Which Of The Following Policies Does Not Build Cash Value

The quest for financial security often leads individuals to explore various insurance policies, each promising a unique blend of protection and investment. However, understanding the intricacies of these policies is crucial to avoid misaligned expectations and make informed decisions. One critical aspect often overlooked is whether a policy builds cash value, a feature that significantly impacts its long-term financial implications.

This article aims to dissect the nuances of different insurance policies, specifically focusing on identifying those that do not accumulate cash value. By examining the features, benefits, and limitations of each policy type, we aim to provide clarity on which options primarily offer pure protection, and which incorporate a savings component. This will enable readers to discern the best fit for their individual financial goals and risk tolerance.

Term Life Insurance: Pure Protection

Term life insurance stands out as a straightforward protection product. It provides coverage for a specific period, typically ranging from 10 to 30 years.

If the insured individual passes away within the term, the beneficiary receives a death benefit. If the term expires without a death occurring, the coverage ceases, and no cash value is accumulated.

Term life is generally the most affordable type of life insurance, making it a popular choice for individuals seeking substantial coverage at a lower cost. However, it's important to note that premiums typically increase upon renewal, reflecting the insured's increasing age and mortality risk.

Renters Insurance: Protecting Your Belongings

Renters insurance, as the name suggests, protects renters against losses to their personal property. These losses could be caused by theft, fire, vandalism, or certain natural disasters.

The policy also usually provides liability coverage if someone is injured on the renter's property. Renters insurance policies are designed to cover specific risks, and do not build cash value.

Like term life, renters insurance is a pure protection product that offers no investment or savings component. Its primary function is to provide financial compensation for covered losses, ensuring renters can replace damaged or stolen belongings.

Health Insurance: Covering Medical Expenses

Health insurance is designed to cover medical expenses, including doctor visits, hospital stays, prescription drugs, and other healthcare services. The cost of health insurance is typically structured as a monthly premium, which grants access to covered medical benefits.

Health insurance policies are designed to provide financial protection against the high cost of healthcare. Therefore, the policies do not build cash value.

Health insurance is a critical form of protection that helps individuals manage potentially devastating medical expenses. While some plans may include wellness programs or preventive care benefits, the core function remains risk mitigation rather than investment.

Property Insurance (Homeowners or Landlord): Shielding Your Dwelling

Property insurance is designed to protect real estate. It covers the dwelling itself along with any attached structures like a garage or shed. It also protects any unattached structures on the property.

If a covered peril damages or destroys the home, such as a fire or windstorm, the insurance policy will pay to repair or rebuild the structure, subject to the policy's coverage limits and deductibles. Property insurance, like other forms of pure protection, does not build cash value.

The policy is designed to offer financial assistance to restore a damaged home back to its original state, not accumulate wealth over time. Landlord insurance, similar to homeowner's insurance, protects the landlord's property and liabilities but does not offer a cash value component.

Auto Insurance: Protecting You on the Road

Auto insurance provides financial protection in the event of an accident, theft, or other covered incident involving a vehicle. Coverage can include liability, collision, comprehensive, and uninsured/underinsured motorist protection.

Auto insurance helps cover the costs of damages to your vehicle, medical expenses for injuries sustained in an accident, and liability claims if you are at fault. Similar to property insurance, auto insurance does not build cash value.

It serves as a financial safety net to mitigate the risks associated with vehicle ownership and operation. This is another example of pure protection, designed solely to address potential financial losses rather than generate long-term savings.

Disability Insurance: Income Protection

Disability insurance provides income replacement if you can't work because of an illness or injury. Short-term policies replace income for a few months, while long-term policies may provide benefits for years, or even until retirement age.

If you become disabled, disability insurance pays a portion of your regular income, helping to cover your living expenses while you're unable to work. This insurance protects your income, but it does not build cash value.

The policy is designed to protect your earnings in the event of a debilitating injury or illness. This is considered to be pure protection.

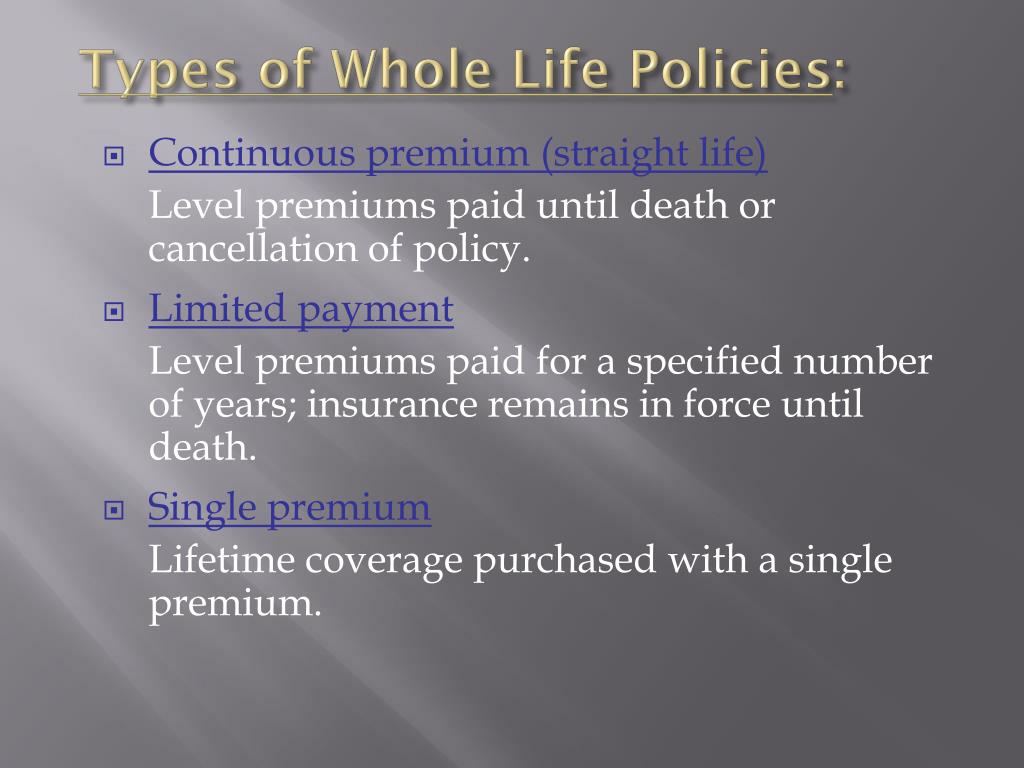

Distinguishing Policies That Do Build Cash Value

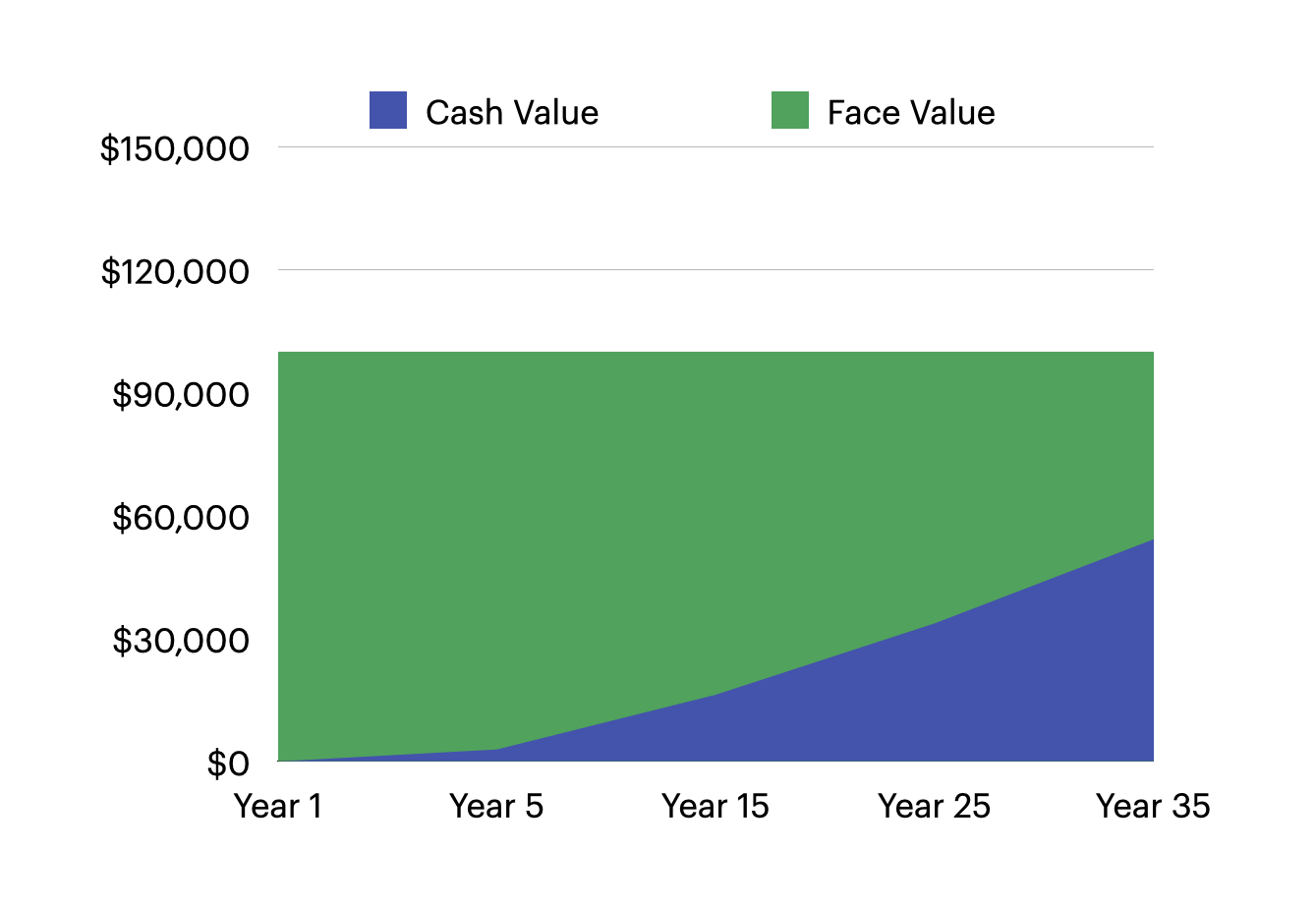

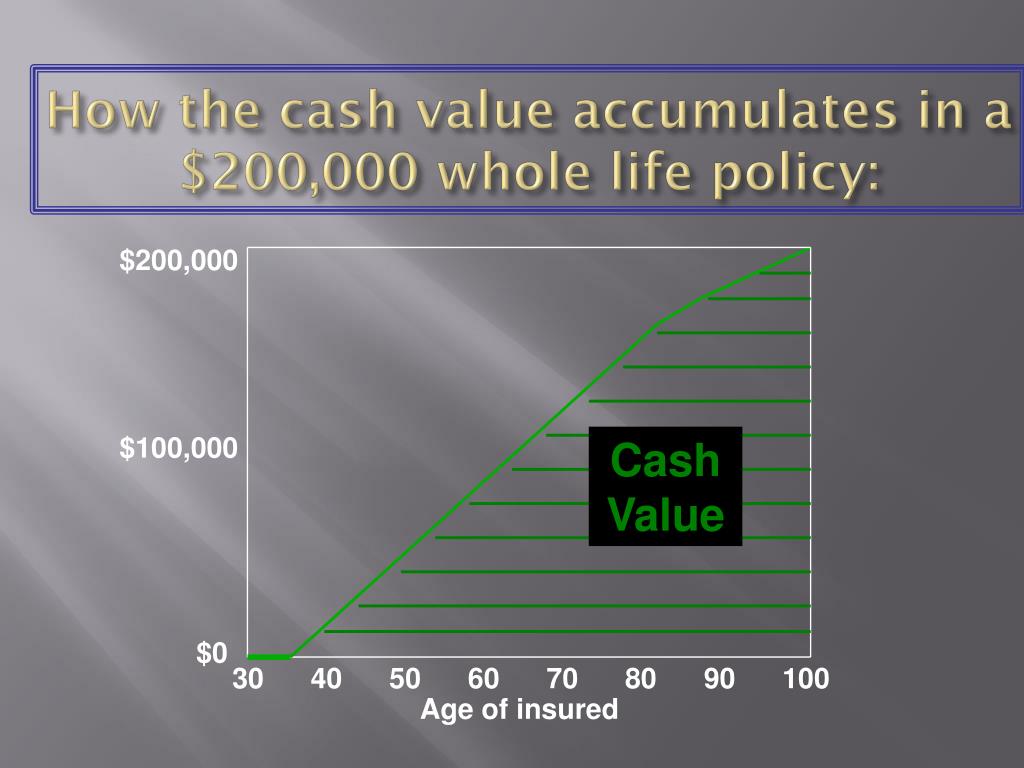

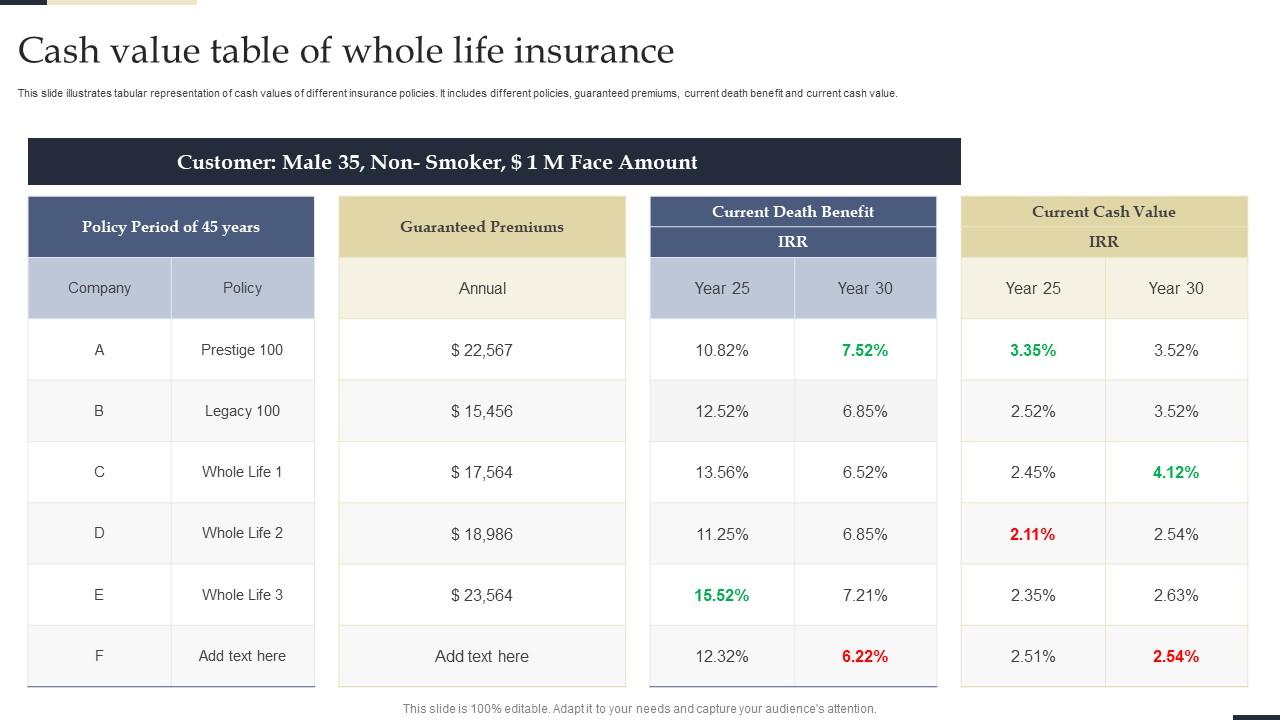

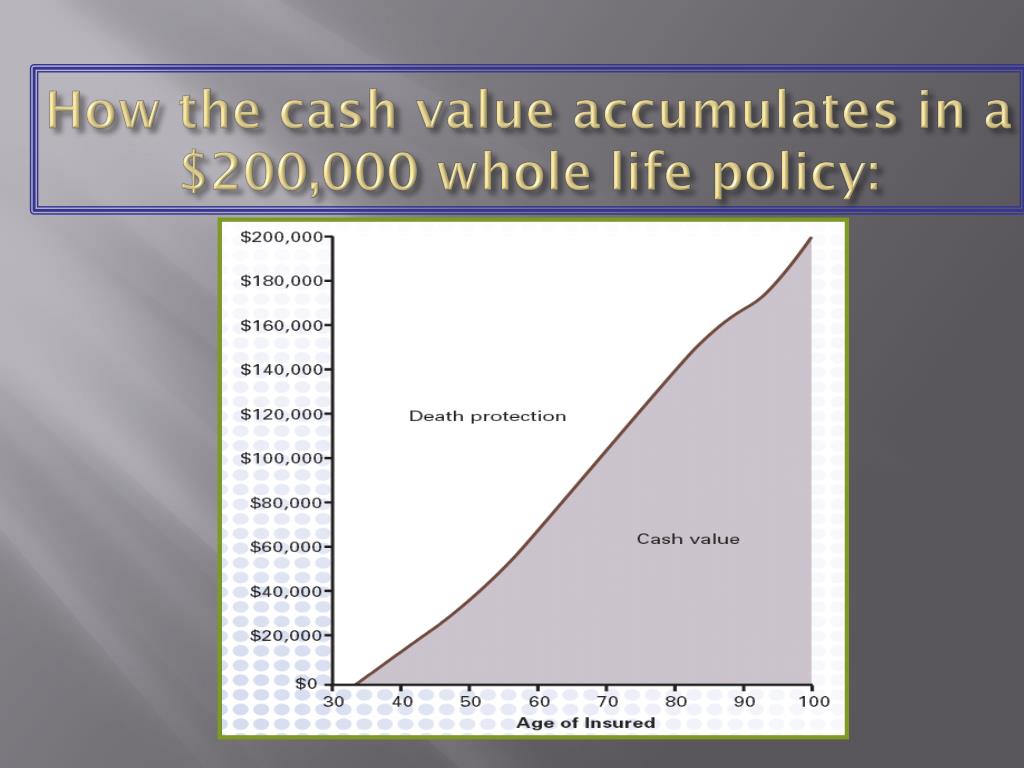

In contrast to the policies outlined above, certain types of life insurance policies *do* accumulate cash value. These include whole life insurance, universal life insurance, and variable life insurance.

With these policies, a portion of the premium goes towards the cost of insurance, while the remainder is invested, allowing the cash value to grow over time. The cash value can be accessed through policy loans or withdrawals, offering policyholders a source of liquidity.

However, it's essential to understand that these policies typically have higher premiums than term life insurance, reflecting the built-in savings component.

Making Informed Decisions

Choosing the right insurance policy requires careful consideration of your individual needs, financial goals, and risk tolerance. If your primary objective is to obtain affordable protection without a savings component, then term life insurance, renters insurance, health insurance, property insurance, and auto insurance may be suitable options.

However, if you desire a policy that combines protection with a savings element, then exploring whole life, universal life, or variable life insurance policies may be worthwhile.

Consulting with a qualified financial advisor can provide personalized guidance, ensuring you make informed decisions that align with your unique circumstances.

Understanding the distinction between policies that build cash value and those that do not is critical for sound financial planning. By carefully evaluating the features, benefits, and limitations of each policy type, individuals can make informed decisions that align with their specific needs and financial goals. As the insurance landscape continues to evolve, staying informed remains paramount to securing a financially stable future.

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

![Which Of The Following Policies Does Not Build Cash Value How Does Life Insurance Work? [Simple Guide For 2025]](https://districtcapitalmanagement.com/wp-content/uploads/2022/09/How-Does-Cash-Value-Life-Insurance-Work_.jpg)