Can My Wife Use My Care Credit Card

CareCredit cardholders are facing confusion regarding authorized user privileges. Can your wife use your CareCredit card? The answer isn't straightforward and depends on understanding CareCredit's specific policies.

This article clarifies who can use a CareCredit account, outlining authorized user options and potential risks associated with improper usage. It provides essential information to avoid account penalties and ensure compliant spending.

Understanding CareCredit's Authorized User Policy

CareCredit doesn't explicitly offer "authorized user" cards in the same way traditional credit cards do. This is a critical distinction. The primary cardholder is ultimately responsible for all charges on the account.

Unlike cards from Chase or American Express, where you can add someone to your account with their own card, CareCredit operates differently. Your wife can only use your card if you, the primary cardholder, authorize the charges at the point of sale. In essence, you must be present, or at least provide explicit consent for each transaction.

What Does This Mean in Practice?

If your wife visits a participating healthcare provider, such as a dentist or veterinarian, she cannot simply present your CareCredit card without your direct authorization. The provider will likely need to verify your consent, potentially through a phone call or other form of confirmation.

Some providers might allow your wife to use the card with a signed authorization form from you. However, this is at the discretion of the provider and not a standard CareCredit policy. It's crucial to check with the provider beforehand to understand their specific requirements.

Risks of Misuse and Account Penalties

Allowing someone to use your CareCredit card without proper authorization can lead to serious consequences. CareCredit terms and conditions clearly state that the primary cardholder is responsible for all charges.

If unauthorized charges are made, you could face disputes, potential account closure, and damage to your credit score. Furthermore, sharing your card and PIN with another person violates the cardholder agreement.

CareCredit monitors accounts for suspicious activity. Unusual spending patterns or charges in locations far from your typical spending habits could trigger a review, potentially leading to a temporary or permanent freeze on your account.

Alternative Options for Family Healthcare Expenses

Consider alternative strategies for managing family healthcare costs. Opening a separate CareCredit account in your wife's name might be a better solution.

This approach grants her individual spending power and responsibility. It also avoids any potential complications arising from using your card without authorization.

Alternatively, exploring traditional credit cards with rewards or cashback on healthcare spending could be beneficial. Compare interest rates and benefits to find the most suitable option for your family's needs.

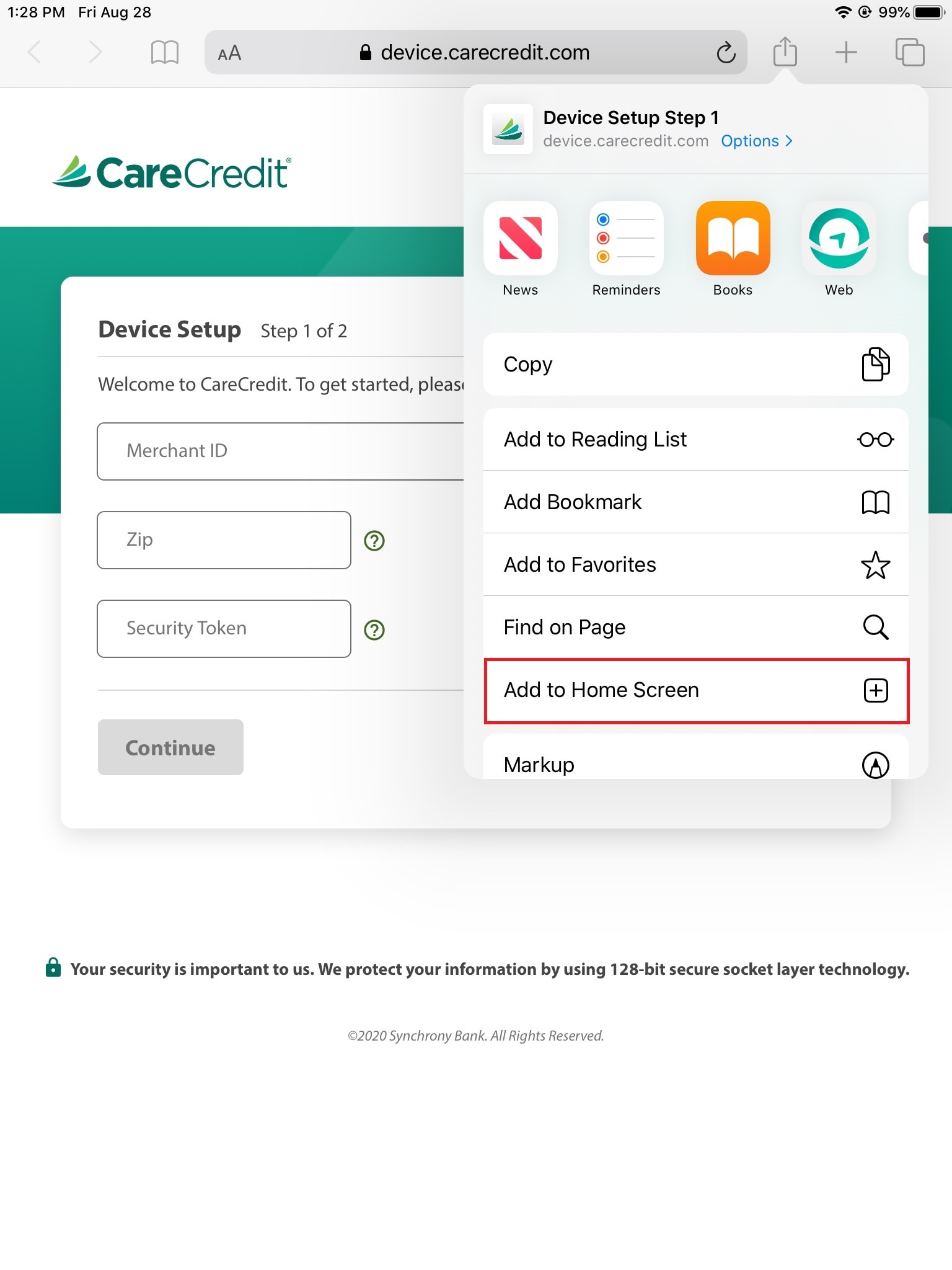

Next Steps: Verify and Clarify

Contact CareCredit directly for clarification on their authorized user policies. Review your cardholder agreement for detailed terms and conditions.

Communicate openly with your wife about CareCredit's restrictions and explore alternative payment solutions. Protecting your credit score and maintaining a good relationship with CareCredit is crucial.

Stay informed about changes to CareCredit policies. Healthcare financing options are constantly evolving, so staying up-to-date is essential for responsible financial management.

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png)