Cash Receipts From Interest And Dividends Are Classified As

The seemingly simple question of where interest and dividend income lands on a company's financial statements sparks considerable debate and often requires careful consideration of accounting standards. Incorrect classification can significantly distort a company’s financial health assessment, misleading investors and analysts alike.

This article dissects the classification of cash receipts from interest and dividends within the statement of cash flows, exploring the nuances that determine whether these receipts are categorized as operating, investing, or financing activities. We will delve into the relevant accounting standards, examine practical implications for financial analysis, and offer insight into how these classifications can shape perceptions of a company's performance and risk profile.

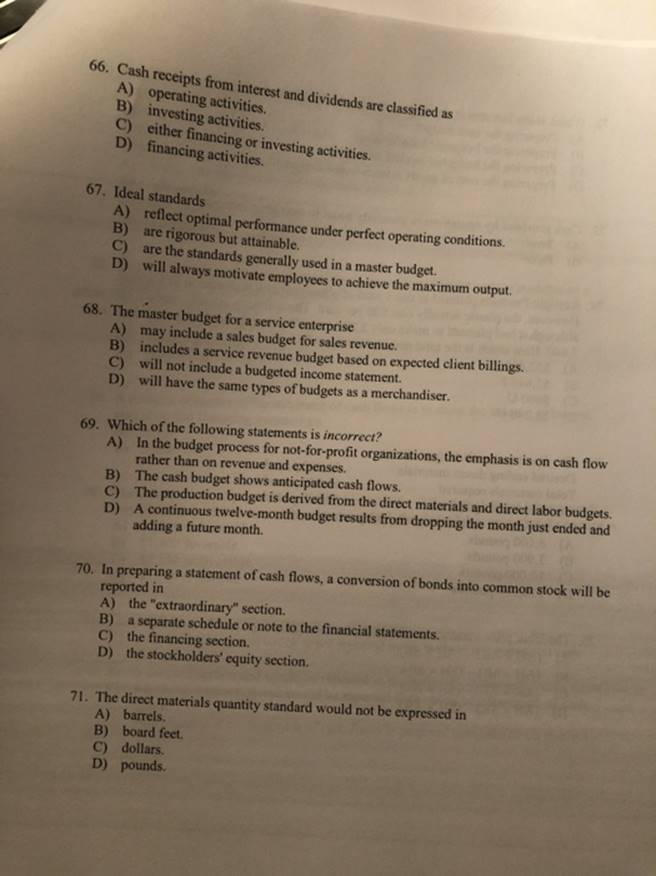

The Core Issue: Statement of Cash Flows

The statement of cash flows provides a vital picture of a company's ability to generate cash and manage its short-term obligations.

It categorizes cash inflows and outflows into three primary activities: operating, investing, and financing. The proper categorization of interest and dividend receipts can substantially affect how stakeholders interpret a company’s financial strength.Operating Activities: The Mainstay of Business

Operating activities generally involve the cash effects of transactions that enter into the determination of net income. This category reflects the core revenue-generating actions of a business.

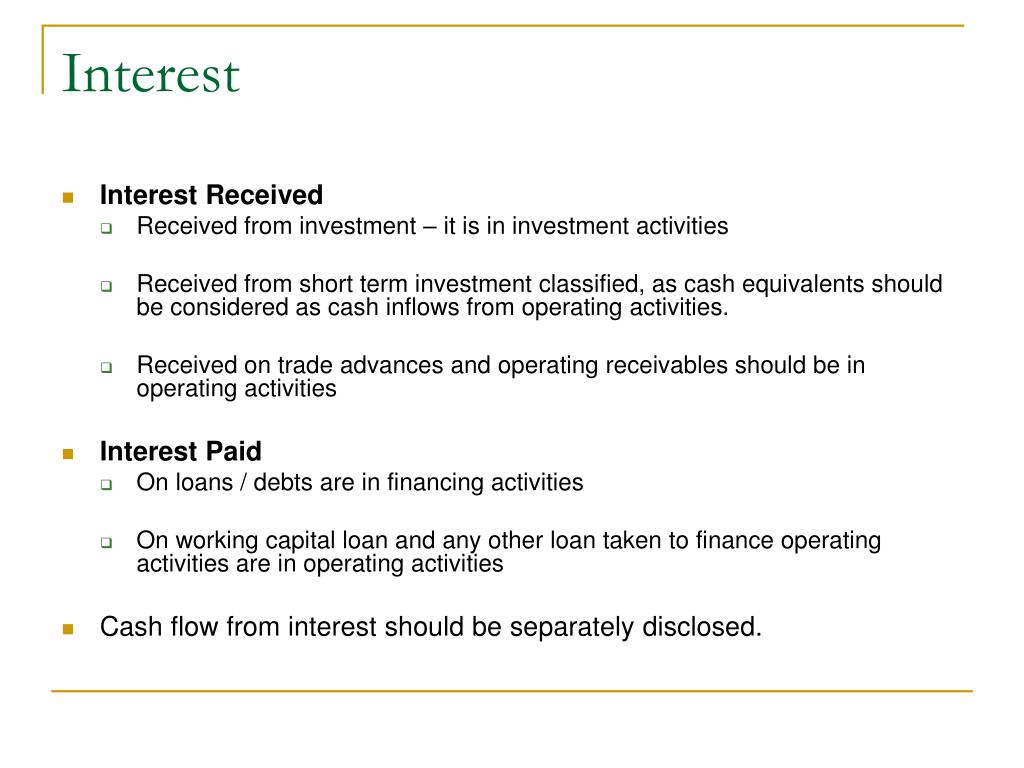

Interest received and dividends received are often classified as operating activities for non-financial companies.This is because these receipts are viewed as a consequence of the company's regular business operations, especially if the investments generating this income are short-term or are used for working capital purposes.

The Financial Accounting Standards Board (FASB) provides guidance on these classifications.Investing Activities: Acquisition and Disposal of Assets

Investing activities involve the purchase and sale of long-term assets and other investments not included in cash equivalents.

This section reflects decisions related to the company's capital expenditures and strategic investments.For financial institutions, such as banks and insurance companies, interest and dividends received might also be classified as operating activities, given that investing is their primary revenue-generating activity. However, for most non-financial companies, if the investment is considered long-term and strategic, any associated interest or dividend income might be classified as an investing activity. This is particularly true if the investment is held for capital appreciation rather than immediate income generation.

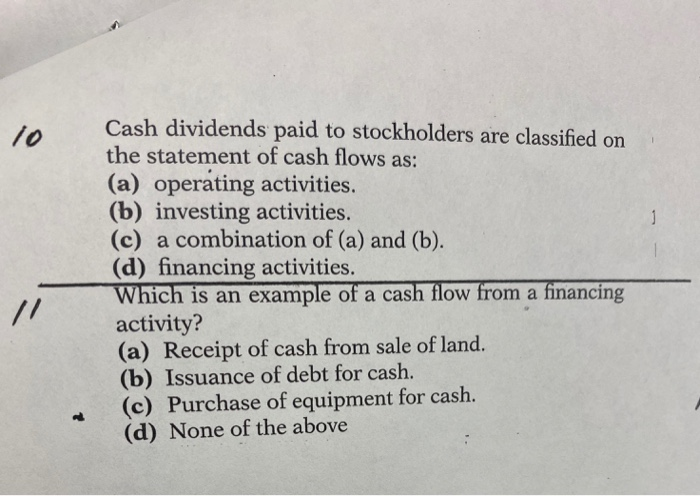

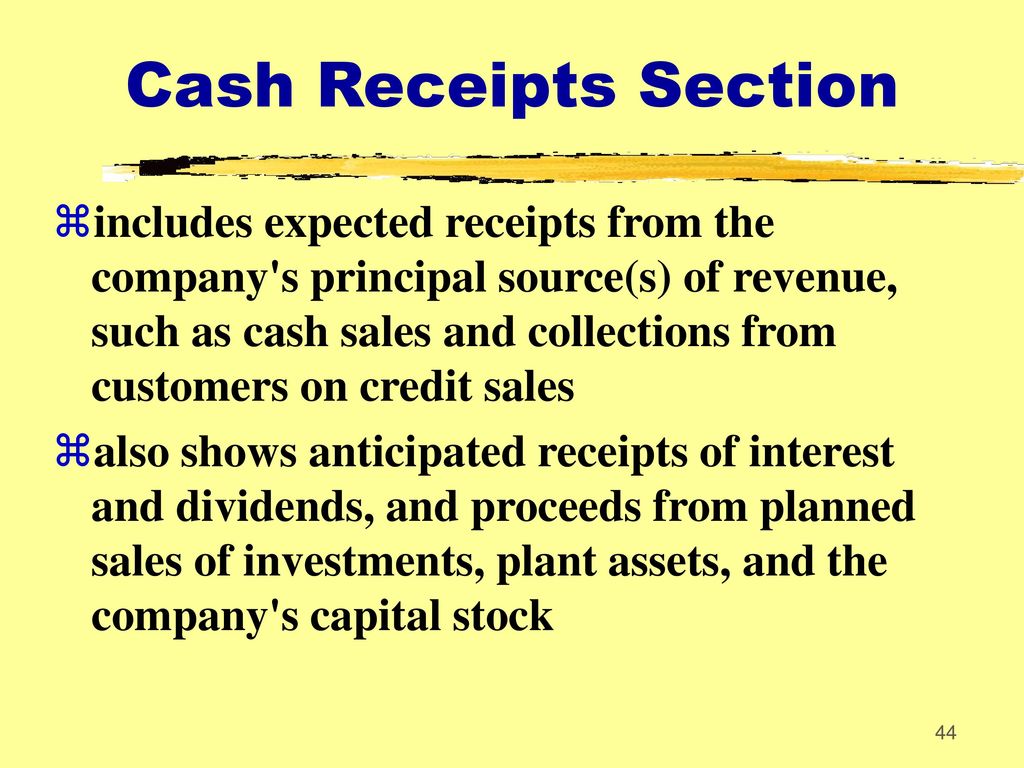

Financing Activities: Capital Structure Management

Financing activities relate to how a company raises capital and repays its creditors and investors.

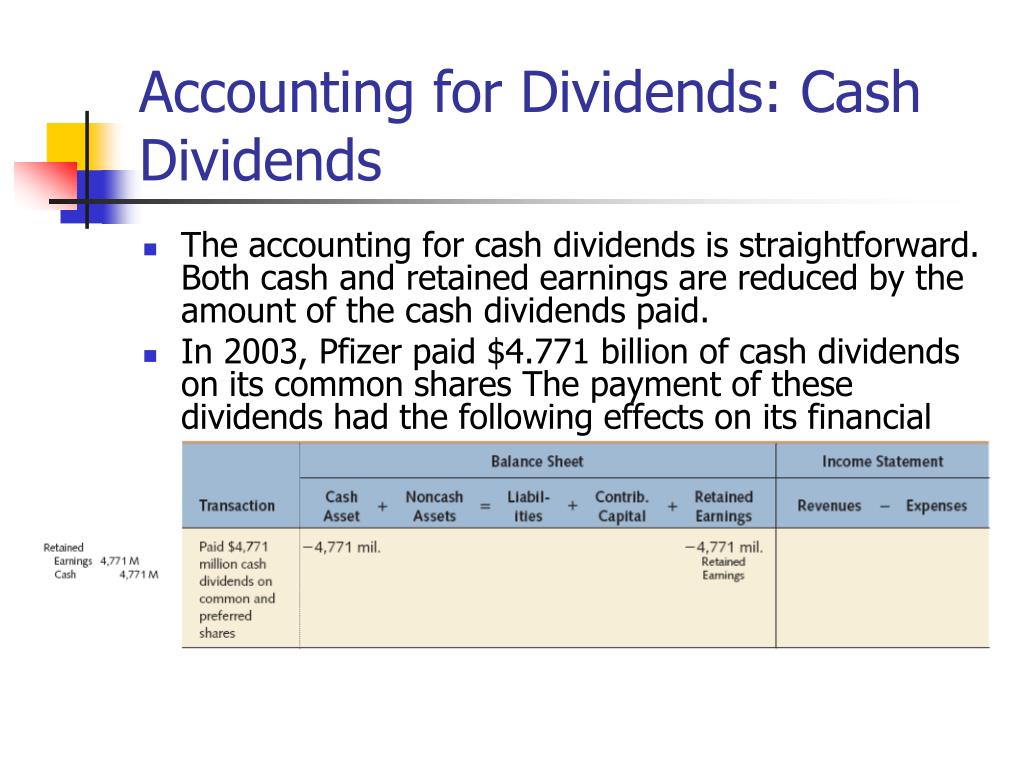

This includes transactions involving debt, equity, and dividends paid to shareholders.Interest payments are almost universally classified as either operating or financing activities, never investing. Dividends paid are always classified as financing activities. How interest receipts are handled depends on the nature of the business receiving them.

Accounting Standards: Navigating the Rules

The classification of interest and dividends is governed by accounting standards, primarily provided by the FASB in the United States and the International Accounting Standards Board (IASB) internationally.

These standards aim to ensure consistency and comparability in financial reporting.Both bodies offer similar guidance, but subtle differences can sometimes lead to varying interpretations. Companies need to carefully consider the specific circumstances of their operations and consult these standards when making these classifications.

Practical Implications: Analyzing Financial Statements

The classification of interest and dividends can significantly impact financial ratios and the overall perception of a company's financial health.

Classifying these receipts as operating activities will boost the company's operating cash flow, potentially painting a rosier picture of its core business performance.Conversely, classifying them as investing activities may highlight the company's strategic investment decisions. Analysts and investors should carefully scrutinize these classifications and understand the underlying rationale to form an accurate assessment. Misinterpretation can lead to flawed investment decisions.

Divergent Practices and Industry Specifics

Practices can vary across industries, particularly between financial and non-financial sectors. Financial institutions, like banks, often treat interest and dividends as core operating revenue. For a non-financial entity, the source and nature of the investment are crucial considerations.

The industry context shapes how companies interpret and apply accounting standards. Consistency in classification is vital for meaningful comparison of financial statements within the same industry.

Looking Ahead: Evolving Accounting Standards

Accounting standards are continually evolving to address emerging business practices and ensure financial statements provide a fair and accurate representation of a company's performance.

The FASB and IASB regularly review existing standards and issue new guidance to address complexities and enhance comparability.Stakeholders must remain vigilant and stay abreast of these changes to accurately interpret financial information.

Accurate classification in the statement of cash flows is paramount for understanding a company's financial dynamics.The future may see further refinements in the guidance concerning the classification of interest and dividend receipts, especially with the increasing complexity of investment vehicles and global business operations. Staying informed ensures accurate financial analysis and sound investment decisions in an ever-changing economic landscape.

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)