Broadstreet Global Fund Reviews Complaints Bbb

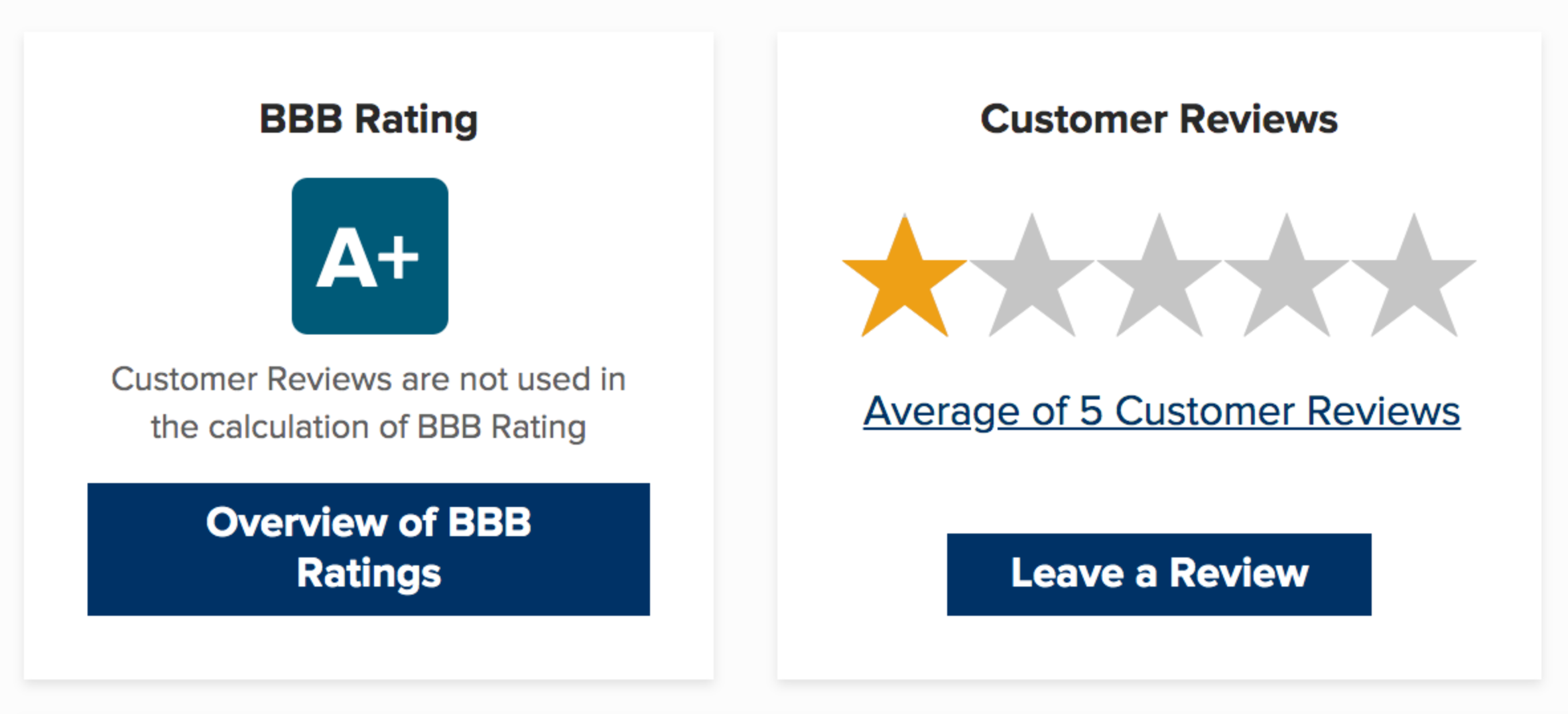

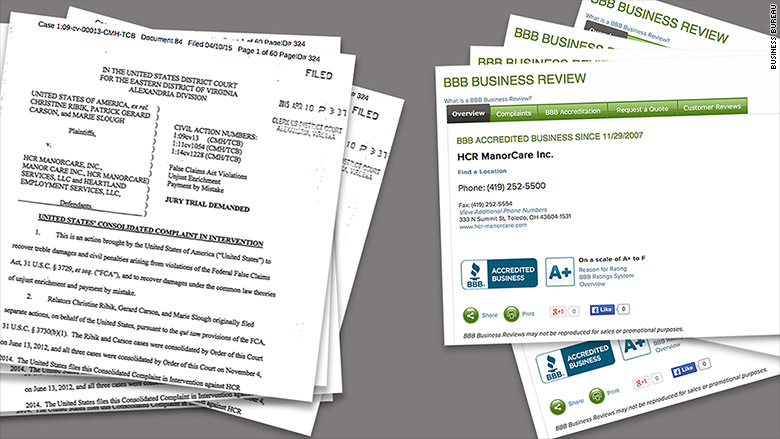

Broadstreet Global Fund is facing mounting pressure as it initiates a review of customer complaints lodged with the Better Business Bureau (BBB). The move comes amid growing concerns over alleged investment mismanagement and opaque communication practices.

This urgent review is critical for the fund to address a significant uptick in negative feedback and maintain investor confidence. Broadstreet must swiftly address these concerns to mitigate potential reputational damage and regulatory scrutiny.

BBB Complaints Trigger Internal Review

The catalyst for this review is a surge in complaints filed against Broadstreet Global Fund with the Better Business Bureau.

These complaints primarily revolve around concerns about unexpected losses, lack of transparency regarding investment strategies, and difficulties in withdrawing funds. The BBB has documented a notable increase in these reports over the past six months.

Broadstreet has confirmed that it is taking these complaints seriously and is dedicating resources to investigate each one thoroughly.

Scope of the Review

The internal review will encompass all complaints submitted to the BBB within the past year.

The investigation will delve into the specific circumstances surrounding each complaint, examining investment decisions, communication logs, and internal procedures. The fund aims to identify any systemic issues contributing to customer dissatisfaction.

Broadstreet has stated that the review will be conducted by an independent team within the organization to ensure impartiality.

Key Concerns Raised in Complaints

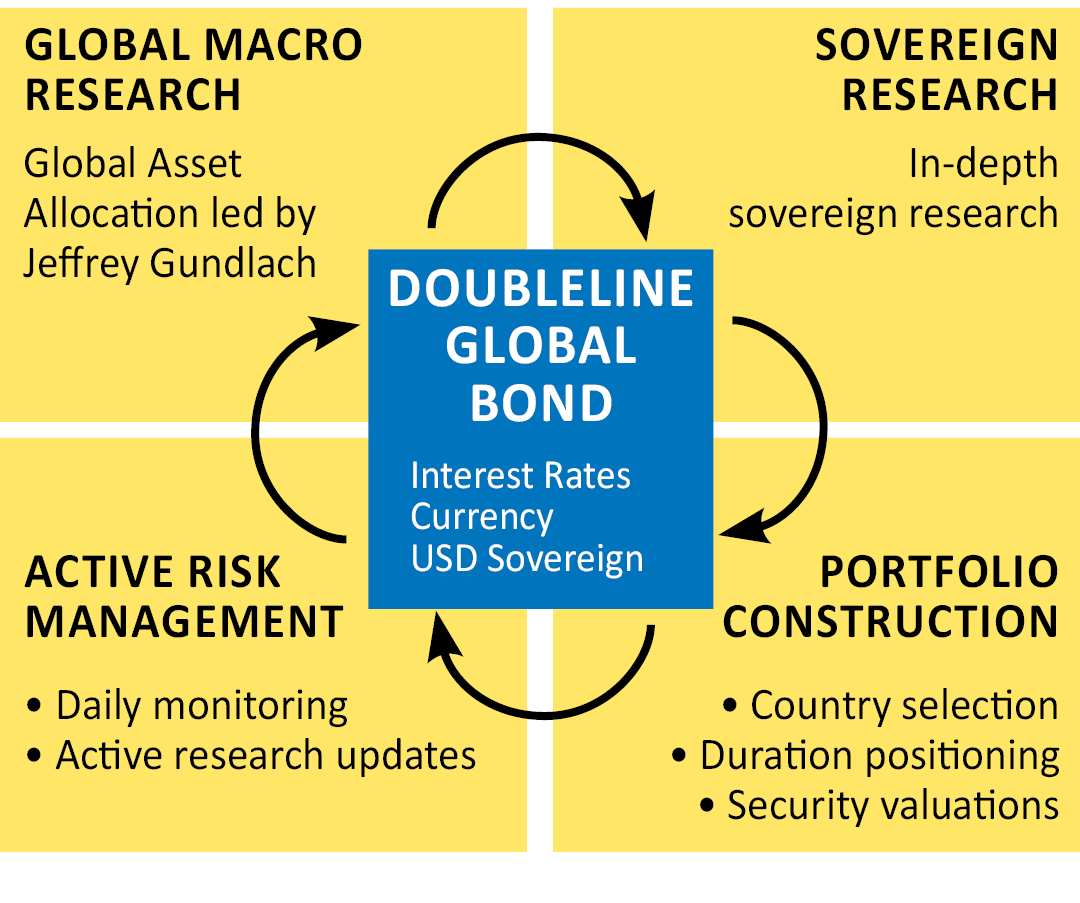

A significant number of complaints highlight concerns over the lack of clarity in investment strategies.

Investors claim they were not adequately informed about the risks associated with certain investments, leading to unexpected financial losses. Several complaints also mention difficulties in reaching customer service representatives and receiving timely responses to inquiries.

Furthermore, some clients allege that their requests for fund withdrawals were delayed or denied without proper explanation. These allegations are central to the ongoing review.

Broadstreet's Response

Broadstreet Global Fund has issued a statement acknowledging the concerns raised by its investors.

The statement emphasizes the fund's commitment to transparency and customer satisfaction. It also outlines the steps being taken to address the complaints and prevent similar issues from arising in the future.

"We understand the frustration and concern expressed by our investors," said a spokesperson for Broadstreet. "We are fully committed to resolving these issues and restoring their trust."

Potential Regulatory Implications

The surge in BBB complaints could attract the attention of regulatory bodies.

Securities regulators may initiate their own investigations if they deem the complaints to be indicative of widespread misconduct or violations of investment regulations. A negative outcome could result in significant penalties and further damage to Broadstreet's reputation.

The fund is aware of the potential for regulatory scrutiny and is actively working to address the issues raised in the complaints.

Next Steps and Ongoing Developments

Broadstreet expects the internal review to be completed within the next two months.

The fund has pledged to communicate the findings of the review to its investors and implement any necessary changes to its policies and procedures. Investors are encouraged to continue submitting their complaints through the BBB and directly to Broadstreet's customer service department.

Further updates will be provided as the review progresses and concrete actions are taken to address the concerns raised.