Why Is Managing Cash Flow Important

Imagine Sarah, the owner of a thriving little bakery, "Sweet Surrender." The aroma of freshly baked bread and the cheerful chatter of customers fill her shop every morning. Yet, behind the sweet facade, Sarah often lies awake at night, her brow furrowed with worry. Her business is booming, but she's constantly juggling bills and struggling to understand why there's never enough cash in the bank.

At the heart of Sarah’s predicament lies a challenge faced by countless businesses, both large and small: managing cash flow. Cash flow, simply put, is the lifeblood of any enterprise. It’s the movement of money in and out of a business, and understanding how to manage it effectively is crucial for survival and growth.

The Vital Role of Cash Flow Management

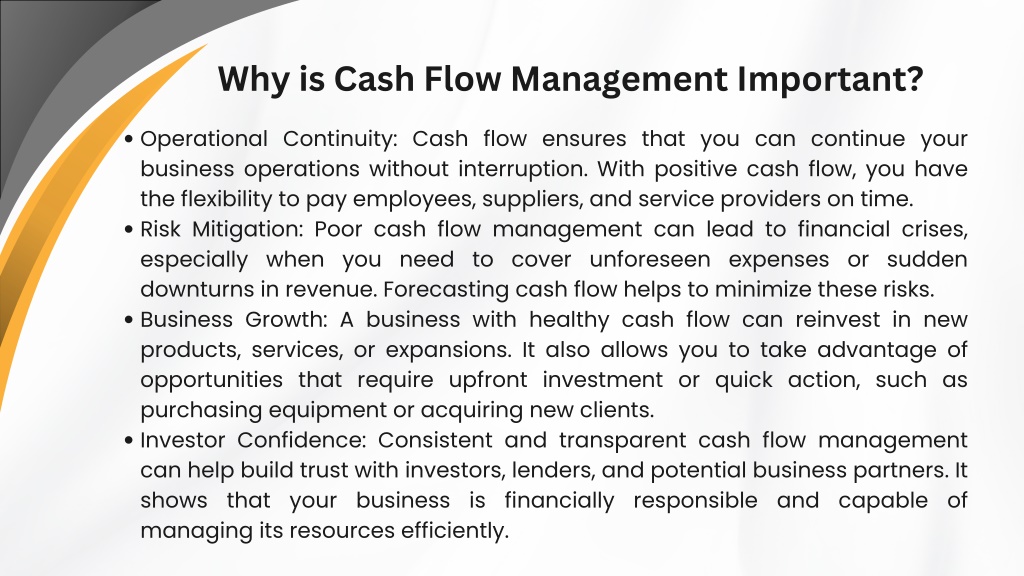

So, why is managing cash flow so critically important? Think of it as the circulatory system of your business. Without sufficient cash flow, a business can quickly find itself in dire straits, even if it's profitable on paper.

A negative cash flow means a company is spending more money than it's bringing in. This can lead to a domino effect of missed payments, damaged credit ratings, and ultimately, business failure.

Conversely, a healthy cash flow allows businesses to invest in growth, seize opportunities, and navigate unexpected challenges. It provides a financial cushion that can weather economic storms and enable long-term sustainability.

Understanding the Components

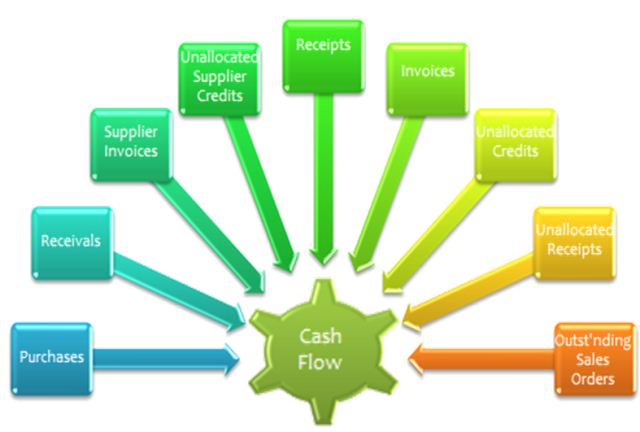

Effective cash flow management requires a clear understanding of its key components. These are primarily cash inflows (money coming into the business) and cash outflows (money leaving the business).

Cash inflows typically include revenue from sales, investments, and loans. Cash outflows encompass expenses like rent, salaries, inventory purchases, and loan repayments.

Analyzing these components helps businesses to identify potential bottlenecks and areas for improvement. According to a study by the Small Business Administration (SBA), poor cash flow management is a leading cause of small business failures.

Strategies for Effective Management

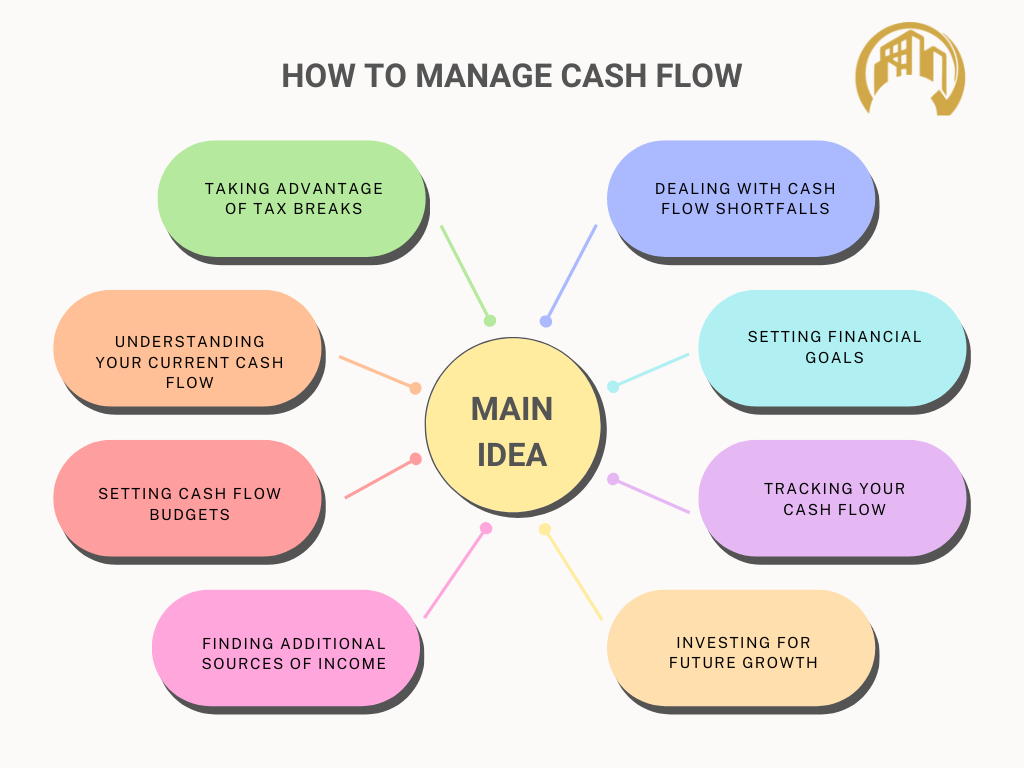

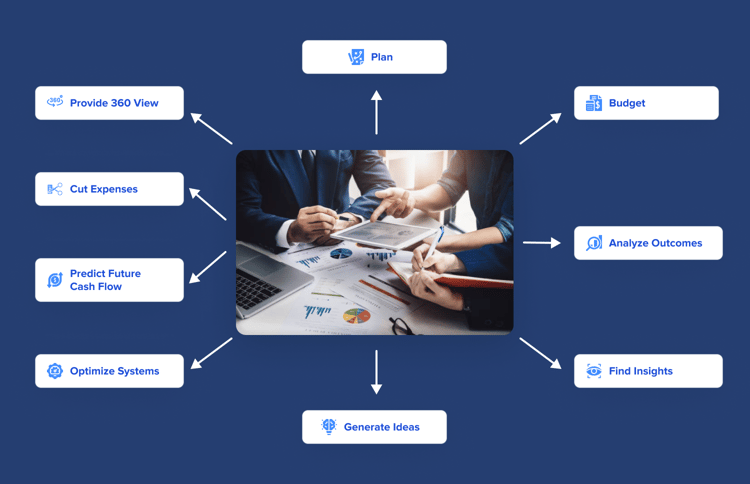

Several strategies can be implemented to improve cash flow management. One of the most important is accurate forecasting. This involves projecting future cash inflows and outflows based on historical data and market trends.

Negotiating favorable payment terms with suppliers is another effective tactic. Extending payment deadlines can free up cash for other immediate needs.

Conversely, accelerating collections from customers can improve cash inflows. This can be achieved through offering discounts for early payments or implementing more efficient invoicing processes.

Consider the use of tools like cash flow statements and management software. These tools provide a comprehensive overview of a business's financial health and can help identify potential problems before they escalate.

The Bigger Picture

Beyond the immediate benefits of financial stability, effective cash flow management contributes to the overall health of the economy. When businesses are financially sound, they are more likely to invest in their communities, create jobs, and drive innovation.

This creates a virtuous cycle of economic growth and prosperity. A healthy business ecosystem benefits everyone.

Back at "Sweet Surrender," Sarah has started working with a financial advisor to implement some of these strategies. She's learning to forecast her cash flow, negotiate better terms with her suppliers, and streamline her invoicing process.

While the challenges remain, Sarah now feels more confident and empowered. She knows she is taking the necessary steps to secure the future of her beloved bakery.

Ultimately, managing cash flow is not just about tracking numbers, it’s about understanding the rhythm of your business. It allows you to make informed decisions, avoid potential pitfalls, and ultimately, achieve your entrepreneurial dreams.