643 Credit Score Good Or Bad

In the complex world of personal finance, few numbers wield as much power as your credit score. This three-digit figure dictates access to loans, mortgages, even rental opportunities, effectively gatekeeping significant life milestones. But what does a 643 credit score really mean? Is it a key to unlock financial opportunities or a roadblock hindering your progress?

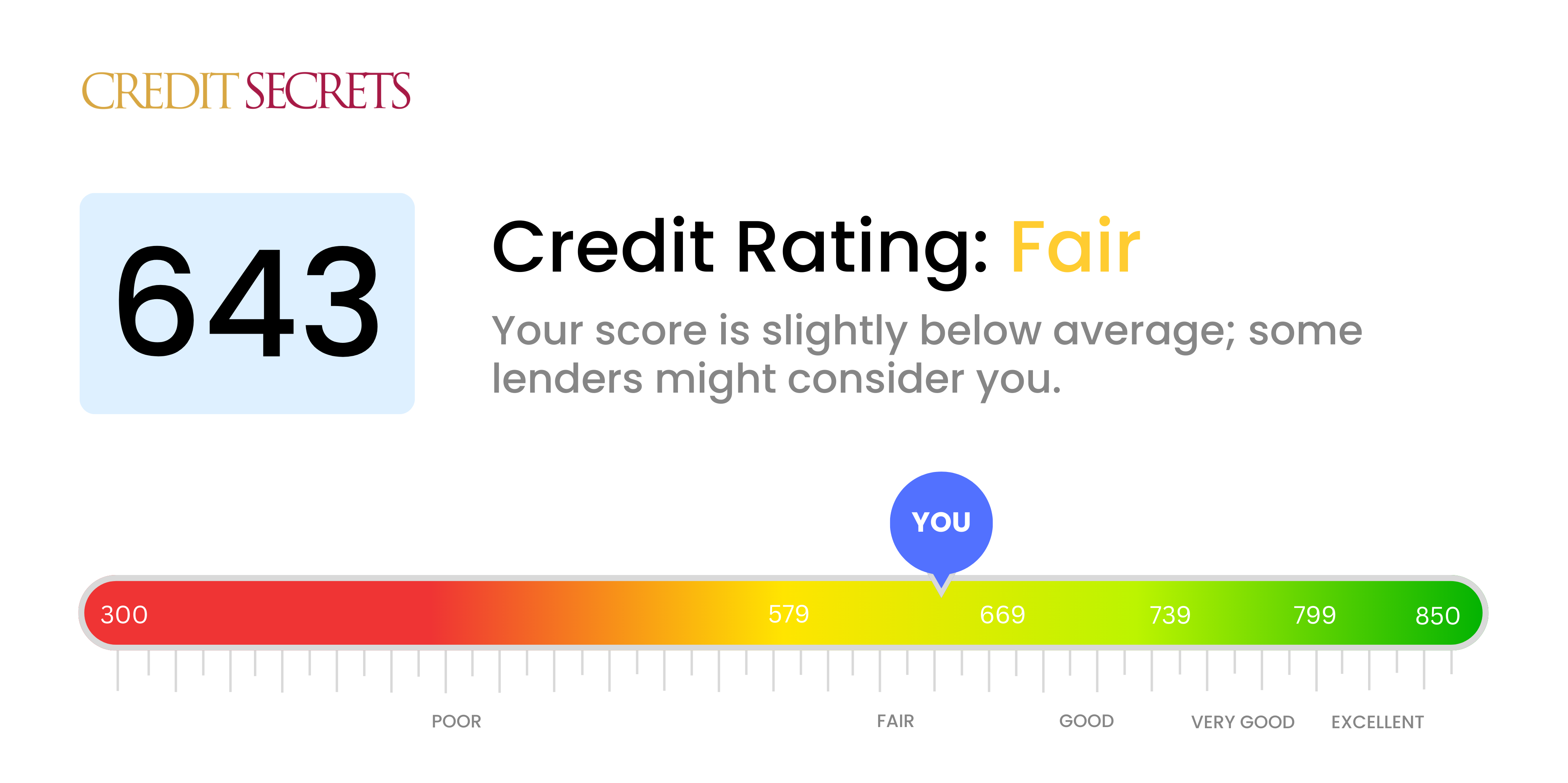

A credit score of 643 falls within the “fair” range, positioning individuals in a precarious middle ground. While not disastrous, it signals potential risks to lenders, impacting interest rates and approval odds. This article dives deep into the implications of a 643 credit score, exploring its impact on borrowing power, strategies for improvement, and the broader context of credit health in today's economic landscape.

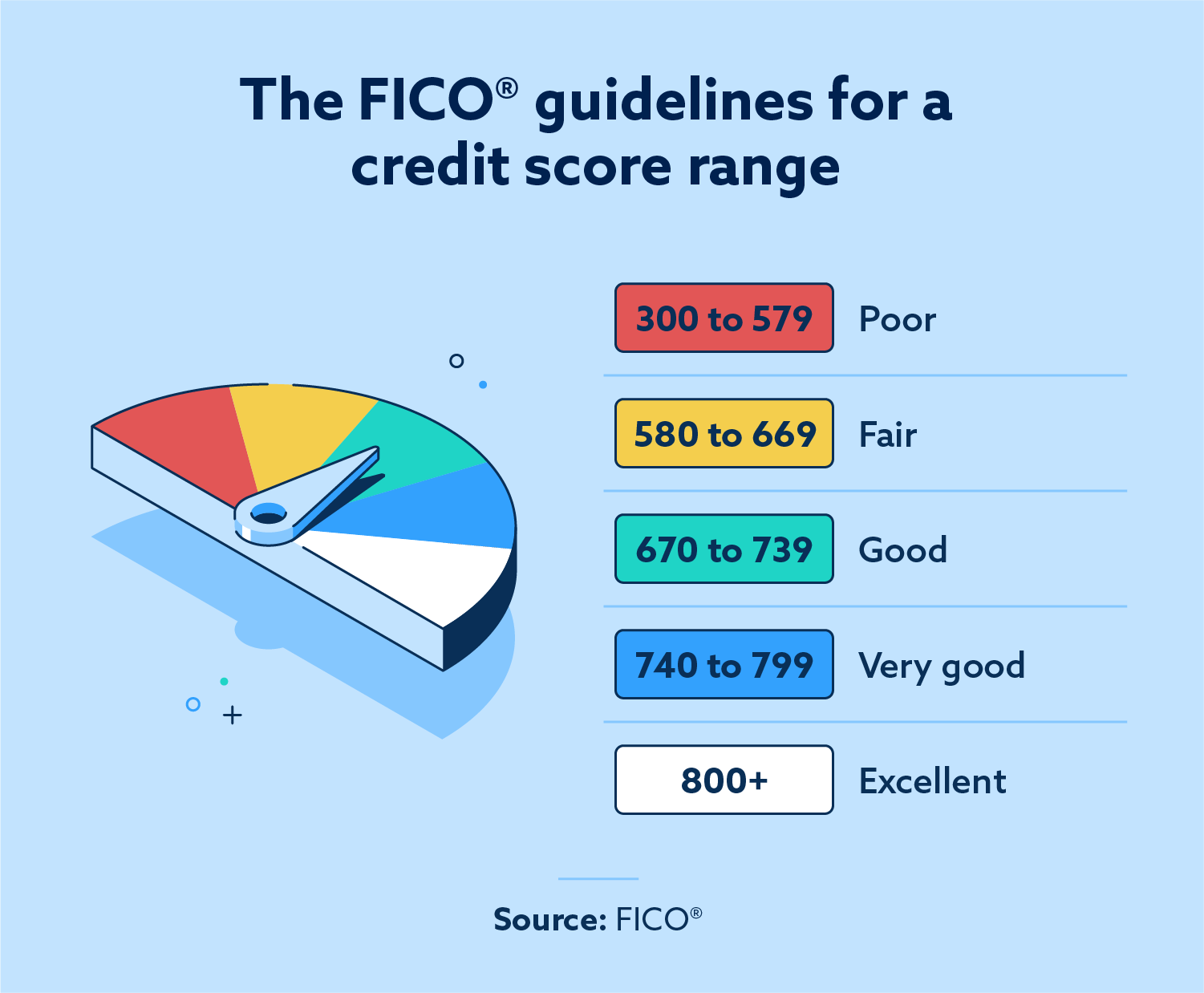

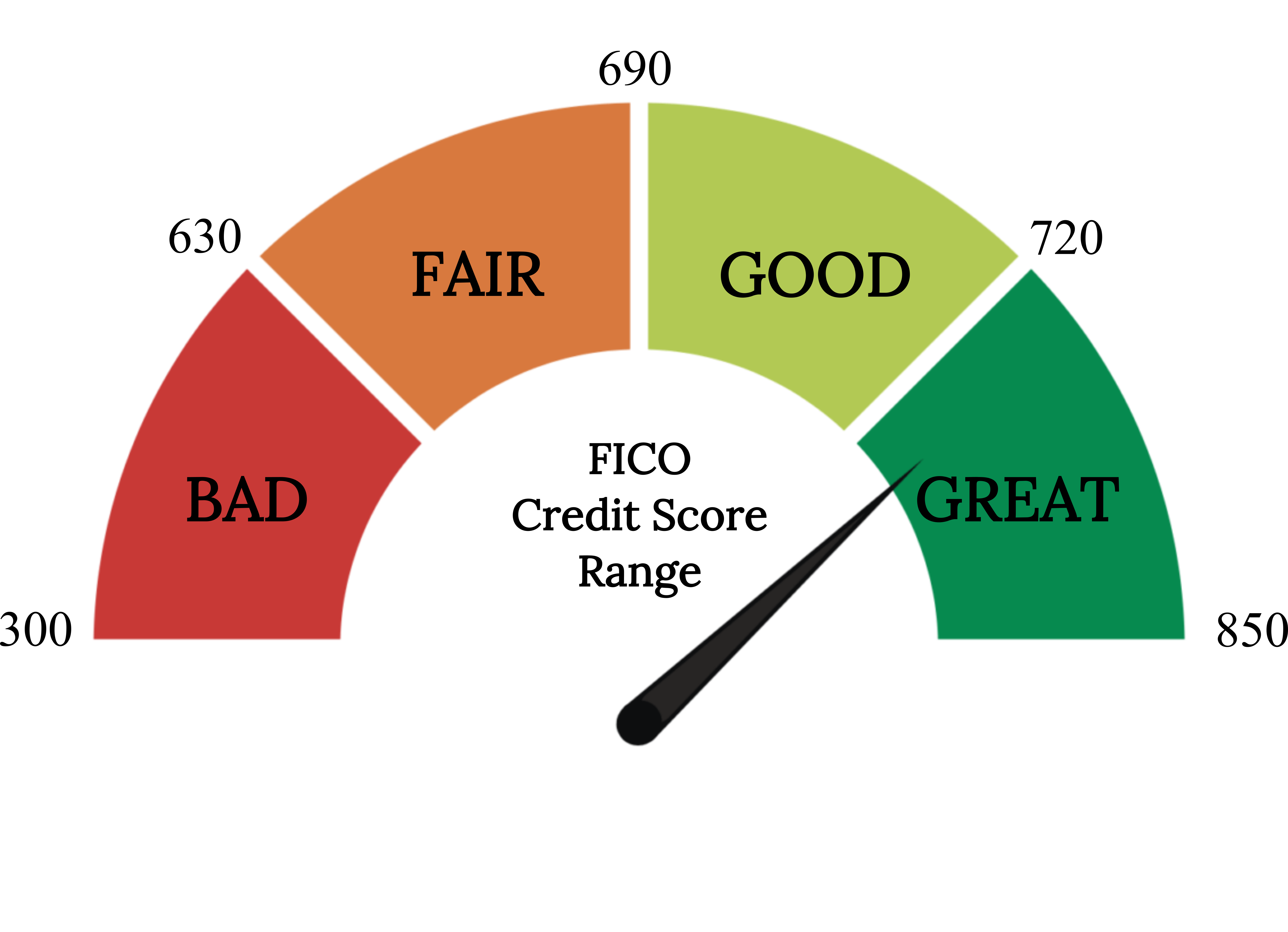

Understanding the Credit Score Spectrum

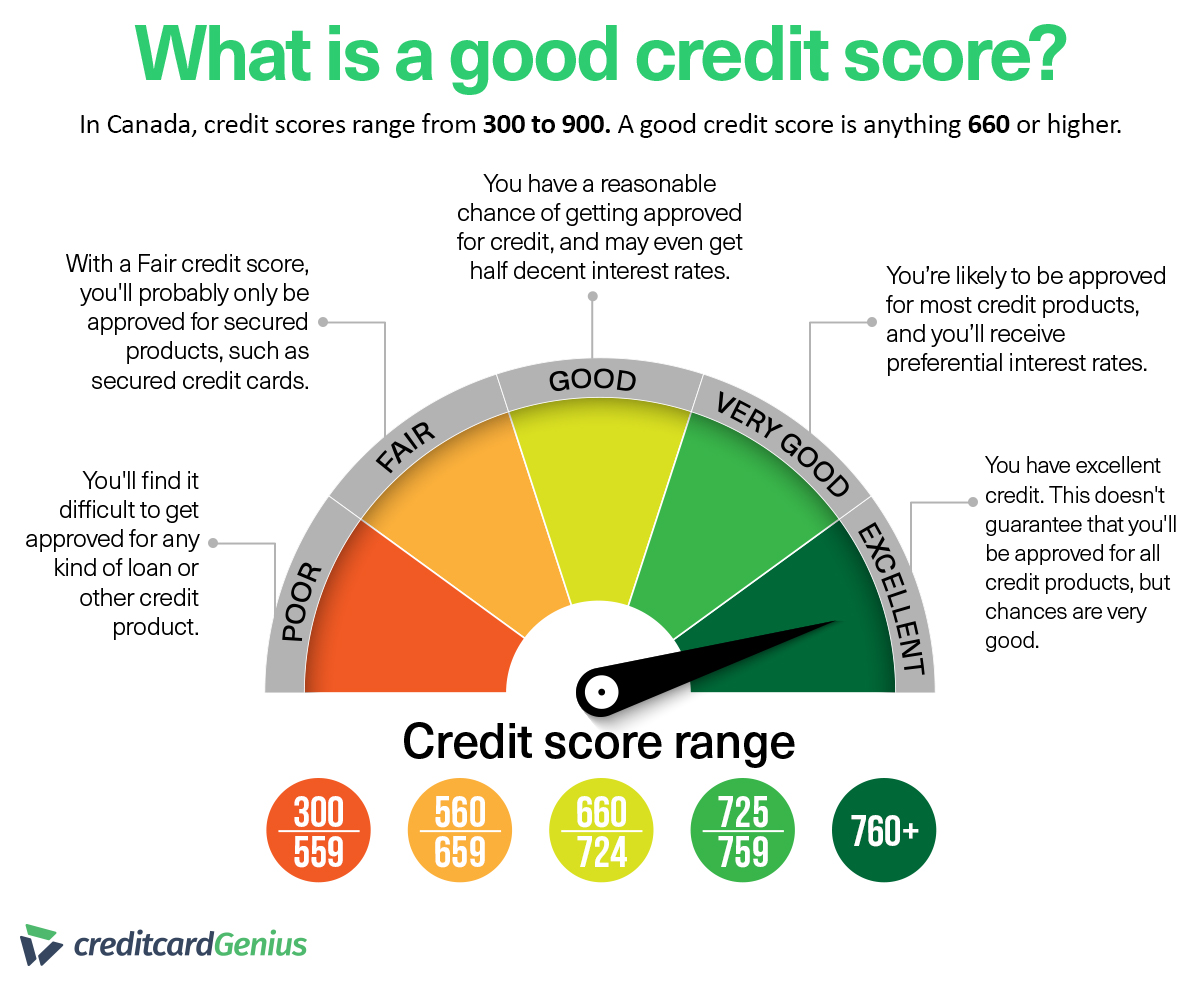

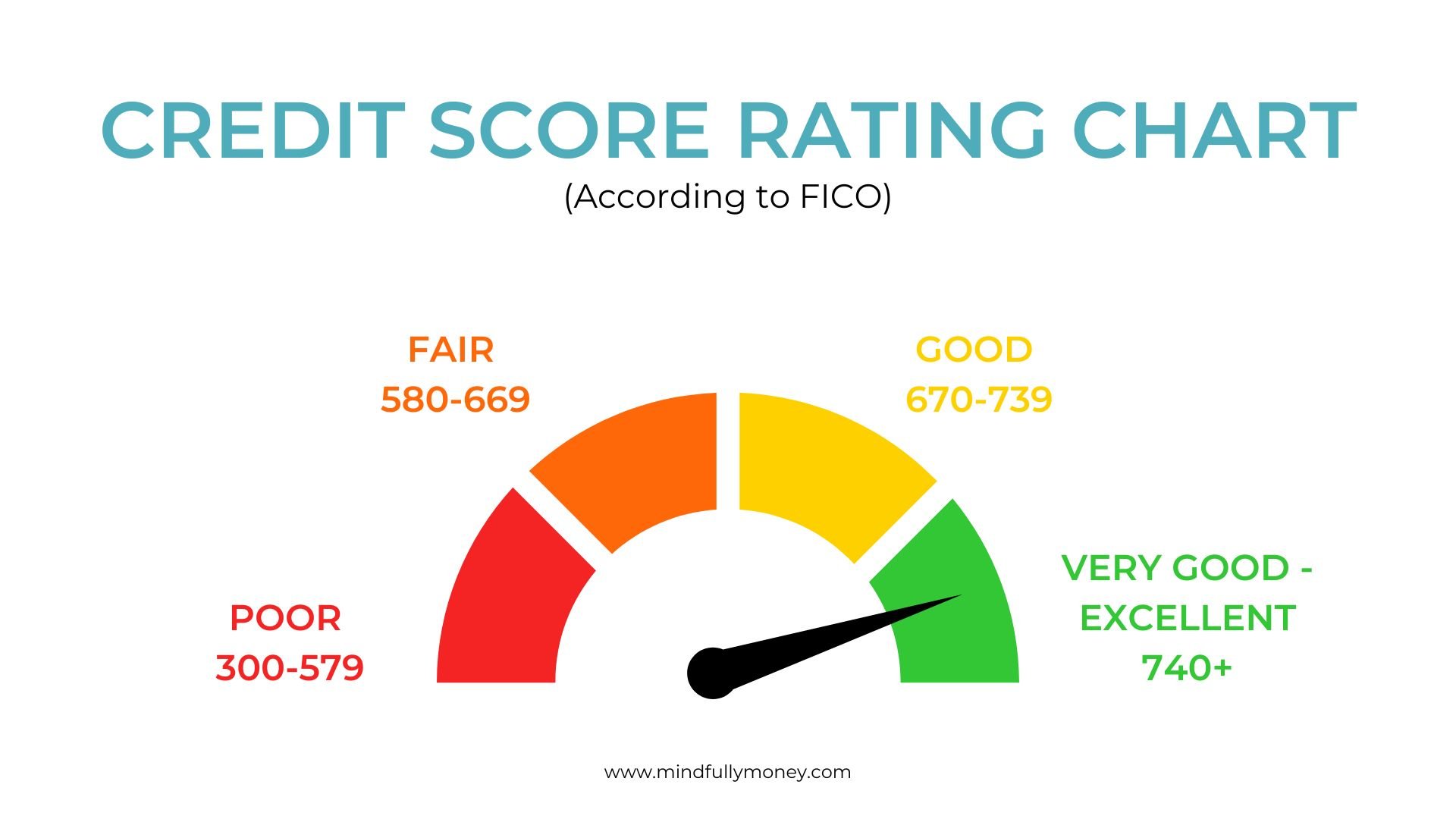

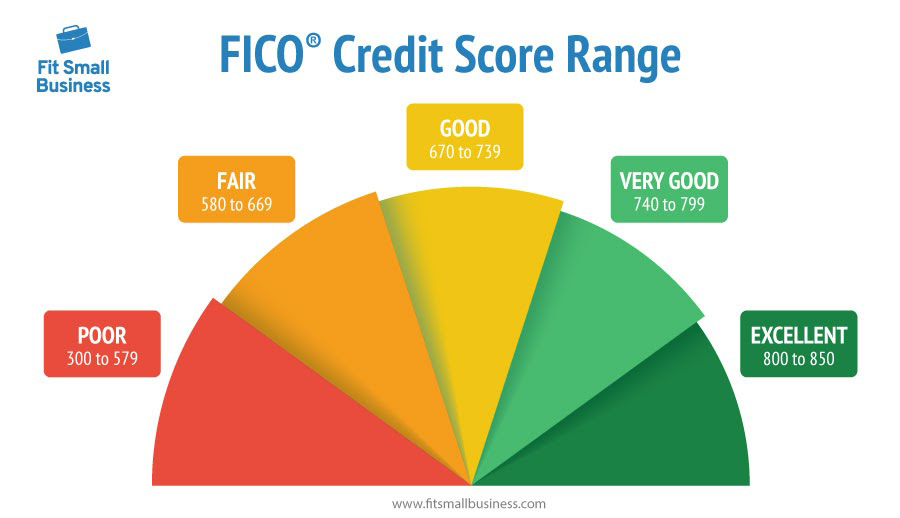

Credit scores, primarily those calculated using the FICO model, range from 300 to 850. The higher the score, the lower the perceived risk to lenders.

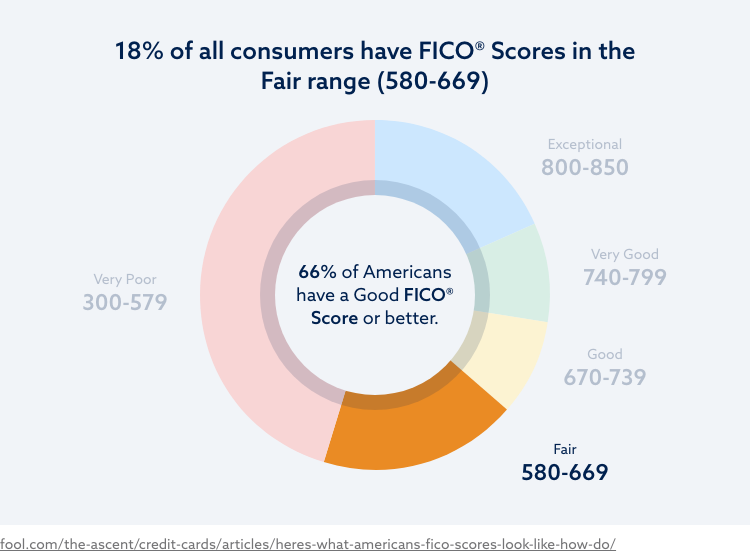

The ranges are typically categorized as follows: 300-579 (Poor), 580-669 (Fair), 670-739 (Good), 740-799 (Very Good), and 800-850 (Exceptional). A 643 credit score places you squarely in the "fair" category, also sometimes referred to as "average."

Experian, one of the three major credit bureaus, notes that individuals in this range may face challenges securing the best interest rates on loans and credit cards.

Impact on Borrowing Power

Having a 643 credit score doesn't necessarily mean you'll be denied credit. However, it significantly impacts the terms you'll receive.

For example, consider applying for a mortgage. Someone with an "exceptional" credit score might qualify for a significantly lower interest rate than someone with a "fair" score, potentially saving tens of thousands of dollars over the life of the loan.

According to data from MyFICO, the interest rates offered to those with fair credit are typically much higher than those offered to individuals with good or excellent credit.

Credit Cards

Access to premium credit cards with perks like travel rewards and cash-back bonuses is often limited with a 643 credit score.

You're more likely to be approved for secured credit cards or cards designed for individuals with average credit, which often come with higher interest rates and lower credit limits.

These cards can be a stepping stone to improving your credit, but responsible usage is crucial.

Loans (Auto, Personal)

Similar to mortgages, interest rates on auto loans and personal loans are directly tied to your credit score.

A 643 credit score will likely result in a higher interest rate, increasing the total cost of borrowing.

Furthermore, you might face stricter loan terms, such as shorter repayment periods, potentially increasing your monthly payments.

Why a 643 Score Matters Beyond Loans

The influence of your credit score extends beyond just borrowing money. Landlords often check credit scores as part of the rental application process.

A 643 score might not disqualify you outright, but it could put you at a disadvantage compared to applicants with better credit.

Some employers also conduct credit checks as part of their background screening process, particularly for positions involving financial responsibility. While less common, a fair credit score could raise concerns.

Strategies for Credit Improvement

The good news is that a 643 credit score is far from unrecoverable. With consistent effort and strategic planning, you can improve your creditworthiness over time.

The following steps are generally recommended by financial experts: Pay bills on time, Reduce credit card balances, and Monitor credit reports.

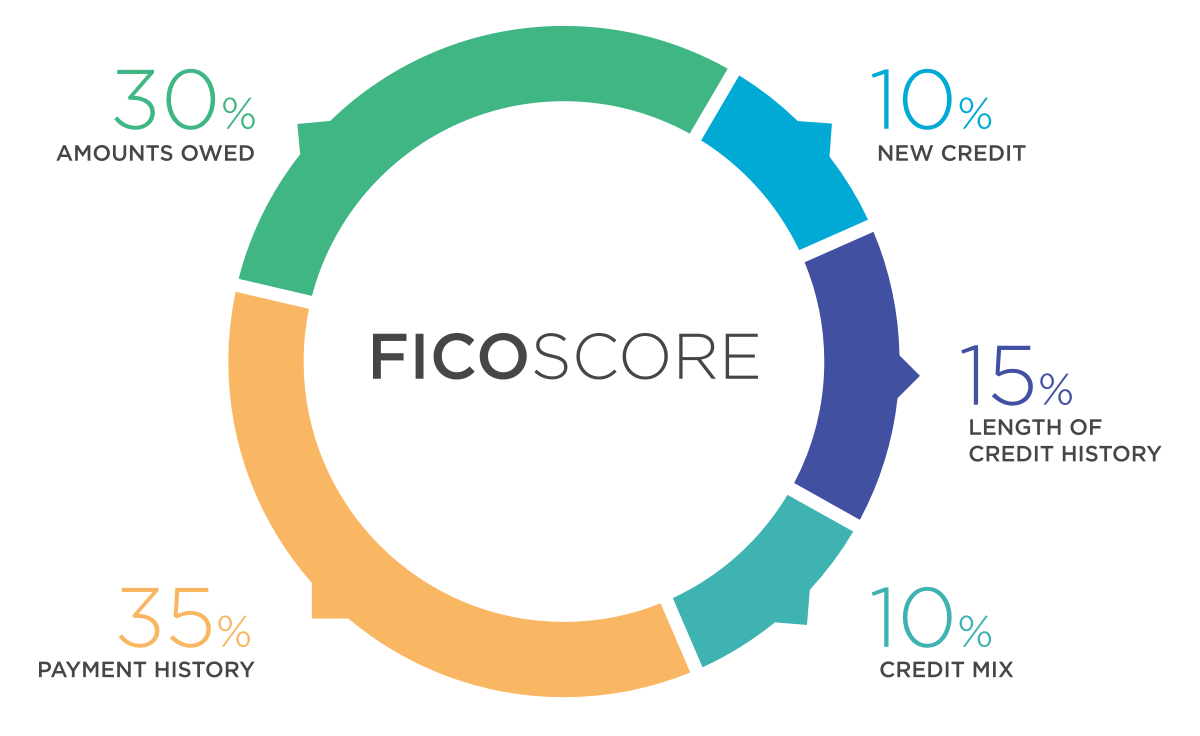

These strategies focus on the key factors that influence your credit score: payment history, credit utilization, and the length of your credit history.

Payment History

Payment history is the single most important factor in determining your credit score. Consistently paying bills on time demonstrates responsibility and reliability to lenders.

Set up automatic payments to avoid missed deadlines and consider using calendar reminders.

Even one late payment can negatively impact your credit score, so prioritize timely payments above all else.

Credit Utilization

Credit utilization refers to the amount of credit you're using compared to your total available credit. Experts recommend keeping your credit utilization below 30%.

For example, if you have a credit card with a $1,000 limit, aim to keep your balance below $300.

Paying down credit card balances can significantly improve your credit score, as it demonstrates responsible credit management.

Credit Report Monitoring

Regularly checking your credit report is essential to identify any errors or fraudulent activity that could be impacting your score.

You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year.

Review your reports carefully and dispute any inaccuracies immediately.

The Role of Credit Counseling

If you're struggling to manage debt and improve your credit score, consider seeking guidance from a reputable credit counseling agency.

These agencies can provide personalized advice, help you develop a budget, and negotiate with creditors on your behalf.

The National Foundation for Credit Counseling (NFCC) is a trusted resource for finding certified credit counselors.

Looking Ahead: Building a Stronger Financial Future

While a 643 credit score presents challenges, it’s not a permanent sentence. By understanding the factors that influence your credit score and implementing effective strategies, you can steadily improve your financial standing.

Focus on building positive credit habits, such as paying bills on time and keeping credit card balances low.

Over time, these efforts will translate into a higher credit score, unlocking better borrowing terms and greater financial opportunities, paving the way for a more secure and prosperous future.

.png)