Best Bookkeeping Books For Small Business

Small business owners, are you drowning in receipts and spreadsheets? It's time to get your finances in order with the right knowledge and resources.

This guide highlights the best bookkeeping books available now to empower you with essential skills and strategies for managing your business's finances effectively.

Mastering the Fundamentals: Core Bookkeeping Guides

Bookkeeping for Dummies by Lita Epstein

This book is a go-to resource for beginners. Epstein breaks down complex concepts into digestible, easy-to-understand explanations.

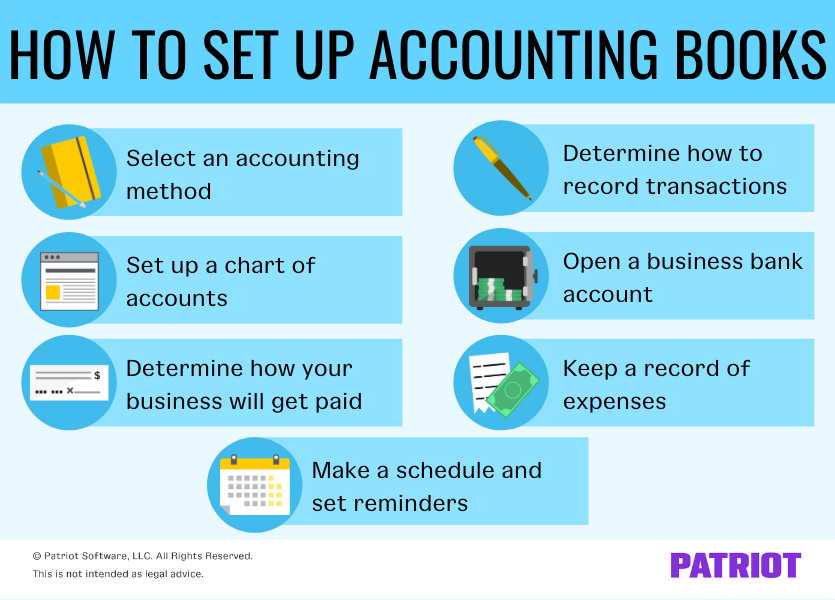

You'll learn about setting up a chart of accounts, recording transactions, and generating basic financial statements.

Bookkeeping for Dummies is available at most major booksellers and online retailers. Start building a solid financial foundation for your business immediately.

QuickBooks for Dummies by Stephen L. Nelson

QuickBooks is a leading accounting software for small businesses. This book provides step-by-step instructions on how to use it effectively.

Nelson covers everything from setting up your company file to managing invoices and payroll. It is updated annually to reflect the latest software version.

Get QuickBooks for Dummies to unlock the full potential of QuickBooks and streamline your accounting processes now.

Advanced Strategies for Growth and Profitability

Profit First by Mike Michalowicz

This book offers a revolutionary approach to managing cash flow. Michalowicz challenges traditional accounting methods and proposes a "pay yourself first" system.

Profit First teaches you how to allocate revenue to different accounts to ensure profitability and financial stability.

Implement the Profit First system to transform your business from a cash-strapped operation to a profit-generating machine starting today.

The E-Myth Revisited by Michael E. Gerber

While not strictly a bookkeeping book, The E-Myth Revisited addresses the importance of systems and processes in running a successful business.

Gerber emphasizes the need to work "on" your business rather than "in" it, including developing efficient bookkeeping procedures.

Read The E-Myth Revisited to create a scalable and sustainable business that isn't dependent on you for every task.

Specialized Guides for Specific Needs

Small Time Operator: How to Start Your Own Small Business by Bernard Kamoroff C.P.A.

This comprehensive guide covers all aspects of starting and running a small business. Kamoroff provides practical advice on bookkeeping, taxes, and legal issues.

Small Time Operator is known for its plain-English explanations and helpful examples. The latest edition incorporates changes in tax regulations.

Grab Small Time Operator for expert guidance on navigating the complexities of small business ownership.

Tax-Free Wealth by Tom Wheelwright

Understanding tax strategies is crucial for maximizing profits. Wheelwright, a CPA and tax advisor, reveals legal ways to reduce your tax burden.

Tax-Free Wealth teaches you how to use tax laws to your advantage and build long-term wealth. This is updated regularly.

Get Tax-Free Wealth to unlock the secrets of tax-efficient investing and business strategies immediately.

Take Control of Your Finances Now

Don't let bookkeeping be a source of stress and confusion. Invest in your financial literacy by reading these essential books.

By implementing the strategies and insights they offer, you can gain control of your finances and set your business up for long-term success.

Start reading today and watch your business thrive!