Can I Buy Canadian Stocks On Fidelity

Urgent alert for investors! Can you buy Canadian stocks on Fidelity? The answer is nuanced, and understanding the specifics is crucial before you make any trades.

This article breaks down Fidelity's access to Canadian markets, outlining which stocks are readily available and what hurdles you might face when trying to diversify your portfolio north of the border.

Direct Access vs. OTC Markets

Fidelity offers access to many Canadian stocks listed on major exchanges like the Toronto Stock Exchange (TSX). You can typically purchase these stocks directly through Fidelity's trading platform, similar to buying U.S. equities.

However, not all Canadian stocks are created equal. Some smaller companies or those with lower trading volumes may only be available on the Over-the-Counter (OTC) markets, also sometimes called the "pink sheets".

Trading OTC stocks can come with increased risks due to lower liquidity and less stringent regulatory oversight.

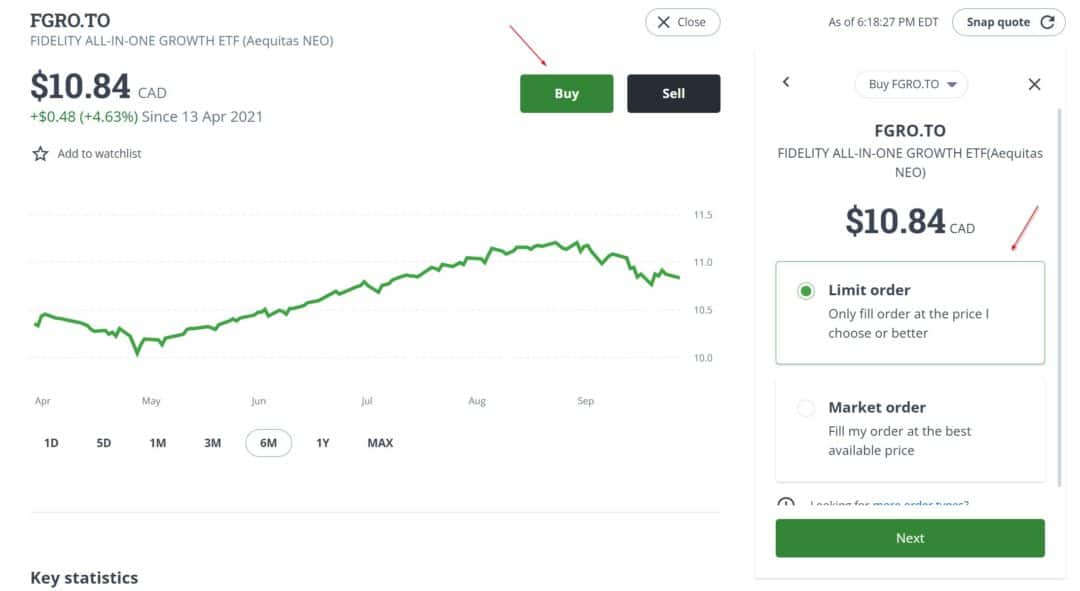

How to Determine Availability

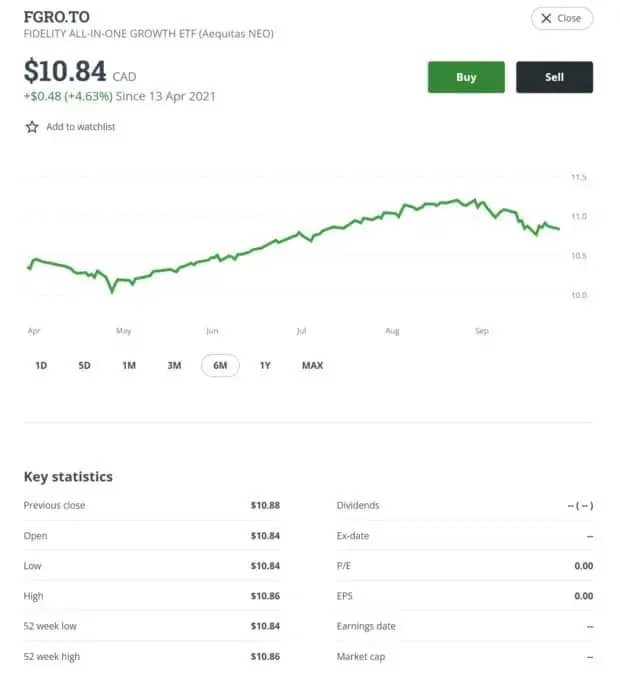

The easiest way to check if a specific Canadian stock is available on Fidelity is to simply search for its ticker symbol on the platform.

If the stock is listed on a major exchange and Fidelity provides access, it should appear in the search results. If you can't find the ticker, it might be an OTC stock or unavailable through Fidelity.

Contacting Fidelity's customer service directly is another reliable way to confirm availability and understand any restrictions.

Trading Canadian Stocks: Important Considerations

When trading Canadian stocks, be aware of potential currency exchange fees. Fidelity will typically convert your USD to CAD to facilitate the trade, and a conversion fee will apply.

Also, be mindful of different trading hours. The TSX operates on Eastern Time, just like the New York Stock Exchange, but holidays and market closures may differ.

Tax implications can also be more complex when dealing with foreign investments. Consult with a tax professional to understand your obligations.

Using ETFs for Broader Exposure

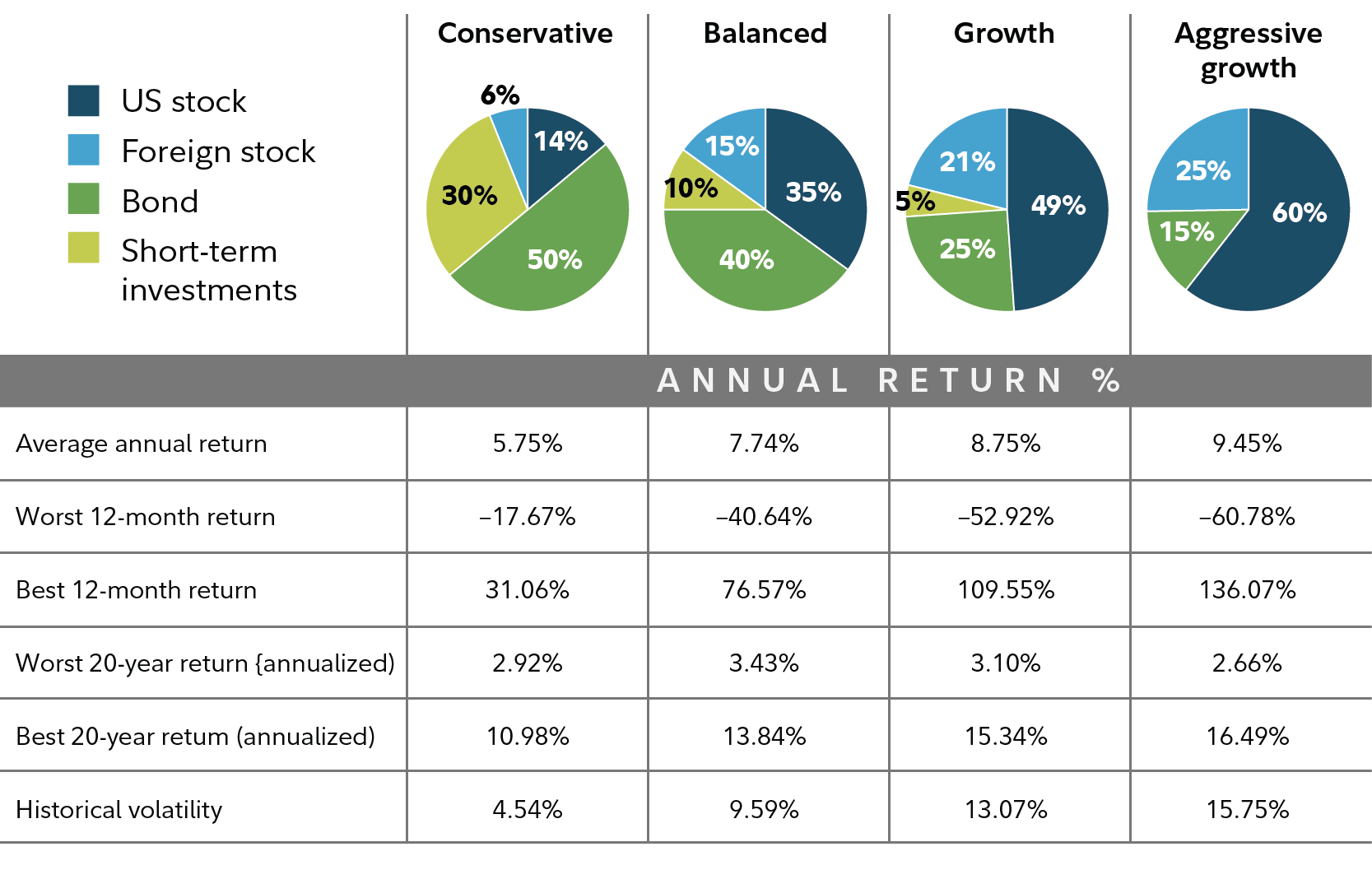

If you want exposure to the Canadian market without buying individual stocks, consider investing in Exchange Traded Funds (ETFs) that track Canadian indexes like the S&P/TSX Composite Index.

Many of these ETFs are U.S.-listed and readily available on Fidelity, offering a diversified approach to investing in Canadian equities.

Examples include iShares MSCI Canada ETF (EWC) and BMO MSCI Canada Index ETF (ZCN).

Potential Restrictions and Alternatives

While Fidelity offers access to a significant portion of the Canadian market, some restrictions may apply to certain accounts or specific stocks.

For instance, margin requirements or trading permissions might differ for international securities. Double-check your account settings and eligibility.

If you find that Fidelity doesn't offer access to a specific Canadian stock you're interested in, consider exploring other brokerage platforms that may have broader international coverage. Interactive Brokers, for example, is known for its extensive global market access.

Opening an account with a Canadian brokerage firm is another option, although it comes with its own set of complexities, including currency exchange and tax reporting.

Next Steps

Before investing in Canadian stocks through Fidelity, verify the availability of the specific securities you're interested in and understand the associated fees and risks.

Evaluate whether individual stock picking or investing in Canadian ETFs better aligns with your investment goals and risk tolerance.

Stay informed about any changes to Fidelity's international trading policies and consult with financial and tax advisors for personalized guidance. Always do your own research before making any investment decisions.