Which Of The Following Statements Is True About Compound Interest

In an era defined by financial uncertainty and the constant pursuit of economic stability, understanding the principles of compound interest is more crucial than ever. Misconceptions surrounding this fundamental concept can lead to significant financial missteps, impacting savings, investments, and long-term financial security.

This article aims to clarify the intricacies of compound interest, dissecting common myths and providing a clear understanding of its workings. We will examine the core truth about how compound interest actually works, relying on validated data and expert insights to guide readers towards informed financial decision-making.

Decoding Compound Interest: The Core Principle

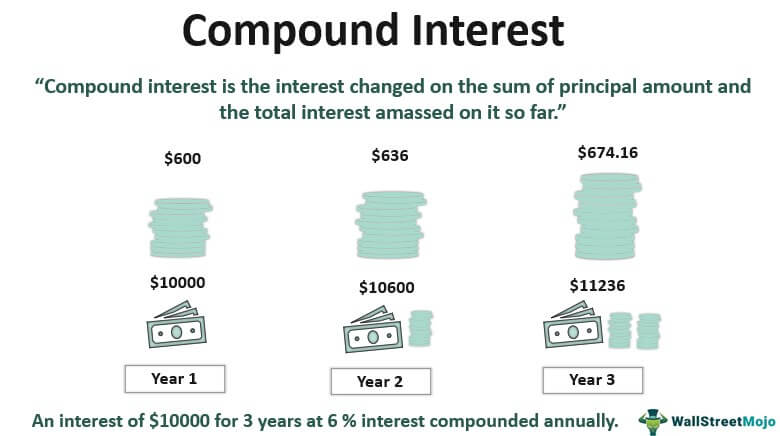

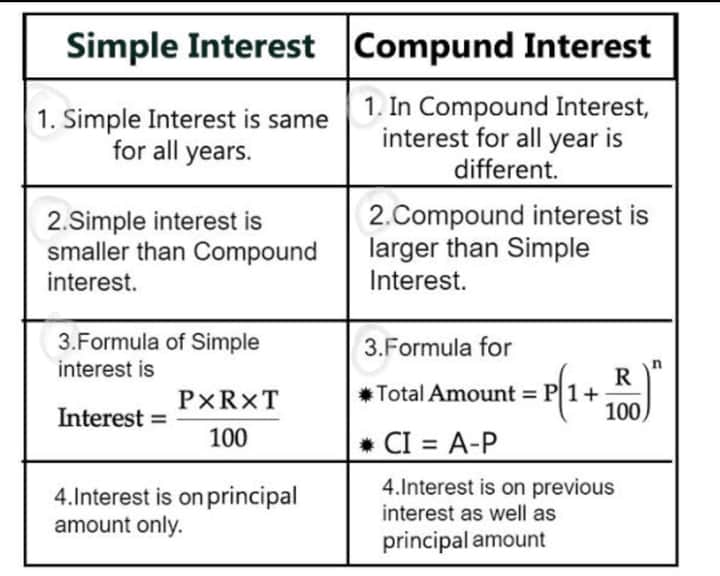

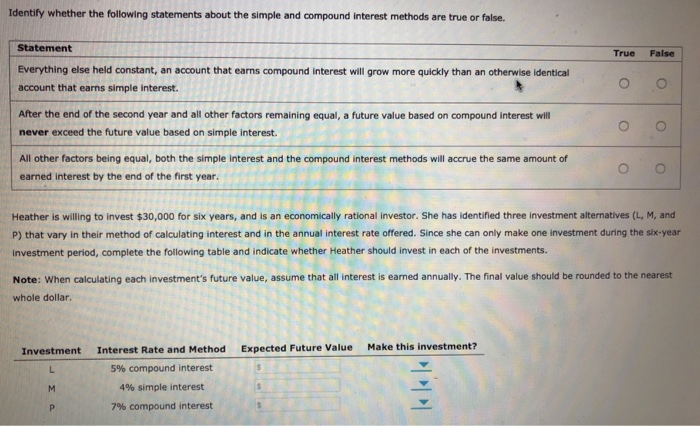

Compound interest is often described as "interest on interest." It's a powerful force in wealth accumulation. This means that the interest earned in one period is added to the principal, and the next period's interest is calculated on this new, larger sum.

The key takeaway is that the earlier you start saving or investing, the greater the impact of compounding over time. This is because the base upon which interest is calculated grows exponentially.

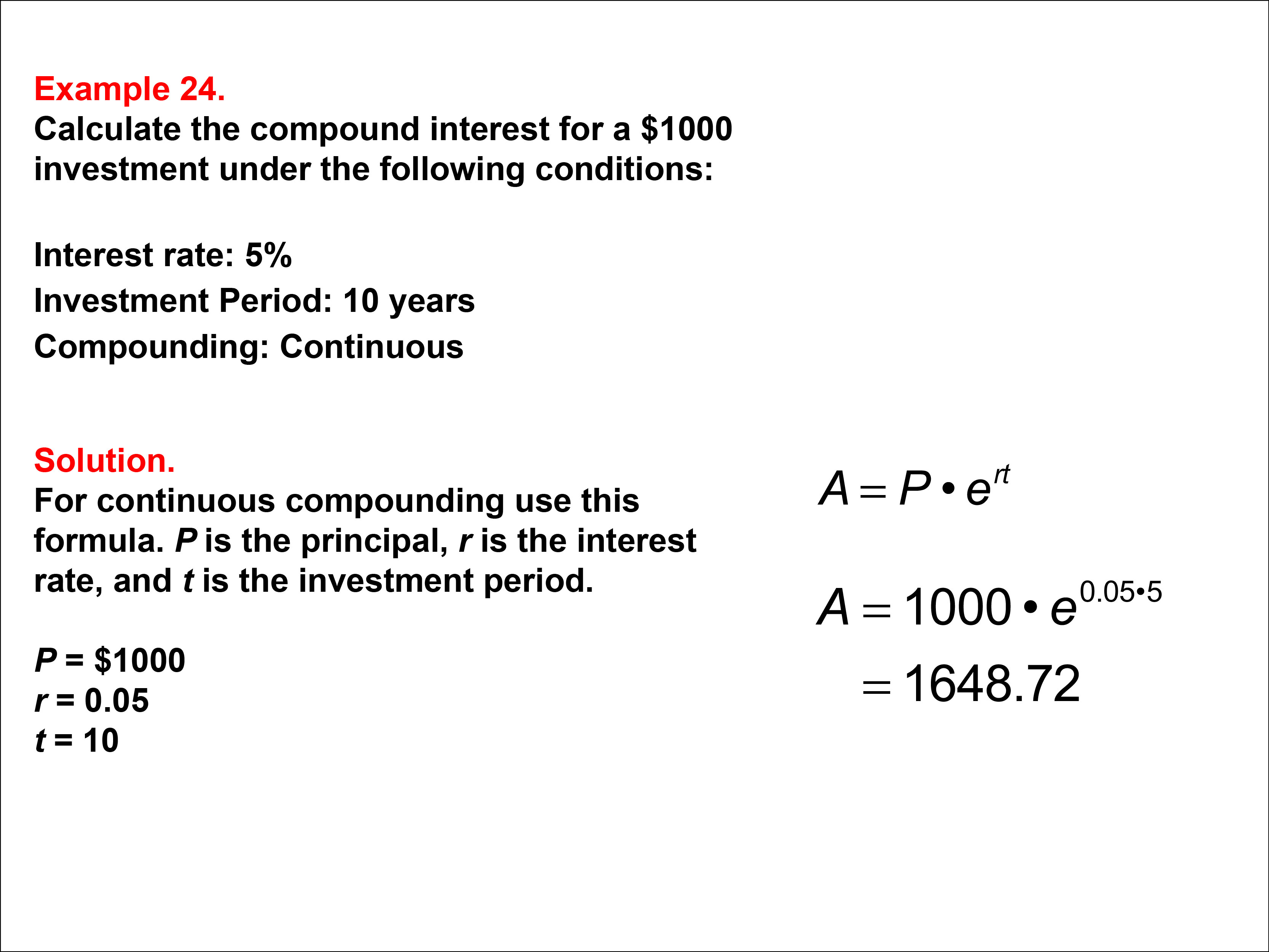

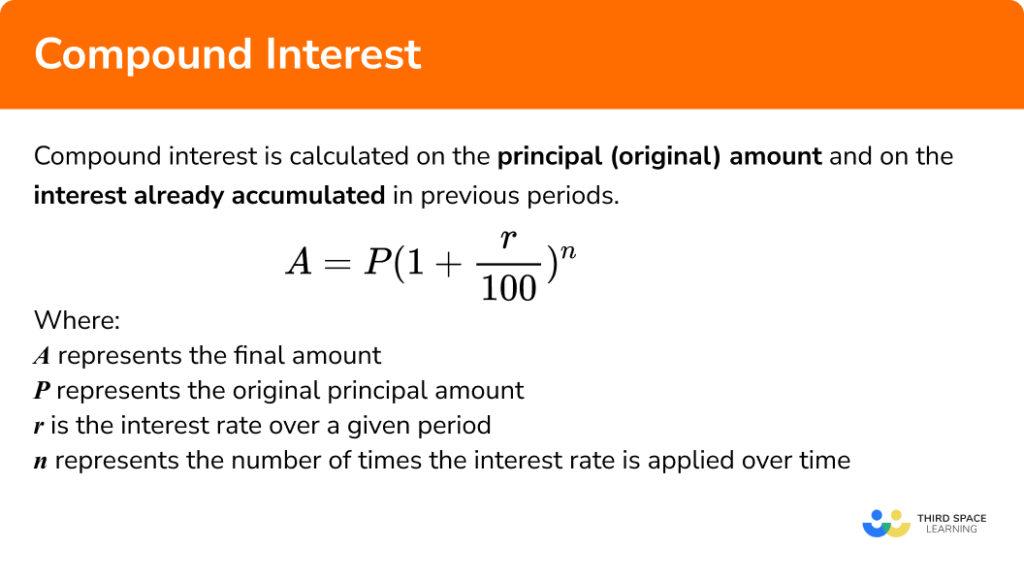

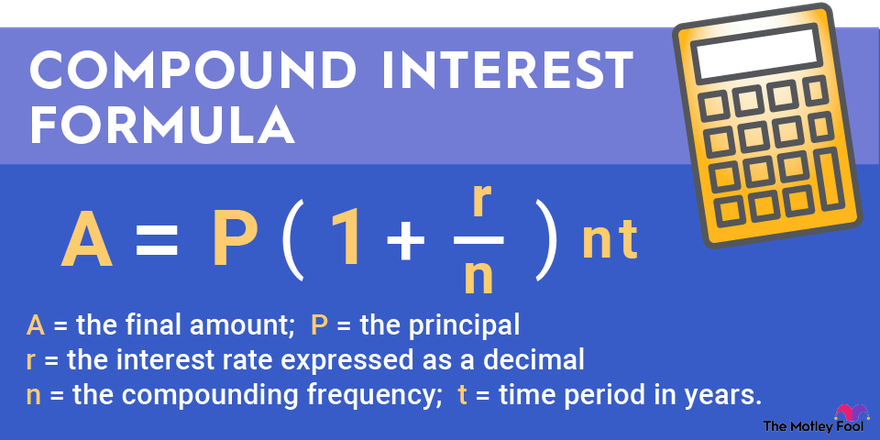

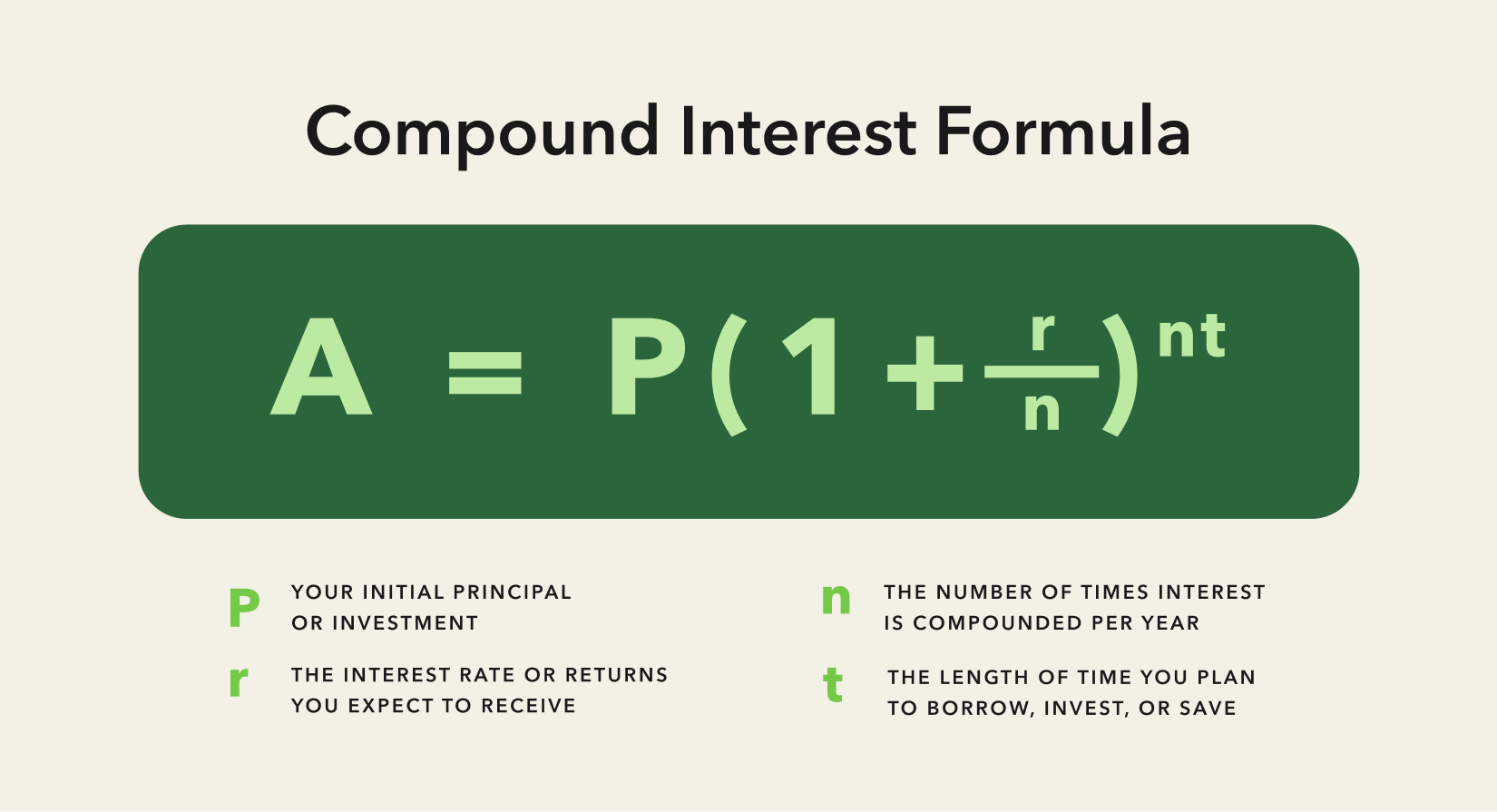

The Mathematical Foundation

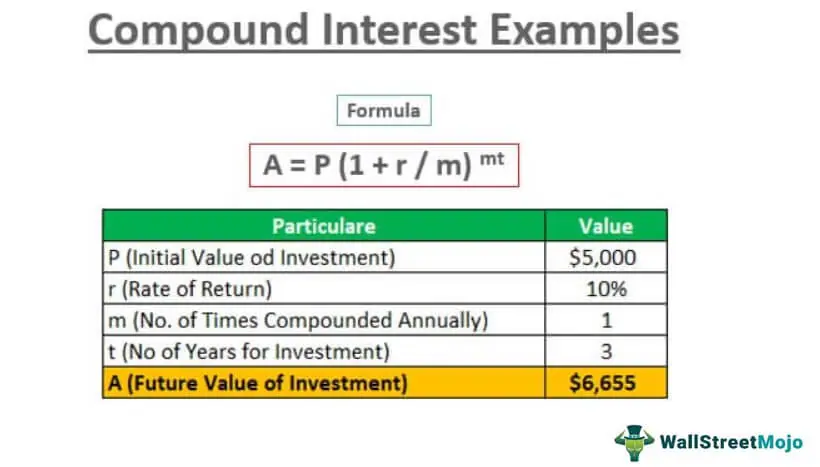

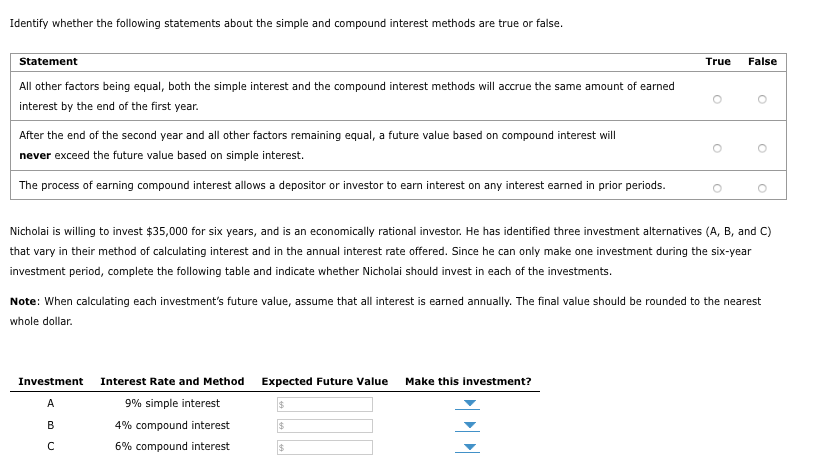

The formula for compound interest is A = P (1 + r/n)^(nt). Here, A represents the future value of the investment, P is the principal amount, r denotes the annual interest rate, n is the number of times that interest is compounded per year, and t stands for the number of years the money is invested or borrowed for.

Understanding this formula helps demystify the process. It allows individuals to project the potential growth of their investments with greater accuracy.

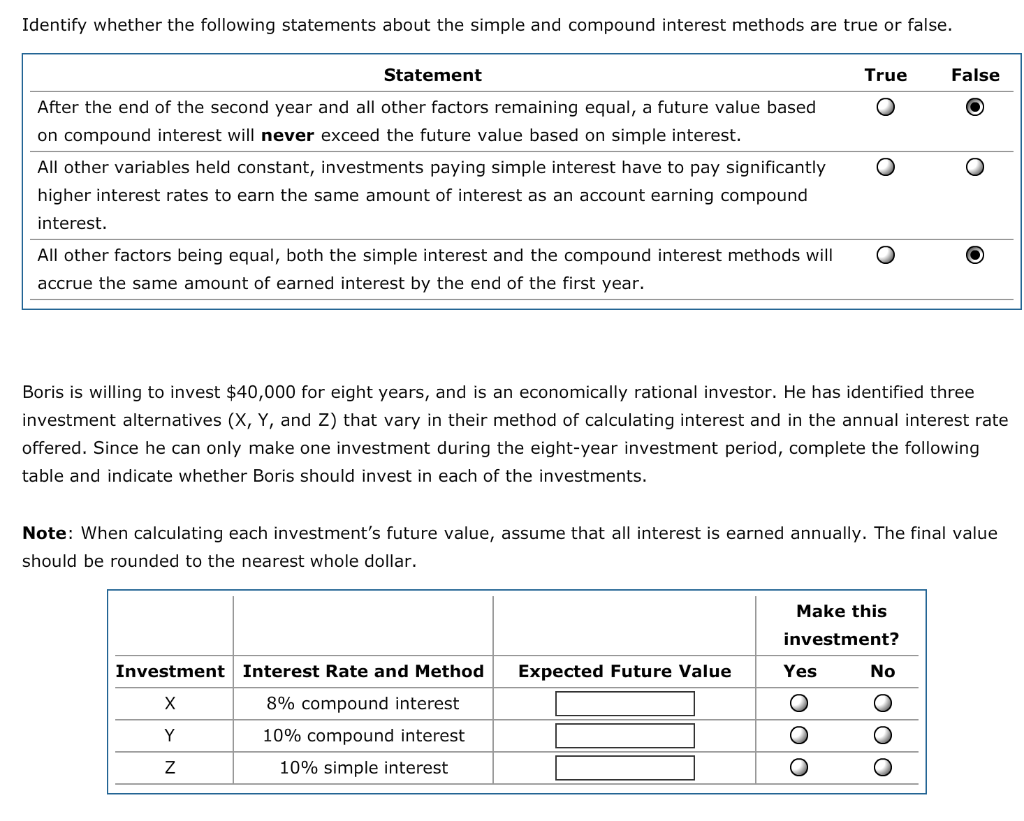

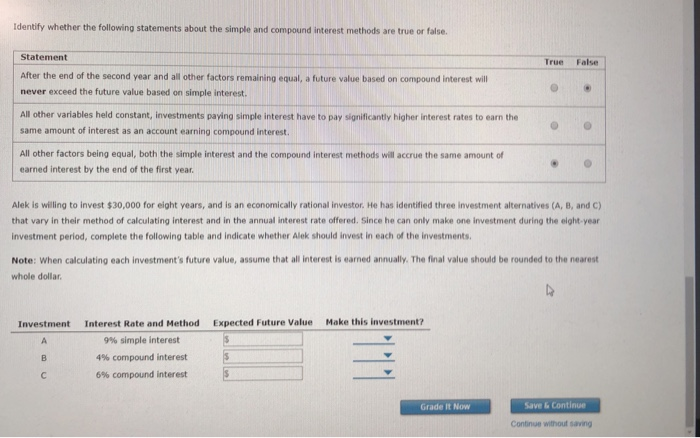

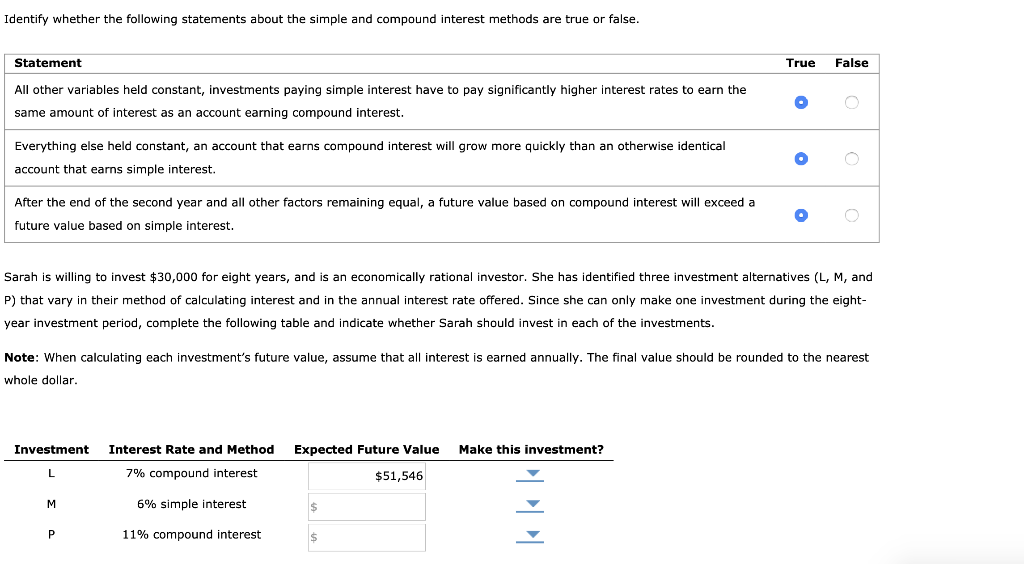

Common Misconceptions and Clarifications

One common misconception is that compound interest only benefits investors. While it's true that it accelerates wealth accumulation through investments, it also applies to debt, working against borrowers. Credit card debt, for instance, often accrues compound interest, quickly escalating the total amount owed.

Another misunderstanding is that higher interest rates always translate to better outcomes. While a higher interest rate generally leads to faster growth, the frequency of compounding also plays a crucial role. Daily compounding, for example, results in slightly higher returns than annual compounding, even at the same interest rate.

Some assume that the principal is the only factor that dictates the power of compounding. The truth is that time horizon and the rate of return are equally, if not more, influential. A small amount invested early can outgrow a larger sum invested later, given sufficient time and a reasonable rate of return.

The Role of Time: An Essential Element

Time is arguably the most critical ingredient in the recipe for compound interest success. The longer your money is invested, the more opportunities it has to grow exponentially.

This emphasizes the importance of starting early, even with small amounts. The benefits of starting early are substantiated by numerous financial analyses demonstrating the stark contrast between those who begin investing in their 20s versus those who wait until their 40s.

Delaying investment allows the initial principal to grow slowly. Procrastination translates into missing out on years of exponential growth. As a result, it’s recommended to start saving and investing right away.

Debt and Compound Interest: A Word of Caution

The power of compound interest is not limited to investments; it also applies to debt. In the context of loans and credit cards, compound interest can quickly turn a manageable debt into an overwhelming burden.

High-interest debt, such as credit card balances, can be particularly damaging due to frequent compounding. The longer it takes to pay off the debt, the more interest accrues, making it increasingly difficult to escape the cycle of debt.

Smart debt management strategies, such as prioritizing high-interest debts and making more than the minimum payment, are crucial to mitigating the negative effects of compound interest on borrowing.

Expert Perspectives on Compound Interest

Financial advisors consistently emphasize the importance of understanding and leveraging compound interest. According to Certified Financial Planner (CFP) professionals, neglecting the principles of compounding can lead to missed opportunities for long-term financial security.

“Compound interest is the eighth wonder of the world," said Albert Einstein, a quote often cited by financial experts to underscore its significance. It underlines the importance of letting your money make money.

Experts suggest focusing on long-term investment strategies and diversifying portfolios to maximize the benefits of compound interest. They also advise regularly reviewing investment performance and adjusting strategies as needed to stay on track towards financial goals.

Looking Ahead: Embracing Compound Interest for Future Financial Success

Mastering the concept of compound interest is essential for achieving long-term financial well-being. Understanding how it works, avoiding common misconceptions, and implementing sound financial strategies can pave the way for a secure and prosperous future.

By starting early, being patient, and remaining disciplined, individuals can harness the transformative power of compound interest to build wealth and achieve their financial goals. Education and understanding will set you up for a better financial future.

Ultimately, the true statement about compound interest is that it's a powerful tool for wealth creation, but it requires a long-term perspective and a clear understanding of its mechanics. This understanding empowers individuals to make informed choices and unlock the potential of their investments.

:max_bytes(150000):strip_icc()/compounding.asp-final-11c1b77f605d4ed0a317f0cf32c73b3f.png)

:max_bytes(150000):strip_icc()/dotdash-how-can-i-tell-if-loan-uses-simple-or-compound-interest-Final-17d192dbebc1467cad0e73f776fa7ffd.jpg)