Best Way To Pay Yourself As An Llc

For value-conscious shoppers running an LLC, understanding the best way to pay yourself is crucial, impacting not only your personal finances but also your business's tax obligations and overall financial health.

This guide analyzes various payment strategies, providing insights into their suitability based on different business structures and individual circumstances.

Let's explore the options to help you make the most informed decision.

Understanding the Importance of Choosing the Right Method

Choosing the correct method isn't just about accessing your earnings; it's about tax optimization, legal compliance, and long-term financial planning.

Improper handling can lead to penalties, missed deductions, and even legal issues. It matters because it affects your bottom line and peace of mind.

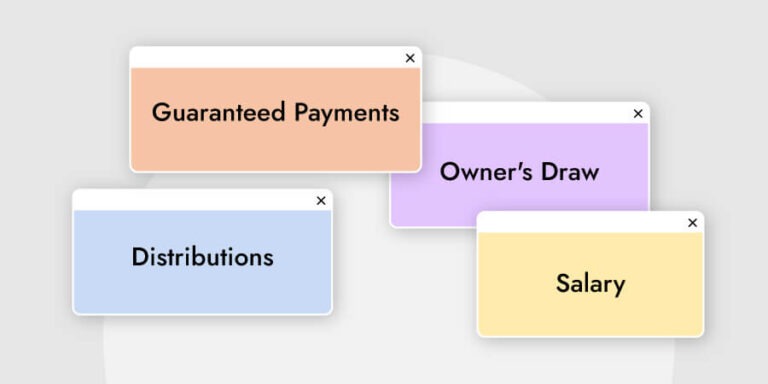

Shortlist of Payment Options Tailored to Different Needs

Here are a few payment options based on your specific circumstances.

- For Sole Proprietorship LLCs: Owner's Draw - Simple, direct access to profits.

- For S-Corp LLCs: Combination of Salary & Distributions - Balancing tax optimization and fair compensation.

- For Multi-Member LLCs: Guaranteed Payments - Ensuring equitable compensation regardless of profitability.

Detailed Reviews of Payment Methods

Owner's Draw (Sole Proprietorship LLC)

The owner's draw is the simplest way for sole proprietorship LLCs to access profits. Owners simply withdraw funds from the business as needed.

There are no payroll taxes involved in draws, but you are still responsible for self-employment taxes. It is suitable for small businesses prioritizing simplicity.

Salary and Distributions (S-Corp LLC)

S-Corp LLCs offer a more structured approach: a reasonable salary and distributions. The salary is subject to payroll taxes, while distributions are only subject to income tax.

Setting a reasonable salary is key to tax optimization. This method can reduce your overall self-employment tax burden.

Guaranteed Payments (Multi-Member LLC)

For multi-member LLCs, guaranteed payments ensure partners receive compensation regardless of the company's profitability. These payments are treated as ordinary income for the recipient and are deductible by the LLC.

This provides a stable income stream for partners. It also adds complexity to tax planning.

Side-by-Side Specs Table with Performance Scores

| Payment Method | LLC Type | Tax Implications | Complexity | Suitability | Score (Out of 5) |

|---|---|---|---|---|---|

| Owner's Draw | Sole Proprietorship | Self-Employment Tax | Low | Simple operations | 4 |

| Salary & Distributions | S-Corp | Payroll & Income Tax | Medium | Tax optimization | 5 |

| Guaranteed Payments | Multi-Member | Ordinary Income (to partner) | Medium | Ensuring partner compensation | 4 |

Practical Considerations

When selecting the best payment strategy, consider these factors. Your LLC's structure, tax bracket, and cash flow all play a role.

Regularly review your chosen method with a tax advisor. Doing so ensures it remains optimal for your evolving business.

Don't forget about the record-keeping involved.

Tax Implications

Each payment method carries unique tax implications. Owner's draws are subject to self-employment tax, while S-Corp salary requires payroll taxes. Distributions are generally subject only to income tax.

Guaranteed payments are treated as ordinary income for the recipient. Consult a tax professional to minimize your tax liability.

Record-Keeping and Compliance

Maintain accurate records of all transactions, regardless of the payment method. This is essential for tax compliance and financial audits.

Proper documentation supports your deductions and protects your business. Invest in accounting software to streamline this process.

Cash Flow Management

Ensure your chosen payment method aligns with your business's cash flow. Avoid overdrawing or setting unrealistic salary expectations.

Regularly forecast your cash flow. This helps you maintain financial stability while compensating yourself fairly.

Summarizing Key Points and Making an Informed Decision

Choosing the best way to pay yourself from an LLC is a critical decision with significant financial and legal consequences.

We've explored owner's draws, salary and distributions, and guaranteed payments. Each option offers advantages and disadvantages depending on your LLC's structure and financial goals.

Consider all the factors discussed: tax implications, record-keeping requirements, and cash flow management. Engage with financial professionals to make informed decisions.

Call to Action

Ready to optimize your LLC's payment strategy? Schedule a consultation with a qualified tax advisor today! Ensure you're paying yourself efficiently while maximizing tax benefits.

Take control of your business finances and secure your financial future.

Frequently Asked Questions (FAQ)

Q: What is the difference between an owner's draw and a salary?

A: An owner's draw is a direct withdrawal of profits, subject to self-employment tax. A salary is a fixed payment subject to payroll taxes like Social Security and Medicare.

Q: How do I determine a reasonable salary for an S-Corp LLC?

A: A reasonable salary should reflect the market value of your services. Consider your skills, experience, and the nature of your work. Consult industry benchmarks and seek professional advice.

Q: Are guaranteed payments subject to self-employment tax?

A: Guaranteed payments are not subject to self-employment tax. But they are considered ordinary income for the recipient and are deductible by the LLC.

Q: What happens if I don't pay myself a reasonable salary as an S-Corp?

A: The IRS may reclassify distributions as wages. This can result in back taxes, penalties, and interest.

Q: What if my LLC is both a sole proprietorship and an S-Corp?

A: It's not possible to be both simultaneously. You must elect to be treated as either a sole proprietorship or an S-Corp by filing the necessary paperwork with the IRS.