Equitas Small Finance Bank Savings Account Interest Rate

In a landscape where every basis point matters, Equitas Small Finance Bank's (ESFB) savings account interest rates have become a focal point for savers and investors alike. The bank's offerings, often positioned as competitive, are now under scrutiny as market dynamics shift and other financial institutions adjust their own rates. Understanding these rates, and their implications, is crucial for anyone looking to maximize returns on their savings.

This article delves into the specifics of Equitas Small Finance Bank's savings account interest rates, examining recent changes, comparing them to industry benchmarks, and analyzing their impact on depositors. We will explore the factors influencing these rates, including regulatory policies and the broader economic environment, providing a comprehensive overview for informed decision-making.

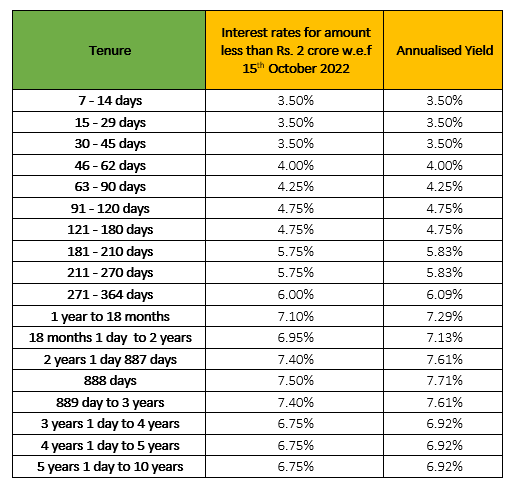

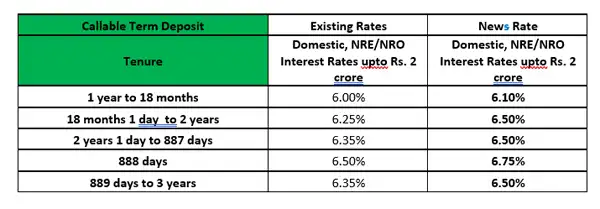

Current Interest Rate Structure

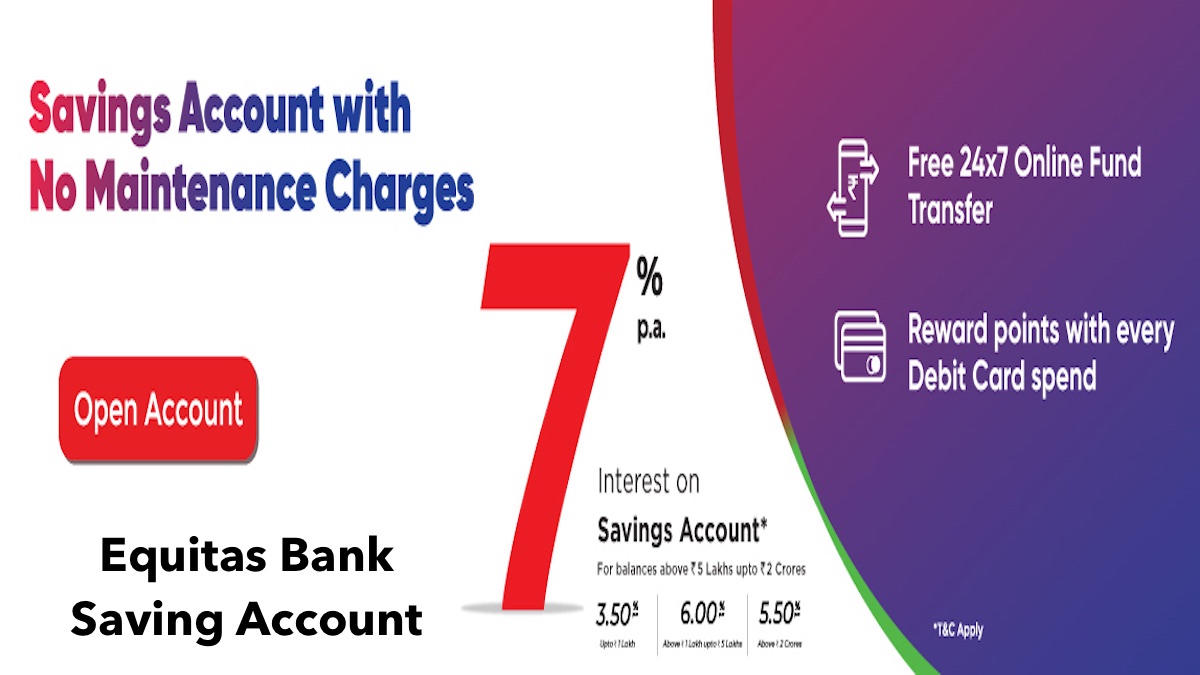

Equitas Small Finance Bank currently offers tiered interest rates on its savings accounts, with higher balances typically earning higher rates. The exact rates vary depending on the amount held in the account and are subject to change at the bank's discretion. These rates are prominently displayed on the bank's website and in branch locations.

As of [Insert Current Date], the interest rate structure for Equitas Small Finance Bank savings accounts is as follows (example - confirm with actual data):

- Balances up to ₹1 Lakh: 3.5% per annum

- Balances above ₹1 Lakh and up to ₹10 Lakhs: 6.5% per annum

- Balances above ₹10 Lakhs: 7.25% per annum

The bank also offers specialized savings accounts for specific demographics, such as senior citizens and children, which may come with different interest rates and features. These targeted products are designed to cater to the unique financial needs of these groups.

Comparison with Competitors

In the competitive realm of small finance banking, Equitas Small Finance Bank's rates are often compared to those offered by its peers. Banks like Ujjivan Small Finance Bank, Suryoday Small Finance Bank, and AU Small Finance Bank also vie for customer deposits, creating a dynamic market for savers.

A recent analysis shows that Equitas' rates are generally competitive, but some competitors occasionally offer promotional rates or slightly higher yields on certain balance tiers. Financial analysts recommend that customers regularly compare rates across different banks to ensure they are getting the best possible return on their savings.

Factors beyond interest rates also play a role in choosing a savings account, including the bank's service quality, branch network, digital banking capabilities, and overall reputation. Customers should weigh these factors alongside interest rates to make an informed decision.

Factors Influencing Interest Rates

Several factors influence the interest rates offered by Equitas Small Finance Bank, including the Reserve Bank of India's (RBI) monetary policy. Changes in the repo rate, the rate at which the RBI lends to commercial banks, directly impact the cost of funds for banks and subsequently affect deposit rates.

The overall economic climate, including inflation rates and economic growth projections, also plays a significant role. Higher inflation often leads to higher interest rates as banks try to attract deposits and maintain their profitability.

Furthermore, the competitive landscape within the banking sector influences interest rate decisions. Banks constantly monitor their competitors' rates and adjust their own offerings to remain attractive to depositors, ensuring they maintain a healthy deposit base.

Impact on Depositors

For depositors, changes in savings account interest rates can significantly impact the returns on their savings. Higher interest rates mean more earnings, while lower rates can reduce the growth of their funds.

The impact is particularly pronounced for individuals who rely on savings account interest for a portion of their income, such as retirees. These individuals need to carefully manage their savings to ensure they can maintain their desired lifestyle.

It is advisable for depositors to regularly review their savings strategies and consider diversifying their investments to mitigate the impact of fluctuating interest rates. This might involve exploring other investment options like fixed deposits, mutual funds, or government bonds.

Future Outlook

Looking ahead, the trajectory of Equitas Small Finance Bank's savings account interest rates will likely depend on the evolving economic landscape and the RBI's monetary policy decisions. Experts anticipate continued volatility in interest rates as the economy navigates various challenges.

The bank's management has indicated a commitment to maintaining competitive rates while balancing the need for profitability and sustainable growth. They will continue to monitor market conditions and adjust their rates accordingly.

Ultimately, depositors should stay informed about the latest developments in the financial market and regularly review their savings strategies to optimize their returns. Informed decision-making is crucial for navigating the ever-changing world of banking and finance.