Buy Now Pay Later Nfl Tickets No Credit Check

The roar of the crowd, the smell of the freshly cut grass, the electrifying energy of an NFL game – for many, it's an experience worth paying for. But with ticket prices soaring, affordability can be a major hurdle. Now, a growing trend is offering a new solution: Buy Now, Pay Later (BNPL) options for NFL tickets, even for those with less-than-perfect credit.

This shift is potentially democratizing access to live sporting events, but also raises questions about responsible spending and the potential for debt accumulation.

The Rise of BNPL in the NFL Ticket Market

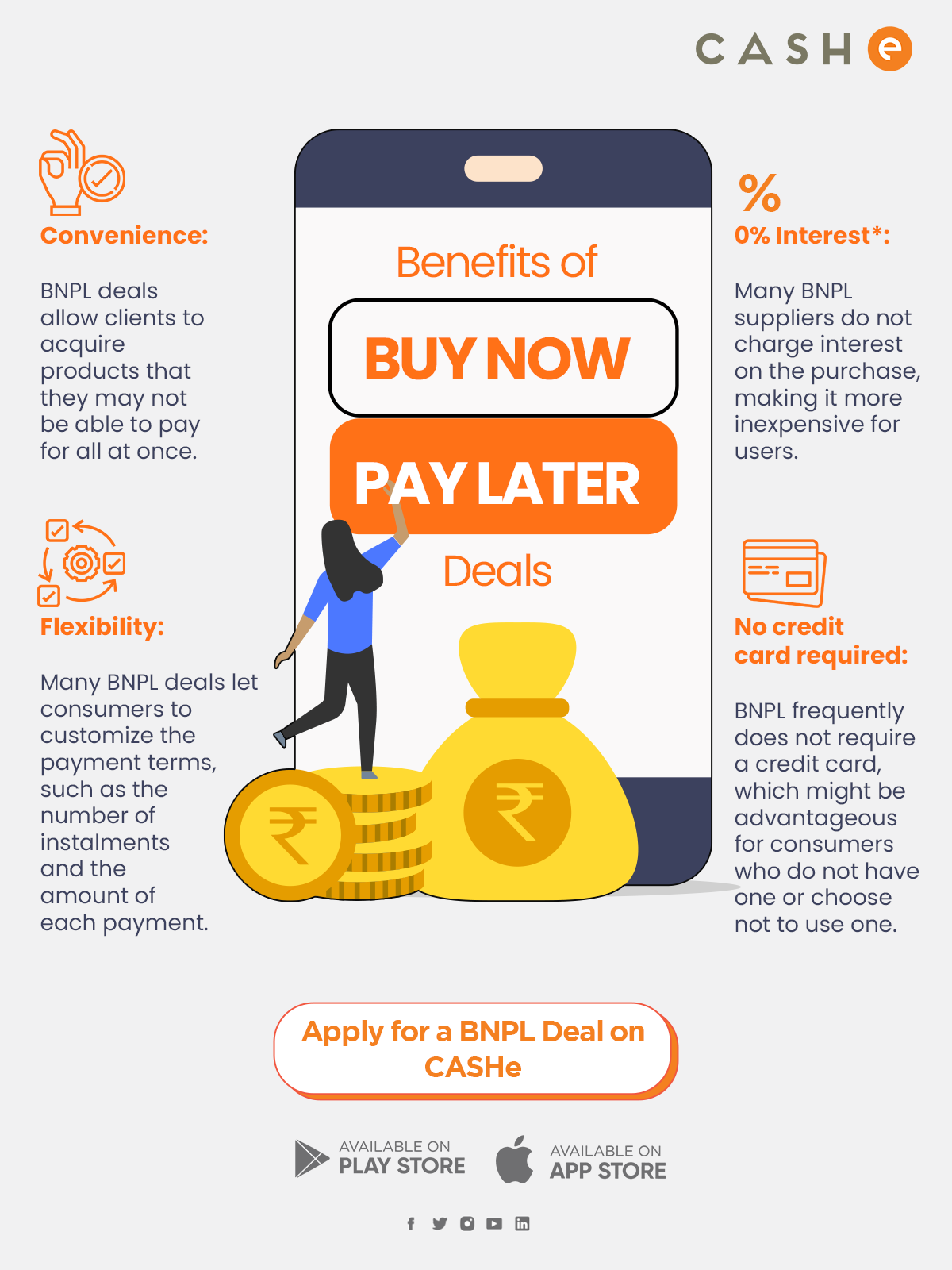

Buy Now, Pay Later services have exploded in popularity in recent years, offering consumers the ability to split purchases into smaller, more manageable installments. This payment model is now being widely adopted across various industries, including ticketing for live events. Several major ticketing platforms and secondary marketplaces now offer BNPL options for NFL games.

Companies like Affirm, Klarna, and Afterpay are partnering with ticket providers to integrate their services directly into the checkout process.

Users can select a BNPL option, often undergoing a soft credit check, and then divide the total cost of the tickets into several installments, typically paid over a few weeks or months. While some BNPL providers charge interest, others offer zero-interest plans if payments are made on time.

How Does it Work?

The process is generally straightforward. A user browsing for NFL tickets on a participating platform selects their desired seats and proceeds to checkout.

They then choose a BNPL option from the available payment methods. The BNPL provider assesses the applicant, sometimes with a soft credit check that doesn't affect their credit score, and approves or denies the payment plan based on factors like income and existing debt.

If approved, the user pays an initial installment, and the remaining balance is automatically charged to their chosen payment method over the agreed-upon timeframe.

The Appeal of BNPL for NFL Fans

For many fans, the appeal of BNPL lies in its ability to spread out the cost of often-expensive NFL tickets. This can be particularly attractive for those on a tight budget or those who want to attend multiple games throughout the season.

The perceived ease and convenience of BNPL, coupled with the often-touted "no credit check" or "soft credit check" promises, make it an appealing alternative to traditional credit cards.

"It allows me to go to a game I normally wouldn't be able to afford," said Mark Johnson, a lifelong Dallas Cowboys fan. "Paying $50 a month is much easier than dropping $300 all at once."

Potential Risks and Concerns

While BNPL offers undeniable convenience, it's crucial to be aware of the potential risks. While some providers offer interest-free plans, others charge interest or late fees if payments are missed.

Accumulating multiple BNPL debts across different platforms can quickly become overwhelming, especially for individuals with limited financial resources.

Consumer advocates are raising concerns about the lack of regulation surrounding BNPL services. The Consumer Financial Protection Bureau (CFPB) is actively investigating the BNPL industry to ensure transparency and protect consumers from potentially predatory practices.

"We are concerned about the rapid growth of BNPL and the potential for consumers to overextend themselves," stated a CFPB representative. "We are working to ensure that these services are fair, transparent, and accountable."

The Importance of Responsible Spending

Experts emphasize the importance of responsible spending habits when using BNPL services. Before opting for a BNPL plan, consumers should carefully assess their ability to make timely payments and understand the terms and conditions, including any potential fees or interest charges.

Creating a budget and tracking spending can help prevent overspending and ensure that BNPL debts are manageable.

Furthermore, individuals with existing debt or those struggling to manage their finances should exercise caution when using BNPL and consider alternative solutions, such as saving up for tickets in advance.

The Future of BNPL and NFL Ticketing

The integration of BNPL into the NFL ticketing market is likely to continue to grow, driven by consumer demand and the desire for increased accessibility. As the industry evolves, it is crucial to address the regulatory gaps and promote responsible lending practices.

Increased transparency, clear communication of terms and conditions, and robust consumer protection measures are essential to ensure that BNPL remains a beneficial tool for fans without leading to financial hardship.

Ultimately, the success of BNPL in the NFL ticketing market depends on a balance between providing convenient payment options and fostering responsible spending habits among fans.

![Buy Now Pay Later Nfl Tickets No Credit Check The Best Time to Buy NFL Tickets [2024] | FinanceBuzz](https://cdn.financebuzz.com/filters:quality(75)/images/2022/08/23/nfl-best-worst-buy-tickets-graphic-1.jpg)

:max_bytes(150000):strip_icc()/buy-now-pay-later-5182291-final-4dcaa9bea32a4aa398eb99e5ca5406bb.png)