Archer-daniels-midland Contracts Obtained Lost April 2025

The agricultural giant Archer-Daniels-Midland (ADM) is facing a period of significant upheaval. Multiple key contracts, secured over decades, have reportedly been lost or will not be renewed as of April 2025. This development casts a shadow over the company's future earnings projections and strategic direction, prompting intense scrutiny from investors and analysts alike.

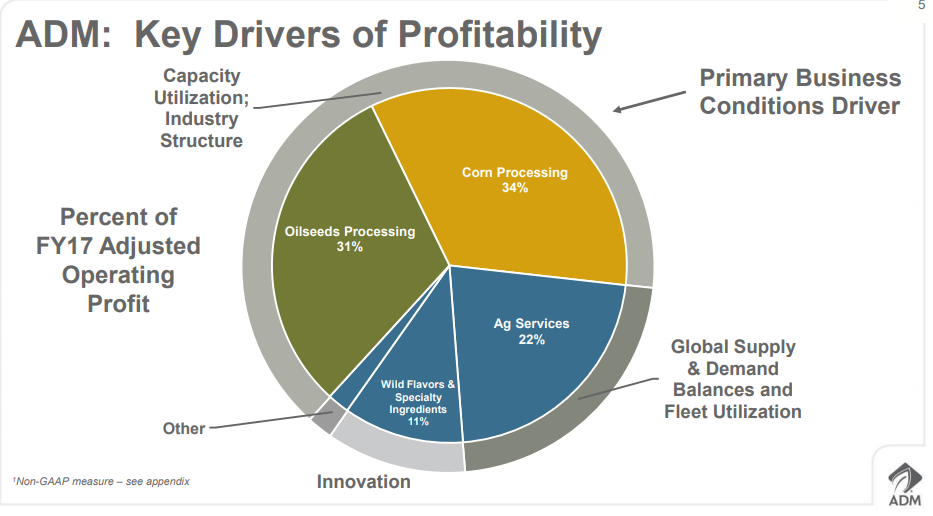

At the heart of this situation lies the potential impact on ADM's market share and profitability within specific sectors. The loss of these contracts, spanning various commodities and regions, raises questions about the company's competitive positioning. It also highlights the evolving dynamics of the global agricultural landscape.

Understanding the Impact

The specifics of the lost contracts remain closely guarded, but industry sources suggest they involve key areas like grain origination, processing, and distribution. ADM has historically held a dominant position in these markets, leveraging its extensive infrastructure and global network. The departure of these agreements thus represents a significant challenge.

A nut graf is essential here: This article will delve into the details of the contract losses, analyze the potential financial and operational ramifications for ADM. It will also examine the broader implications for the agricultural industry, exploring potential contributing factors and considering alternative strategies for the company's future.

Financial Ramifications

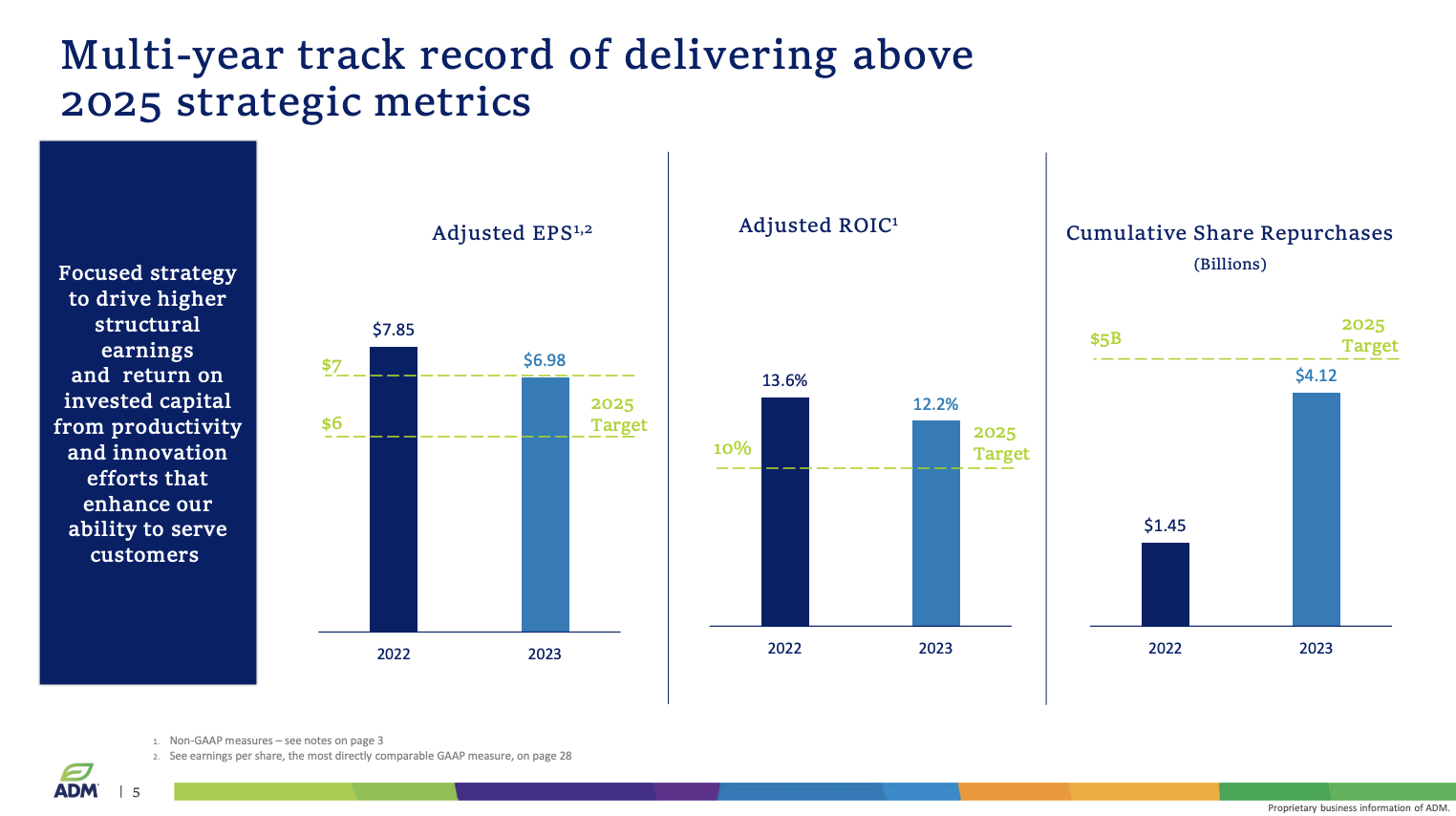

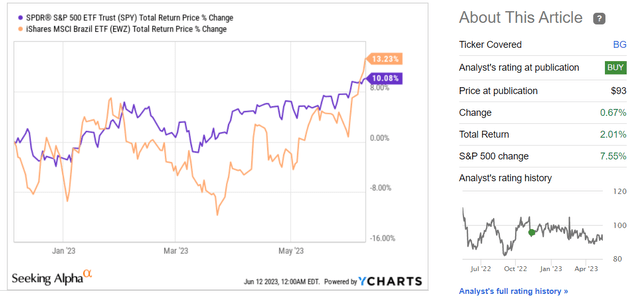

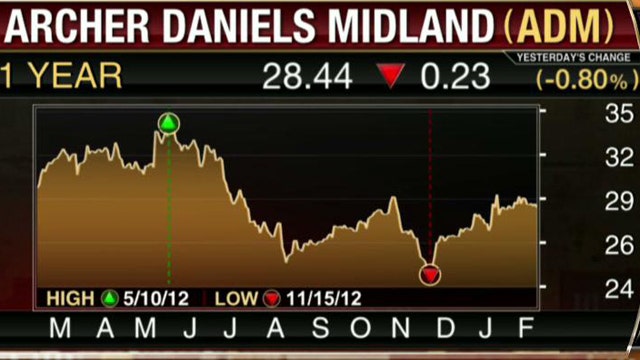

Analysts are actively revising their forecasts for ADM's future earnings. The lost contracts are projected to impact revenue streams and profit margins. The extent of this impact is currently being debated, with estimates varying depending on the size and profitability of the affected agreements.

Credit rating agencies are also closely monitoring the situation. A downgrade in ADM's credit rating could increase borrowing costs and limit the company's financial flexibility. This would potentially hinder its ability to invest in new projects or acquisitions.

Operational Challenges

Beyond the financial implications, the loss of contracts presents operational challenges for ADM. The company may need to restructure its operations and reallocate resources. This could involve streamlining processes and reducing headcount in certain areas.

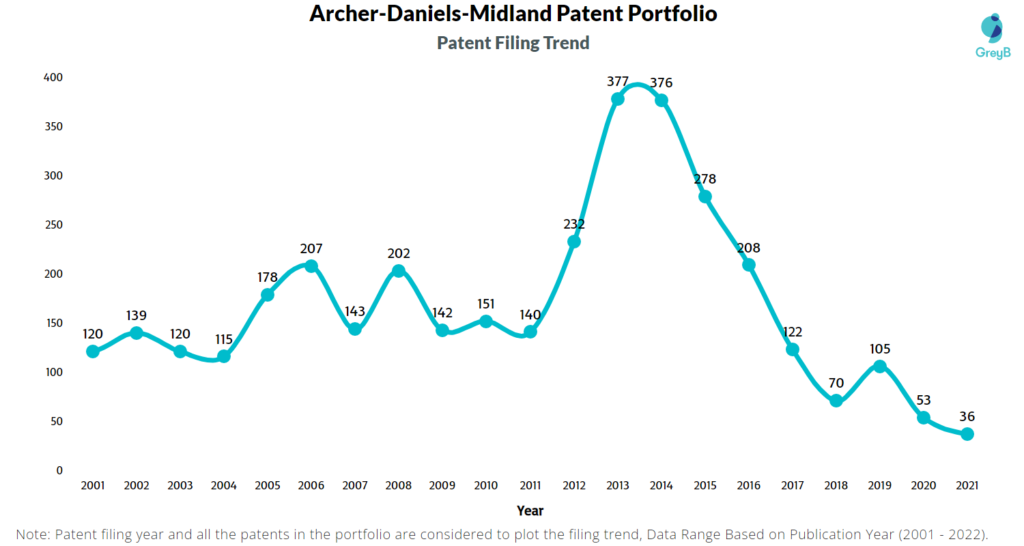

Furthermore, ADM will need to find new sources of revenue to offset the losses. This could involve expanding into new markets or developing innovative products and services. The company’s ability to adapt will be crucial to its long-term success.

Possible Contributing Factors

Several factors may have contributed to the loss of these contracts. Increased competition from rival agricultural companies is one possibility. Emerging players, particularly in Asia and South America, are aggressively expanding their market share.

Changing market dynamics, such as shifts in consumer demand and trade patterns, may also be playing a role. These changes could be prompting customers to seek alternative suppliers. ADM will need to address these concerns to maintain its competitive edge.

Another potential factor is pricing. Customers might have found more competitive offers from other suppliers. Supply chain disruptions and global economic instability further adds complexities to the situation.

ADM's Response and Future Strategies

ADM has acknowledged the contract losses and is actively working to mitigate their impact. The company is focusing on strengthening its relationships with existing customers and pursuing new business opportunities. It is also exploring strategic acquisitions and partnerships to expand its reach.

“We are committed to delivering long-term value for our shareholders,” said a spokesperson for ADM in a recent statement. “We are confident in our ability to navigate these challenges and emerge stronger.” The statement emphasized ADM's dedication to innovation and sustainable practices.

However, the company faces a difficult task in regaining lost ground. It will need to demonstrate its ability to adapt to the changing market conditions and deliver value to its customers. ADM has deep roots in the agricultural industry.

Industry Perspective

The situation at ADM is being closely watched by other players in the agricultural sector. The loss of these contracts underscores the increasing competition and volatility in the global market. It also serves as a reminder of the importance of building strong customer relationships and maintaining a competitive edge.

Smaller agricultural companies may see this as an opportunity to gain market share. Larger competitors may try to attract some of ADM's clients. The competition will likely intensify.

"This is a wake-up call for the entire industry," said an analyst at a leading agricultural research firm. "Companies need to be proactive in adapting to the changing market dynamics and investing in innovation to stay ahead."

Looking Ahead

The next few months will be critical for ADM as it navigates these challenges. The company's success will depend on its ability to execute its strategic plan and regain the confidence of investors and customers. The evolving global landscape requires adaptability.

The longer-term implications of the contract losses are still uncertain. However, it is clear that ADM is facing a period of significant transition. The company must leverage its strengths, address its weaknesses, and adapt to the changing market dynamics to ensure its long-term success. A proactive approach is key.

The situation serves as a case study of how even dominant players in a global industry can face unexpected challenges. The agricultural sector continues to evolve, requiring constant vigilance and strategic agility to thrive. ADM's response will set a precedent for others in the sector.