A Firm's Cash Flow From Financing Activities Includes:

Imagine a small bakery, "Sweet Surrender," buzzing with activity. Flour dusts the air as the aroma of freshly baked bread wafts through the open door. But behind the scenes, beyond the tempting treats, lies a different kind of recipe – a financial one, tracking the movement of money in and out of the business, particularly related to how it's funded.

Understanding where a company’s money comes from and where it goes is crucial. One vital piece of this puzzle is the cash flow from financing activities, which reveals how a company raises and manages capital from investors and lenders.

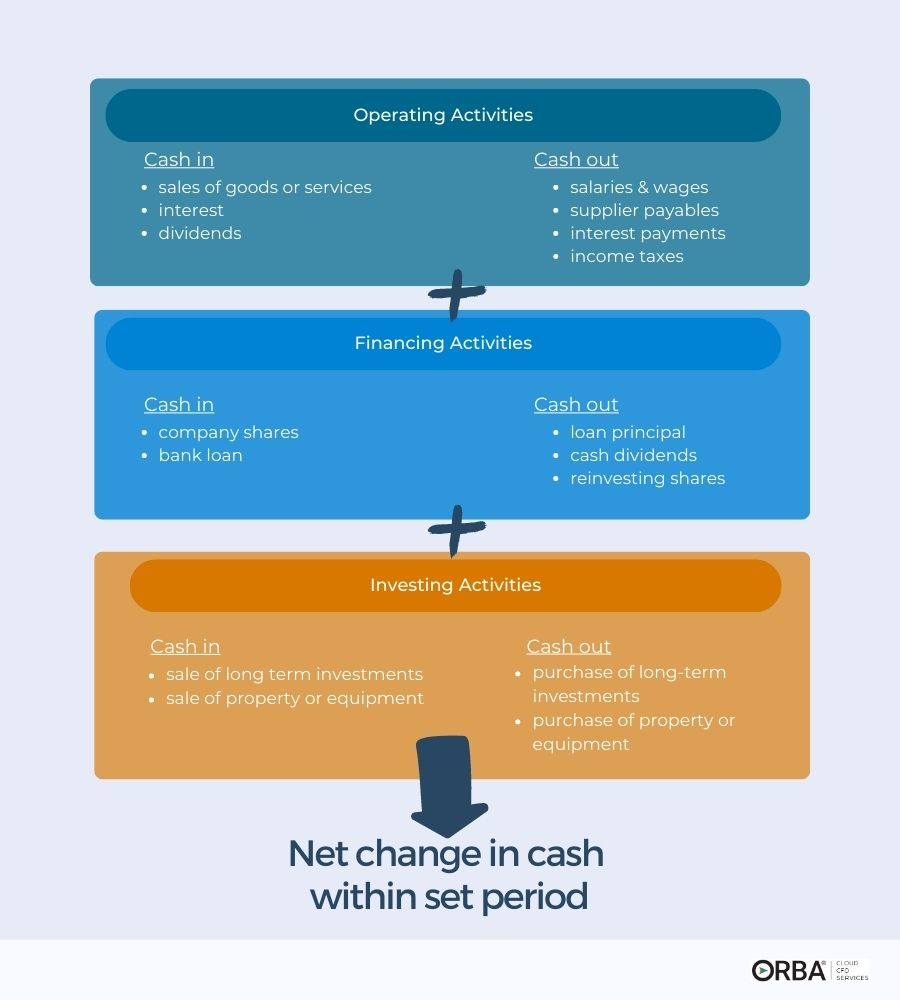

Understanding Cash Flow Statements

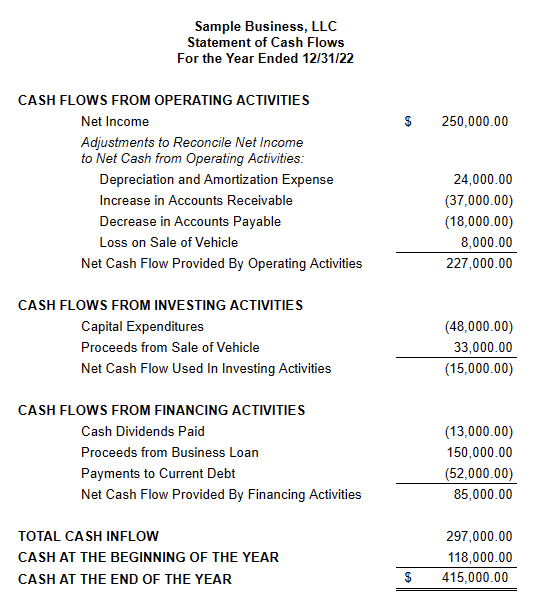

At the heart of understanding a company's financial health lies the cash flow statement. It's one of the three core financial statements, alongside the balance sheet and income statement.

This statement provides a detailed look at all the cash inflows (money coming in) and cash outflows (money going out) that a company experiences during a specific period. Unlike the income statement, which includes non-cash items like depreciation, the cash flow statement focuses solely on actual cash transactions.

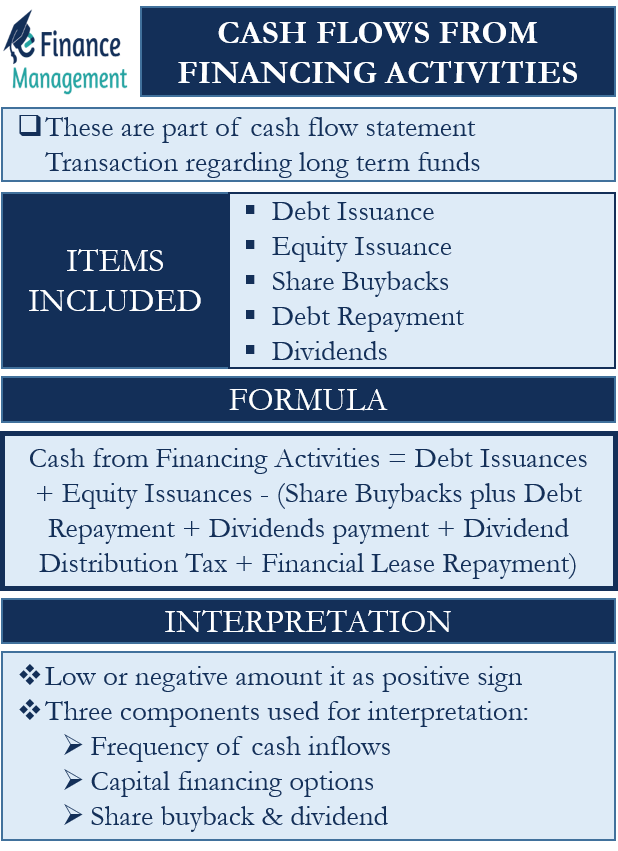

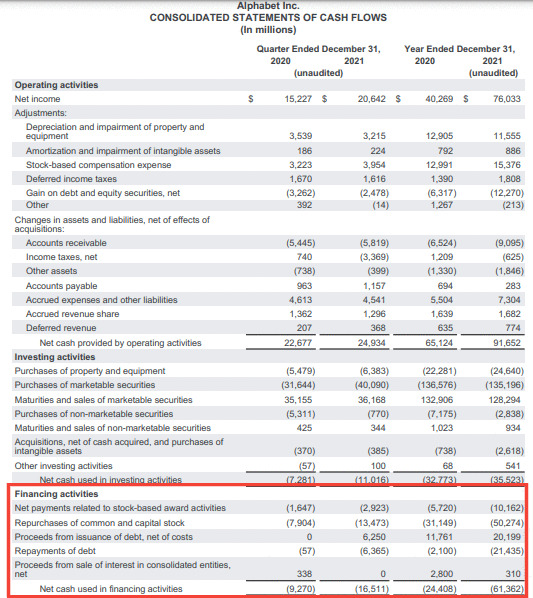

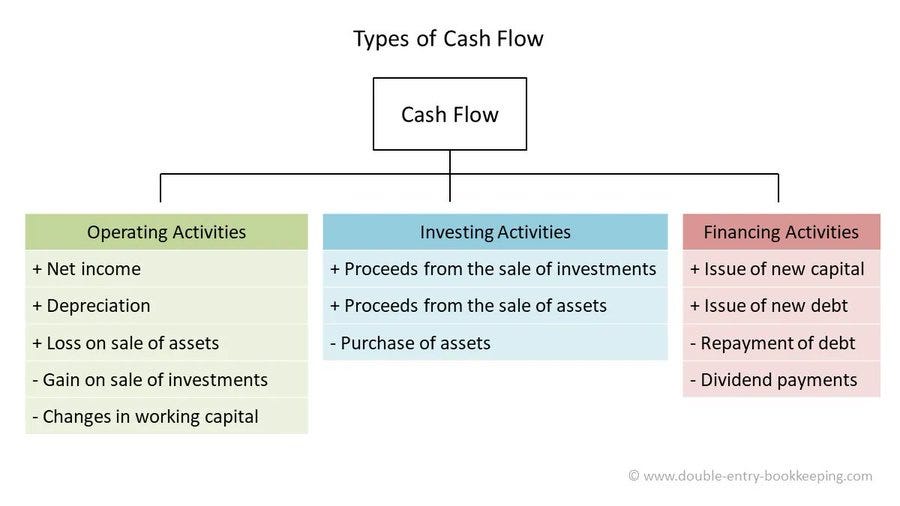

The cash flow statement is divided into three main sections: operating activities, investing activities, and the star of our show, financing activities.

Breaking Down the Sections

Operating activities reflect the cash generated from a company's core business operations. Think of it as the money earned from selling those delicious pastries in "Sweet Surrender’s" case.

Investing activities cover the cash flow related to the purchase and sale of long-term assets, like new ovens or delivery vans.

Now, let's dive into financing activities, the area that reveals how a company funds its operations and growth.

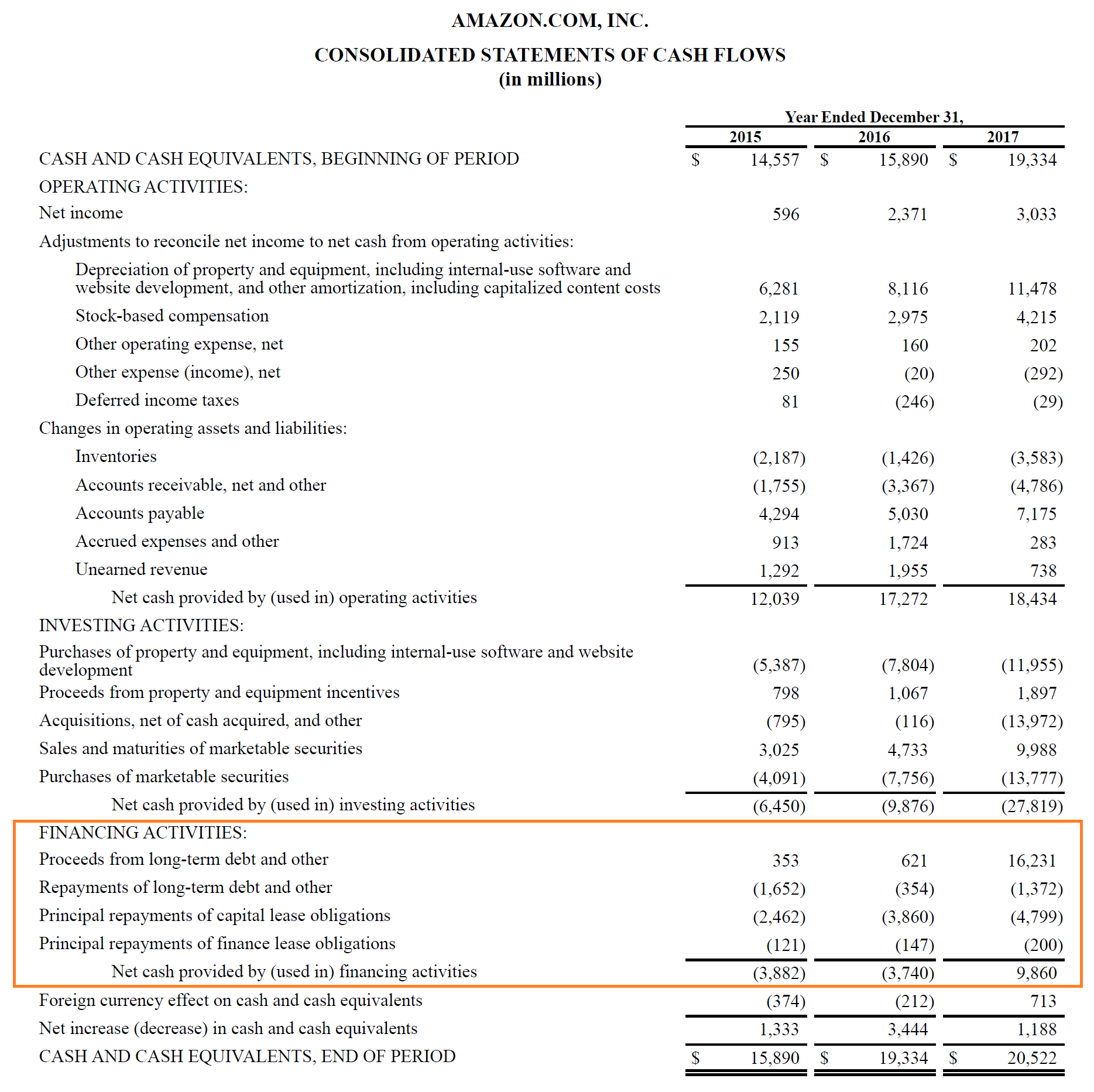

Cash Flow From Financing Activities: The Details

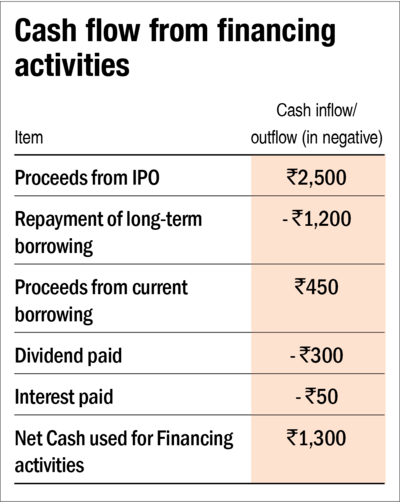

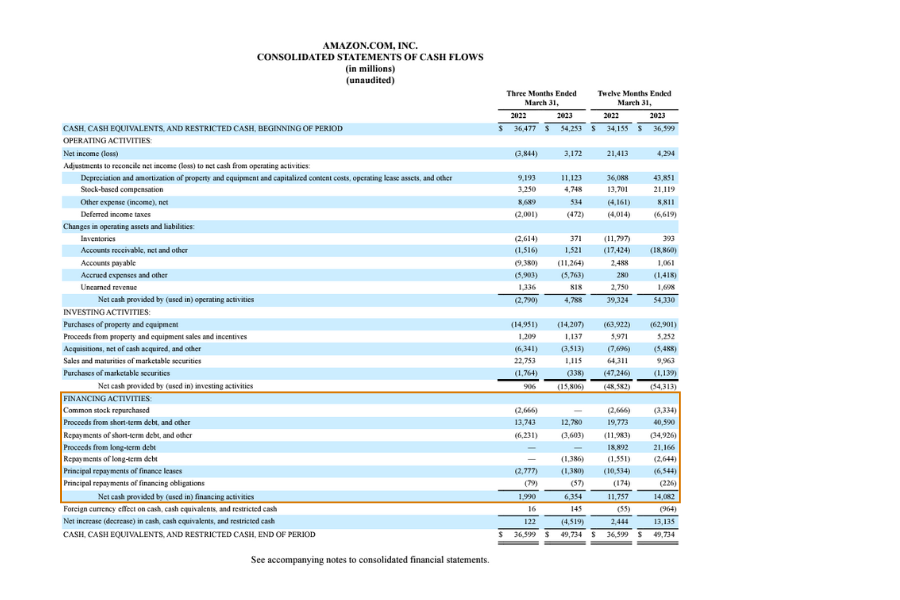

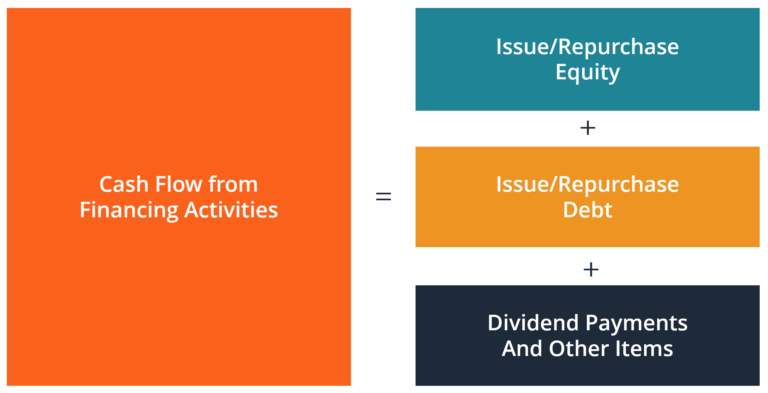

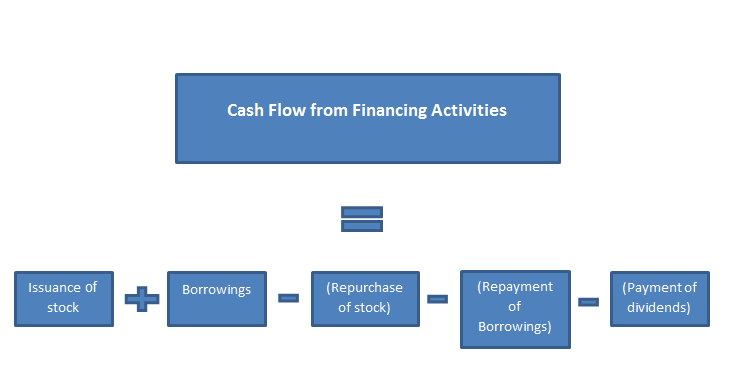

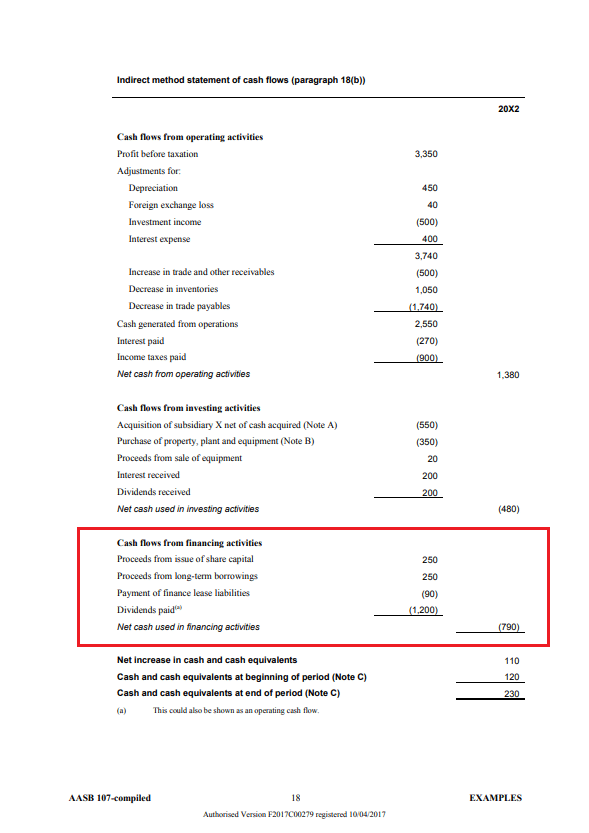

Cash flow from financing activities reflects all cash transactions related to a company's debt and equity. It shows how the company obtains capital and returns it to investors and creditors.

This section of the cash flow statement provides insights into a company's financial structure and its ability to meet its obligations and reward its investors.

Several key elements fall under this category.

Issuance of Stock

When a company issues new stock, whether it's common stock or preferred stock, it receives cash from investors. This inflow of cash is a positive cash flow from financing activities.

For example, if "Sweet Surrender" decides to expand and sell shares to the public, the cash received from the stock sale would be recorded here.

The amount received is usually net of any issuance costs, like underwriting fees.

Repurchase of Stock (Treasury Stock)

Conversely, when a company buys back its own shares, it spends cash. This is known as a stock repurchase or treasury stock purchase, resulting in a negative cash flow from financing activities.

This action reduces the number of outstanding shares and can increase earnings per share.

It is a common method used to return value to shareholders.

Issuance of Debt

Companies often borrow money to finance their operations or expansion plans. When a company issues bonds, loans, or other forms of debt, it receives cash, which is a positive cash flow from financing activities.

If "Sweet Surrender" takes out a loan to renovate its kitchen, the loan proceeds would be recorded in this section.

This is a critical way businesses fund growth and manage their cash flow.

Repayment of Debt

As a company repays its debt obligations, it spends cash. These debt repayments are a negative cash flow from financing activities. It shows a company fulfilling its financial commitments.

Consistent debt repayment demonstrates financial discipline and reduces financial risk.

These payments are essential for maintaining a good credit rating.

Payment of Dividends

Dividends are payments made to shareholders as a reward for their investment. When a company pays dividends, it spends cash, leading to a negative cash flow from financing activities.

Dividend payments are often seen as a sign of financial health and stability, demonstrating that the company is profitable and generating sufficient cash flow to reward its investors.

For shareholders, dividends are a valuable source of income.

Other Financing Activities

Other less common financing activities can include the issuance and repayment of short-term debt, such as commercial paper, and payments related to capital leases.

These activities can significantly impact a company's cash flow from financing activities.

Understanding these nuances is essential for a complete financial analysis.

Significance of Analyzing Financing Activities

Analyzing the cash flow from financing activities provides valuable insights into a company's financial health and its ability to manage its capital structure effectively. It helps investors and creditors understand how a company is funding its operations, whether it's relying heavily on debt or equity, and how it's returning value to shareholders.

For example, a company with consistently high cash inflows from financing activities might be rapidly expanding, but it could also indicate that the company is relying too much on debt, potentially increasing its financial risk.

Conversely, a company with significant cash outflows from financing activities might be reducing its debt burden or returning value to shareholders through dividends and stock repurchases, which can be viewed positively.

Real-World Example

Consider Apple Inc. (AAPL). Apple's cash flow statement consistently shows significant cash outflows from financing activities, primarily due to stock repurchases and dividend payments.

According to their 2023 annual report, Apple spent billions on repurchasing its own stock and paying dividends to shareholders. This indicates that Apple is generating substantial cash flow and is committed to returning value to its investors.

This also reflects Apple's confidence in its future prospects.

"Our commitment to innovation, combined with our disciplined capital allocation strategy, allows us to deliver long-term value to our shareholders," - A quote from Apple's CFO about their capital allocation strategy.

Conclusion

The cash flow from financing activities offers a crucial window into a company's financial strategies. It's not just about numbers; it's about the story those numbers tell – a story of growth, debt management, and shareholder value. It is a vital component for investors, creditors, and management teams alike.

Whether it's a small bakery like "Sweet Surrender" or a global giant like Apple, understanding how a company manages its cash flow from financing activities is paramount to assessing its financial health and future prospects.

By paying close attention to this section of the cash flow statement, stakeholders can make more informed decisions and gain a deeper appreciation for the intricate financial dance that keeps businesses thriving.

:max_bytes(150000):strip_icc()/Term-Definitions_CFF-Final-V2-59b1197815114baf8e44d14286edbf6e.jpg)