Which Of The Following Statements Is True Of Amortization

Financial professionals and borrowers face a critical need for clarity on amortization principles. Determining the correct statement about amortization is vital for accurate financial planning and reporting.

This article cuts through the complexity, delivering a definitive answer based on established financial practices and resources. It's designed to provide immediate clarity on a core concept impacting loan repayment, asset valuation, and accounting accuracy.

Understanding Amortization: The Core Principle

Amortization is the process of spreading out a loan or intangible asset's cost over a period of time. This process reduces the value of a loan or intangible asset systematically over a defined timeline.

It's most commonly associated with loan repayment, but also applied to intangible assets like patents or goodwill. The correct statement of amortization is that it is the systematic allocation of the cost of an intangible asset or the repayment of a loan over its term.

Why This Matters: Implications for Borrowers and Businesses

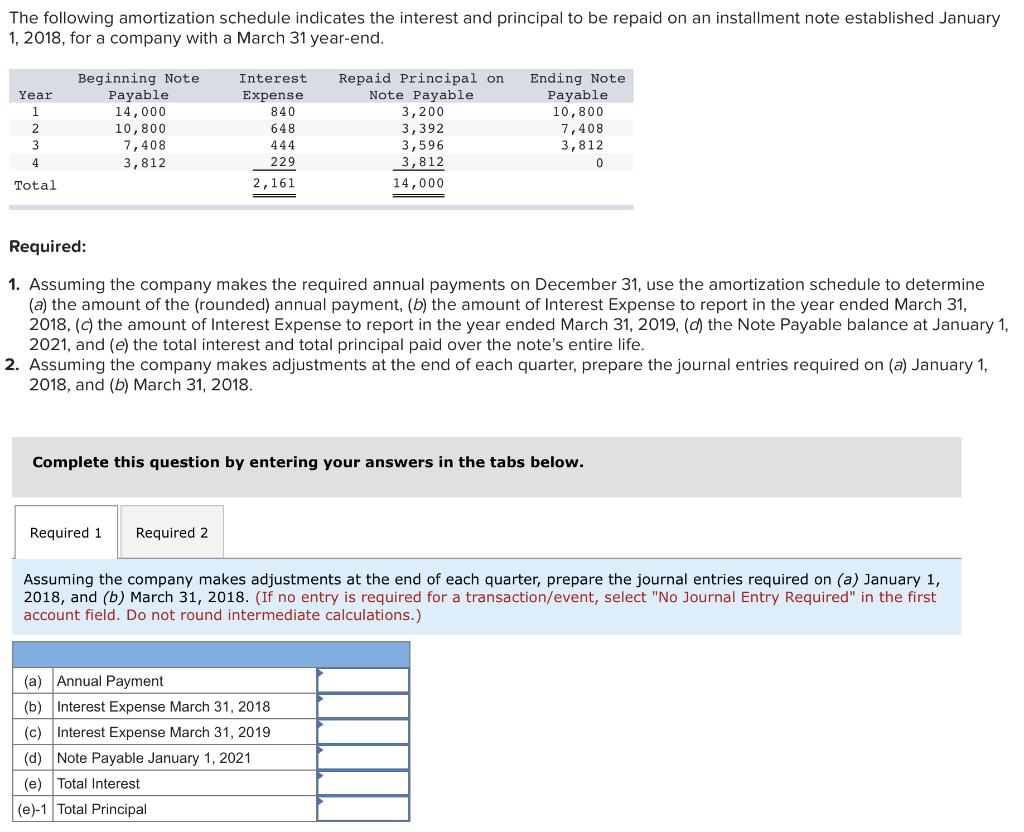

For borrowers, understanding amortization is crucial to comprehending loan repayment schedules. Amortization schedules break down each payment into principal and interest components.

In the early stages of a loan, a larger portion of each payment goes toward interest. As the loan matures, a greater percentage of each payment reduces the principal balance.

Businesses leverage amortization to expense intangible assets over their useful life. This is in accordance with accounting standards, impacting financial statements and tax obligations.

Debunking Common Misconceptions

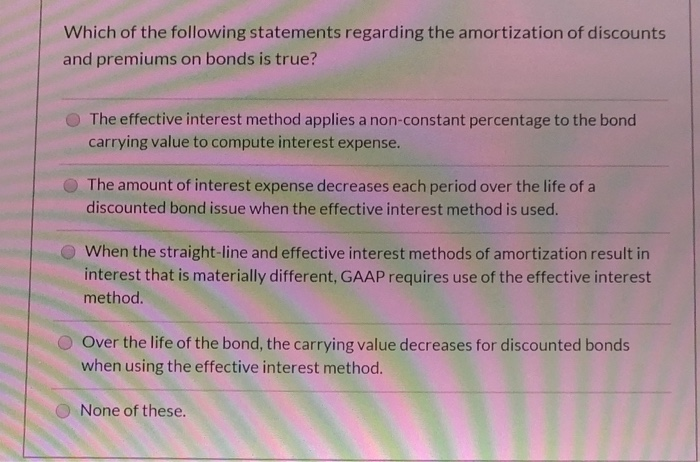

Some mistakenly believe that amortization is solely about loan repayment. This is inaccurate because amortization also applies to intangible assets as depreciation applies to physical assets.

Another misconception is that amortization means the total interest paid equals the loan amount. This is false, the total interest paid depends on the interest rate and loan term, usually significantly less than the loan balance.

It's also untrue that only loans with fixed interest rates are amortized. Both fixed and variable interest rate loans can be amortized.

Key Characteristics of Amortization

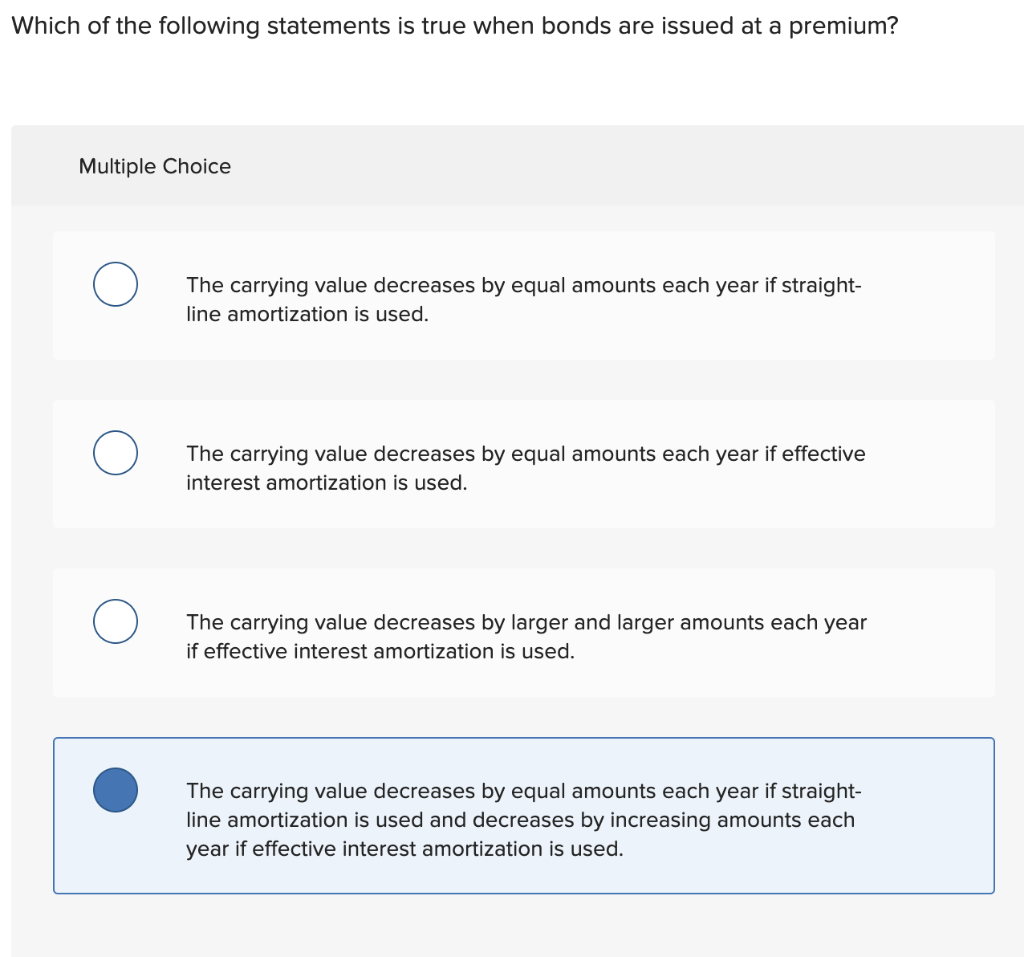

Amortization results in a decrease in the carrying value of an asset or liability over time. This decrease reflects the consumption of the asset's economic benefits or the reduction of the loan principal.

It ensures expenses are matched with the revenue they generate, providing a more accurate picture of profitability. For loans, it leads to a gradual decrease in the outstanding debt.

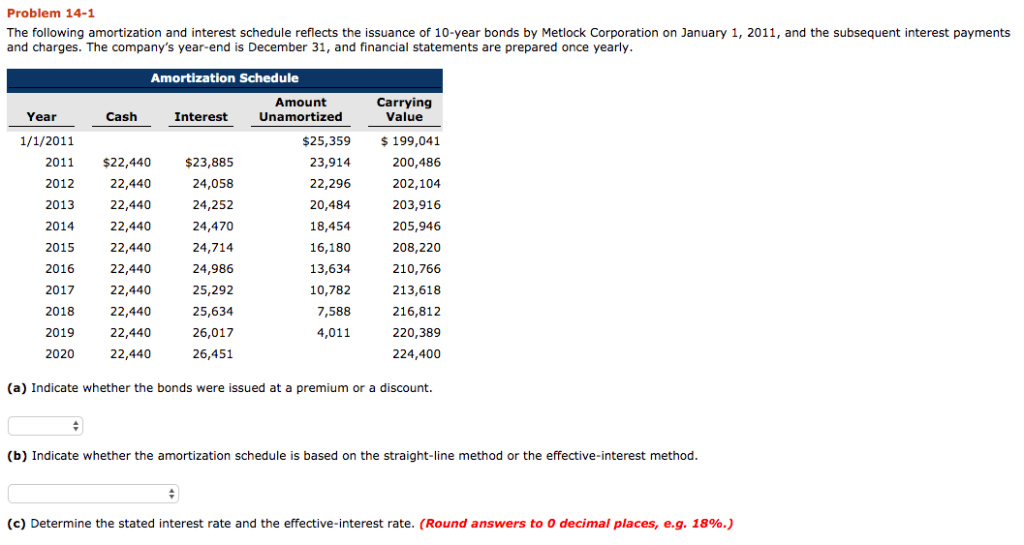

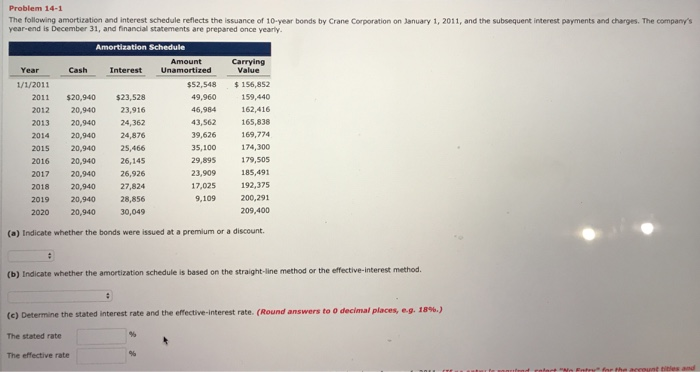

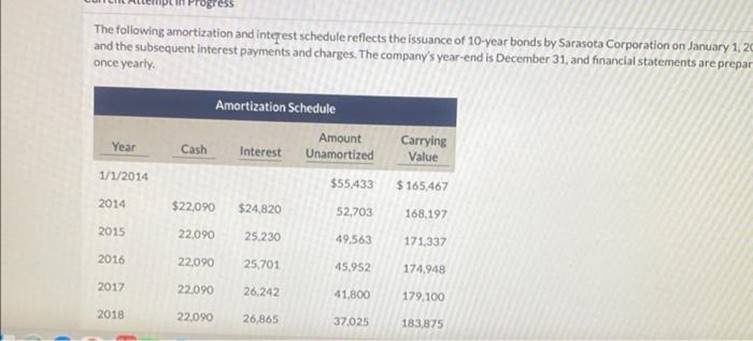

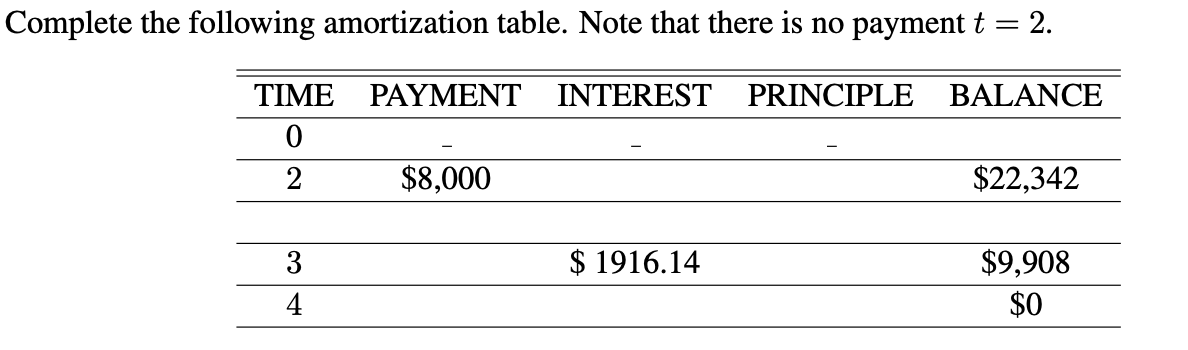

An amortization schedule is a detailed table showing each payment, the portion allocated to principal, the portion allocated to interest, and the remaining balance.

Real-World Examples

Home mortgages are a prime example of amortized loans. Each monthly payment contributes to both interest and principal, gradually paying off the house.

Companies amortize patents over their legal life, reflecting their gradual decline in value. This expense reduces taxable income.

Software development costs, if capitalized, are often amortized over the software's expected useful life. This spreads the cost over the period the software generates revenue.

Consequences of Incorrect Amortization

Misunderstanding amortization can lead to inaccurate financial statements. This in turn will make businesses make wrong decision.

For borrowers, misinterpreting amortization schedules can result in budgeting errors. This may include being unprepared for higher interest payments in the early loan stages.

Incorrect amortization of intangible assets can distort a company's reported earnings. It might lead to inaccurate tax liabilities.

The Definitive Statement: Amortization Explained

After careful review and consideration of accounting and financial principles, the correct statement regarding amortization is: Amortization is the systematic allocation of the cost of an intangible asset or the repayment of a loan over its term.

This accurately captures the dual application of amortization across asset valuation and debt management.

This is a critical understanding for those seeking to be experts in accounting.

Moving Forward: Ensuring Accuracy and Compliance

Consult with a qualified financial advisor or accountant for personalized guidance on amortization. Understand your specific financial situation, whether it involves loans or intangible assets.

Utilize amortization calculators and tools to create accurate schedules. This helps both borrowers and businesses.

Stay updated on accounting standards and regulations related to amortization. Compliance is key to ensuring financial integrity.