Cheap Full Coverage Car Insurance For 18 Year Olds

Skyrocketing car insurance premiums are hitting 18-year-old drivers hard. Finding affordable full coverage is now a top priority for young drivers and their families nationwide.

This article breaks down how 18-year-olds can navigate the complex insurance market to secure the cheapest full coverage options available, focusing on practical strategies and verified resources.

The Reality of Full Coverage Costs

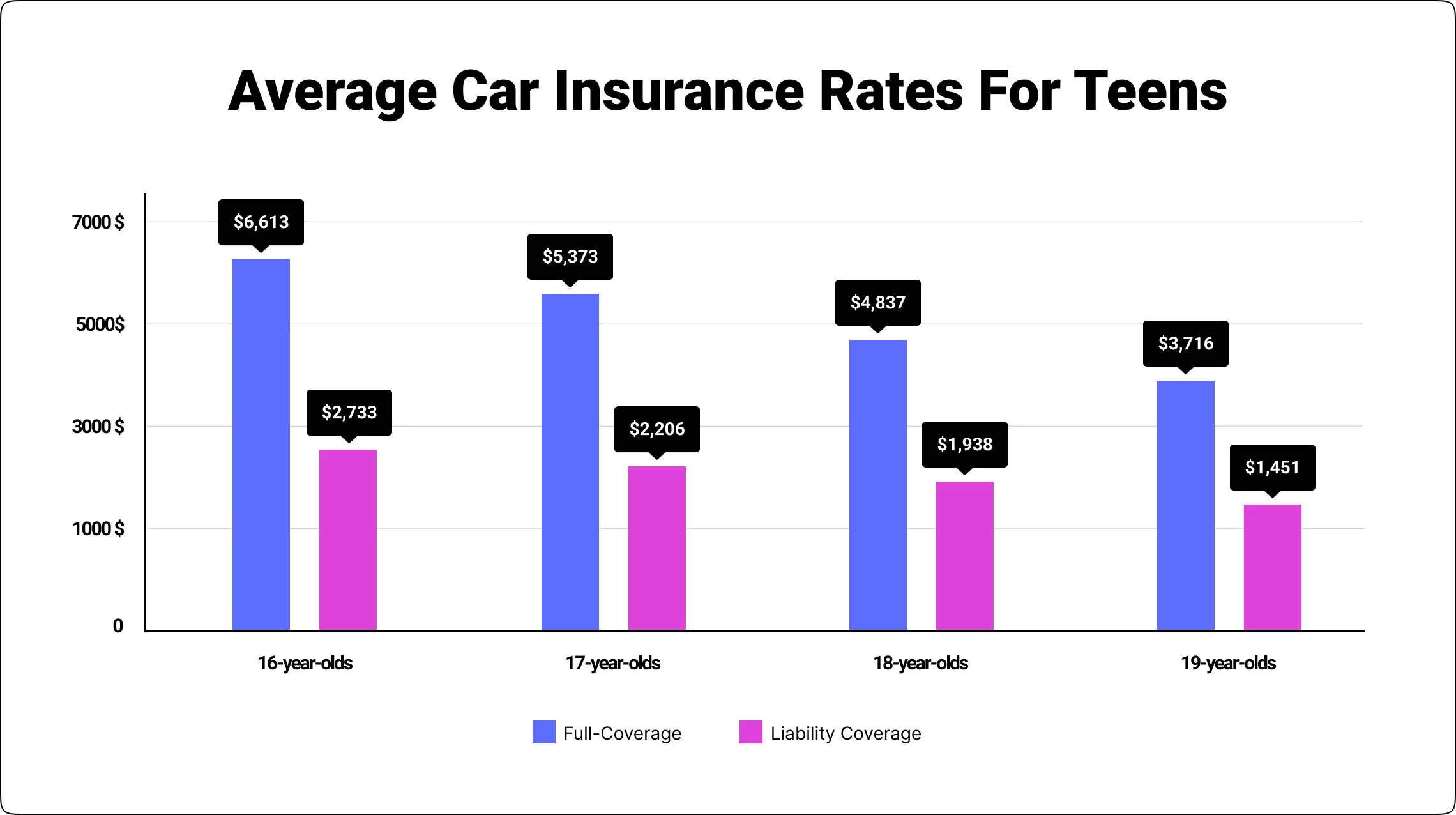

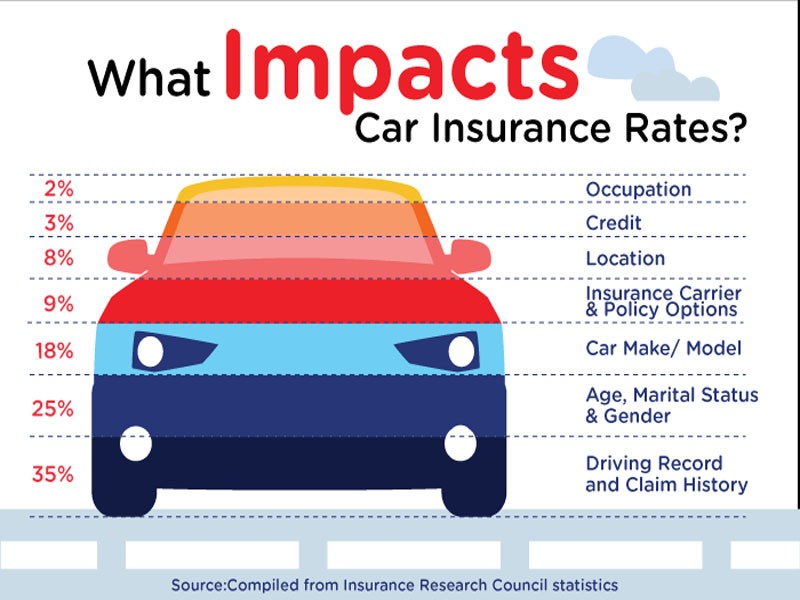

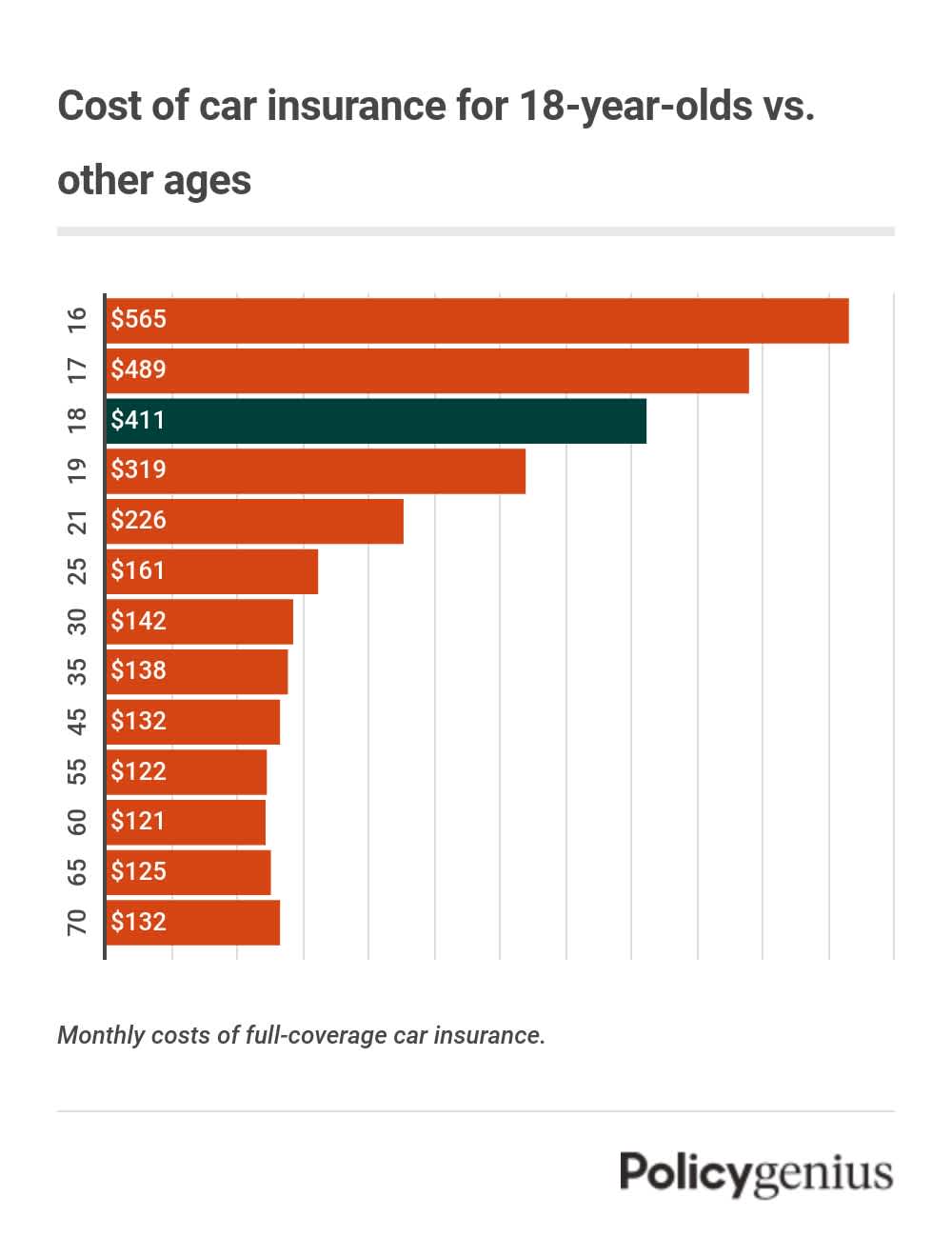

According to a recent study by the Insurance Information Institute (III), 18-year-old drivers face some of the highest car insurance rates. The reason is that insurance companies statistically categorize them as high-risk due to their lack of driving experience. Full coverage, including collision and comprehensive, adds significantly to these costs.

Data from ValuePenguin indicates that the average annual cost for full coverage for an 18-year-old can range from $3,000 to over $6,000, depending on location and driving record. This number can be daunting, but affordable options exist.

Strategies for Securing Lower Premiums

1. Comparison Shopping is Key

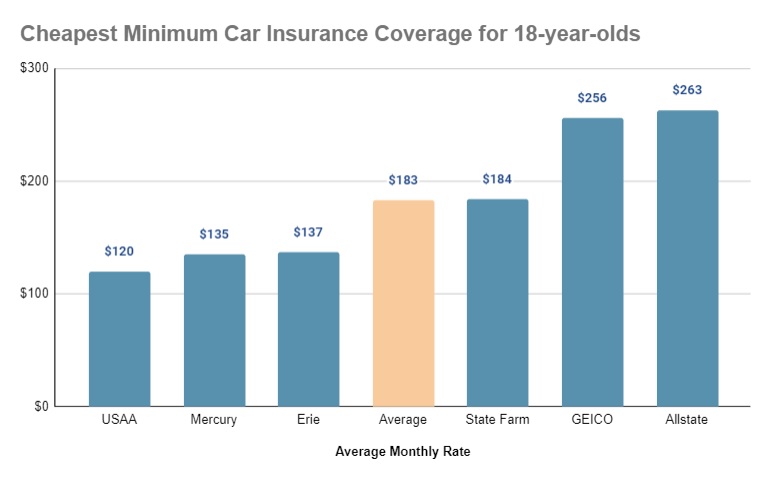

Don't settle for the first quote you receive. Experts at NerdWallet advise comparing rates from at least three to five different insurance companies. Online comparison tools can streamline this process.

Websites like The Zebra and QuoteWizard allow you to enter your information once and receive multiple quotes from various insurers.

2. Leverage Discounts

Insurers offer a variety of discounts. Look for discounts for good grades, safe driving courses, being a dependent on a parent's policy, and having anti-theft devices installed in the vehicle. State Farm and Geico are known for offering several discount options.

Specifically, a "good student" discount can lower premiums significantly, often requiring a GPA of 3.0 or higher.

3. Increase Your Deductible

A higher deductible means you pay more out-of-pocket in the event of an accident, but it also lowers your monthly premium. Consider increasing your deductible from $500 to $1,000 to save money.

However, ensure you can comfortably afford the higher deductible should you need to file a claim.

4. Consider Telematics Programs

Many insurers offer telematics programs that track your driving habits through a mobile app or device. Safe driving can lead to significant discounts. Progressive's Snapshot and Allstate's Drivewise are popular examples.

These programs monitor factors like speeding, hard braking, and nighttime driving.

5. Stay on Your Parents' Policy

If possible, remaining on your parents' insurance policy can be much cheaper than obtaining your own. However, this may impact their rates and coverage options. Consult with your family's insurance agent to explore the best option.

This is especially beneficial if your parents have a long history of safe driving and have accumulated discounts.

Verified Resources and Next Steps

The National Association of Insurance Commissioners (NAIC) provides consumer guides and resources for understanding car insurance. Visit their website at naic.org for unbiased information.

Contact multiple insurance agents directly to discuss your specific needs and receive personalized quotes. Don't hesitate to ask about any potential discounts or payment plans.

Young drivers and their families must act now to explore these strategies and resources. Continuous monitoring of insurance rates and diligent comparison shopping are crucial to securing affordable full coverage.