Why Do Small Businesses Often Fail

The dream of owning a small business is a cornerstone of economic aspiration, yet the reality is often harsh. A significant percentage of these ventures, brimming with initial enthusiasm and innovative ideas, fail within their first few years. Understanding the multifaceted reasons behind this phenomenon is crucial for aspiring entrepreneurs and policymakers alike.

The failure rate of small businesses is a complex issue, influenced by a confluence of factors ranging from inadequate funding and poor management to market saturation and unforeseen economic downturns. This article delves into the key reasons behind this trend, drawing on data from reputable sources like the Small Business Administration (SBA) and academic research, to provide a comprehensive overview of the challenges facing small business owners.

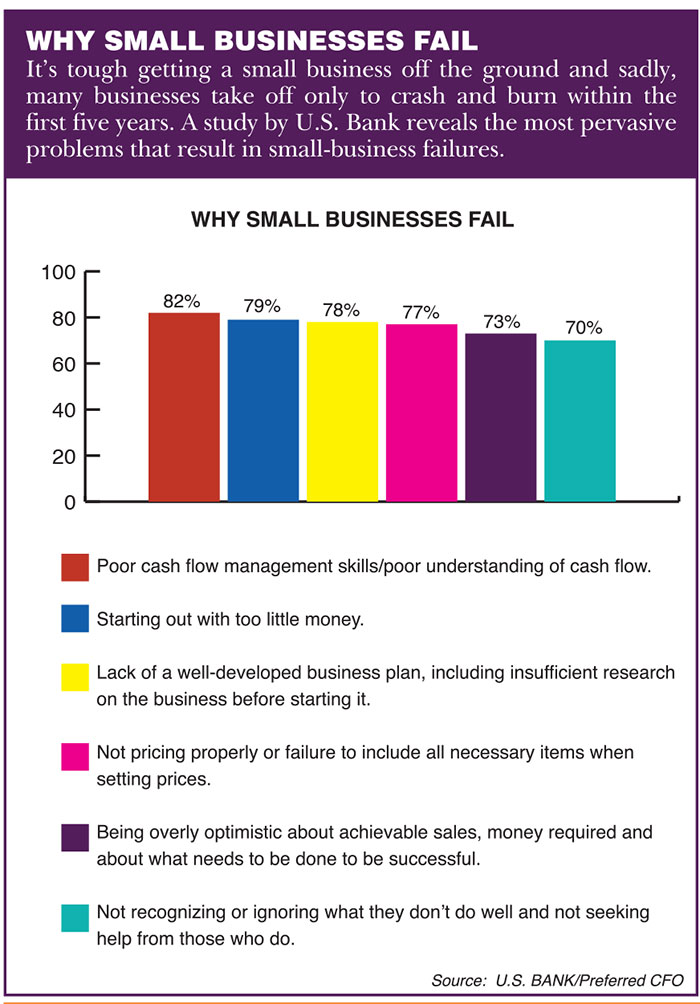

Financial Mismanagement: A Primary Culprit

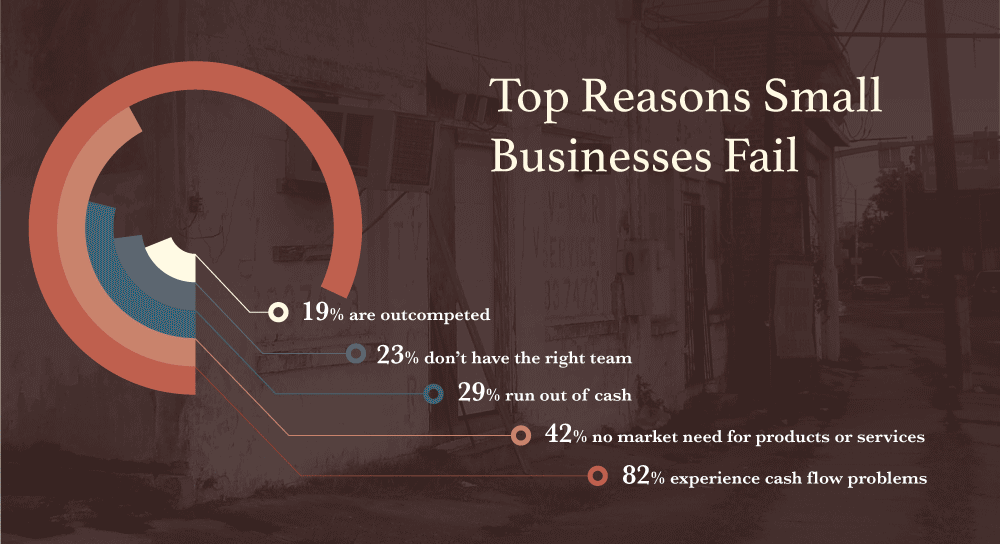

One of the most significant contributors to small business failure is inadequate financial planning and management. Many entrepreneurs underestimate the capital required to launch and sustain their business, leading to premature depletion of funds.

Poor budgeting, inaccurate forecasting, and a lack of understanding of cash flow management are common pitfalls. The SBA often emphasizes the importance of robust financial literacy for small business owners. Without it, businesses can quickly find themselves in a precarious situation.

Lack of Market Research and Planning

Failing to conduct thorough market research can be a fatal error. Launching a business without understanding the target audience, competitive landscape, or market demand significantly increases the risk of failure.

A poorly defined business plan is another common problem. A well-structured plan outlines the business's goals, strategies, and financial projections. Neglecting this crucial step can leave businesses directionless and unprepared for potential challenges.

Management Deficiencies and Inexperience

Effective management is paramount to the success of any business. However, many small business owners lack the necessary experience or skills to effectively manage employees, operations, and finances.

Poor leadership, inadequate training, and a failure to adapt to changing market conditions can all contribute to a business's downfall. Delegation, communication, and problem-solving are crucial management skills that are often underdeveloped.

External Factors and Economic Conditions

While internal factors play a significant role, external forces can also contribute to small business failures. Economic downturns, increased competition, and changing consumer preferences can all pose significant challenges.

Unexpected events, such as natural disasters or global pandemics, can have a devastating impact on small businesses, especially those with limited resources. The COVID-19 pandemic, for example, forced many small businesses to close permanently.

Competition and Market Saturation

The modern marketplace is highly competitive. Small businesses often struggle to compete with larger, more established companies that have greater resources and brand recognition.

Entering a saturated market without a unique selling proposition can make it difficult to attract customers and generate sustainable revenue. Innovation and differentiation are essential for survival in a competitive environment.

Operational Inefficiencies

Inefficient operations can drain resources and hinder a business's ability to compete. This includes issues such as poor inventory management, inefficient production processes, and inadequate technology adoption.

Streamlining operations, automating tasks, and embracing new technologies can improve efficiency and reduce costs. Investing in technology and training can be crucial for small businesses seeking to optimize their operations.

The Human Element: A Personal Story

Consider the story of Maria Rodriguez, who opened a boutique clothing store in a trendy neighborhood. While her initial sales were promising, she quickly faced challenges managing inventory, hiring reliable staff, and adapting to the online shopping boom.

Despite her passion and dedication, Maria was forced to close her store after just two years. Her experience highlights the importance of comprehensive planning, financial acumen, and adaptability in the face of adversity.

Conclusion: Mitigating the Risks

The failure of small businesses is a complex issue with no easy solutions. However, by understanding the common pitfalls and taking proactive steps to mitigate the risks, aspiring entrepreneurs can increase their chances of success.

Thorough planning, sound financial management, effective leadership, and a willingness to adapt to changing market conditions are essential ingredients for building a sustainable and thriving small business. The SBA and other organizations offer valuable resources and support to help small business owners navigate these challenges.

.jpg)

![Why Do Small Businesses Often Fail What Percentage Of Small Businesses Fail? [2023]: Top Reasons And](https://www.zippia.com/wp-content/uploads/2022/03/why-do-small-businesses-fail.jpg)