Can You Buy An Oura Ring With Hsa

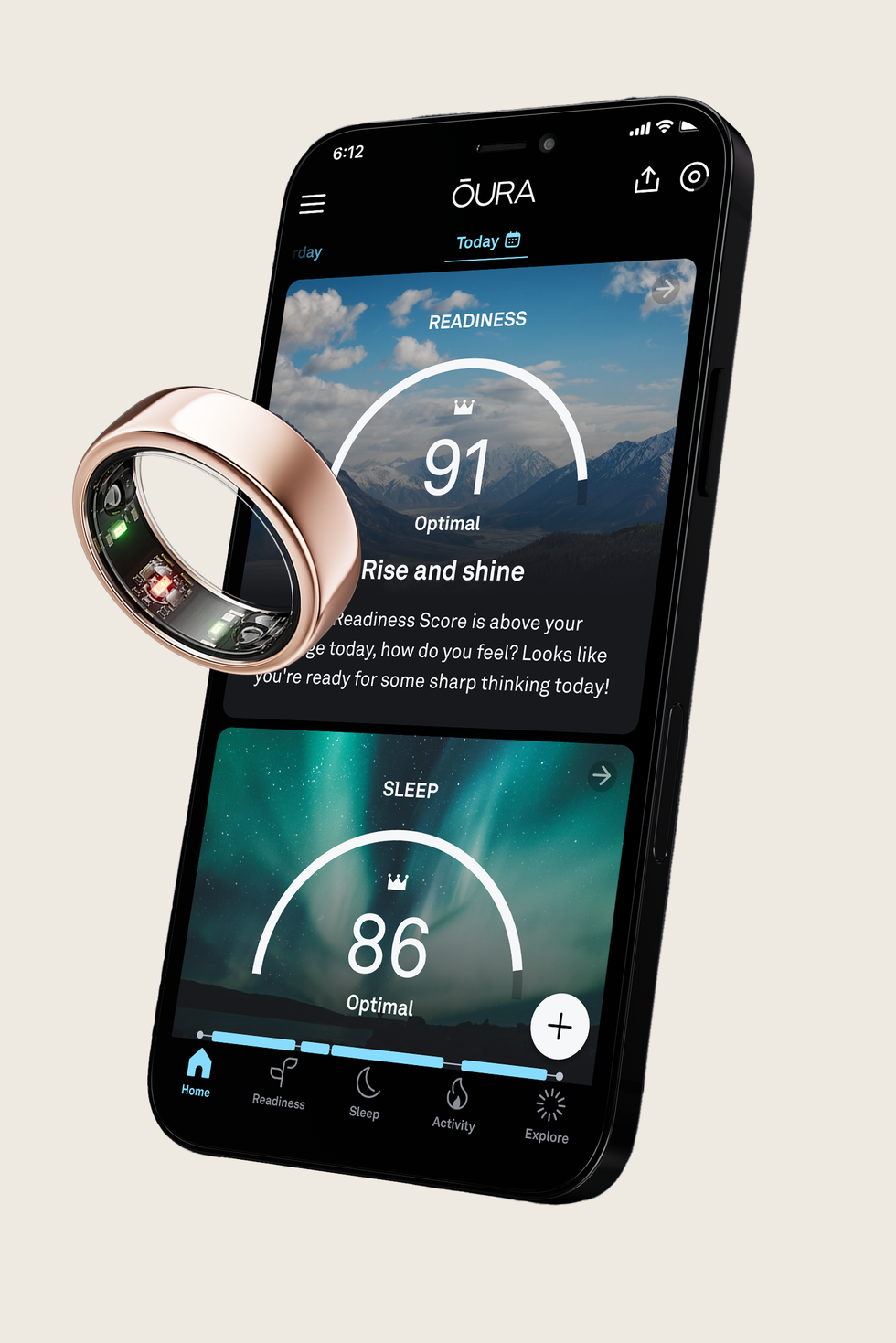

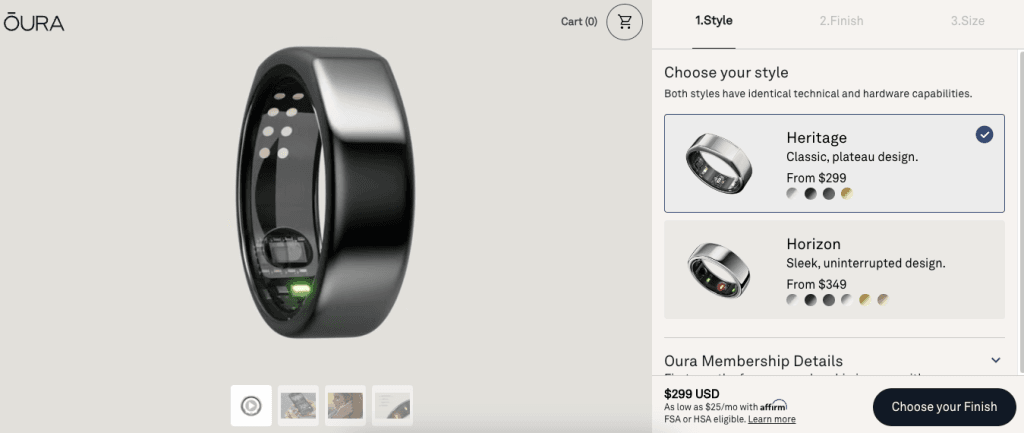

The question of whether health-related purchases qualify for reimbursement from Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) has become increasingly relevant as wearable technology integrates further into personal healthcare. Among the popular devices facing this scrutiny is the Oura Ring, a sleek wearable that tracks sleep, activity, and various physiological metrics. Can you use pre-tax dollars from your HSA or FSA to purchase this device, blurring the lines between fitness tracker and medical necessity?

This article delves into the complexities surrounding the eligibility of the Oura Ring for HSA/FSA reimbursement. It examines the current IRS guidelines, explores the arguments for and against its inclusion, considers the documentation required for potential approval, and analyzes expert opinions on the matter. Ultimately, this piece aims to provide readers with a comprehensive understanding of the factors determining whether they can use their HSA/FSA funds to purchase an Oura Ring.

Understanding HSA/FSA Eligibility

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are tax-advantaged accounts designed to help individuals pay for qualified medical expenses. The Internal Revenue Service (IRS) sets the rules regarding which expenses qualify for reimbursement. Generally, eligible expenses must be primarily for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

The core of the issue lies in demonstrating that a purchase is primarily for medical care and not simply for general health or wellness. Over-the-counter medications, for example, often require a prescription to be eligible. Durable Medical Equipment (DME) generally qualifies, but often requires a Letter of Medical Necessity from a physician.

The Case for Oura Ring Eligibility

Proponents argue that the Oura Ring could be eligible for HSA/FSA reimbursement if it's used under the guidance of a healthcare professional to manage a specific medical condition. For instance, someone with a sleep disorder, anxiety, or a heart condition might use the Oura Ring to track relevant metrics and share that data with their doctor. This data-driven approach can inform treatment plans and potentially improve health outcomes.

The Oura Ring's ability to track sleep stages, heart rate variability (HRV), and body temperature provides valuable insights into an individual's health status. These metrics can be particularly useful for identifying trends and patterns that might otherwise go unnoticed. Such data is crucial for people managing conditions like insomnia or recovering from an illness.

The Case Against Oura Ring Eligibility

Skeptics argue that the Oura Ring is primarily a wellness device and its use doesn't automatically qualify as medical care. The IRS emphasizes that an expense must be primarily for medical care and not merely beneficial to general health. Devices marketed for general fitness and wellness often fall into this non-eligible category.

Without a specific medical diagnosis and a Letter of Medical Necessity, it may be difficult to convince an HSA/FSA administrator that the Oura Ring is a qualified medical expense. Many HSA/FSA providers are strict in their interpretation of IRS guidelines. They prioritize avoiding potential audits and penalties.

The Importance of a Letter of Medical Necessity

A Letter of Medical Necessity (LMN) is a crucial document in establishing the medical purpose of a purchase. An LMN is a signed and dated statement from a licensed healthcare provider. It clearly outlines the medical condition being treated and explains how the Oura Ring specifically addresses that condition.

The LMN should detail how the Oura Ring's features, such as sleep tracking or HRV monitoring, directly contribute to the diagnosis, treatment, or prevention of the medical condition. It should also explain why other, less expensive options are not suitable or adequate.

Documenting Medical Necessity

Beyond an LMN, it is important to maintain thorough documentation to support an HSA/FSA claim for an Oura Ring. This includes keeping records of doctor's appointments. Keeping records of consultations where the use of the Oura Ring was discussed and recommended is crucial.

Also, retain any data collected by the Oura Ring and shared with your healthcare provider. This demonstrates the ongoing use of the device for medical purposes. Showing the device wasn't simply a one-time purchase for casual tracking.

Expert Perspectives and Guidance

Financial and healthcare experts offer varying perspectives on the HSA/FSA eligibility of wearable devices like the Oura Ring. Some emphasize the importance of strict adherence to IRS guidelines and the need for a clear medical purpose. Others acknowledge the evolving role of technology in healthcare and support the use of HSA/FSA funds for devices that demonstrably improve health outcomes.

Dr. Emily Carter, a physician specializing in sleep medicine, states: "While the Oura Ring can provide valuable data for patients with sleep disorders, its eligibility for HSA/FSA reimbursement depends on individual circumstances and proper documentation." She emphasizes the need for a physician's recommendation and ongoing use of the data in clinical decision-making.

Mark Thompson, a Certified Financial Planner, advises: "Before purchasing an Oura Ring with HSA/FSA funds, contact your plan administrator to confirm their specific requirements and procedures. Obtain a Letter of Medical Necessity from your doctor and maintain detailed records to support your claim." His counsel prioritizes proactive verification before purchase.

Potential Changes in the Future

The landscape of HSA/FSA eligibility is subject to change as technology advances and healthcare practices evolve. There may be future updates to IRS guidelines to specifically address the use of wearable devices for medical purposes. It is essential to stay informed about these developments.

Lobbying efforts by healthcare technology companies and patient advocacy groups could also influence policy changes. Advocating for broader acceptance of digital health tools could lead to increased HSA/FSA eligibility for devices like the Oura Ring. This will improve access to technology-driven healthcare.

Conclusion

Whether you can buy an Oura Ring with your HSA or FSA isn't a straightforward yes or no. It hinges on demonstrating a clear medical purpose, obtaining a Letter of Medical Necessity from a healthcare provider, and adhering to the specific guidelines of your HSA/FSA administrator. It remains crucial to consult with your healthcare provider and HSA/FSA administrator to determine eligibility based on your specific circumstances.

As wearable technology becomes increasingly integrated into healthcare, the line between fitness trackers and medical devices continues to blur. Consumers should exercise due diligence and seek expert advice to navigate the complex rules governing HSA/FSA eligibility for these innovative health tools.