You Are Creating A Budget For Your New Business

The scent of freshly brewed coffee mingles with the crisp, hopeful aroma of new stationery. Sunlight streams through the window, illuminating a scattered array of papers, sticky notes in vibrant hues, and the comforting glow of a laptop screen. A quiet determination hangs in the air, a palpable sense of building something from the ground up.

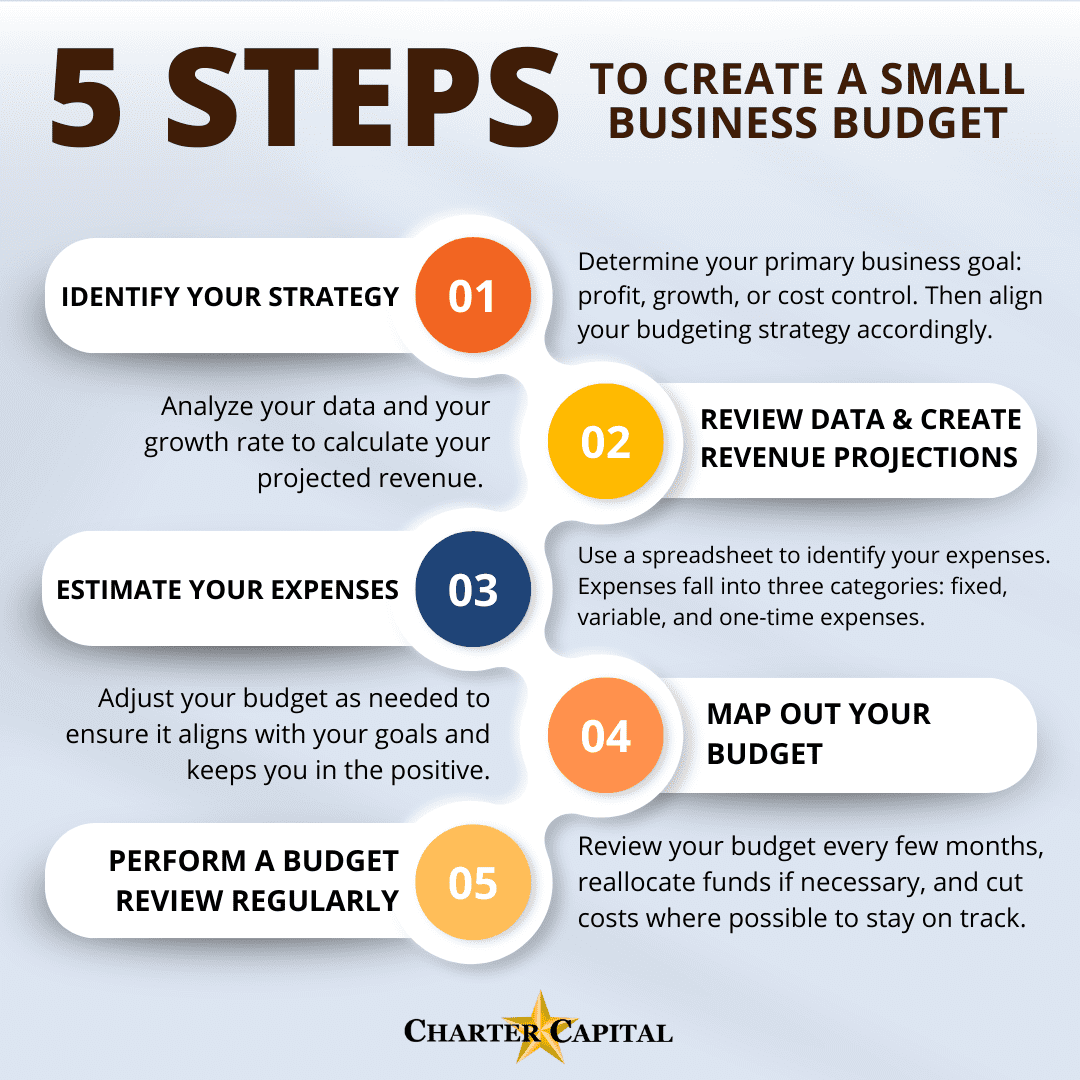

Creating a budget for a new business is a critical step. It's about building a solid foundation for future success. This process involves careful planning and realistic forecasting to ensure financial stability and growth.

The Genesis of an Idea

Every great business starts with an idea, a spark of inspiration that ignites a passion. For many entrepreneurs, that spark is often followed by a period of intense research and development. It's a time of validating the market, refining the product or service, and mapping out the initial business strategy.

Before diving into numbers, understanding the vision is key. What problem are we solving? Who are we serving? What makes us unique?

From Vision to Reality

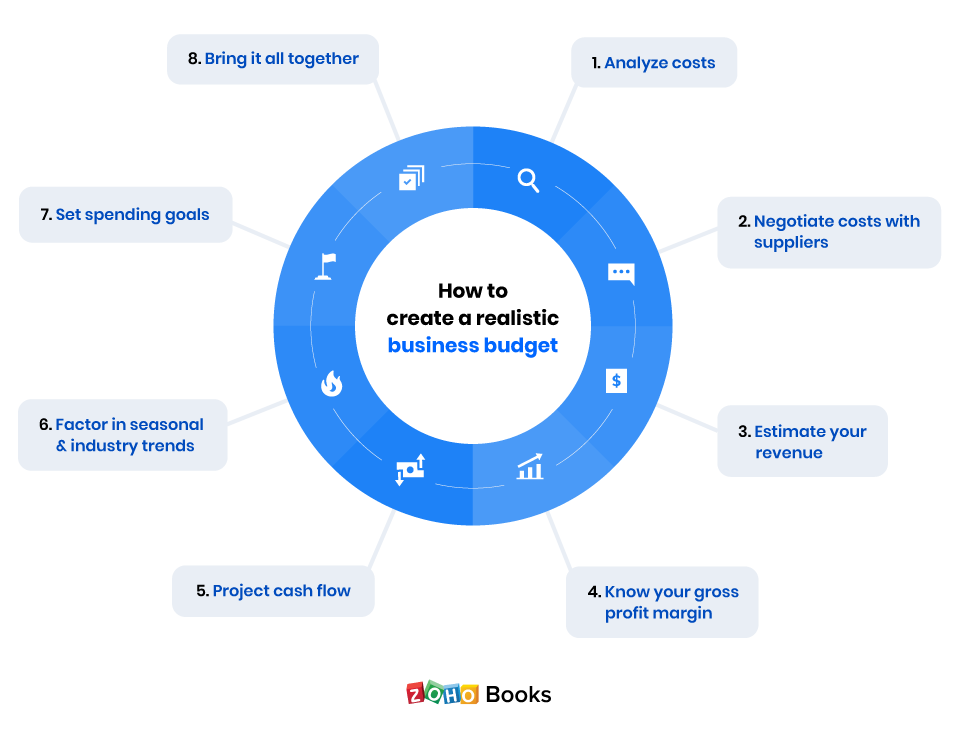

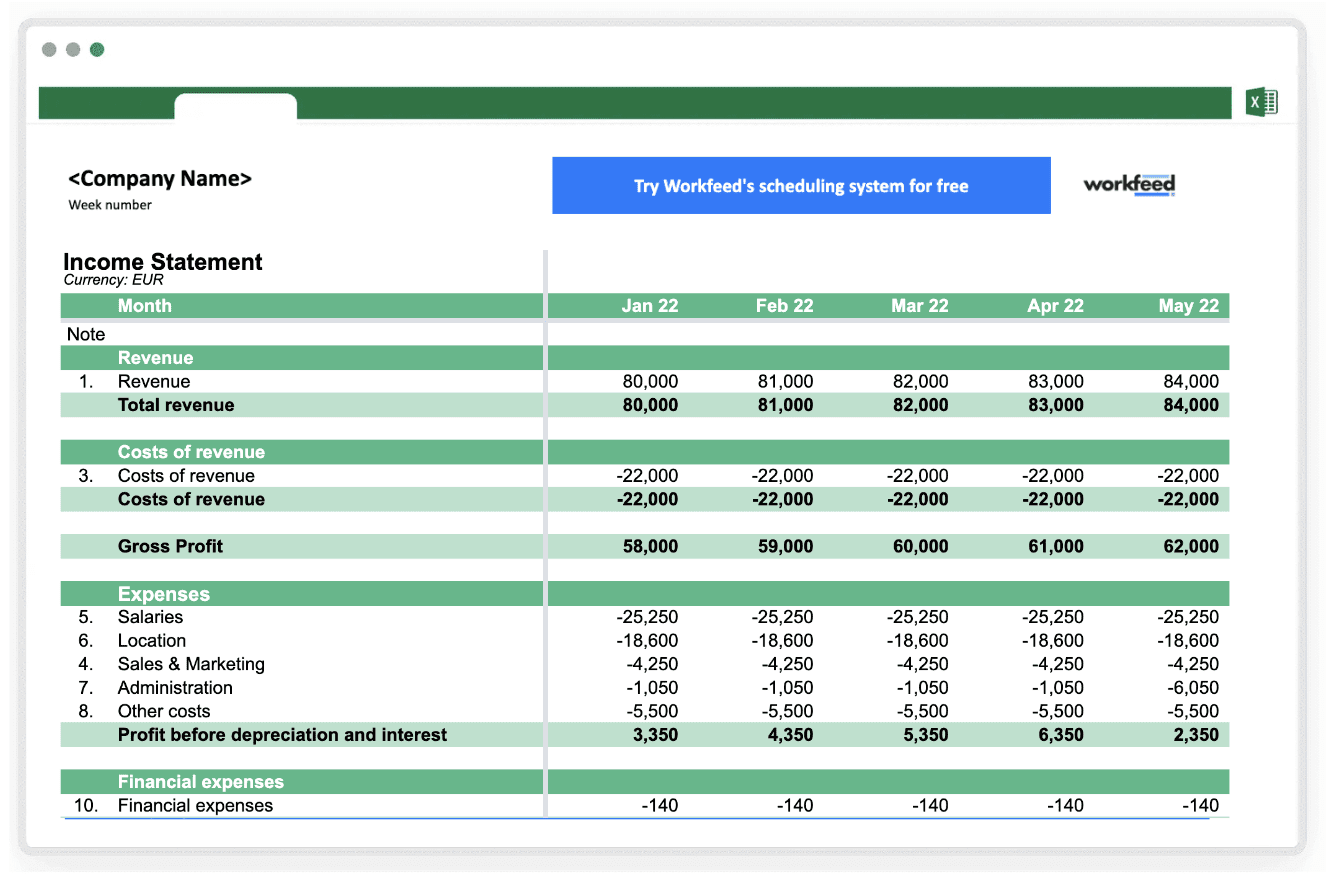

Transforming a vision into a tangible business requires a meticulous approach to finances. This starts with a thorough assessment of all potential revenue streams and projected expenses. It’s a delicate balancing act.

“A well-crafted budget is more than just numbers; it's a roadmap to achieving your business goals,” notes the Small Business Administration (SBA) in their guide to financial management.

Building the Budget: Layer by Layer

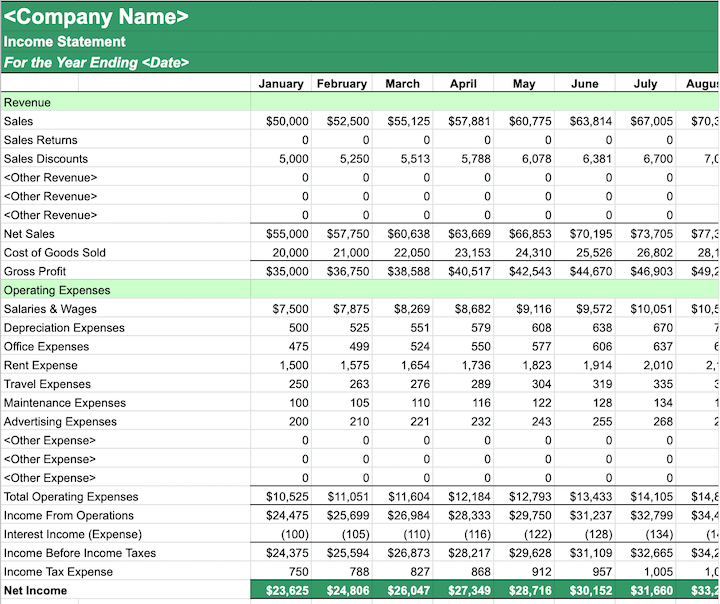

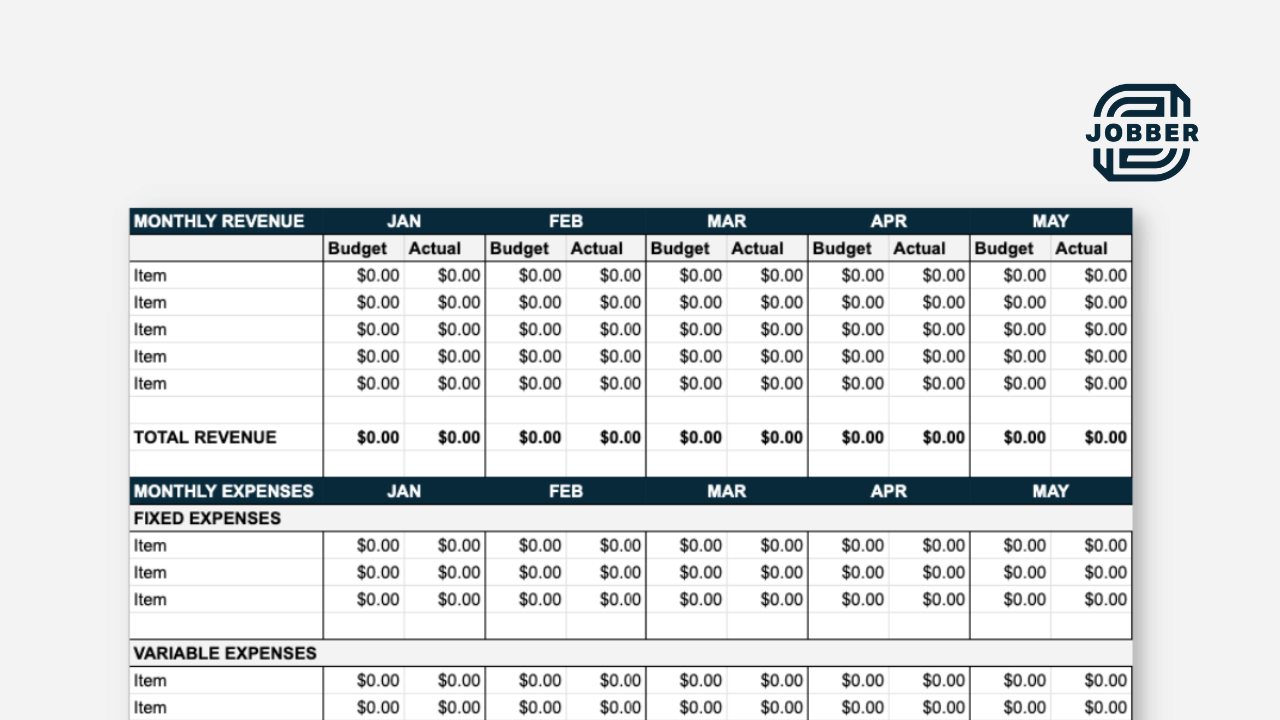

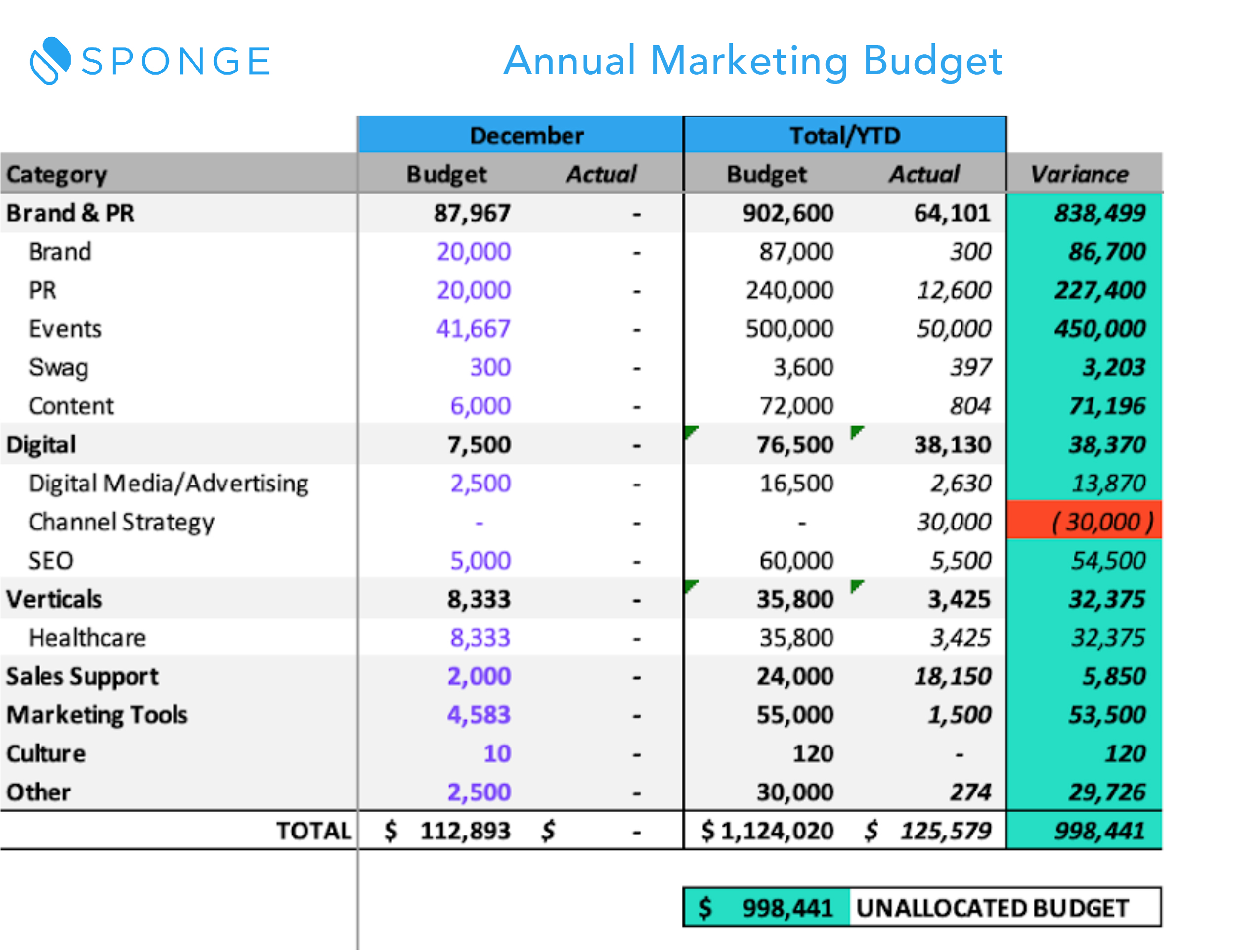

The first layer involves identifying all potential revenue sources. This might include sales projections, subscription fees, or even initial investments from friends and family. <Forecasting accurately is crucial, as this provides the financial lifeblood of the business.

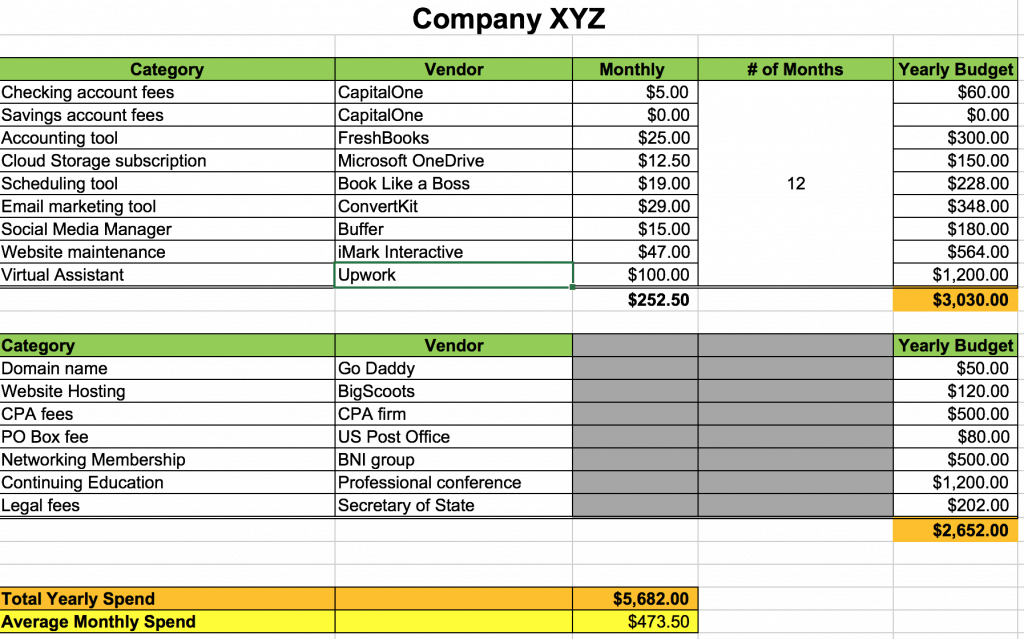

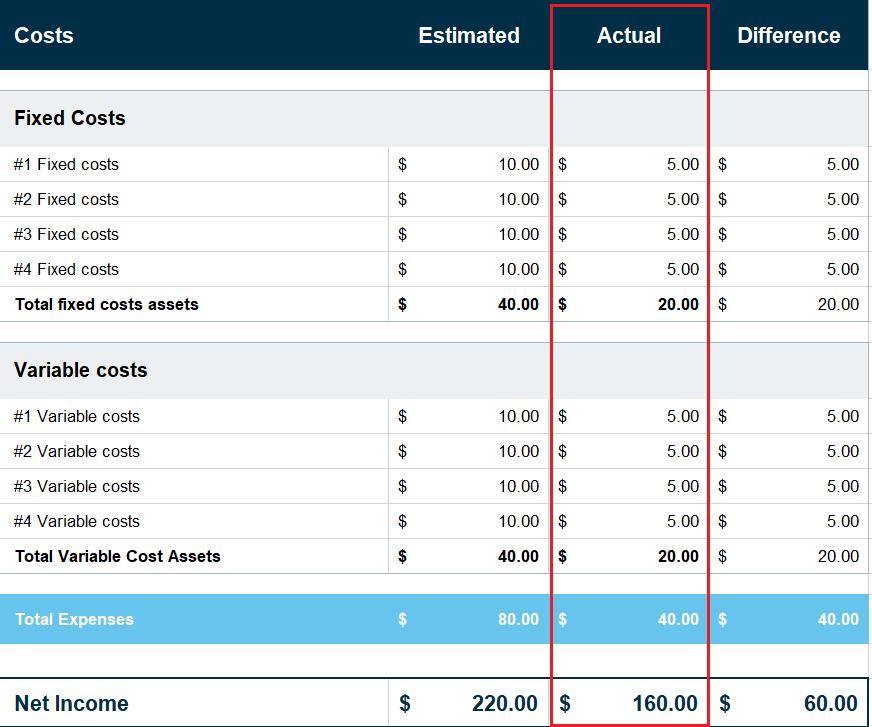

Next comes a comprehensive breakdown of expenses. These fall into various categories, including startup costs, operational expenses, marketing, and administrative fees. Each category requires careful estimation.

Fixed costs, such as rent and insurance, are generally easier to predict. Variable costs, however, like raw materials and marketing spend, require more in-depth analysis.

Startup Costs: The Initial Investment

Startup costs can be a significant hurdle for many new businesses. These include expenses related to setting up the business, such as legal fees, equipment purchases, and initial inventory.

Careful management of these costs is essential. Look for opportunities to minimize expenses without compromising quality.

"Bootstrapping, whenever possible, can be a powerful tool for preserving capital in the early stages,” financial expert Suze Orman has stated.

Navigating the Financial Landscape

Budgeting isn't just about crunching numbers; it's about making informed decisions. Understanding key financial concepts, like cash flow, is critical for long-term sustainability.

Cash flow is the lifeblood of any business. A healthy cash flow ensures the business can meet its financial obligations and invest in future growth.

Tools and Resources

Numerous tools and resources can assist in the budgeting process. Spreadsheet software, like Microsoft Excel or Google Sheets, can be invaluable for organizing and analyzing financial data. There are also specialized accounting software packages designed for small businesses.

The SBA offers a wealth of resources for entrepreneurs, including templates, guides, and online courses. These resources can provide valuable support and guidance throughout the budgeting process.

Looking Ahead

Creating a budget is not a one-time event; it's an ongoing process. Regular monitoring and adjustments are essential to ensure the budget remains aligned with the business's evolving needs.

By embracing a proactive approach to financial management, new businesses can lay a strong foundation for long-term success. And navigate the inevitable challenges with confidence and resilience.