Assets Include All Of The Following Except

The seemingly simple phrase, "Assets Include All Of The Following Except," has triggered a wave of confusion and concern across various sectors, from personal finance to corporate accounting. Misunderstanding this concept can lead to significant errors in financial planning, investment strategies, and even legal compliance. The repercussions extend from individual households miscalculating their net worth to businesses facing inaccurate valuations and potential audits.

At its core, the phrase highlights the importance of distinguishing between assets and non-assets, a foundational principle in economics and finance. This article will delve into the nuances of this concept, clarifying what qualifies as an asset, exploring common misconceptions, and outlining the potential consequences of misidentification. Understanding these distinctions is crucial for informed decision-making and accurate financial representation, ensuring individuals and organizations alike can navigate the complexities of asset management with confidence.

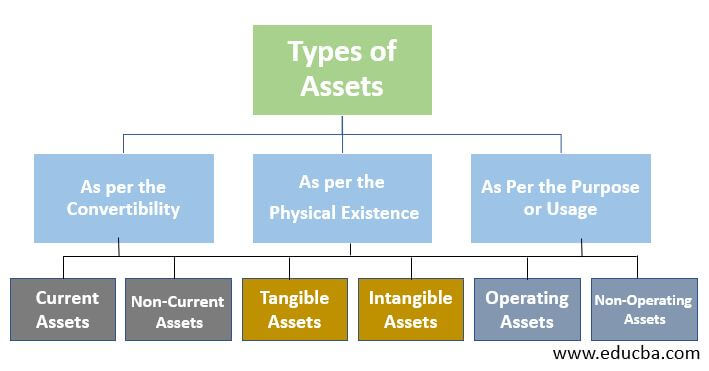

Defining Assets: A Comprehensive Overview

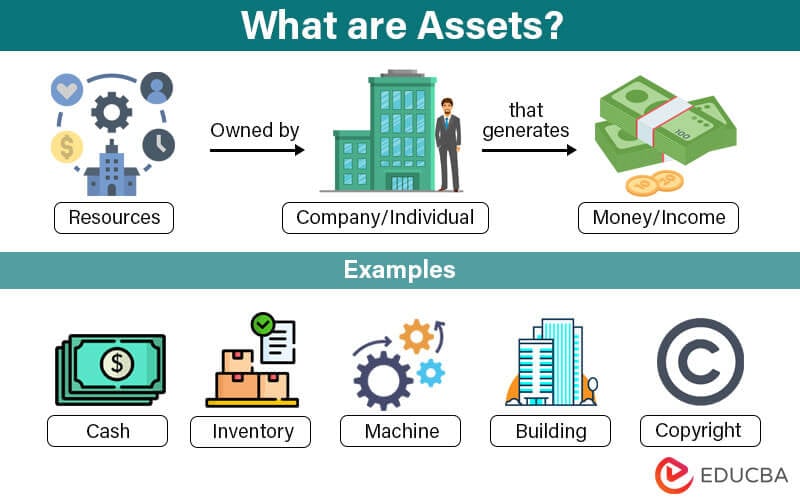

An asset is generally defined as a resource controlled by an individual or organization as a result of past events and from which future economic benefits are expected to flow. These benefits typically manifest as cash inflows, reduction in cash outflows, or the potential to generate revenue. Assets can be tangible, like real estate, equipment, and inventory, or intangible, such as patents, trademarks, and goodwill.

The key element is the expectation of future economic benefit. This differentiates an asset from an expense, which is consumed or used up in the current period. A truck used for deliveries is an asset because it will contribute to future sales; the fuel used to run the truck is an expense because it is consumed immediately.

Common Examples of Assets

Real Estate: This includes land, buildings, and any permanent structures affixed to the land. Real estate is a tangible asset that can appreciate in value over time, generating wealth for the owner.

Financial Investments: Stocks, bonds, mutual funds, and other securities represent ownership or debt claims in companies or governments. These investments can generate income through dividends, interest payments, or capital appreciation.

Cash and Cash Equivalents: This is the most liquid asset, encompassing currency, bank accounts, and short-term investments that can be easily converted to cash. Cash is essential for meeting immediate obligations and funding operations.

Accounts Receivable: These are amounts owed to a company by its customers for goods or services already delivered. Accounts receivable represent a future inflow of cash.

Inventory: This includes raw materials, work-in-progress, and finished goods held for sale. Inventory is a key asset for businesses involved in manufacturing or retail.

What Doesn't Qualify as an Asset? Unveiling the Exceptions

While the definition of an asset seems straightforward, certain items are often mistakenly categorized as such. Understanding these exceptions is critical for accurate financial analysis and decision-making.

Expenses: As previously mentioned, expenses are costs incurred in the current period that do not provide future economic benefit. Examples include rent, salaries, utilities, and advertising costs.

Liabilities: These are obligations to others, such as accounts payable, loans, and mortgages. Liabilities represent a claim against the assets of an individual or organization.

Equity: This represents the owner's stake in the assets of a company after deducting liabilities. Equity is not an asset per se but rather a claim on the company's net assets.

Depreciated Assets with No Salvage Value: Once an asset is fully depreciated and has no remaining value, it is no longer considered an asset, even if it's still physically present. Its economic benefit has been exhausted.

The Nuances of Intangible "Assets"

The line between an intangible asset and something that *appears* to be an asset can be particularly blurry. For example, while a brand can be a valuable intangible asset, the *cost* of building that brand through marketing campaigns is generally considered an expense, not an asset. The *value* attributed to the brand, if reliably measured and meeting specific accounting standards, can be recognized as an asset.

Similarly, employee skills and knowledge are crucial for a company's success, but they are not typically recognized as assets on the balance sheet. This is because they are not owned or controlled by the company in the same way as a patent or trademark.

Consequences of Misidentifying Assets

Misidentifying assets can have significant financial and legal consequences. For individuals, overstating assets can lead to inaccurate net worth calculations, potentially affecting loan applications and retirement planning.

For businesses, misclassification can distort financial statements, misleading investors and creditors. This can result in lower stock prices, difficulty securing financing, and potential regulatory scrutiny from bodies like the SEC. Incorrect asset classification can also trigger tax implications, leading to penalties and interest charges.

Moreover, in the context of mergers and acquisitions, inaccurate asset valuations can lead to unfair deals and subsequent legal disputes. A proper due diligence process is crucial to ensure assets are correctly identified and valued.

Ensuring Accurate Asset Identification

To avoid misidentifying assets, individuals and organizations should adhere to established accounting principles and seek professional advice when necessary. Consulting with a certified public accountant (CPA) or financial advisor can provide clarity and ensure compliance with relevant regulations.

Businesses should implement robust internal controls to safeguard assets and maintain accurate records. Regular audits and internal reviews can help identify and correct any errors in asset classification.

Furthermore, staying updated on changes in accounting standards is essential. Regulatory bodies like the Financial Accounting Standards Board (FASB) periodically issue new guidelines that can impact asset recognition and measurement.

Looking Ahead: The Evolving Landscape of Assets

The concept of assets is constantly evolving, particularly with the rise of digital assets like cryptocurrencies and NFTs (Non-Fungible Tokens). These new asset classes pose unique challenges for valuation and accounting, requiring a reevaluation of traditional definitions.

As technology continues to advance, it is crucial for individuals and organizations to remain adaptable and informed about the changing landscape of assets. A thorough understanding of what constitutes an asset, and equally important, what does not, is paramount for navigating the complexities of the modern financial world and making sound decisions.

Ultimately, a clear grasp of the phrase "Assets Include All Of The Following Except" is not merely an exercise in semantics. It's a fundamental building block for financial literacy and responsible asset management, ensuring both individuals and organizations can build a secure and prosperous future.