Determining Your Current Financial Situation Involves Which Of The Following

In today's complex economic landscape, understanding your financial standing is no longer a luxury, but a necessity. From managing debt to planning for retirement, a clear picture of your current financial health is the foundation upon which all successful financial decisions are built. But where do you even begin to assess something so personal and often overwhelming?

This article delves into the essential steps involved in determining your current financial situation. We'll break down the key components, from meticulously tracking income and expenses to evaluating assets and liabilities. This comprehensive guide will equip you with the knowledge and tools needed to take control of your finances and navigate the path toward a secure future.

Building Your Financial Foundation: The Core Components

A comprehensive financial assessment encompasses several key areas. These areas provide a holistic view of your current financial state and serve as a springboard for future financial planning. Let's explore these in detail.

1. Income and Expenses: The Cash Flow Chronicle

Understanding your cash flow is paramount. This involves meticulously tracking all sources of income, from salaries and investments to side hustles and benefits.

Similarly, you need to account for all expenses. Categorizing expenses (e.g., housing, transportation, food, entertainment) allows for a more granular understanding of where your money is going.

Tools like budgeting apps, spreadsheets, or even a simple notebook can be invaluable in this process. The goal is to determine if you're spending more than you earn, a critical indicator of financial instability.

2. Assets and Liabilities: The Net Worth Snapshot

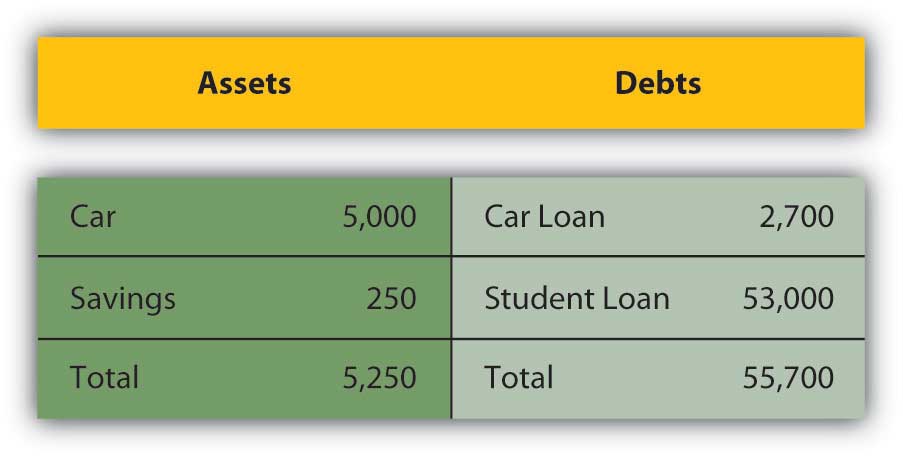

Calculating your net worth provides a snapshot of your overall financial position at a given point in time. This involves listing all your assets – what you own – and your liabilities – what you owe.

Assets include cash, savings, investments (stocks, bonds, real estate), and valuable personal property. Liabilities encompass debts like mortgages, student loans, credit card balances, and personal loans.

Subtracting your total liabilities from your total assets gives you your net worth. A positive net worth indicates financial health, while a negative net worth suggests that you owe more than you own.

3. Debt Analysis: Unpacking Your Obligations

Analyzing your debt is crucial for identifying potential risks and developing a plan for repayment. This involves understanding the types of debt you have, the interest rates you're paying, and the repayment terms.

Prioritize high-interest debt, such as credit card balances, as these can quickly erode your financial stability. Explore strategies for debt consolidation or balance transfers to lower interest rates and accelerate repayment.

The Consumer Financial Protection Bureau (CFPB) offers valuable resources and tools for understanding and managing debt. Their website provides unbiased information on various debt-related topics.

4. Credit Score Assessment: Your Financial Reputation

Your credit score is a numerical representation of your creditworthiness. Lenders use it to assess the risk of lending you money. A higher credit score generally translates to better interest rates and loan terms.

You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Review these reports carefully for any errors or inaccuracies.

Understanding the factors that influence your credit score, such as payment history, credit utilization, and length of credit history, is essential for maintaining a healthy credit profile.

5. Insurance Coverage: Protecting Your Assets

Adequate insurance coverage is crucial for protecting yourself and your assets from unexpected events. This includes health insurance, auto insurance, homeowners or renters insurance, and life insurance.

Assess your insurance needs based on your individual circumstances. Consider factors such as your age, health, family status, and assets when determining the appropriate level of coverage.

Shop around for insurance policies from different providers to compare rates and coverage options. Regularly review your insurance policies to ensure they still meet your needs.

6. Retirement Planning: Securing Your Future

Retirement planning should be an integral part of your overall financial assessment, regardless of your age. This involves estimating your future retirement expenses and determining how much you need to save to meet those expenses.

Take advantage of employer-sponsored retirement plans, such as 401(k)s or 403(b)s, especially if they offer matching contributions. Consider opening an Individual Retirement Account (IRA) to supplement your retirement savings.

Consult with a financial advisor to develop a comprehensive retirement plan tailored to your specific goals and risk tolerance. The Social Security Administration (SSA) provides resources and tools for estimating your future Social Security benefits.

Turning Knowledge into Action: What to Do Next

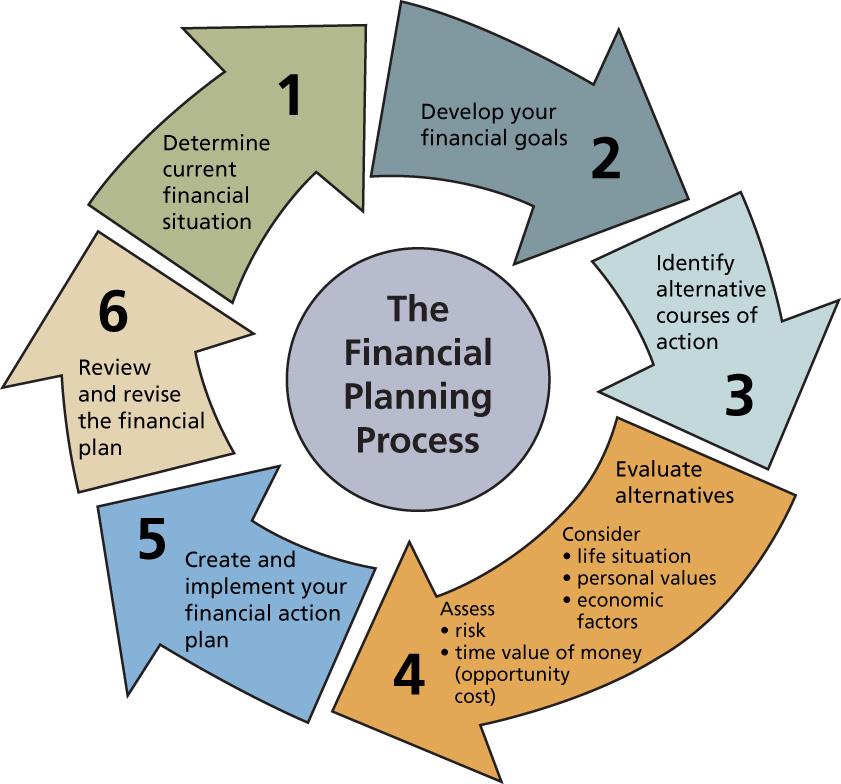

Once you have a clear understanding of your current financial situation, the next step is to develop a plan for achieving your financial goals. This involves setting realistic goals, creating a budget, and regularly monitoring your progress.

Consider seeking guidance from a qualified financial advisor. A financial advisor can help you develop a personalized financial plan, manage your investments, and navigate complex financial decisions.

Remember that financial planning is an ongoing process. Regularly review your financial situation and make adjustments as needed to stay on track toward achieving your goals. Proactive financial management is the key to long-term financial security and peace of mind.