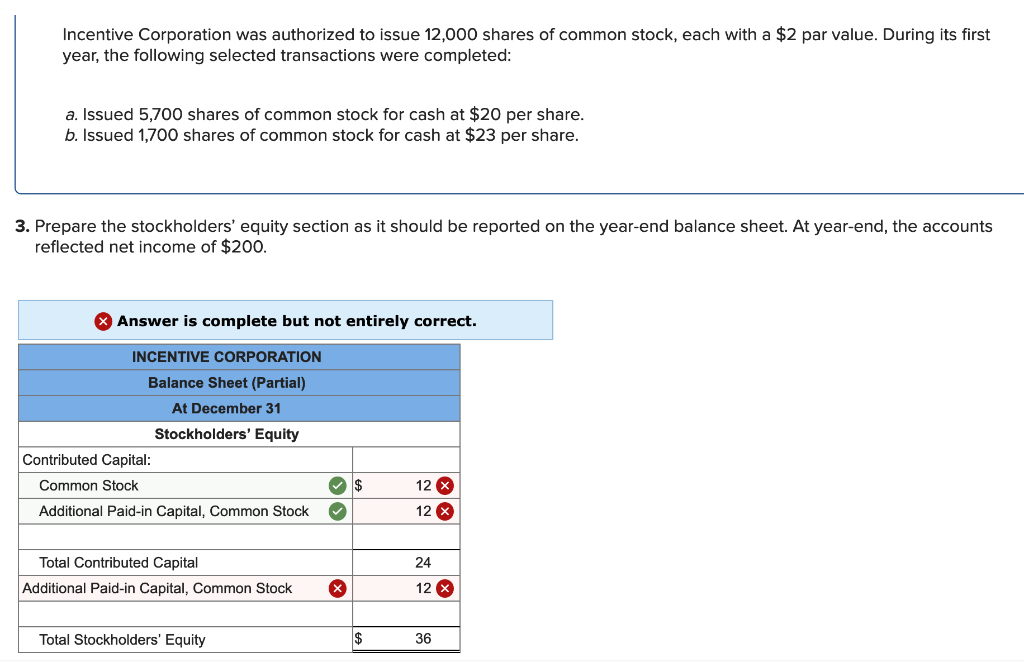

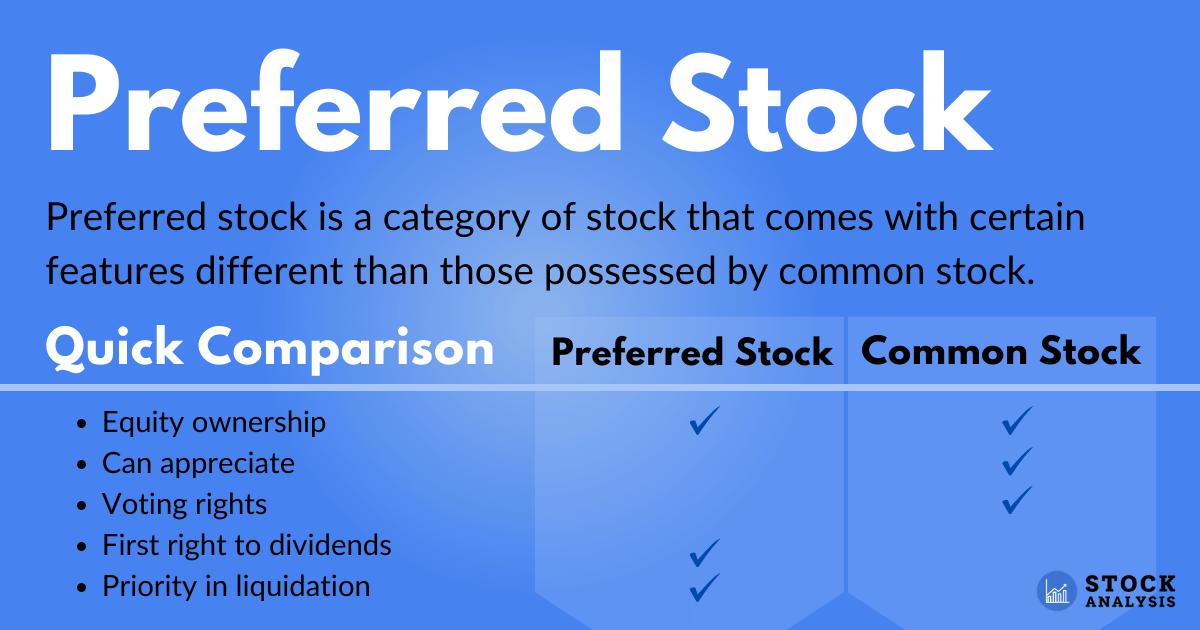

Understanding Common Stock

Before delving into the "who," it's crucial to understand the "what." Common stock represents ownership in a corporation. Holders of common stock typically have voting rights, allowing them to influence the company's direction, and are entitled to a share of the company's profits, if any, through dividends.

However, unlike bondholders or preferred stockholders, common stockholders are last in line during bankruptcy proceedings. This means they bear the highest risk, but also stand to gain the most from a company's success.

The Rare Breed: Companies Solely Funded by Common Stock

It's relatively uncommon for established companies to *exclusively* use common stock for funding. Most businesses utilize a mix of debt (bonds, loans) and equity (stock) to optimize their capital structure. However, certain categories are more likely to rely solely on equity financing.

Startups and Early-Stage Companies: These ventures, often brimming with potential but lacking a proven track record, frequently depend on angel investors and venture capital firms who receive equity in exchange for funding. Because securing debt financing is incredibly difficult in these early days, common stock is frequently the only option.

Without a history of profitability or assets to pledge as collateral, traditional lenders are hesitant to extend credit. Instead, startups issue common stock (or preferred stock, which often converts to common stock) to raise the capital needed to fuel their growth.

Companies Prioritizing Independence: Some companies deliberately avoid debt to maintain greater operational flexibility and avoid the constraints imposed by lenders. They may prioritize retaining full control and avoiding the fixed payment obligations associated with debt.

This aversion to debt often stems from a desire to pursue unconventional strategies or maintain a long-term vision without the pressure of meeting short-term financial targets demanded by creditors.

Why Choose Common Stock Only?

The decision to finance solely through common stock carries both advantages and disadvantages.

Advantages: No debt burden and the corresponding interest payments frees up cash flow for reinvestment in the business. This greater financial flexibility allows the company to weather economic downturns and pursue opportunities that might be unavailable to companies weighed down by debt. Retaining full control over the company is another attractive incentive.

Disadvantages: Dilution of existing shareholders' ownership. Issuing new shares to raise capital reduces the percentage of the company owned by existing shareholders. A higher cost of capital, equity financing generally has a higher cost of capital than debt financing because investors demand a higher rate of return to compensate for the higher risk associated with equity investments.

Examples and Case Studies

While publicly traded, well-established companies relying solely on common stock are rare, examples can be found in specific niches.

Historically, certain community-owned enterprises or cooperatives might operate primarily with member equity, which functions similarly to common stock. These organizations prioritize community benefit over maximizing shareholder value and often avoid debt to maintain local control.

Some smaller, privately held technology startups in highly specialized fields, backed by a small group of venture capitalists, may also operate solely on equity funding for extended periods while they develop their technology and pursue initial market traction.

The Role of Risk and Growth

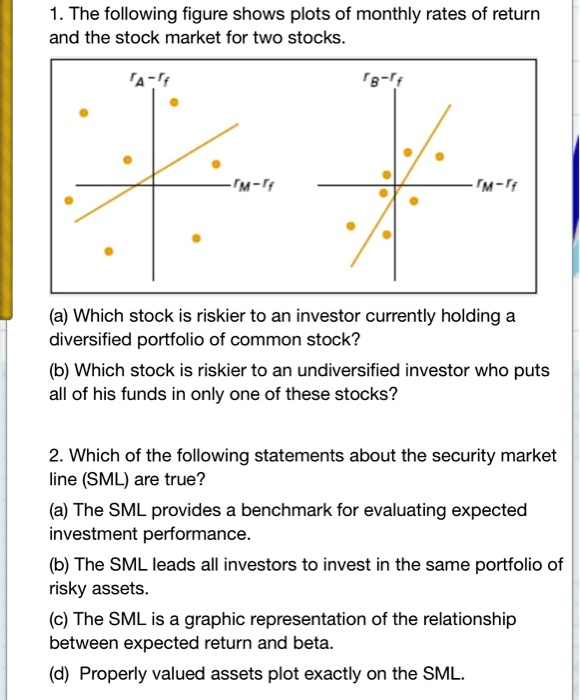

The choice to rely solely on common stock is often a reflection of a company's risk profile and growth trajectory.

High-growth startups, despite their inherent risk, often attract investors willing to bet on their future potential. These investors understand that the potential returns from a successful startup far outweigh the risk of loss.

Conversely, mature, established companies with stable cash flows typically find debt financing more attractive because it is cheaper than equity financing and does not dilute existing shareholders' ownership.

Implications for Investors

For investors, a company that exclusively issues common stock presents a unique proposition. Investing in such a company is inherently riskier.

However, the potential rewards can also be substantial if the company is successful. It's crucial for investors to carefully assess the company's business model, management team, and growth prospects before investing.

It is also important to understand the potential for dilution and the impact of future equity offerings on the value of their existing shares.

Conclusion: A Matter of Choice and Circumstance

The decision to finance a company solely through common stock is a strategic choice driven by a complex interplay of factors. It is frequently a necessity for startups and a deliberate choice for companies prioritizing independence.

While it's not a common practice for large, established corporations, understanding the rationale behind this financing strategy offers valuable insights into the dynamics of corporate finance and the diverse ways companies pursue their ambitions.

Ultimately, the choice of how to finance a business speaks volumes about its philosophy, risk tolerance, and vision for the future.