636 Credit Score Good Or Bad

Navigating the world of credit scores can feel like deciphering a complex code, with numbers holding the keys to financial opportunities. A 636 credit score often sits on the cusp, leaving many wondering: is it good or bad? The answer, unfortunately, isn't straightforward, but it significantly impacts your access to loans, interest rates, and even rental approvals.

This article delves into the implications of a 636 credit score, dissecting its position within the broader credit score landscape, exploring the challenges and opportunities it presents, and offering insights into strategies for improvement. We'll examine data from reputable organizations like Experian, Equifax, and TransUnion, along with expert opinions, to provide a comprehensive understanding of this crucial financial metric. Ultimately, understanding where you stand empowers you to take control of your financial future.

Understanding the 636 Credit Score

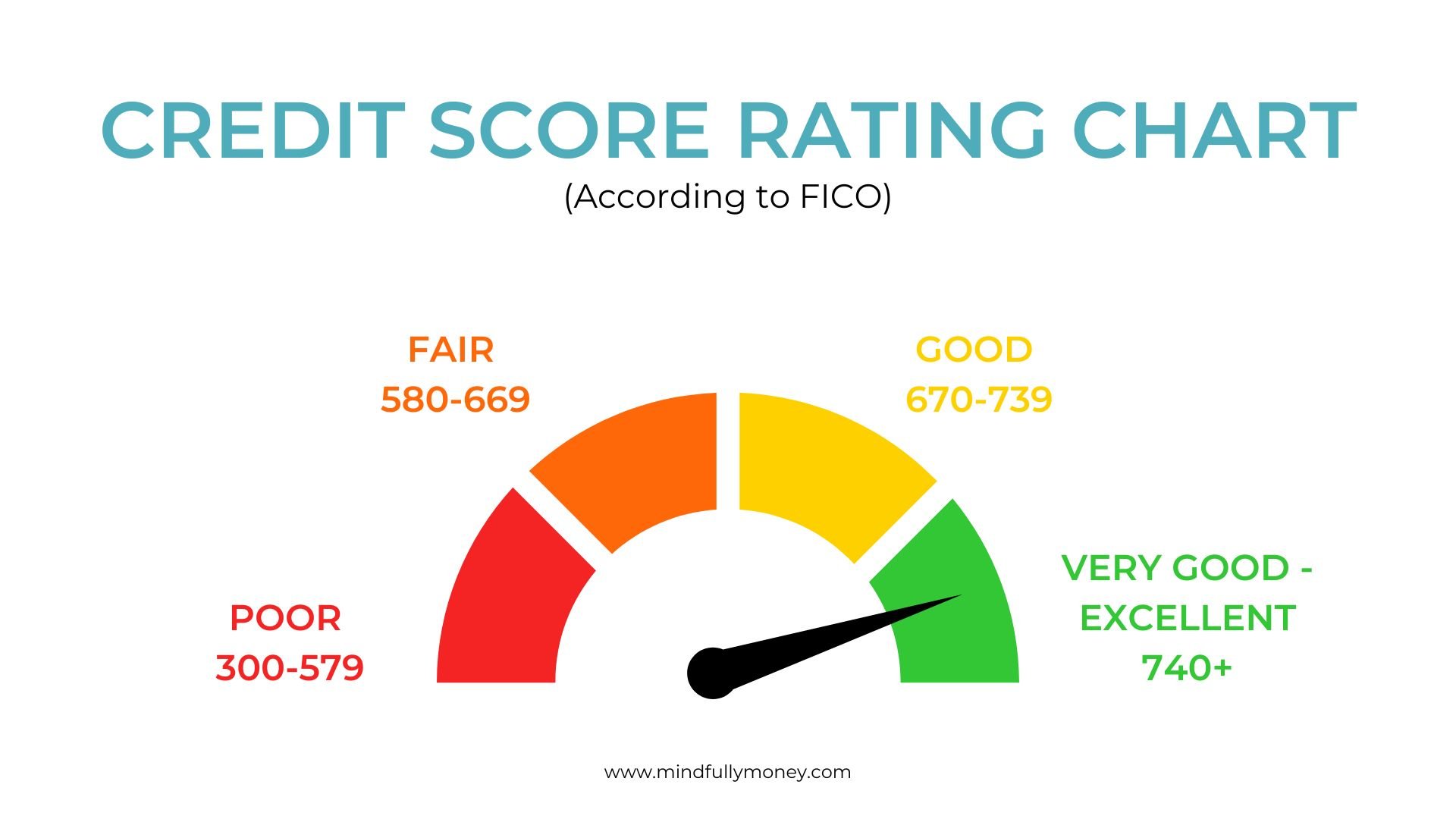

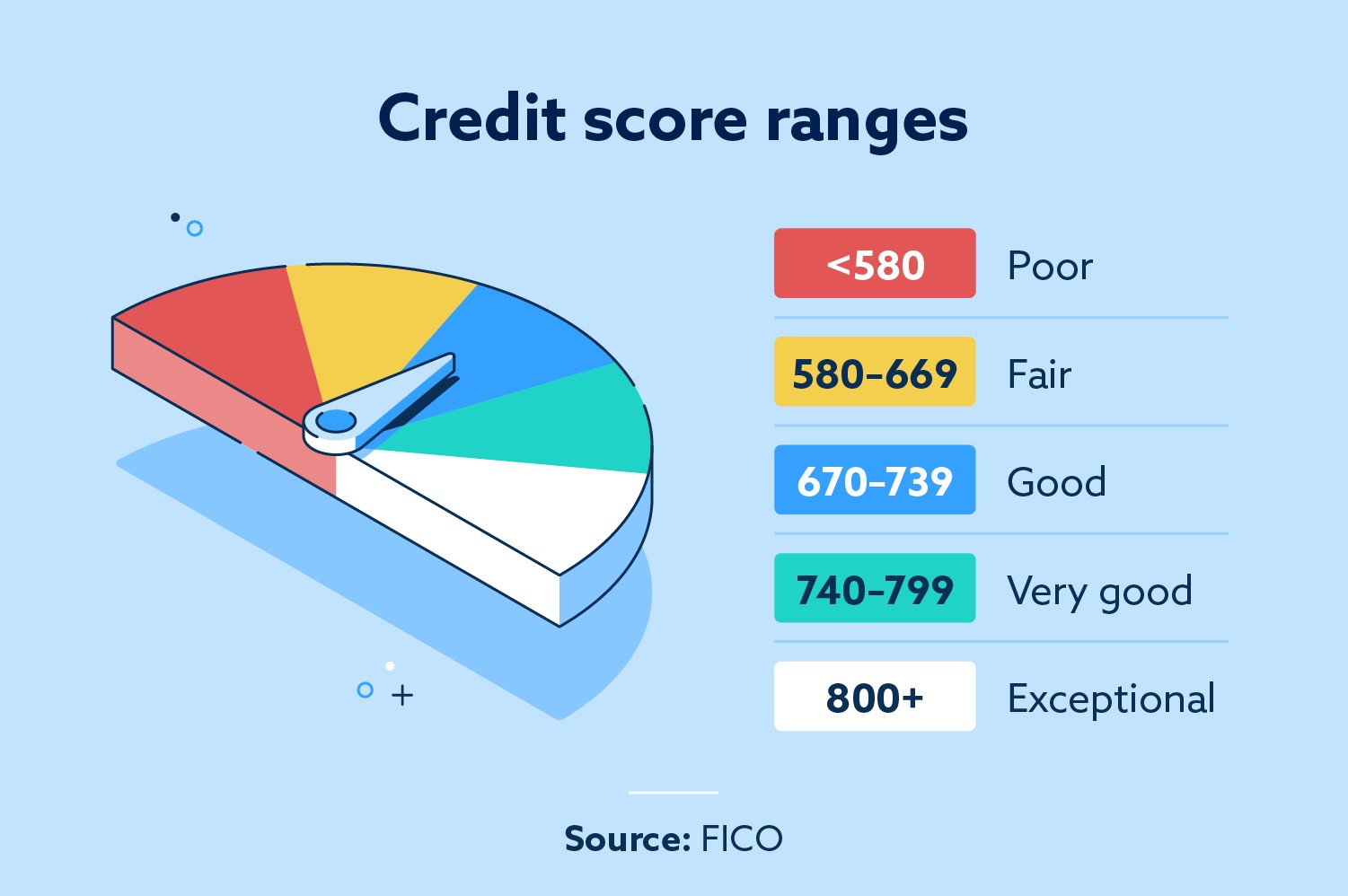

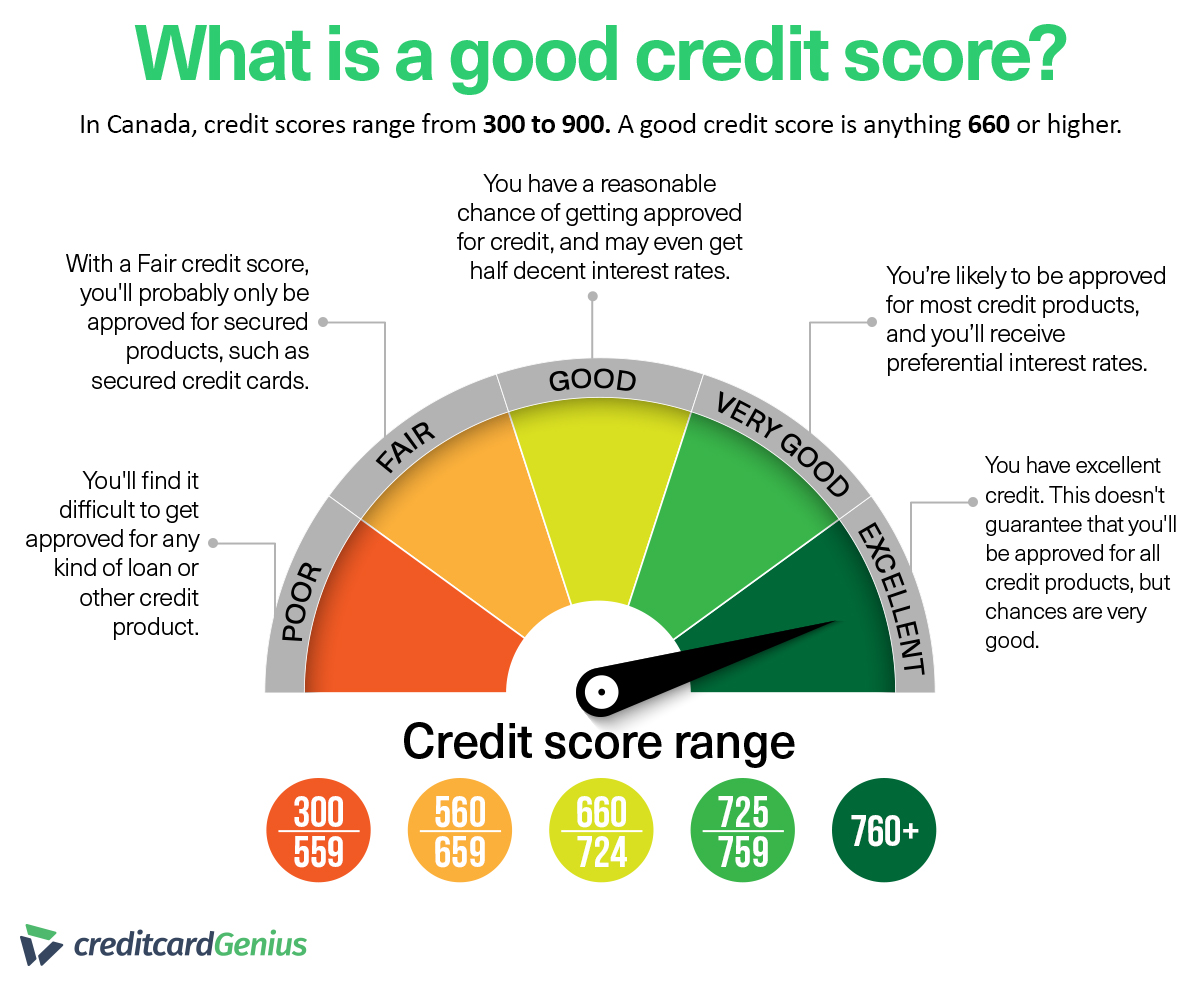

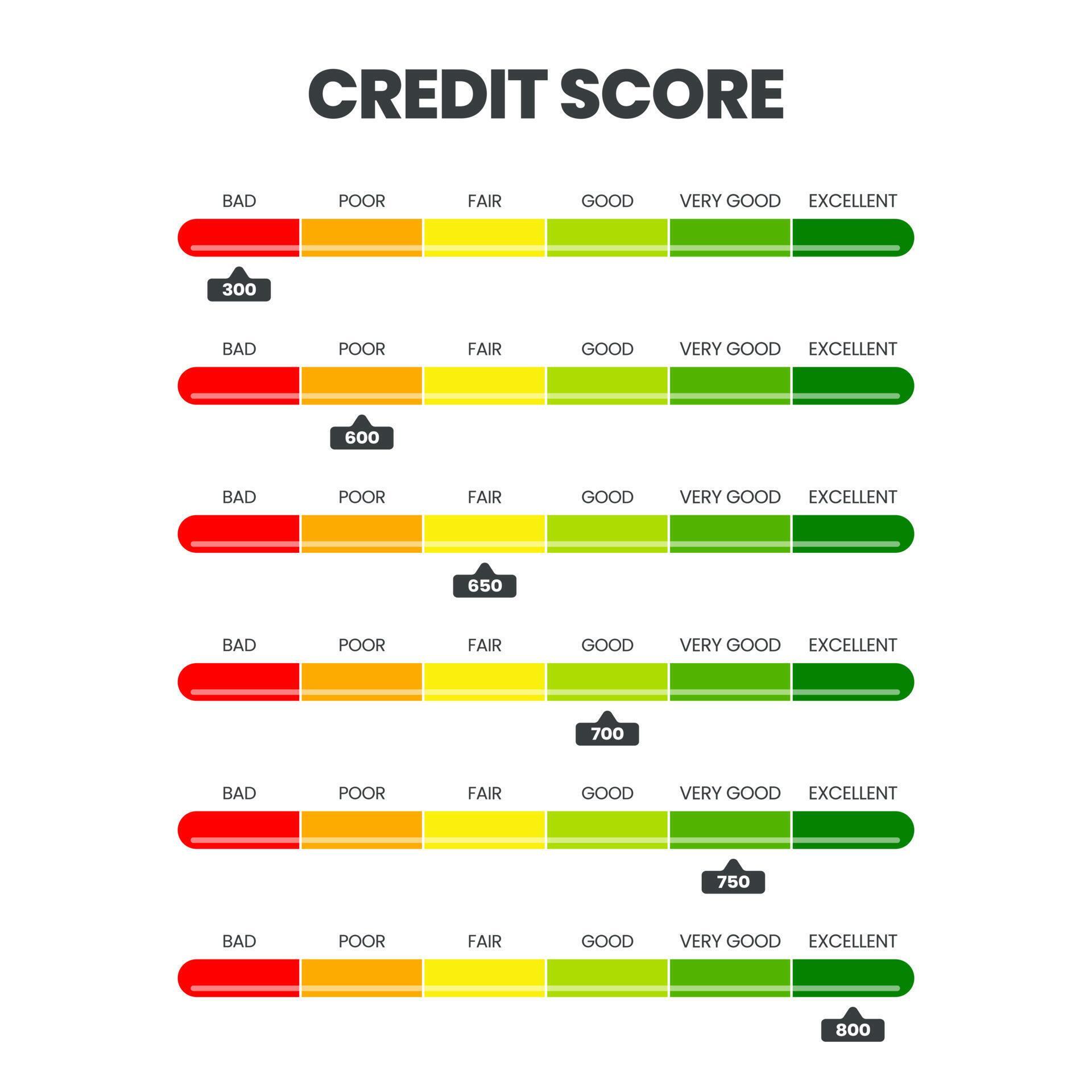

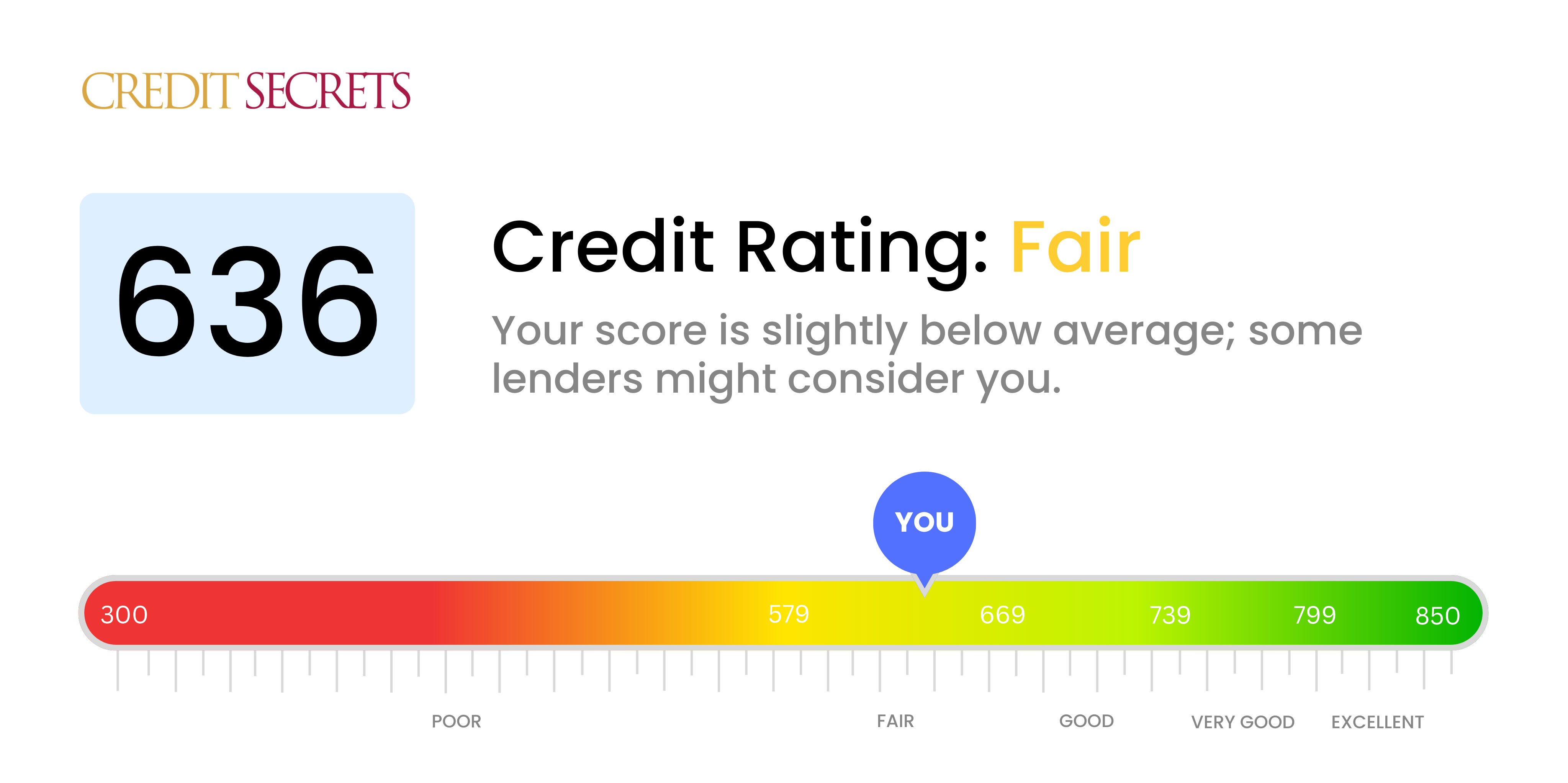

Credit scores, primarily using the FICO scoring model, range from 300 to 850. A score of 636 falls within the "fair" range. According to Experian, the typical FICO score range definitions are: Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), and Exceptional (800-850).

This places a 636 credit score above the "poor" category but below what is considered "good." It's a middle ground that necessitates careful consideration of its consequences and potential for advancement. This score is the average of what is reported by all 3 credit bureaus.

The Implications of a Fair Credit Score

A fair credit score, such as 636, can significantly impact various aspects of your financial life. The most immediate effect is on loan eligibility and interest rates. Borrowers with fair credit scores are typically viewed as higher risk, leading lenders to charge higher interest rates on loans, credit cards, and mortgages.

This means you'll pay more over the life of the loan compared to someone with a "good" or "excellent" credit score. It can also affect your ability to qualify for certain types of loans or credit cards altogether. This is especially true for loans from larger, more traditional lending institutions.

Beyond borrowing, a 636 credit score can influence other areas. Landlords may consider it a red flag, potentially requiring a larger security deposit or even denying your application. Insurance companies may also use your credit score to determine premiums, potentially resulting in higher costs for auto or home insurance.

The Factors Affecting Your Credit Score

Understanding the factors that influence your credit score is crucial for improvement. The five primary components of a FICO score are payment history, amounts owed, length of credit history, credit mix, and new credit.

Payment history is the most significant factor, accounting for 35% of your score. Consistent on-time payments demonstrate responsible credit management. Amounts owed, or credit utilization, makes up 30% of your score, measuring the amount of credit you're using compared to your total available credit.

Keeping your credit utilization low (ideally below 30%) is crucial. The length of credit history (15%), credit mix (10%), and new credit (10%) also play important roles. Having a longer credit history, a mix of different credit accounts (credit cards, loans), and avoiding opening too many new accounts in a short period can all positively impact your score.

Strategies for Improving a 636 Credit Score

Improving a 636 credit score requires a strategic and consistent approach. The first step is to obtain copies of your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion).

Review these reports carefully for any errors or inaccuracies. Disputing any incorrect information can lead to a quick boost in your score. Focus on making on-time payments for all your credit accounts. Set up reminders or automatic payments to avoid missing deadlines.

Reducing your credit utilization is another key strategy. Pay down balances on your credit cards to lower the amount of credit you're using. Consider requesting a credit limit increase on your existing cards, but avoid spending more as a result. Responsible use of a secured credit card can also help build credit.

Avoid opening too many new credit accounts at once, as this can negatively impact your score. Be patient, as building credit takes time and consistent effort. It may take several months to see significant improvements in your score.

The Future of Credit Scoring

The landscape of credit scoring is constantly evolving. Alternative credit scoring models, such as VantageScore, are gaining traction. These models may consider different factors than FICO, potentially offering a more inclusive assessment for individuals with limited credit history.

Furthermore, there's growing discussion about incorporating alternative data, such as rent payments and utility bills, into credit scoring models. This could benefit individuals who don't have a long history of using traditional credit products. However, concerns about data privacy and fairness remain.

As technology advances, expect to see continued innovation in credit scoring, with a focus on providing more accurate and accessible assessments. Staying informed about these changes can help you navigate the evolving credit landscape and maximize your financial opportunities.

Conclusion

A 636 credit score is neither exceptionally good nor disastrously bad, but rather a stepping stone. It signifies an opportunity for improvement and greater financial access. By understanding the factors that influence your score and implementing effective strategies, you can move towards a "good" or even "excellent" credit rating.

Remember, building credit is a marathon, not a sprint. Consistency, patience, and a commitment to responsible financial habits are key to achieving your credit goals. A higher credit score unlocks lower interest rates, better loan terms, and greater overall financial flexibility.

Take control of your credit today, and you'll be setting yourself up for a brighter financial future.