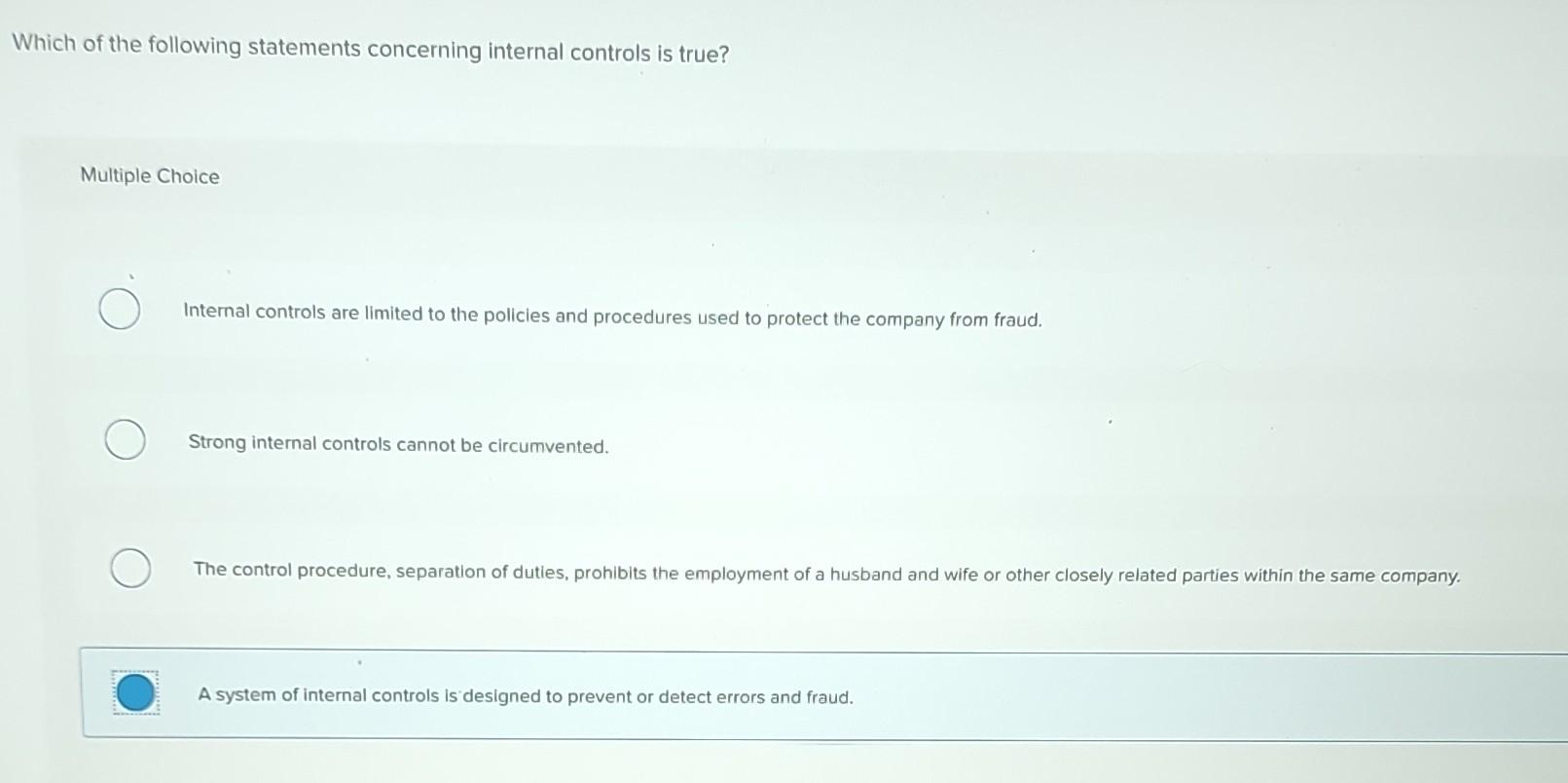

Which Of The Following Statements Concerning Internal Controls Is True

A recent survey conducted by the Institute of Internal Auditors (IIA) has revealed a significant gap in understanding fundamental principles of internal controls among professionals, raising concerns about organizational risk management and financial accountability.

The survey, which targeted individuals across various industries and organizational levels, aimed to assess comprehension of core concepts related to internal control frameworks. The findings highlight a concerning lack of clarity on even basic definitions and applications. The implications of this knowledge deficit are substantial, potentially leading to flawed risk assessments, inadequate control design, and ultimately, increased vulnerability to fraud and errors.

Key Findings from the IIA Survey

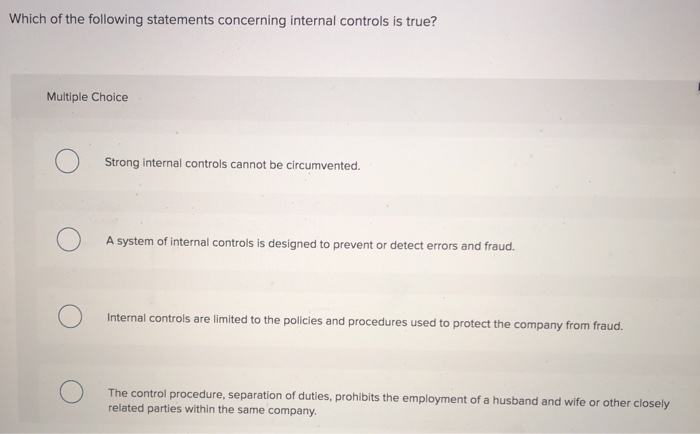

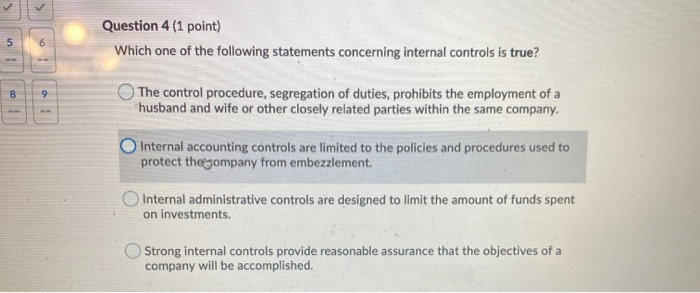

The survey presented participants with several statements concerning internal controls and asked them to identify the accurate one. A significant portion struggled with identifying the correct answer, indicating a widespread misunderstanding of the key concepts. This misunderstanding is not limited to entry-level positions; surprisingly, even experienced professionals exhibited gaps in their knowledge.

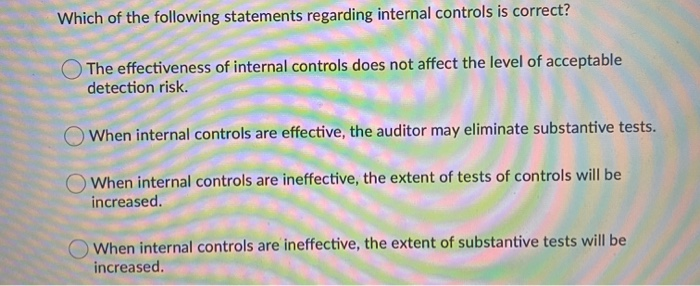

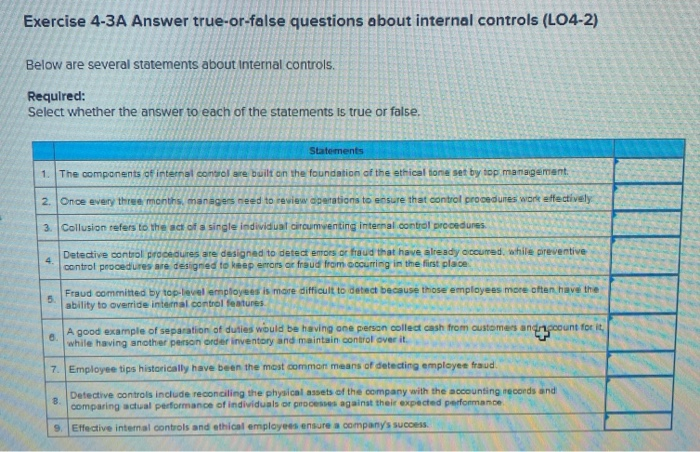

The survey revealed that the most frequently misunderstood aspect of internal controls revolves around their inherent limitations. Many participants incorrectly believed that internal controls could provide absolute assurance against all potential risks. This misconception is dangerous because it can lead to overconfidence in the effectiveness of control systems.

Another common misconception involved the scope of responsibility for internal controls. Some participants wrongly assumed that internal controls are solely the responsibility of the internal audit department. However, effective internal control is a shared responsibility across the entire organization.

Specific Statements and Misconceptions

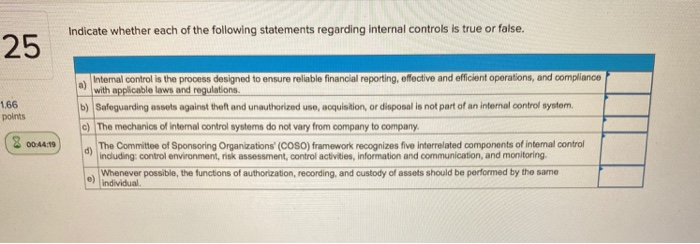

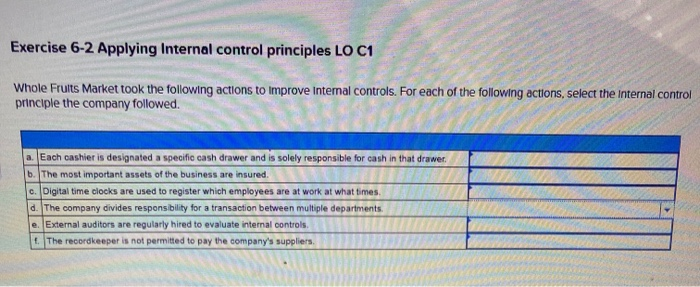

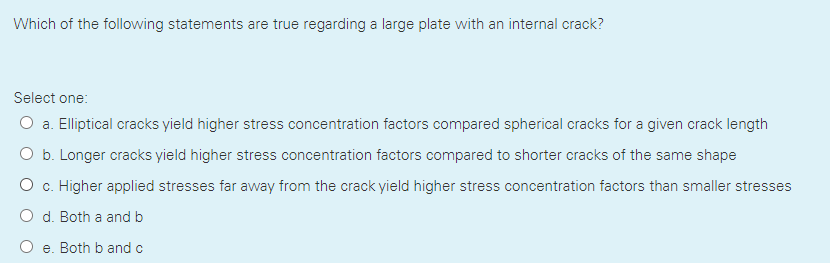

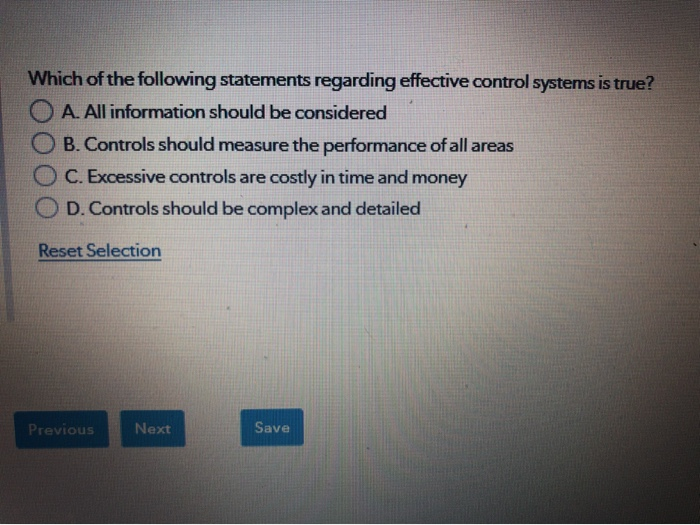

The IIA report highlighted several specific statements that proved particularly challenging for respondents.

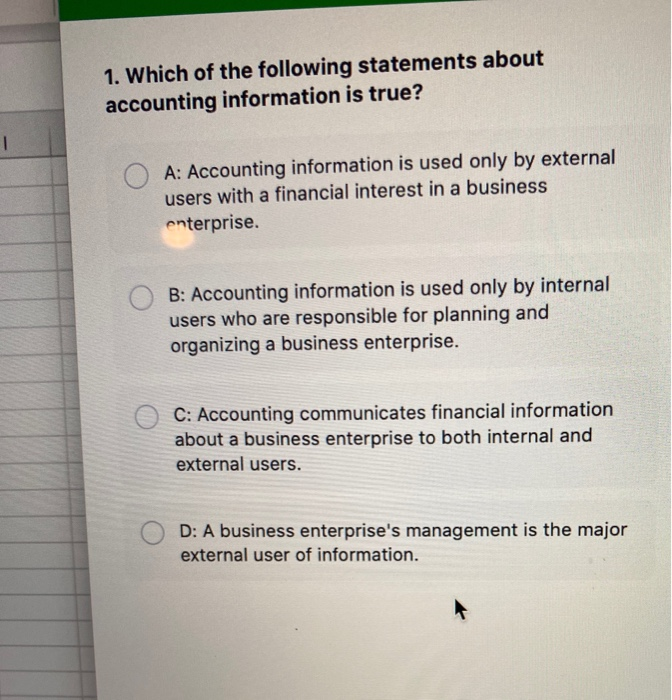

One statement focused on the role of management in establishing and maintaining internal controls. While most participants recognized management's responsibility, a significant minority underestimated the extent of their involvement, seeing it as merely a compliance requirement rather than an integral part of strategic decision-making.

Another statement explored the relationship between internal controls and organizational objectives. Many participants failed to fully appreciate that internal controls are designed to help an organization achieve its objectives, not simply to prevent errors or fraud. This indicates a lack of understanding of the proactive and value-adding nature of effective internal control systems.

"The findings underscore the critical need for enhanced training and education on internal control principles," stated Dr. Sarah Miller, lead researcher on the IIA survey. "Organizations must invest in developing a culture of control consciousness at all levels."

The Impact on Organizations and Society

The lack of understanding regarding internal controls has profound implications for organizations. Inadequate control environments can lead to financial misstatements, operational inefficiencies, and reputational damage. Furthermore, a weak control environment can increase the risk of fraud and corruption.

Ultimately, these organizational failures can have ripple effects throughout society. Investors can lose confidence in the market, customers can be harmed by unsafe products or services, and employees can be negatively impacted by unethical business practices.

Addressing the Knowledge Gap

The IIA is advocating for increased emphasis on internal control education and training. This includes developing comprehensive training programs for professionals at all levels, promoting awareness of internal control frameworks, and encouraging organizations to foster a strong culture of control consciousness.

Several organizations are already taking steps to address the knowledge gap. They are implementing mandatory training programs, strengthening their internal audit functions, and enhancing their risk management processes. Some companies are also leveraging technology to improve the effectiveness of their internal controls, such as implementing automated monitoring systems and data analytics tools.

The survey results serve as a wake-up call for organizations and professionals alike. A thorough understanding of internal control principles is essential for effective risk management, financial accountability, and ethical business practices. Organizations must prioritize internal control education and training to protect themselves from potential financial and reputational harm.