Which Of The Following Statements Is True About A Fiduciary

Imagine your grandmother, a woman who scrimped and saved her entire life, finally ready to retire. She’s entrusted her nest egg to a financial advisor, hoping for a comfortable future. But what assurances does she have that this advisor truly has her best interests at heart? This scenario, replicated millions of times over, highlights the crucial importance of understanding the concept of a fiduciary.

At its core, being a fiduciary means acting in the best interests of another person or entity. But beyond this simple definition lies a complex web of legal and ethical obligations. This article will explore what it truly means to be a fiduciary, dissecting the legal responsibilities and ethical considerations involved, and helping you understand which of the following statements is definitively true about a fiduciary: A fiduciary is legally bound to act solely in the best interests of their client.

What is a Fiduciary? The Foundation of Trust

The term fiduciary originates from the Latin word "fiducia," meaning trust or confidence. A fiduciary relationship exists when one person (the fiduciary) is legally obligated to act for the benefit of another person (the beneficiary). This obligation extends beyond mere advice; it demands unwavering loyalty and a commitment to prioritizing the beneficiary’s interests above all else.

Think of it as a solemn promise to always put someone else's needs first when handling their affairs. This duty distinguishes a fiduciary relationship from ordinary business transactions. It emphasizes trust and ethical conduct as foundational principles.

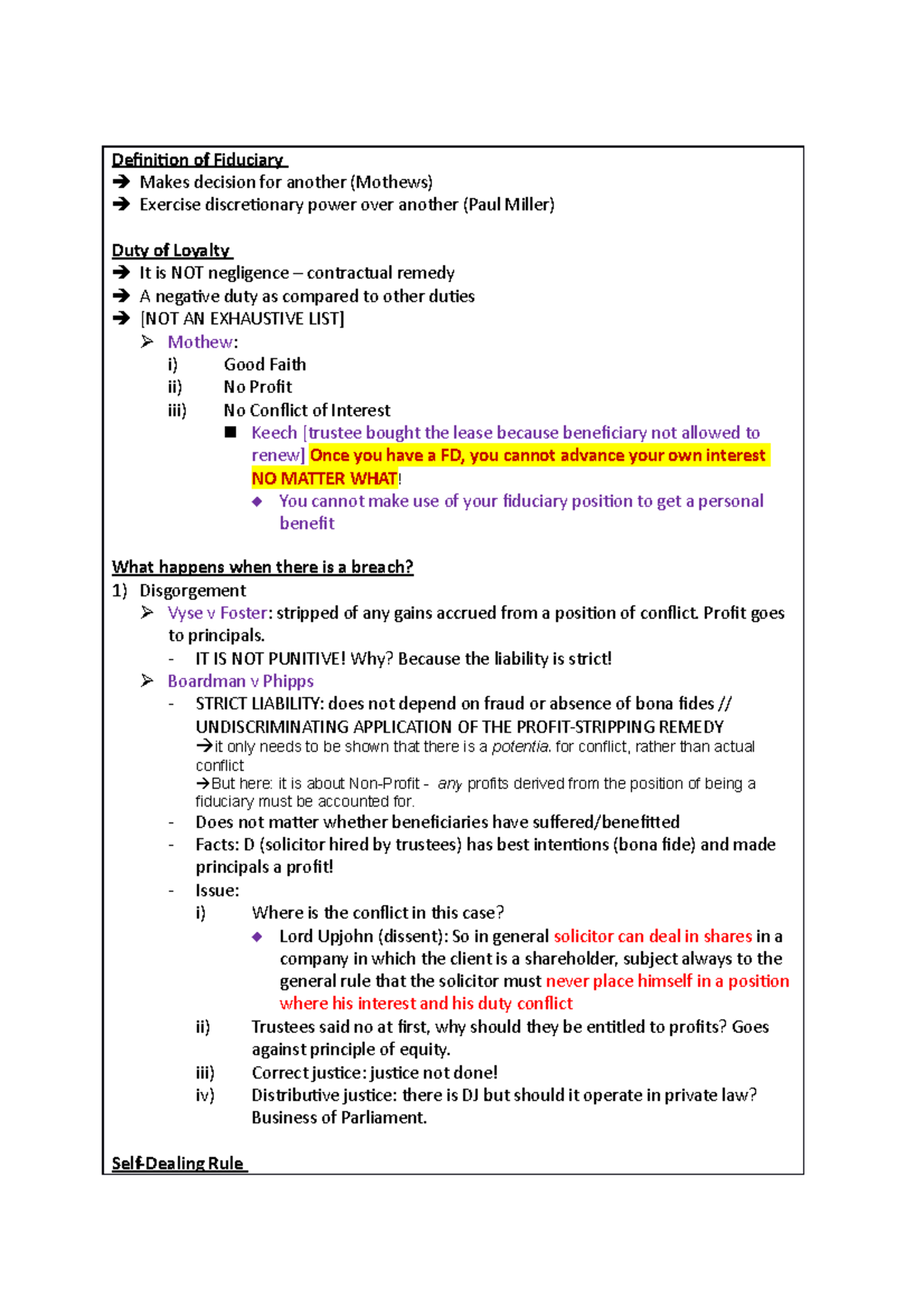

The Legal Landscape of Fiduciary Duty

The legal definition of a fiduciary duty is often codified in statutes and case law. These laws vary depending on the specific context of the fiduciary relationship. However, some core principles remain consistent across different jurisdictions.

These principles include a duty of loyalty, a duty of care, and a duty to disclose. The duty of loyalty requires the fiduciary to act solely in the beneficiary’s best interests, avoiding conflicts of interest and self-dealing. The duty of care mandates that the fiduciary act with reasonable prudence and diligence when managing the beneficiary's affairs. The duty to disclose requires the fiduciary to provide the beneficiary with all material information relevant to their relationship, including potential conflicts of interest.

Failure to uphold these duties can result in legal consequences for the fiduciary. These consequences can include lawsuits, fines, and even criminal charges in some cases.

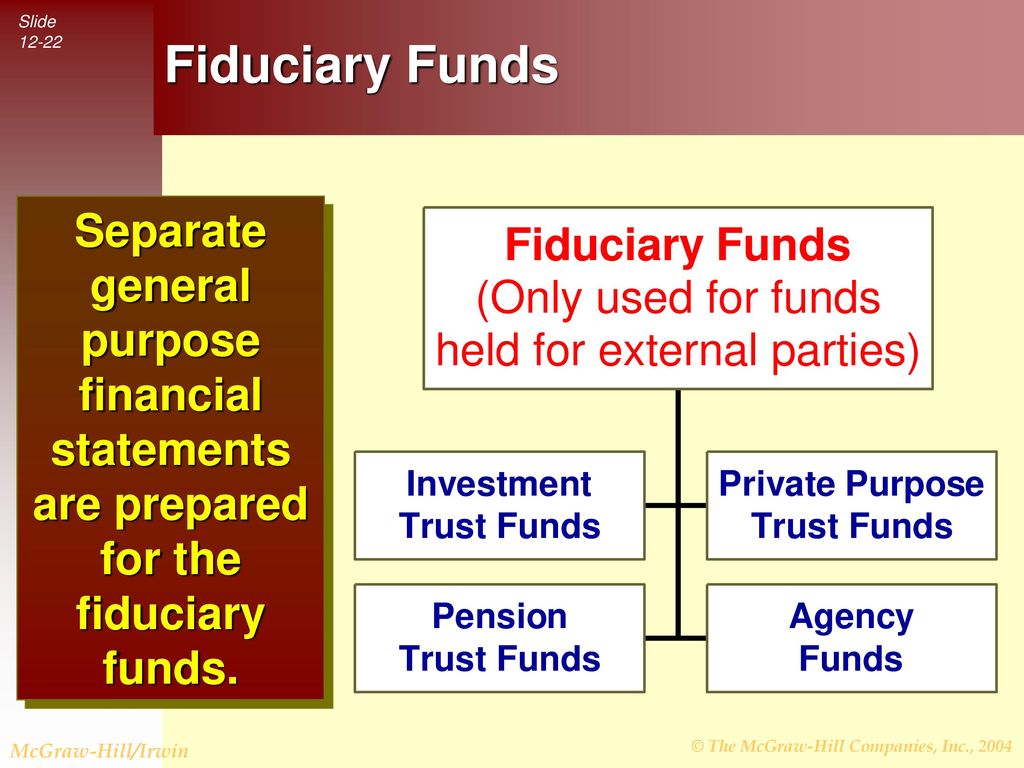

Common Examples of Fiduciary Relationships

Fiduciary relationships are prevalent in various aspects of modern life. They exist whenever one person relies on another to act in their best interest.

Some common examples include:

- Trustees: Individuals or entities responsible for managing assets held in trust for beneficiaries.

- Financial Advisors: Those who manage investments or provide financial advice to clients. (Note: Not all financial advisors are fiduciaries.)

- Lawyers: Attorneys representing clients in legal matters.

- Corporate Officers and Directors: Individuals responsible for managing a corporation on behalf of its shareholders.

- Guardians: Individuals appointed by a court to care for and manage the affairs of a minor or incapacitated person.

Each of these roles carries a unique set of responsibilities and obligations specific to the nature of the relationship. Understanding these nuances is essential for both fiduciaries and beneficiaries.

The Importance of Distinguishing Between Fiduciary and Non-Fiduciary Roles

The distinction between a fiduciary and a non-fiduciary role is crucial, particularly in the financial services industry. Many financial advisors operate under a "suitability" standard, which requires them to recommend investments that are suitable for their clients' needs. This suitability standard is different from the fiduciary standard.

While suitability may seem beneficial, it allows advisors to recommend products that generate higher commissions for themselves, even if those products are not the absolute best option for the client. In contrast, a fiduciary must always prioritize the client’s interests above their own. This is the crux of the difference.

The Financial Industry Regulatory Authority (FINRA) has taken steps to educate investors about the difference between these standards. However, it remains the responsibility of individuals to understand their rights and to seek out advisors who are legally bound to act as fiduciaries.

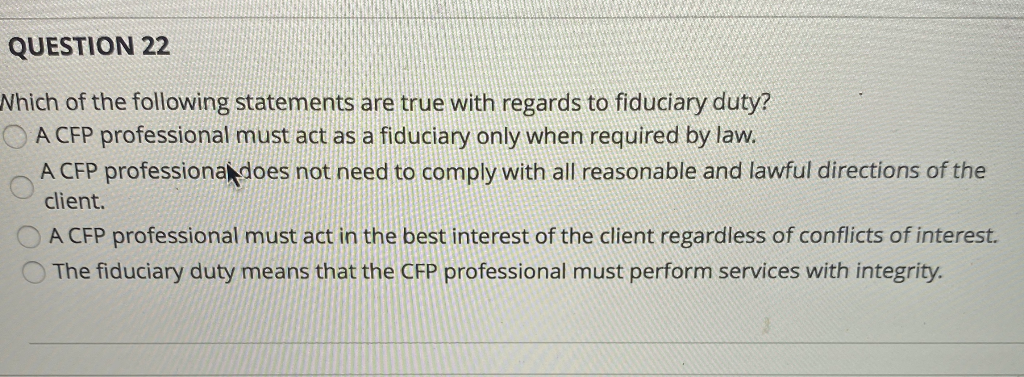

What Makes a Statement True About a Fiduciary

Given the complex legal and ethical obligations associated with being a fiduciary, it's essential to understand what definitively defines the role. Several statements might seem plausible, but only one captures the essence of the fiduciary duty.

Here's a breakdown of why certain statements might be misleading or incomplete:

- A fiduciary must always provide profitable advice: While aiming for profitable outcomes is desirable, it's not the core defining factor. Market fluctuations and unforeseen circumstances can impact investment performance. The primary duty is to act in the client's best financial interest, even if it doesn’t guarantee a profit.

- A fiduciary is simply someone who gives financial advice: Many people give financial advice, but only those legally obligated to put their clients' interests first are considered fiduciaries. A key element is the legal responsibility and potential for liability.

- A fiduciary must disclose all fees: While fee disclosure is important and often legally required, it doesn't, on its own, define a fiduciary. Transparency is a component of the overall duty of care and loyalty.

Therefore, the truest statement about a fiduciary is: A fiduciary is legally bound to act solely in the best interests of their client. This statement encapsulates the essence of the fiduciary duty, highlighting the legal obligation to prioritize the client's needs and interests above all else.

Finding a Fiduciary: Protecting Your Interests

If you're seeking financial advice or entrusting someone with managing your assets, it's crucial to find a fiduciary. Here are some steps you can take to ensure you're working with someone who has your best interests at heart:

First, ask potential advisors directly if they operate under a fiduciary standard. Request written confirmation of their fiduciary status. If they hesitate or are unable to provide clear documentation, that’s a red flag.

Second, research the advisor's background and credentials. Check their disciplinary history and regulatory filings through organizations like FINRA and the Securities and Exchange Commission (SEC). Look for advisors who are registered as Registered Investment Advisors (RIAs), as they are generally required to act as fiduciaries.

A Future Built on Trust

Understanding the role and responsibilities of a fiduciary is paramount in today's complex financial landscape. By seeking out fiduciaries and demanding transparency and accountability, individuals can protect their financial well-being and build a future based on trust and sound advice.

Going back to the image of your grandmother, by understanding the fiduciary duty, she can ensure her advisor is legally bound to act in her best interest. This knowledge offers her peace of mind, knowing her financial future is in safe and trustworthy hands. And that, in the end, is the true value of understanding what it means to be a fiduciary.