An Investor Should Expect To Receive A Risk Premium For:

In the complex world of finance, the concept of a risk premium is fundamental. It underpins every investment decision, acting as the silent motivator that drives investors to allocate their capital despite the inherent uncertainties. But what precisely warrants this premium, and how should investors navigate the intricate landscape to ensure they are adequately compensated for the risks they undertake?

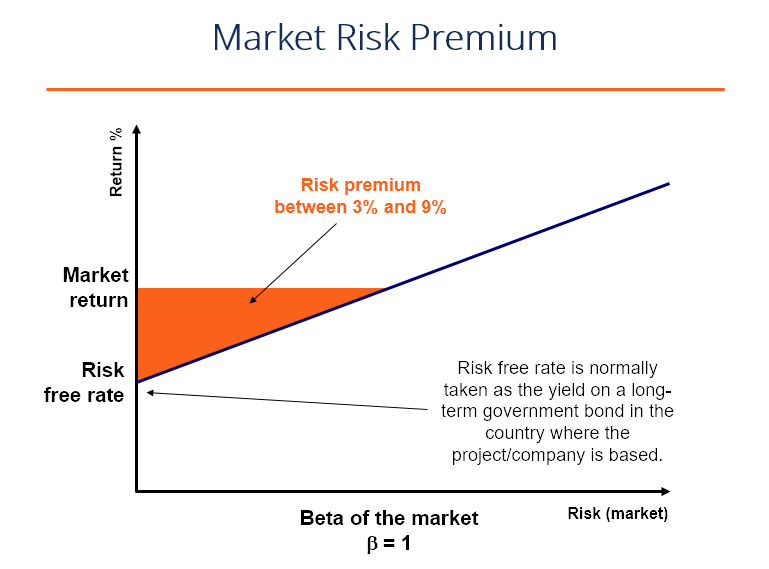

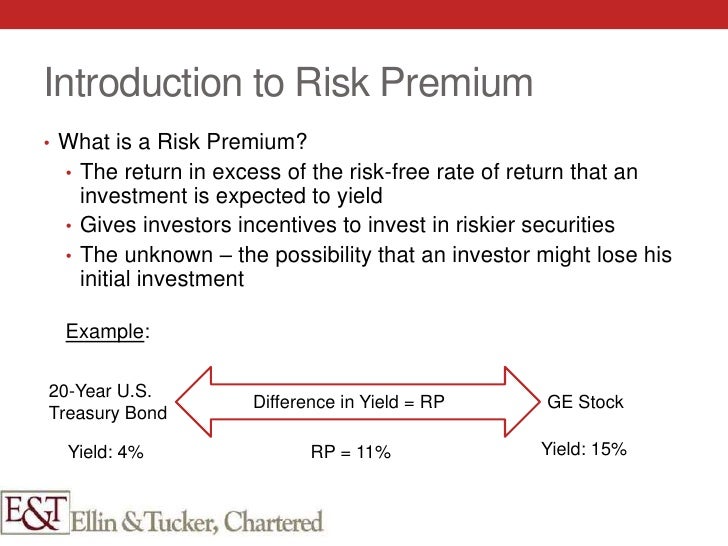

At its core, the risk premium represents the additional return an investor expects to receive for assuming a higher level of risk compared to a risk-free investment, such as government bonds. Understanding the specific factors that contribute to this premium is crucial for making informed investment choices and achieving long-term financial goals. This article delves into the key sources of risk premium, drawing on expert insights and empirical data to provide a comprehensive overview for investors of all levels.

Understanding the Equity Risk Premium

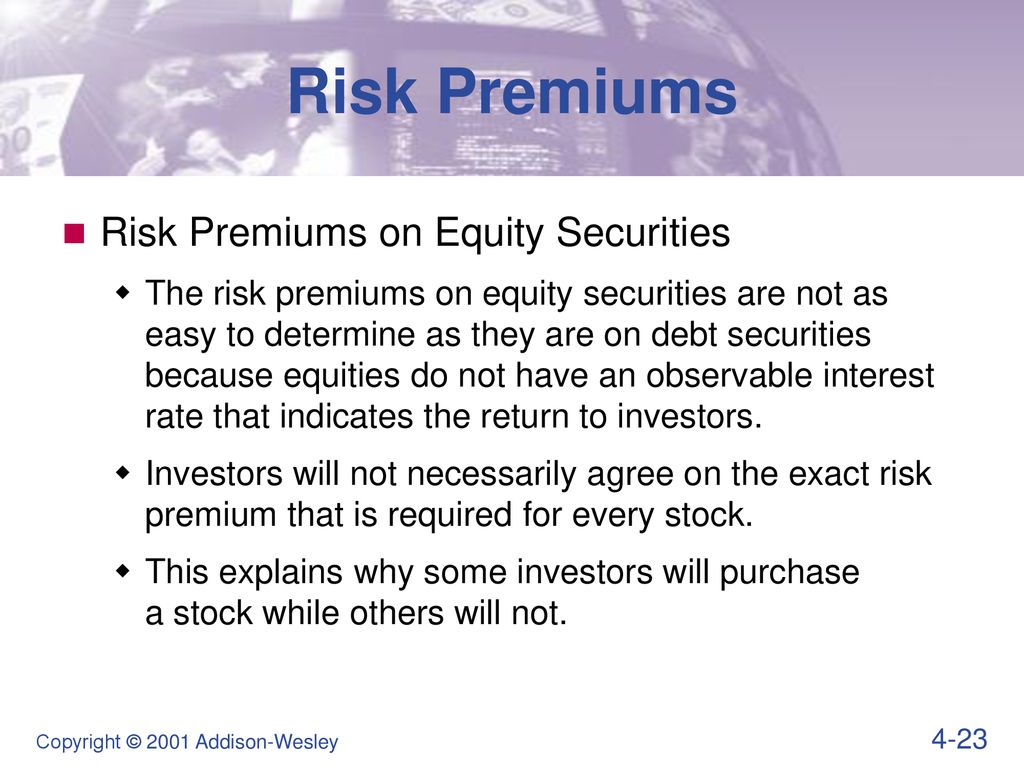

One of the most widely recognized and studied risk premiums is the Equity Risk Premium (ERP). It signifies the extra return investors demand for holding stocks over risk-free assets.

The ERP is often justified by the inherent volatility and potential for losses associated with equity investments.

As Dr. Anya Sharma, a leading financial economist at the University of Chicago's Booth School of Business, explains, "Equities are inherently riskier than government bonds because their returns are tied to the performance of companies, which can be affected by a myriad of factors including economic downturns, competition, and management decisions."

Historical data consistently demonstrates the existence of a positive ERP over long periods. Studies analyzing market returns over several decades show that stocks, on average, outperform bonds, validating the need for a risk premium.

However, the magnitude of the ERP can fluctuate significantly depending on market conditions and economic outlook.

Factors Influencing the Equity Risk Premium

Several factors influence the ERP, including macroeconomic conditions, investor sentiment, and company-specific risks. Periods of economic uncertainty, such as recessions or financial crises, tend to widen the ERP as investors become more risk-averse.

Conversely, during periods of economic expansion and positive market sentiment, the ERP may narrow as investors become more willing to take on risk.

Company-specific risks, such as poor management, declining sales, or regulatory challenges, can also increase the risk premium associated with individual stocks.

"Investors must carefully assess the risk factors associated with each investment and demand an adequate return to compensate for the potential downside," says Mark Thompson, a portfolio manager at Fidelity Investments.

Credit Risk Premium: Assessing Default Probability

Beyond equities, another significant source of risk premium arises in the bond market, known as the Credit Risk Premium.

This premium reflects the additional return investors require for lending money to borrowers with a higher risk of default.

The creditworthiness of a borrower is typically assessed by credit rating agencies, such as Moody's, Standard & Poor's, and Fitch, which assign ratings based on the borrower's ability to repay its debt obligations.

Bonds with lower credit ratings, often referred to as high-yield or junk bonds, carry a higher credit risk premium to compensate investors for the increased probability of default.

The spread between the yield on a corporate bond and the yield on a comparable government bond of the same maturity represents the credit risk premium.

Professor David Lee, a fixed-income expert at Stanford University, emphasizes, "Investors must diligently evaluate the creditworthiness of borrowers and demand a premium commensurate with the assessed risk. Ignoring credit risk can lead to significant losses in a portfolio."

Liquidity Risk Premium: The Cost of Illiquidity

Liquidity Risk, which arises when an investment cannot be easily bought or sold without a significant loss in value, also warrants a risk premium.

Illiquid assets, such as real estate, private equity, and certain types of alternative investments, typically offer higher returns than more liquid assets to compensate investors for the challenges associated with selling them quickly.

The Liquidity Risk Premium reflects the potential costs and delays involved in converting an illiquid asset into cash.

This premium is particularly relevant for investors who may need to access their funds quickly in an emergency or unexpected situation.

Assets traded on exchanges generally feature greater liquidity than over-the-counter market.

As Sarah Chen, a financial advisor at Goldman Sachs, notes, "Investors should carefully consider their liquidity needs and demand an appropriate premium for investing in illiquid assets. Diversification across asset classes with varying degrees of liquidity can help mitigate this risk."

Inflation Risk Premium: Protecting Purchasing Power

Inflation Risk, the uncertainty surrounding future inflation rates, is another critical factor that influences the risk premium demanded by investors.

Inflation erodes the purchasing power of future returns, so investors require a premium to compensate for the potential loss of real value.

The Inflation Risk Premium is the additional return investors demand to protect their investments against the erosion of purchasing power due to inflation.

Inflation-indexed securities, such as Treasury Inflation-Protected Securities (TIPS), are designed to mitigate inflation risk by adjusting their principal value based on changes in the Consumer Price Index (CPI).

John Miller, an investment strategist at Vanguard, advises, "Investors should consider the impact of inflation on their investment returns and incorporate an appropriate inflation risk premium into their investment decisions. Diversifying across asset classes and considering inflation-protected securities can help mitigate this risk."

Looking Ahead: Navigating the Risk Premium Landscape

The risk premium is a dynamic concept that constantly evolves in response to changing market conditions and economic outlook. Understanding the various sources of risk premium and how they interact is essential for making informed investment decisions and achieving long-term financial goals.

As investors navigate the ever-changing financial landscape, it is crucial to stay informed about market trends, economic developments, and the evolving risk profile of different asset classes. Seeking professional advice from qualified financial advisors can also provide valuable insights and guidance in managing risk and optimizing investment returns.

Ultimately, the key to successful investing lies in carefully assessing risk, demanding an adequate premium, and maintaining a well-diversified portfolio that aligns with one's individual financial goals and risk tolerance.

:max_bytes(150000):strip_icc()/equityriskpremium.asp_FINAL-23aad9c0590a4d6688bbb700569ba4a3.png)