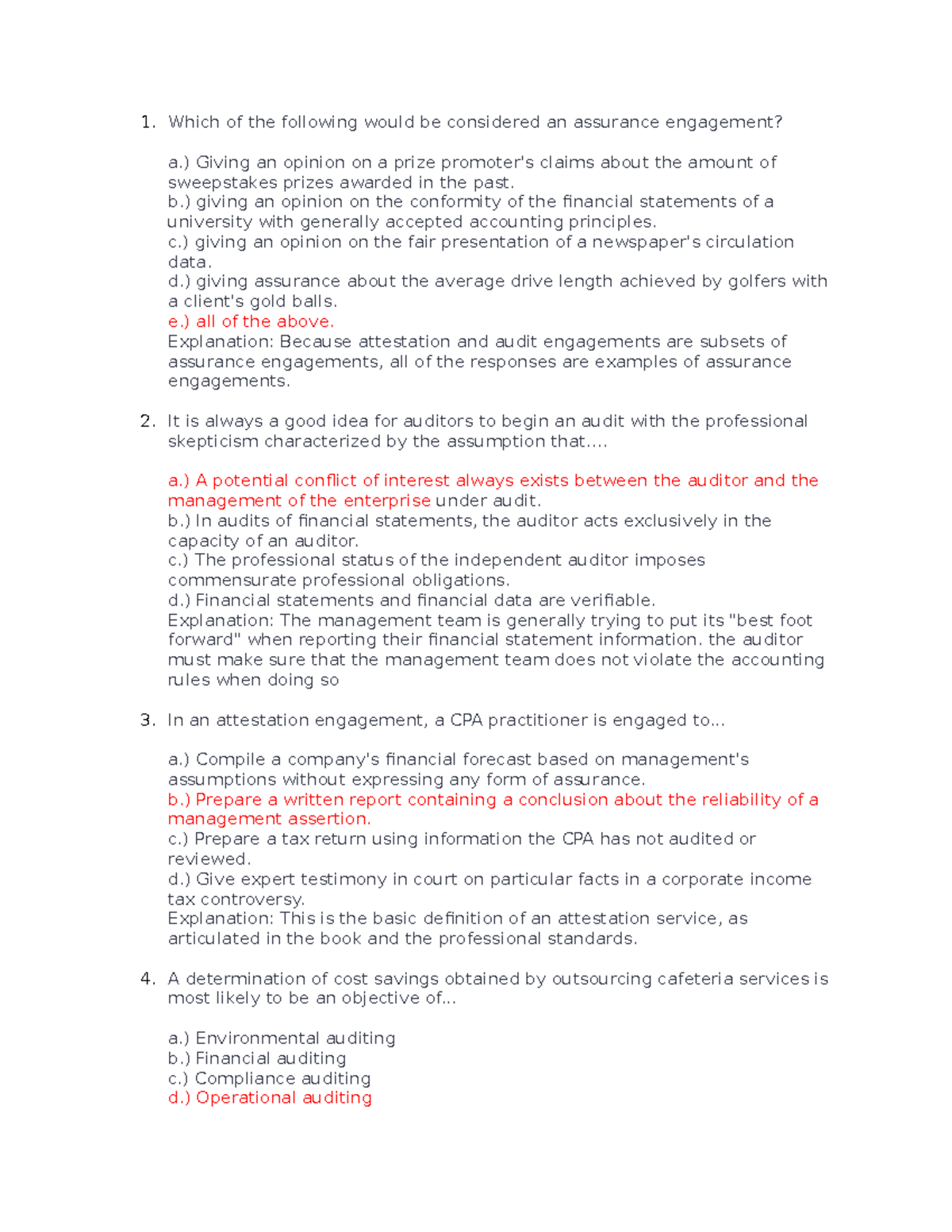

Which Of The Following Would Be Considered An Assurance Engagement

The question of what constitutes an assurance engagement is crucial for businesses, accountants, and stakeholders seeking reliable and independent verification of information. Understanding the different types of engagements and their specific characteristics is essential for ensuring financial transparency and building trust.

Determining which activities qualify as assurance engagements is not always straightforward. This article explores the key characteristics of such engagements, examining common examples and clarifying the boundaries to ensure accurate identification.

Defining Assurance Engagements

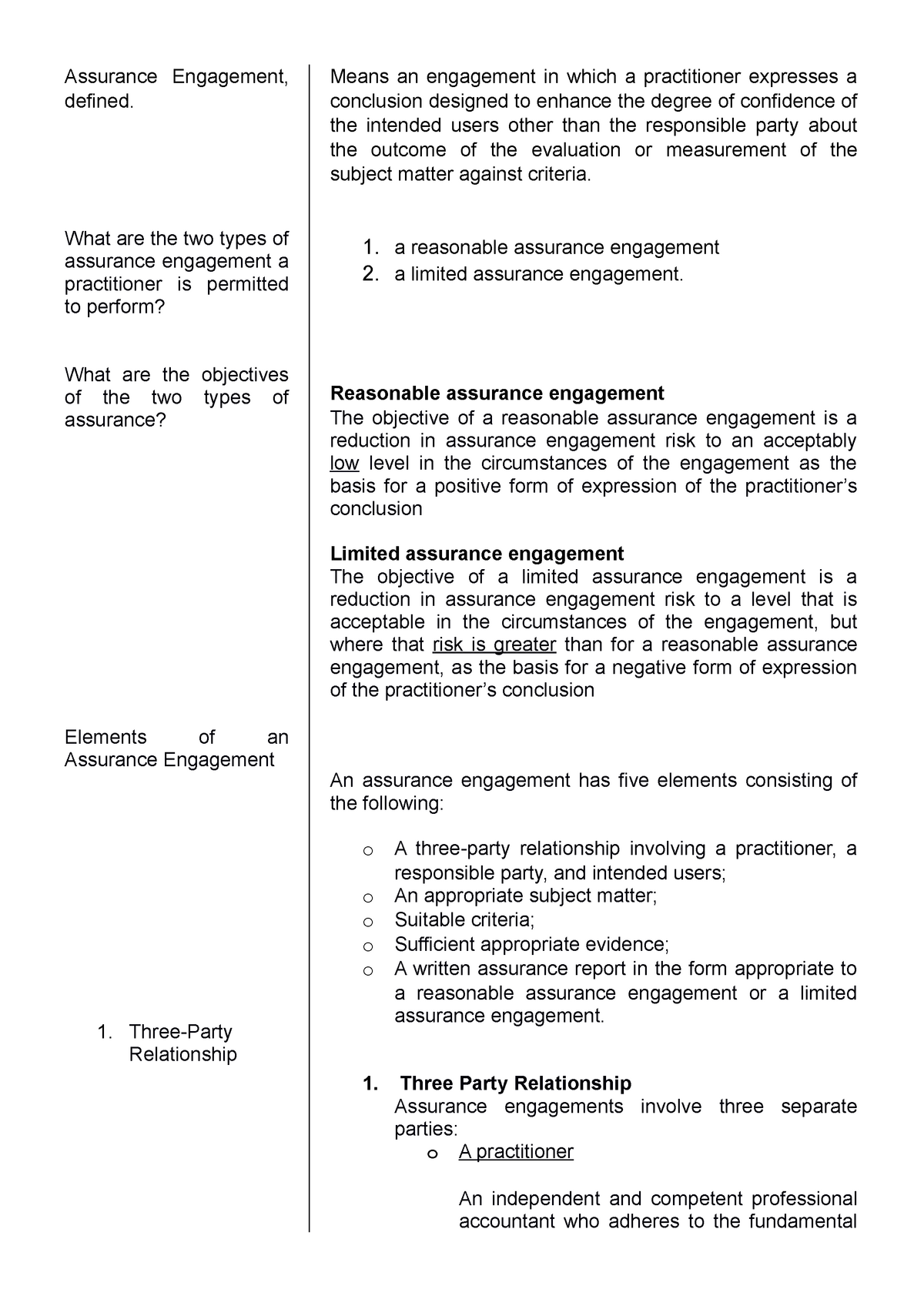

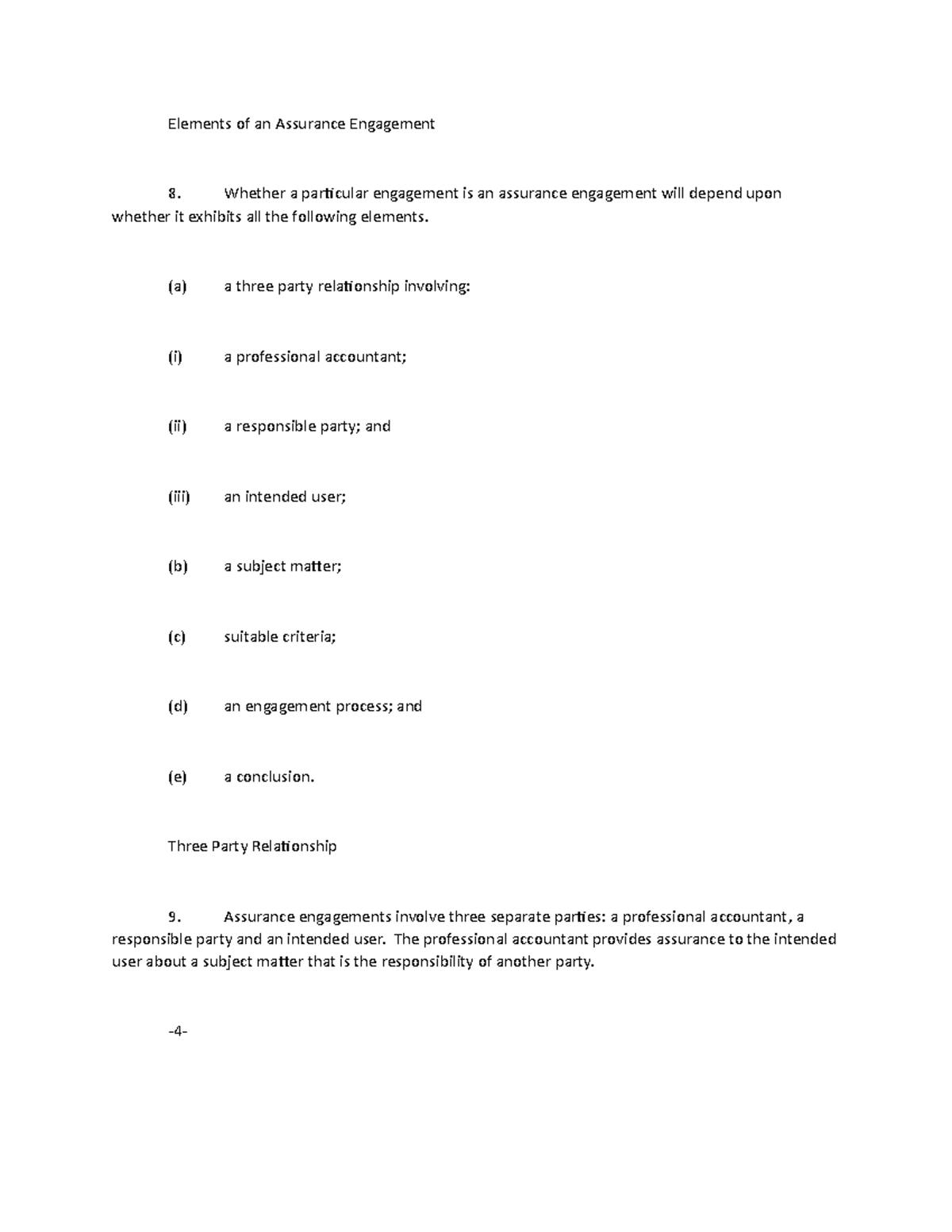

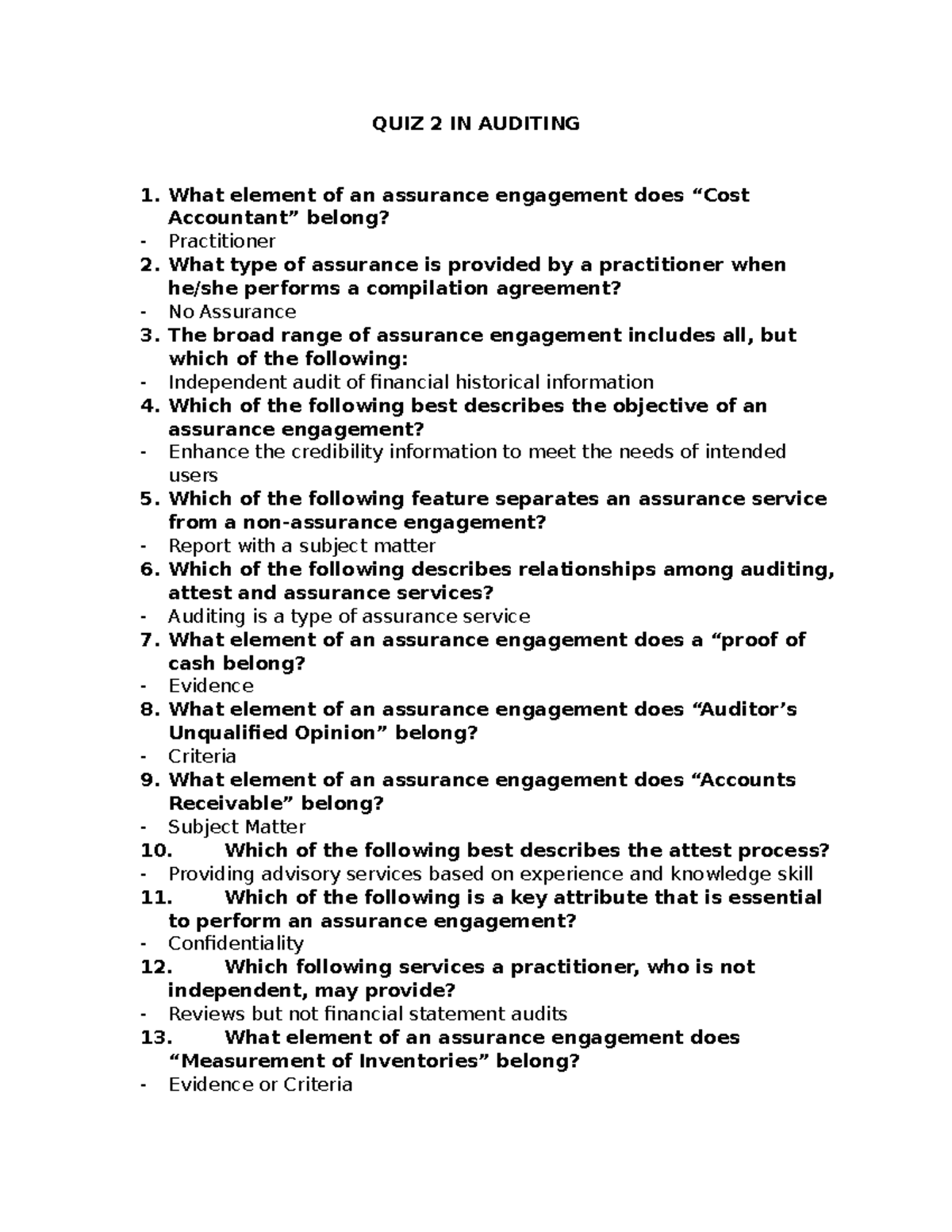

At its core, an assurance engagement involves a professional evaluating a subject matter against identified criteria. This evaluation aims to express a conclusion providing a level of assurance about the reliability and credibility of the subject matter. It typically involves three parties: the responsible party, the practitioner, and the intended user.

According to the International Auditing and Assurance Standards Board (IAASB), an assurance engagement is one in which a practitioner expresses a conclusion designed to enhance the degree of confidence of the intended users other than the responsible party about the outcome of the evaluation or measurement of a subject matter against criteria.

Key Elements of an Assurance Engagement

Several key elements must be present for an activity to be classified as an assurance engagement. These elements distinguish it from other professional services.

Firstly, there must be a three-party relationship. This includes the responsible party who prepares the subject matter, the practitioner who provides the assurance, and the intended users who rely on the practitioner's conclusion.

Secondly, a suitable subject matter is required. This could be financial statements, internal controls, or compliance with regulations.

Thirdly, suitable criteria are necessary against which the subject matter is evaluated. These criteria provide a benchmark for assessing the subject matter's reliability and accuracy. They must be objective, measurable, and understandable.

Fourthly, the engagement must involve sufficient appropriate evidence. The practitioner needs to gather enough evidence to support their conclusion.

Lastly, the practitioner expresses a written assurance report containing a conclusion that conveys the level of assurance provided. This report communicates the practitioner's findings to the intended users.

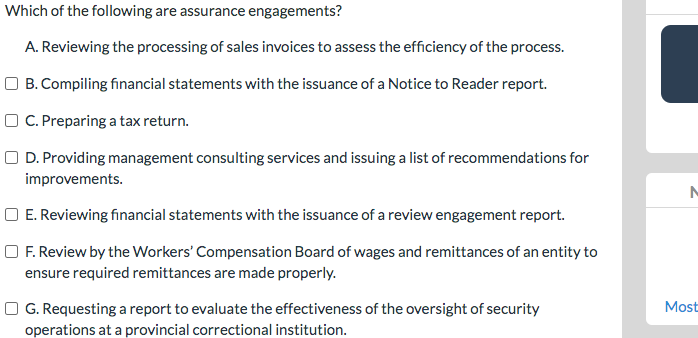

Examples of Assurance Engagements

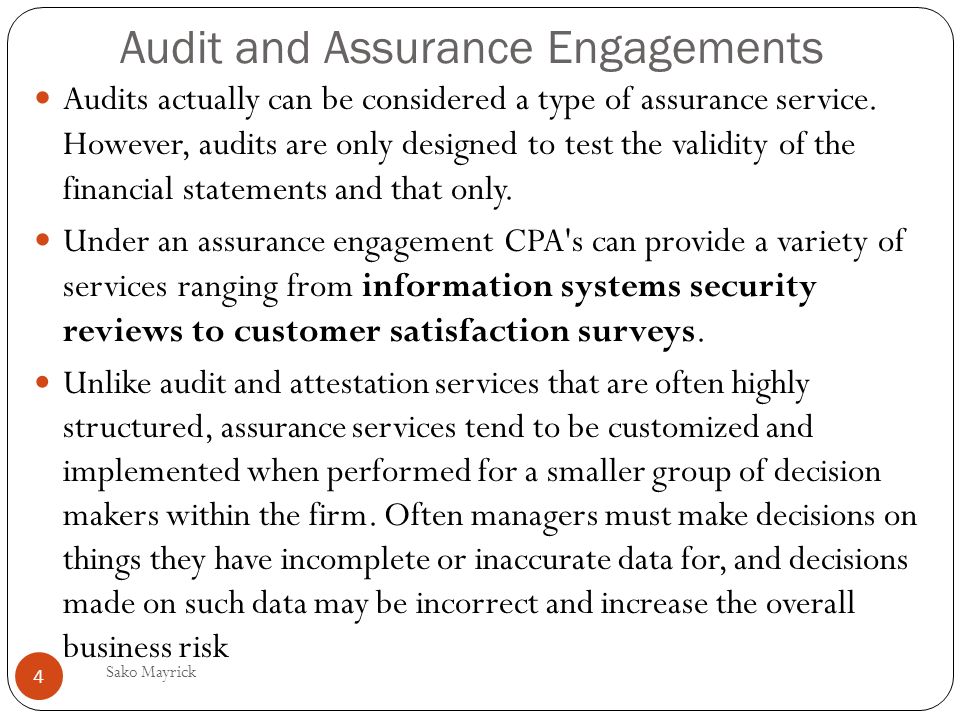

Many services fall under the umbrella of assurance engagements. These provide stakeholders with increased confidence in the information they are using.

A classic example is an audit of financial statements. Here, an independent auditor examines a company's financial records to ensure they fairly present the company's financial position and performance in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

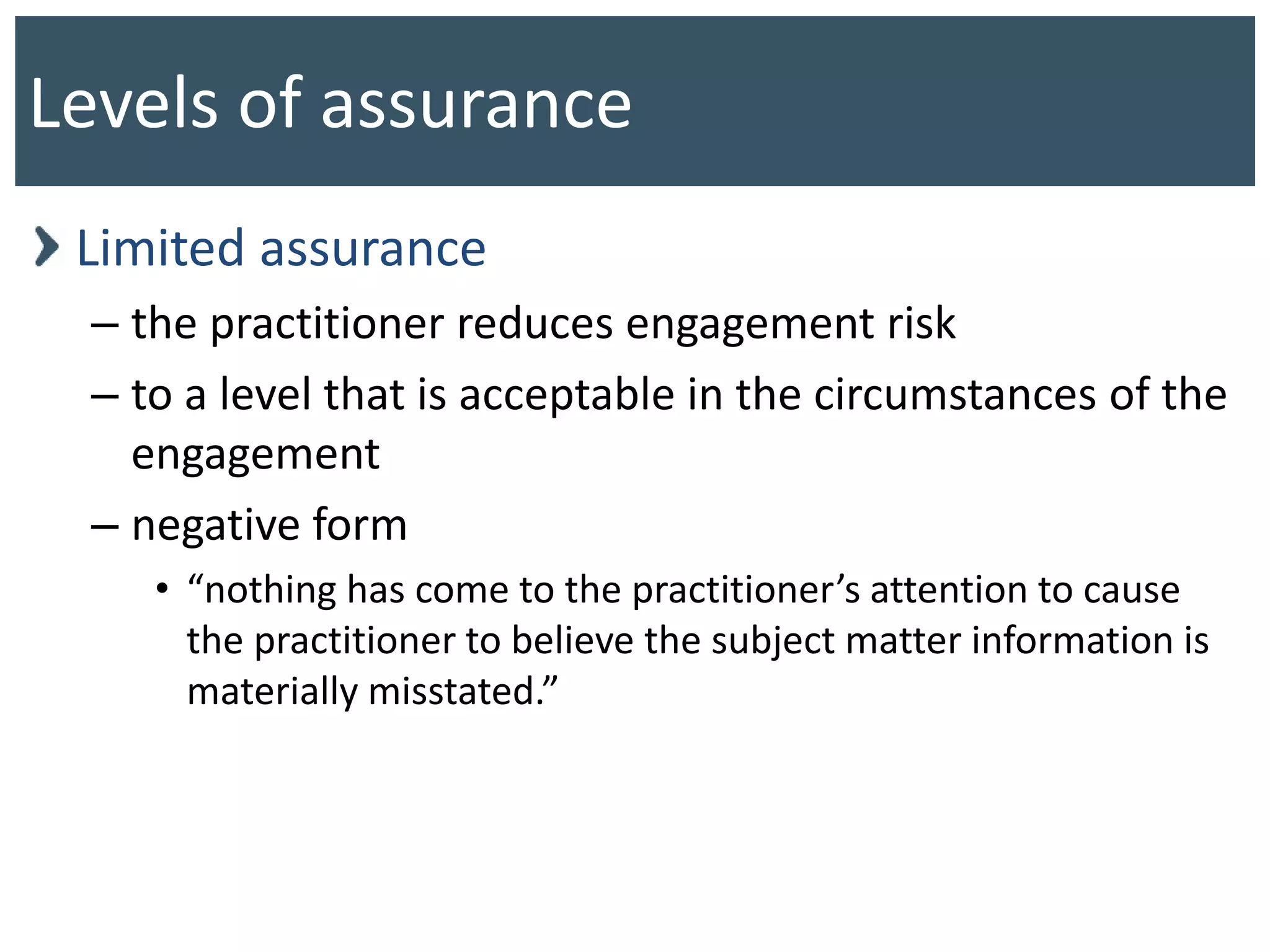

Another example is a review engagement. This provides a lower level of assurance than an audit, but still offers some confidence to users. A review typically involves inquiry and analytical procedures.

Assurance engagements can also extend to internal controls. For instance, a company might engage an auditor to assess the effectiveness of its internal controls over financial reporting, complying with requirements such as Sarbanes-Oxley Act (SOX).

Compliance audits also fall under assurance engagements, evaluating an organization's adherence to specific laws, regulations, or contractual obligations.

Distinguishing Assurance from Non-Assurance Engagements

Not all professional services qualify as assurance engagements. It’s essential to differentiate between the two.

For example, tax preparation services are generally not considered assurance engagements. While tax preparers provide a valuable service, they are primarily acting as advisors rather than providing an independent assessment.

Similarly, consulting services, such as management consulting or IT consulting, usually don't qualify. Although consultants may provide recommendations to improve a company’s operations, they typically don't issue an assurance report.

Agreed-upon procedures can be tricky. If the report is restricted to only the party that requested it, it does not qualify as an assurance engagement. If the report is accessible to other parties, it would be an assurance engagement.

The Impact of Assurance Engagements

Assurance engagements have a significant impact on financial markets and corporate governance. They enhance the reliability and credibility of information. This promotes trust among investors, creditors, and other stakeholders.

By providing independent verification, these engagements help to mitigate the risk of fraudulent reporting and errors. They foster a more transparent and accountable business environment.

In conclusion, correctly identifying assurance engagements is essential for ensuring that stakeholders receive reliable and independent information. By understanding the key elements and distinctions, businesses and individuals can make informed decisions and enhance trust in financial reporting and other critical areas.

.jpg)