Which S&p 500 Companies Pay Dividends

Imagine a tranquil evening, the setting sun casting a warm glow as you review your investment portfolio. The subtle satisfaction of seeing steady returns, amplified by the sweet cadence of dividend payouts, fills the air. In the vast and sometimes turbulent ocean of the stock market, dividends act as a reassuring lighthouse, guiding investors towards calmer waters.

This article delves into the world of dividend-paying stocks within the S&P 500, shedding light on which companies reward their shareholders with a slice of their profits. Understanding which of these giants offer dividends can be instrumental in building a robust, income-generating portfolio.

The Allure of Dividends

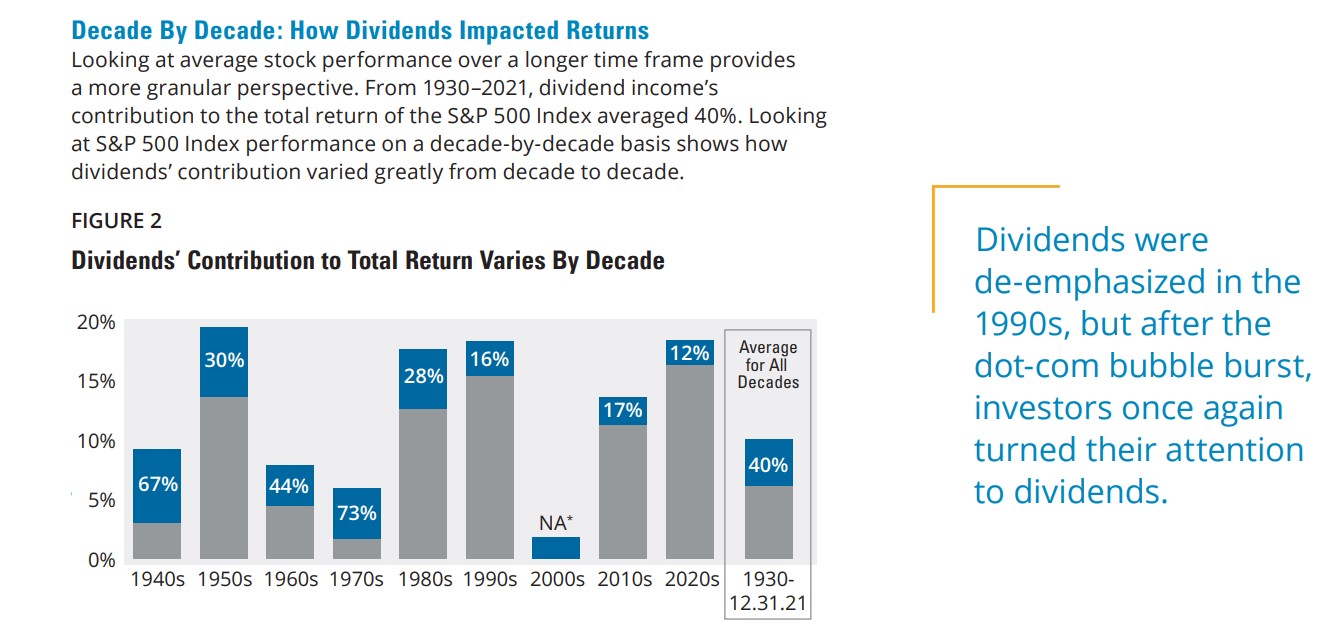

Dividends are essentially a portion of a company's earnings that are distributed to its shareholders. They represent a tangible return on investment, offering a steady stream of income beyond potential capital appreciation.

For many investors, especially those in retirement, dividends are a critical source of income. They can help supplement savings and provide financial security.

The S&P 500, a market-capitalization-weighted index of the 500 largest publicly traded companies in the United States, is a bellwether of the American economy. Many of its constituents regularly share their prosperity through dividends.

A Landscape of Dividend Payers

It's important to understand that not all S&P 500 companies pay dividends. The decision to issue dividends is a strategic one, based on factors like profitability, cash flow, and future investment opportunities.

However, a significant portion of the S&P 500 does offer dividends, making it an attractive hunting ground for income-seeking investors. Companies in sectors like utilities, consumer staples, and financials are often known for their consistent dividend payouts.

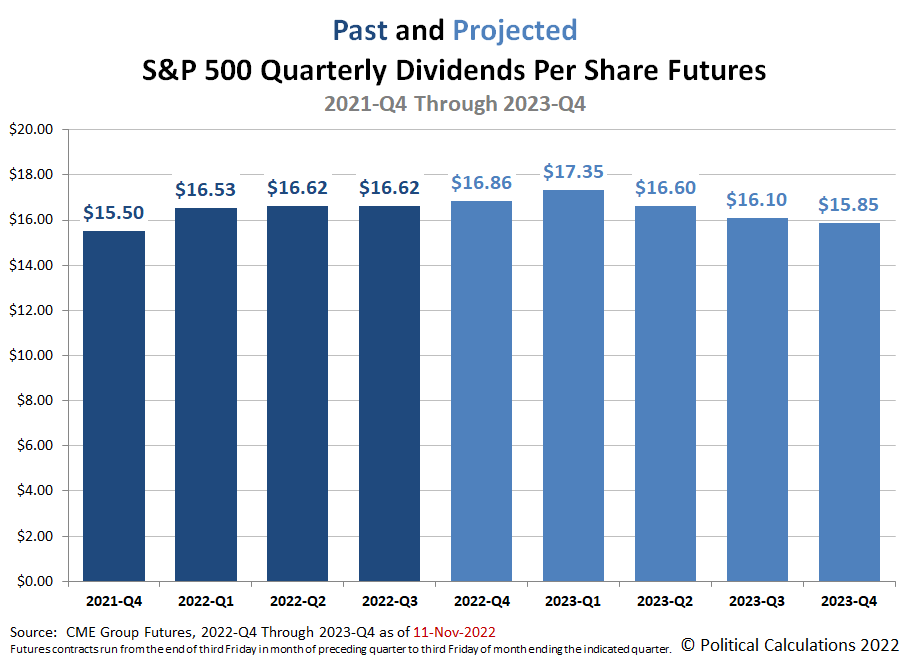

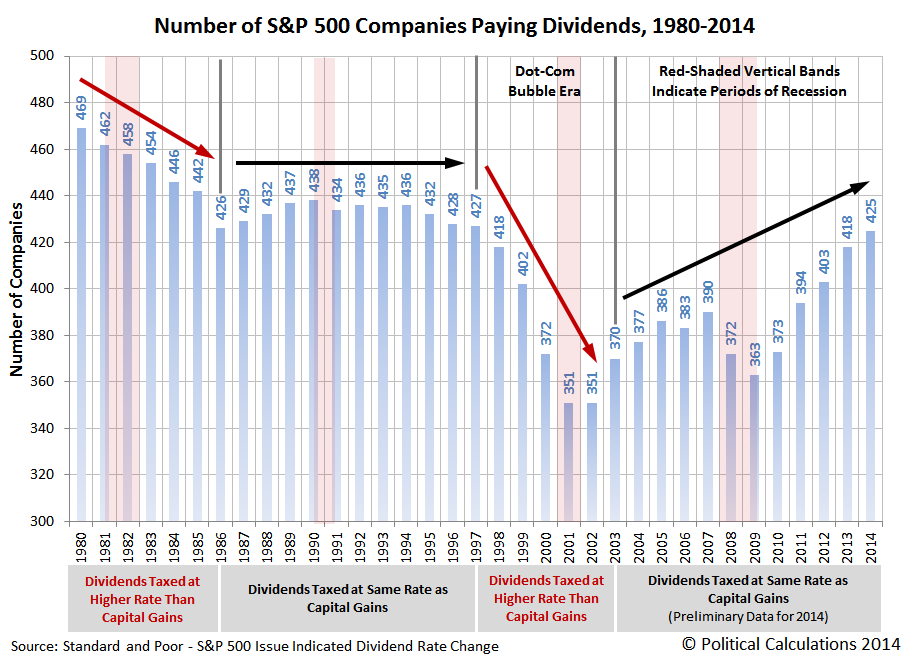

According to data from S&P Dow Jones Indices, historically, a substantial percentage of the S&P 500 companies have consistently paid dividends. This makes the index a valuable resource for investors seeking stable income streams.

Navigating the Dividend Universe

Identifying specific dividend-paying companies within the S&P 500 requires due diligence and access to reliable financial information. Resources like financial news websites, brokerage platforms, and company investor relations pages are invaluable.

Websites such as Yahoo Finance and Bloomberg provide comprehensive lists of S&P 500 companies, along with key metrics like dividend yield and payout ratio.

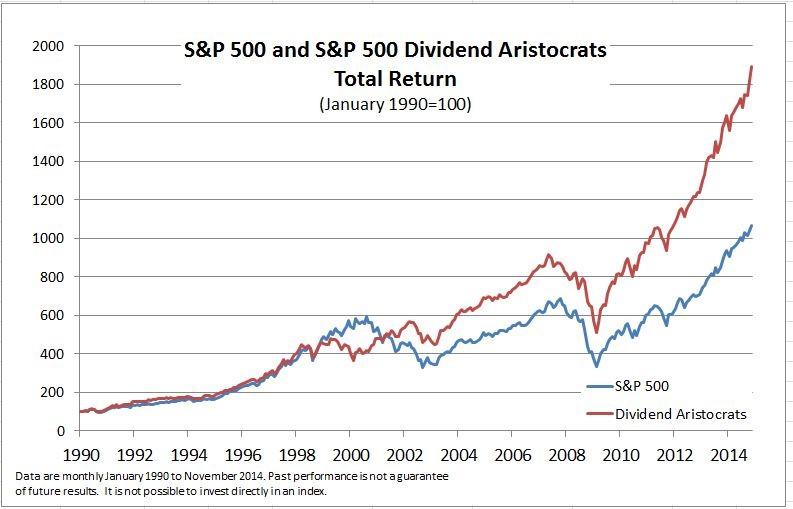

For example, companies like Procter & Gamble (PG), Johnson & Johnson (JNJ), and Coca-Cola (KO) are well-known for their long histories of dividend payments, often referred to as "Dividend Aristocrats" or "Dividend Kings" for their consecutive years of increasing dividends.

These companies have demonstrated a commitment to rewarding shareholders through thick and thin.

Beyond the Dividend Yield

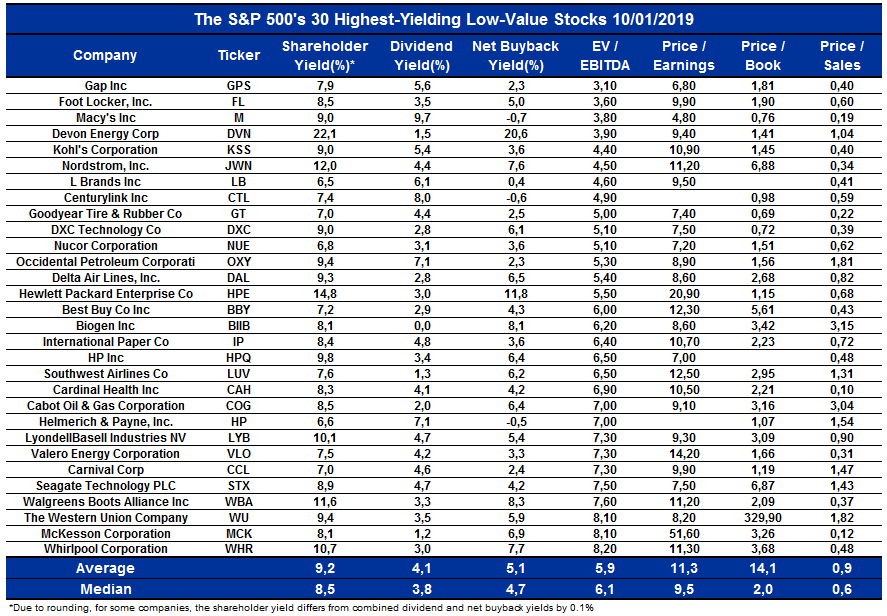

While dividend yield – the annual dividend payment divided by the stock price – is a key metric, it's not the only factor to consider. A high dividend yield can sometimes be a red flag, indicating a company facing financial difficulties.

Investors should also examine the company's payout ratio, which indicates the percentage of earnings paid out as dividends. A high payout ratio may suggest that the company has limited capacity to increase dividends in the future.

Furthermore, analyzing the company's overall financial health, including its debt levels and growth prospects, is crucial for making informed investment decisions. It is essential to consult resources like the companies' own SEC filings and reports.

A Concluding Thought

The world of dividend-paying stocks within the S&P 500 offers a wealth of opportunities for investors seeking a blend of income and long-term growth. By carefully researching individual companies and understanding their dividend policies, investors can build a portfolio that generates a steady stream of income while participating in the potential upside of the stock market.

Remember, investing always carries risk, and past performance is not indicative of future results. However, with informed decision-making and a long-term perspective, dividends can be a powerful tool for achieving your financial goals.

As you continue your investment journey, may the steady rhythm of dividend payouts bring you peace of mind and the satisfaction of building a secure financial future.

:max_bytes(150000):strip_icc()/dotdash-history-sp-500-dividend-yield-FINAL-328ee74ab3d54ff1a015335a5e8dc788.jpg)