A Lender Will Realize Unexpected Benefit When The

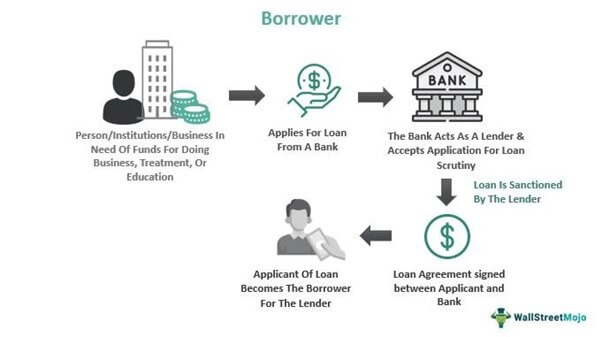

A major lending institution, First National Trust (FNT), is poised to reap a substantial, unforeseen financial windfall due to a previously overlooked clause in a decades-old loan agreement. This unexpected boon stems from the explosive growth of a small tech startup, BioSyn Technologies, a former recipient of FNT's early-stage venture lending.

This situation highlights the complexities and occasionally serendipitous nature of long-term financial investments. The forgotten clause, tied to BioSyn's future revenue streams, is about to trigger a multi-million dollar payout to FNT, significantly bolstering its Q3 earnings.

The Forgotten Clause: A Lucrative Legacy

The clause, buried within the original 1998 loan agreement, stipulated that FNT would receive a percentage of BioSyn's annual revenue exceeding $50 million. At the time, this seemed a highly improbable scenario, as BioSyn was a fledgling biotech firm with limited prospects.

Now, thanks to a groundbreaking drug discovery, BioSyn's revenue has skyrocketed, exceeding $500 million in the last fiscal year. The forgotten clause is about to transform into a significant asset for FNT.

Who Benefits?

First National Trust (FNT) stands to gain the most, receiving an estimated $25 million payout. This injection of capital will positively impact the bank's bottom line and shareholder value.

However, the immediate impact will be felt most profoundly in FNT's investment portfolio. The unexpected revenue stream arrives just in time, bolstering the bank's reserves amidst growing economic uncertainty.

What Triggered This?

BioSyn Technologies' phenomenal growth is the direct catalyst. Their recent breakthrough in gene therapy has revolutionized treatment for a rare genetic disorder.

This success has translated into substantial sales and profit margins, pushing their revenue far beyond the threshold specified in the agreement. This success has made BioSyn a major player in the gene therapy landscape.

Where Did This Originate?

The original loan agreement was signed at FNT's headquarters in Chicago. BioSyn Technologies, then a local startup, sought funding to develop its initial research projects.

The agreement reflects the lending practices of the late 1990s and the nascent venture capital scene. Back then, such "revenue sharing" clauses were relatively common, but often yielded negligible returns.

When Will FNT Receive the Payout?

The payout is expected to be finalized within the next 30 days. FNT's legal team has confirmed the validity of the clause and is working with BioSyn's financial advisors to process the transfer.

According to a recent filing, FNT anticipates reporting the unexpected revenue in its upcoming Q3 earnings report. Investors are eagerly awaiting the full financial implications of this revelation.

How Will This Impact FNT?

The $25 million windfall provides FNT with increased financial flexibility. The bank can use the funds to bolster its capital reserves, invest in new initiatives, or distribute dividends to shareholders.

The sudden influx of capital will undoubtedly improve FNT's financial health and stability. It will allow for better risk management and position the bank for future growth opportunities.

The Legal Ramifications

The confirmation of the clause's validity has been verified by both FNT's and BioSyn's legal teams. No challenges or disputes are anticipated.

The situation serves as a reminder of the importance of meticulous record-keeping and diligent contract review. It underscores how even seemingly insignificant clauses can have major financial implications years later.

Next Steps

FNT's management is currently evaluating the best use of the unexpected funds. Several strategic options are under consideration.

Furthermore, FNT is reviewing its existing loan portfolio for similar clauses that could potentially yield additional revenue streams. This discovery has prompted a thorough examination of legacy agreements.

Ongoing Developments

Analysts are closely monitoring FNT's stock performance in light of this news. The stock has already seen a slight increase in value.

The incident is also sparking discussions within the financial industry about risk management and the value of long-term investment strategies. It might redefine the landscape of modern venture capital.