Why Did Trade Desk Stock Drop

The digital advertising landscape is in constant flux, and recent turbulence has sent ripples through Wall Street, particularly impacting The Trade Desk, a leading programmatic advertising company. A sharp decline in its stock price has left investors and industry analysts searching for answers, dissecting market conditions, and reevaluating the company's trajectory in a rapidly evolving sector.

The stock's recent performance begs the question: What factors contributed to this downturn, and what does it signal for the future of The Trade Desk and the broader digital advertising ecosystem?

Understanding the Stock Drop: The Nut Graf

The recent dip in The Trade Desk's stock price can be attributed to a confluence of factors. These include broader market anxieties concerning inflation and interest rate hikes, which disproportionately impact growth stocks; concerns surrounding the evolving digital advertising landscape, particularly regarding privacy regulations and the future of cookies; and a somewhat muted forward guidance that tempered investor expectations after a period of high growth.

This article delves into these elements, examining how they coalesced to create a challenging environment for The Trade Desk and what potential strategies the company might employ to navigate these headwinds.

Macroeconomic Pressures and Growth Stock Vulnerability

The global economic outlook has been increasingly uncertain. Persistent inflation and the Federal Reserve's subsequent interest rate hikes have created a risk-averse environment, leading investors to rotate out of growth stocks and into more stable, value-oriented assets.

Companies like The Trade Desk, which have historically traded at high multiples due to their growth potential, are particularly vulnerable in such climates. Investors become less willing to pay a premium for future earnings, leading to a downward pressure on stock prices.

This shift is a broad market trend, affecting numerous technology companies alongside The Trade Desk, indicating a systemic re-evaluation of risk and reward in the current macroeconomic context.

The Shifting Sands of Digital Advertising: Privacy and Regulation

The digital advertising industry is undergoing a fundamental transformation driven by increasing privacy concerns and stricter regulations. Apple's App Tracking Transparency (ATT) framework, for example, has significantly impacted the ability of advertisers to track users across apps, diminishing the effectiveness of targeted advertising on iOS devices.

Furthermore, the impending demise of third-party cookies, long a cornerstone of online advertising, presents both a challenge and an opportunity. The Trade Desk has been proactive in developing alternative solutions, such as Unified ID 2.0 (UID2), but the widespread adoption and effectiveness of these solutions remain uncertain.

These changes are forcing advertisers to adapt their strategies, potentially shifting budgets away from platforms that rely heavily on traditional tracking methods. While The Trade Desk is actively innovating, the transition period creates uncertainty that can weigh on investor sentiment.

Forward Guidance and Investor Expectations

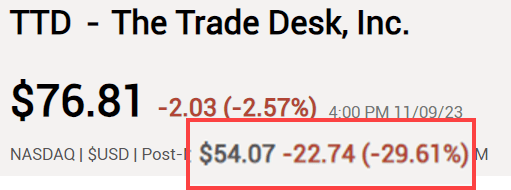

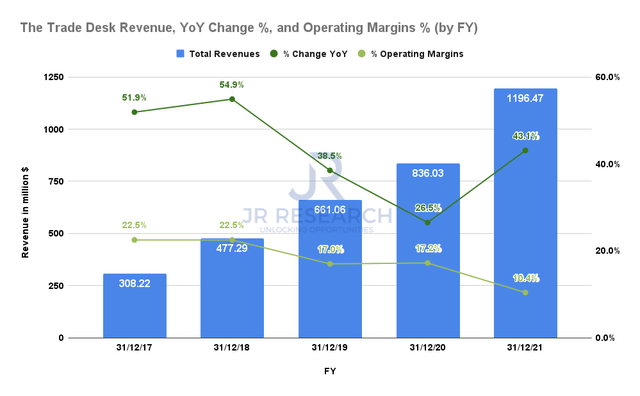

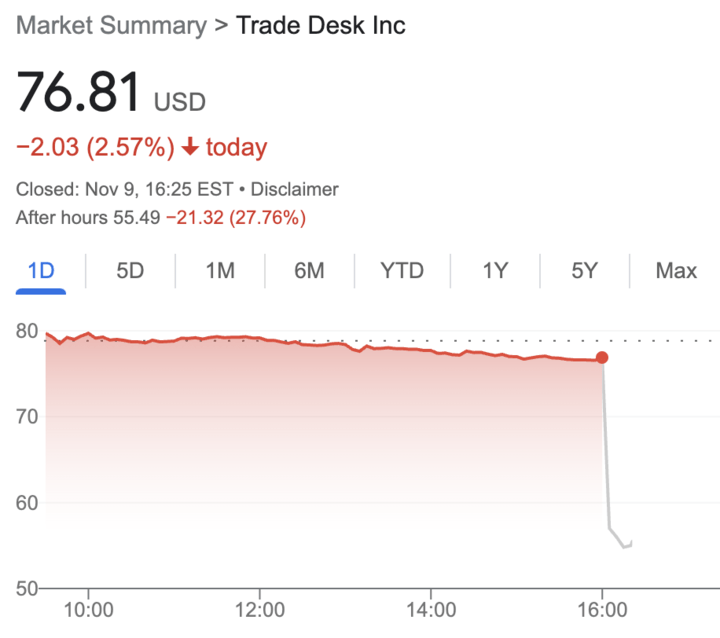

Following a period of impressive growth, The Trade Desk's recent forward guidance, while still positive, may have tempered investor expectations. While the company continues to expand its market share and develop new technologies, the pace of growth may be moderating due to the factors outlined above.

In its most recent earnings call, The Trade Desk projected continued revenue growth, but some analysts interpreted the figures as slightly below previous forecasts. This perceived slowdown, however slight, can trigger a sell-off, especially among investors accustomed to high growth rates.

The market often reacts disproportionately to even minor deviations from expectations, particularly for companies with lofty valuations. This highlights the delicate balance between delivering solid results and managing investor sentiment.

The Trade Desk's Response and Future Outlook

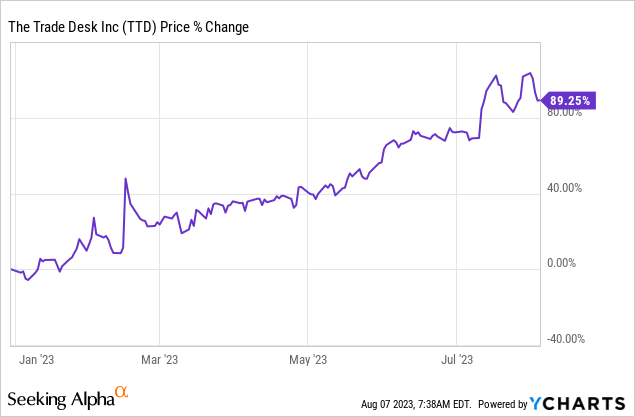

Despite the recent challenges, The Trade Desk remains a dominant player in the programmatic advertising space. The company is actively addressing the evolving landscape by investing heavily in its technology platform, expanding its partnerships, and advocating for privacy-conscious advertising solutions.

UID2, while facing adoption hurdles, represents a significant effort to create a more privacy-friendly and effective alternative to third-party cookies. The company is also focusing on expanding its reach into emerging channels, such as connected TV (CTV), which offers significant growth opportunities.

CEO Jeff Green has repeatedly emphasized the long-term potential of programmatic advertising and The Trade Desk's commitment to innovation. The company's ability to navigate the current headwinds will depend on its continued execution, its ability to adapt to the changing regulatory environment, and its success in driving the adoption of its alternative advertising solutions.

Analyst Perspectives and Investment Strategies

Analysts have offered a range of perspectives on The Trade Desk's future prospects. Some remain bullish, citing the company's strong market position, its innovative technology, and the long-term growth potential of programmatic advertising. Others are more cautious, acknowledging the challenges posed by privacy regulations and the uncertain macroeconomic environment.

Investment strategies vary depending on individual risk tolerance and investment horizons. Some investors may view the recent stock drop as a buying opportunity, betting on The Trade Desk's ability to overcome its challenges and capitalize on future growth opportunities. Others may prefer to wait and see, monitoring the company's progress and the evolving industry landscape before making a decision.

Ultimately, the success of The Trade Desk will depend on its ability to adapt, innovate, and navigate the complexities of the digital advertising ecosystem. The coming months will be crucial in determining whether the company can regain its momentum and solidify its position as a leader in the industry.

Conclusion: Navigating the Turbulence

The Trade Desk's recent stock performance reflects a complex interplay of macroeconomic pressures, industry-specific challenges, and tempered investor expectations. While the company faces headwinds, it also possesses significant strengths, including a leading technology platform, a strong market position, and a proactive approach to innovation.

The future success of The Trade Desk hinges on its ability to navigate the evolving digital advertising landscape, particularly in the face of increasing privacy regulations and the demise of third-party cookies. Its strategic investments in alternative solutions and its focus on emerging channels will be critical in determining its long-term growth trajectory.

Investors will continue to closely monitor The Trade Desk's performance, paying particular attention to its adoption of new technologies, its ability to adapt to regulatory changes, and its overall growth prospects in a dynamic and competitive market.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SPC2WLIZ4JA43BPP7TBAY6CXDY.jpg)