Accounting Systems For Small Business

The lifeblood of any small business is cash flow, yet many struggle to maintain a clear, accurate picture of their financial health. This struggle often stems from inadequate or outdated accounting systems, leading to missed opportunities, compliance issues, and ultimately, potential business failure. Choosing the right accounting system is not just about tracking transactions; it's about empowering informed decision-making and fostering sustainable growth.

At the heart of this issue is the need for small businesses to move beyond basic spreadsheets and adopt systems that can scale with their growth. The right accounting system provides real-time insights into profitability, expenses, and overall financial performance. This equips business owners to make data-driven decisions, secure funding, and navigate the complexities of the modern business landscape.

Understanding the Landscape of Accounting Systems

The market offers a wide array of accounting systems, ranging from cloud-based software to traditional desktop solutions. Each option caters to different needs, budgets, and technical expertise levels.

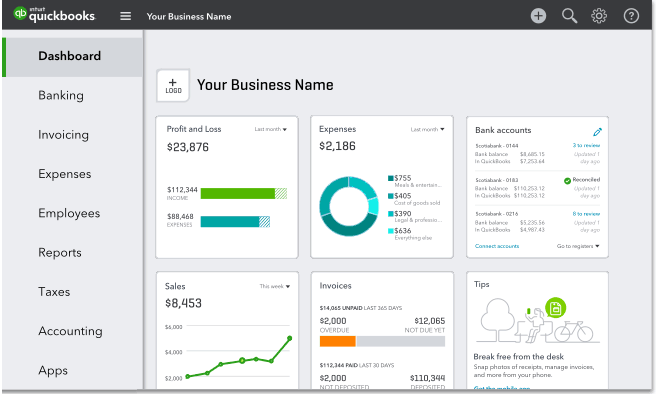

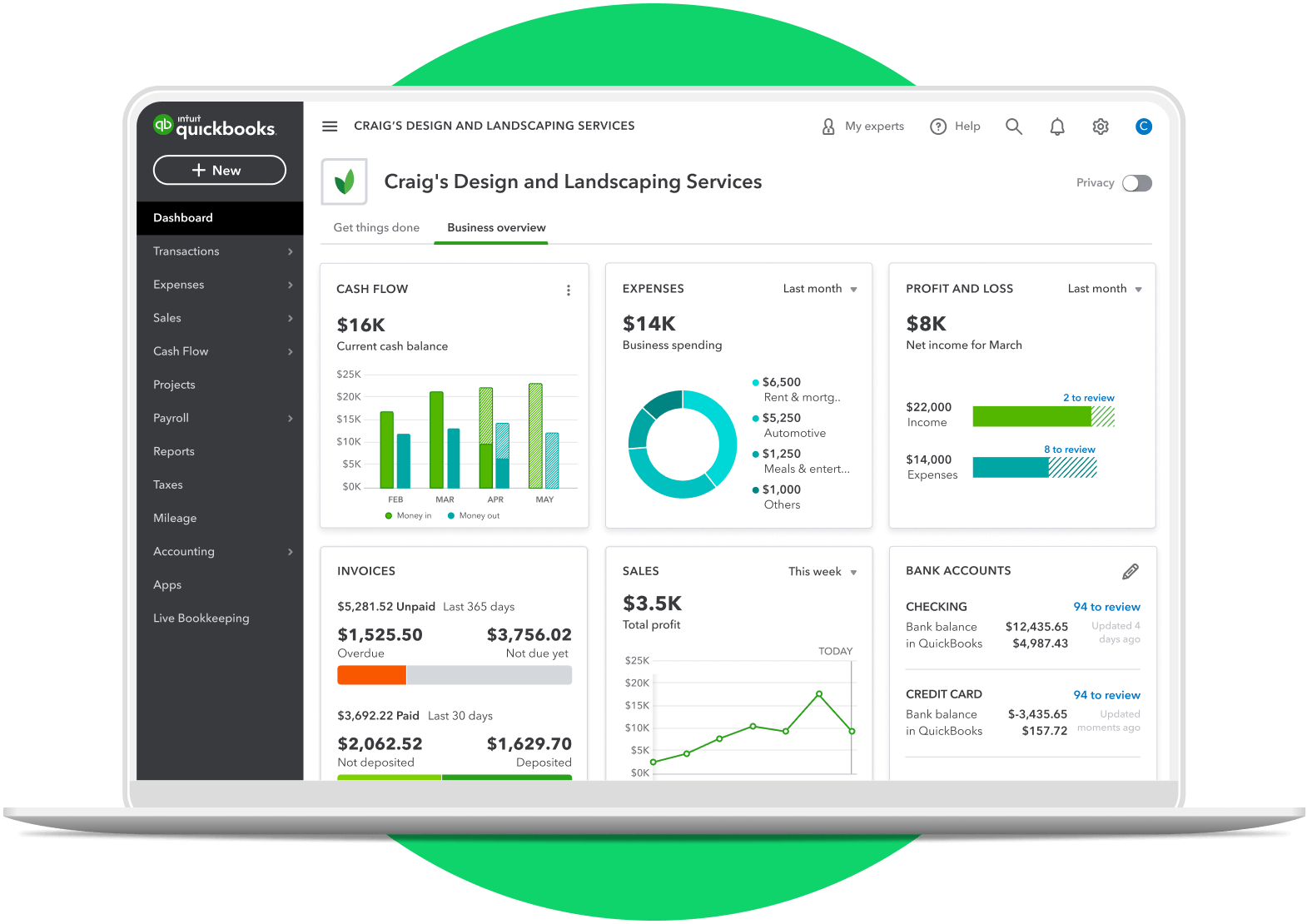

Cloud-Based Accounting Software

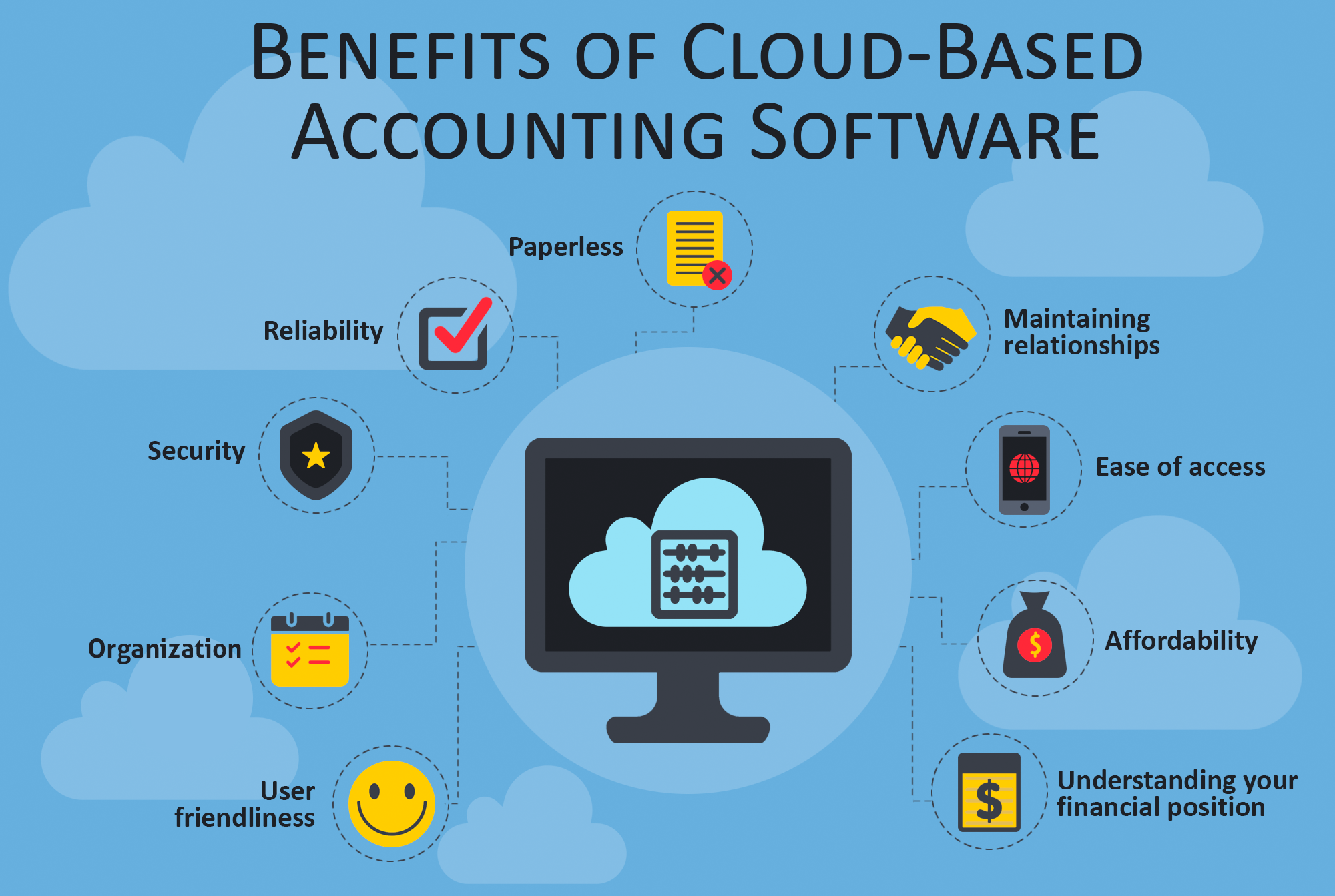

Cloud-based accounting software, like QuickBooks Online, Xero, and Zoho Books, has become increasingly popular. These platforms offer accessibility from anywhere with an internet connection, automatic data backups, and real-time collaboration capabilities. This can be particularly beneficial for businesses with remote teams or those who frequently travel.

Furthermore, cloud solutions often integrate seamlessly with other business applications, such as CRM (Customer Relationship Management) and e-commerce platforms. This integration streamlines workflows and eliminates the need for manual data entry, reducing errors and saving time.

Desktop Accounting Software

Traditional desktop accounting software, such as QuickBooks Desktop, is installed directly on a computer. This option offers more control over data security and may be preferred by businesses with strict compliance requirements.

However, desktop solutions often require manual updates and backups, and can be more expensive to maintain over the long term. They also lack the real-time accessibility and collaborative features of cloud-based platforms.

Key Considerations for Choosing a System

Selecting the right accounting system requires careful consideration of several factors. These factors include business size, industry, budget, and technical expertise.

Scalability is crucial: the system should be able to handle increasing transaction volumes and evolving business needs. Ease of use is also essential, as a complex system can lead to frustration and errors. It's crucial to ensure that the selected software provides the features needed to create sales invoices, record payments, monitor costs, and create and review comprehensive financial statements.

Integration capabilities are another important consideration. A system that integrates with other business applications can streamline workflows and improve data accuracy.

The Role of Accountants and Bookkeepers

While accounting software can automate many tasks, the expertise of a qualified accountant or bookkeeper remains invaluable. They can help businesses set up their accounting system, interpret financial data, and ensure compliance with tax regulations.

According to the U.S. Small Business Administration (SBA), seeking professional accounting advice is a critical step in managing finances effectively. A skilled professional can also advise on complex accounting issues and help businesses navigate tax planning strategies.

Furthermore, accountants can provide valuable insights into business performance and help identify areas for improvement. This can lead to increased profitability and sustainable growth.

Challenges and Opportunities

Implementing a new accounting system can present several challenges. These challenges include data migration, employee training, and potential disruptions to existing workflows.

However, the long-term benefits of a well-implemented system far outweigh the initial challenges. Businesses can experience improved efficiency, reduced costs, and better financial control.

"Investing in the right accounting system is an investment in the future of your business," says Sarah Johnson, a certified public accountant specializing in small business finance. "It provides the foundation for informed decision-making and sustainable growth."

Looking Ahead: The Future of Accounting Systems

The future of accounting systems is likely to be driven by advancements in artificial intelligence (AI) and machine learning (ML). These technologies can automate tasks such as bank reconciliation, invoice processing, and fraud detection.

AI-powered accounting systems can also provide predictive analytics, helping businesses anticipate future financial trends and make proactive decisions. This can give them a significant competitive advantage.

As technology continues to evolve, small businesses will need to adapt and embrace new accounting solutions to stay competitive. The key is to choose a system that aligns with their specific needs and goals and to seek professional guidance when needed. By doing so, they can unlock the full potential of their financial data and pave the way for long-term success.