Can I Pay Off My Overdraft In Installments

Navigating the world of overdraft fees can feel like walking a financial tightrope. Many individuals, caught off guard by unexpected expenses or timing discrepancies, find themselves in the red and grappling with hefty charges. A key question arises: can these overdraft balances be paid off in installments, alleviating the immediate financial strain?

This article examines the possibility of repaying overdrafts through installment plans, exploring the options available to consumers, the potential benefits and drawbacks, and the broader implications for financial well-being. Understanding these options is crucial for anyone who has faced, or may face, the burden of overdraft fees.

Overdrafts: A Costly Reality

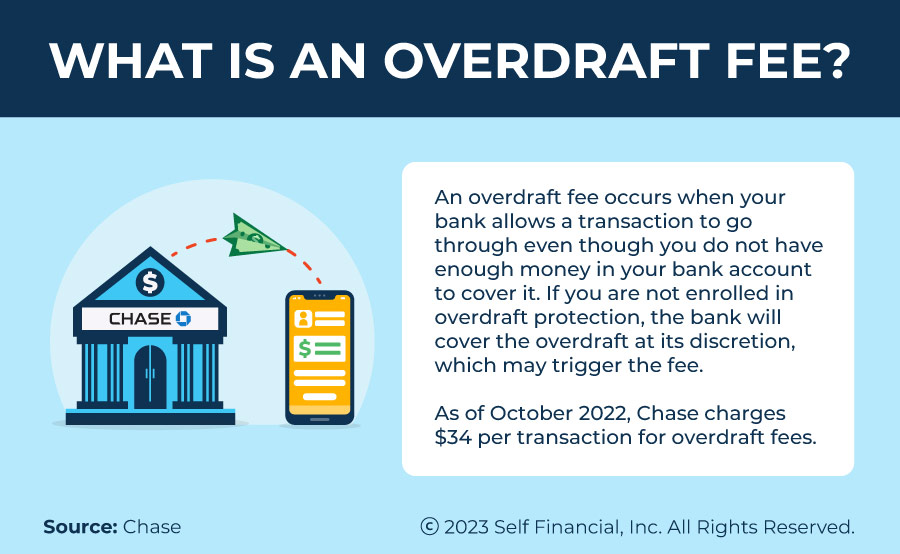

An overdraft occurs when you spend more money than is available in your bank account. Financial institutions typically cover these transactions, but then charge a fee for the service. According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), overdraft fees disproportionately impact low-income individuals and can lead to a cycle of debt.

The median overdraft fee is around $35, and these fees can quickly accumulate if multiple transactions overdraw an account. The financial burden is further compounded for those who struggle to repay the overdraft promptly.

The Installment Option: Is it Available?

Whether or not you can repay an overdraft in installments largely depends on the specific bank's policies and the nature of your account. Some banks offer formal repayment plans or lines of credit designed to help customers manage overdraft debt.

However, it's crucial to understand that not all banks provide this option, and the terms and conditions can vary significantly. Reaching out to your bank directly is the first step in determining if a payment plan can be established.

Exploring Bank Policies

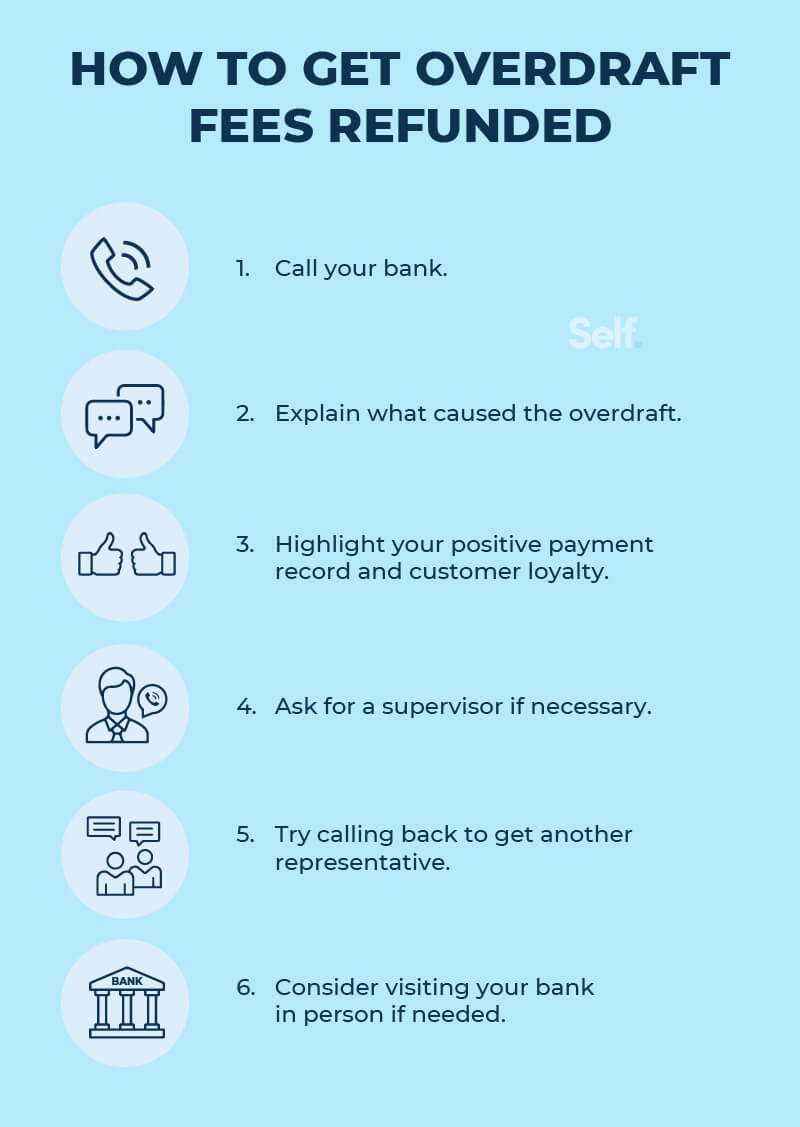

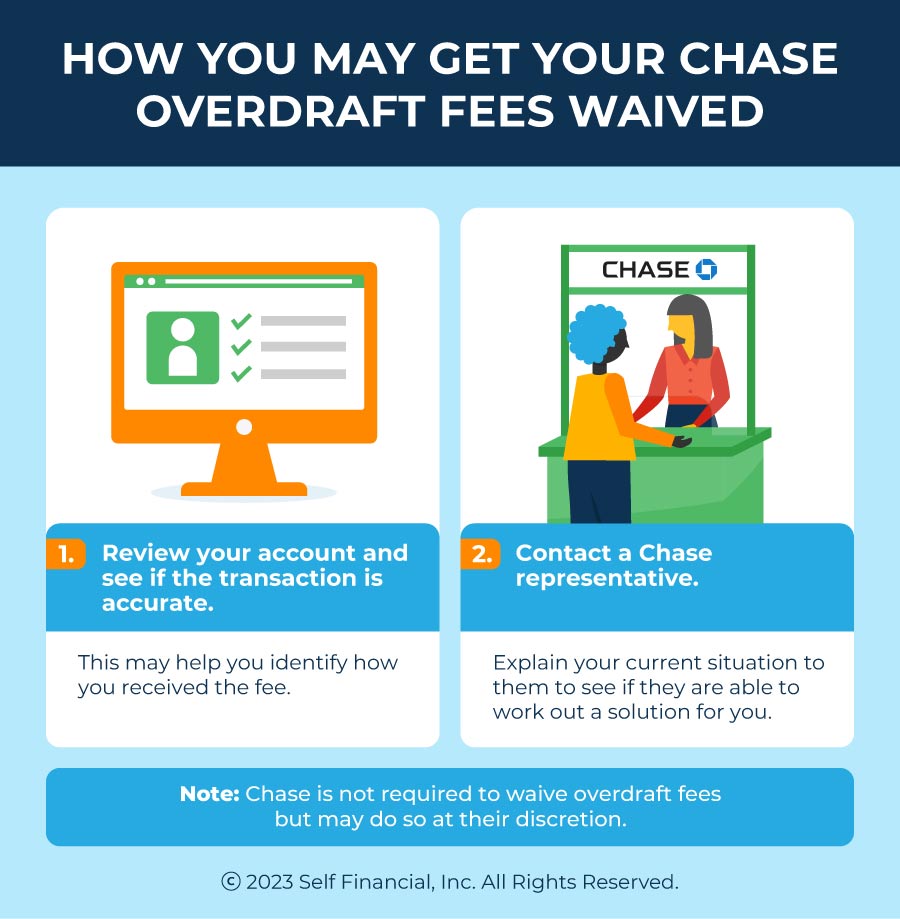

Contacting your bank's customer service department, either online, by phone, or in person, is essential. Ask specifically about options for repaying your overdraft in installments or through a structured payment plan. Be prepared to provide details about your account and the circumstances that led to the overdraft.

Some banks might offer a temporary line of credit to cover the overdraft, which can then be repaid over time with interest. Others may agree to a payment schedule, potentially waiving or reducing further fees if the repayment is consistent.

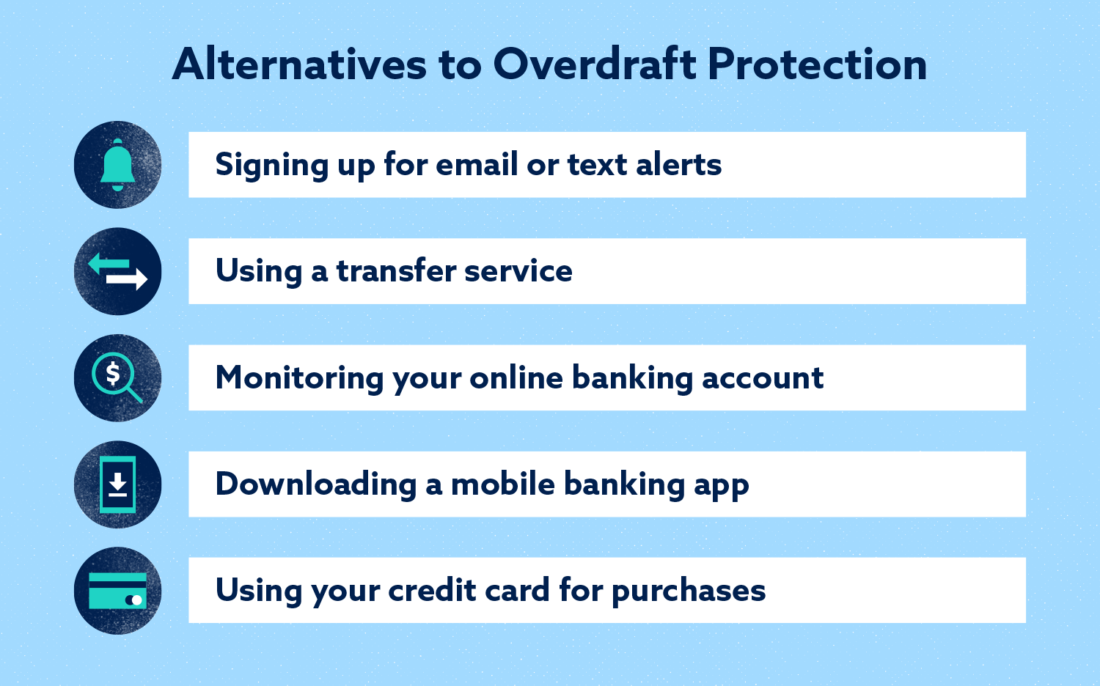

Alternative Solutions

If your bank doesn't offer a suitable installment plan, consider exploring alternative financial solutions. These might include a personal loan from a credit union or online lender, which could be used to consolidate the overdraft debt into a more manageable payment structure.

Another option could be a balance transfer to a low-interest credit card. However, it's important to carefully evaluate the interest rates and fees associated with these alternatives to ensure they offer a genuine benefit.

Potential Benefits and Drawbacks

Repaying an overdraft in installments offers several potential benefits. Primarily, it can ease the immediate financial pressure by spreading the cost over time. This also prevents the accumulation of more fees and penalties that would occur if the overdraft remains unpaid.

However, there are also potential drawbacks to consider. Installment plans, lines of credit, or personal loans often come with interest charges, increasing the overall cost of repaying the overdraft. A missed payment on the agreed schedule may also incur more fees and potentially damage your credit score.

"The key is to understand the terms and conditions of any repayment plan before committing," advises Jane Smith, a certified financial planner. "Factor in the interest rates, fees, and repayment schedule to determine if it's truly the best option for your financial situation."

The Impact on Financial Well-being

The ability to repay overdrafts in installments can significantly impact financial well-being. For many individuals, especially those living paycheck to paycheck, a large, unexpected overdraft fee can be a major setback.

Providing a flexible repayment option can reduce financial stress and prevent a downward spiral of debt. It promotes responsible financial management by allowing individuals to address their overdraft in a structured manner.

A Call for Greater Transparency

The availability and accessibility of overdraft repayment options remain uneven across different financial institutions. Consumer advocacy groups are calling for greater transparency and standardization of overdraft policies.

They argue that banks should proactively offer affordable repayment options to customers facing overdrafts and provide clear information about the associated costs and terms. Ultimately, greater transparency empowers consumers to make informed decisions and avoid falling into cycles of debt.

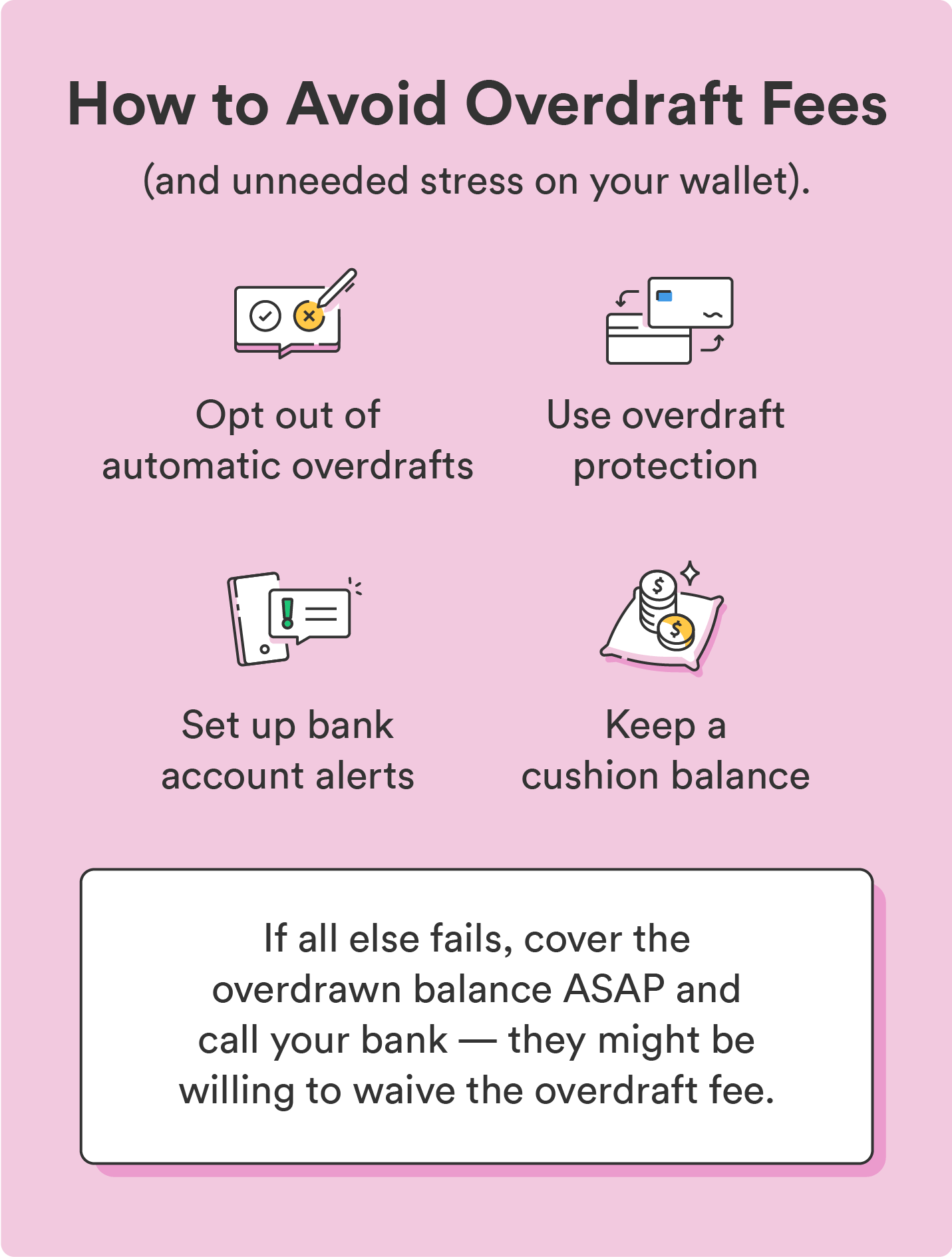

Ultimately, the ability to pay off an overdraft in installments provides an important tool for managing personal finances. Although it's essential to proactively prevent overdrafts through careful budgeting and account management, knowing that flexible repayment options exist can provide a crucial safety net in times of financial difficulty. By contacting your bank and exploring all available alternatives, you can take control of your overdraft debt and work towards a more stable financial future.

:max_bytes(150000):strip_icc()/insufficient-funds-315343-final-89b1ea8eda2f41c7b2fbfeae44426e65.png)