Dfcu Home Equity Line Of Credit

Urgent Alert: Dfcu Bank has announced significant changes to its Home Equity Line of Credit (HELOC) program, impacting thousands of Ugandan homeowners. These changes, effective immediately, involve increased interest rates and stricter eligibility requirements.

The alteration to Dfcu's HELOC offerings is a pivotal moment for borrowers. It affects their access to credit and potentially alters long-term financial planning. This shift necessitates immediate attention from existing and potential HELOC holders.

Dfcu HELOC Program: What's Changing?

Effective immediately, Dfcu Bank has increased the interest rates on its HELOCs. The previous variable rate, tied to the prevailing prime lending rate, has been adjusted upwards by approximately 1.5%. This increase impacts both new and existing borrowers.

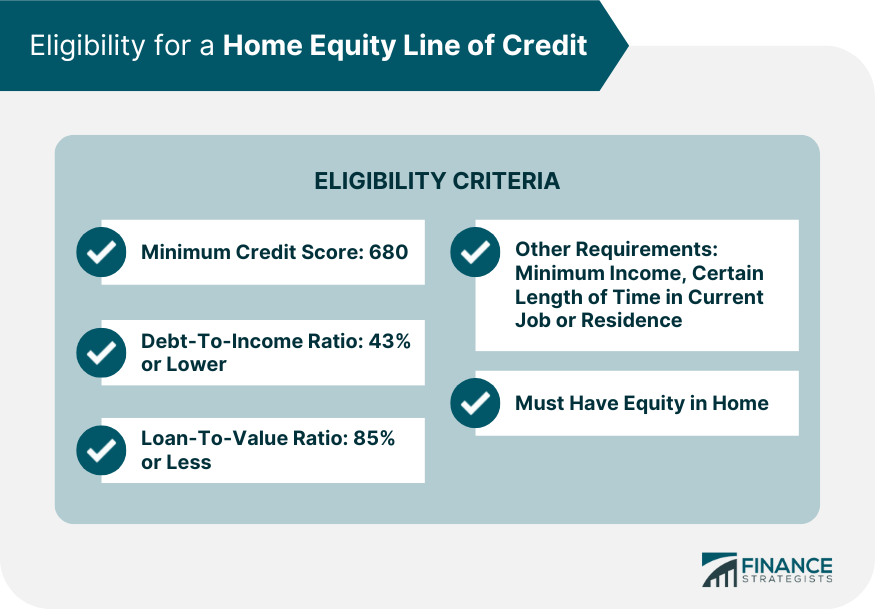

Furthermore, eligibility criteria for new HELOC applications have been tightened. The loan-to-value (LTV) ratio, a crucial factor in determining approval, has been reduced from 80% to 70%. This means homeowners can borrow less against their home's equity.

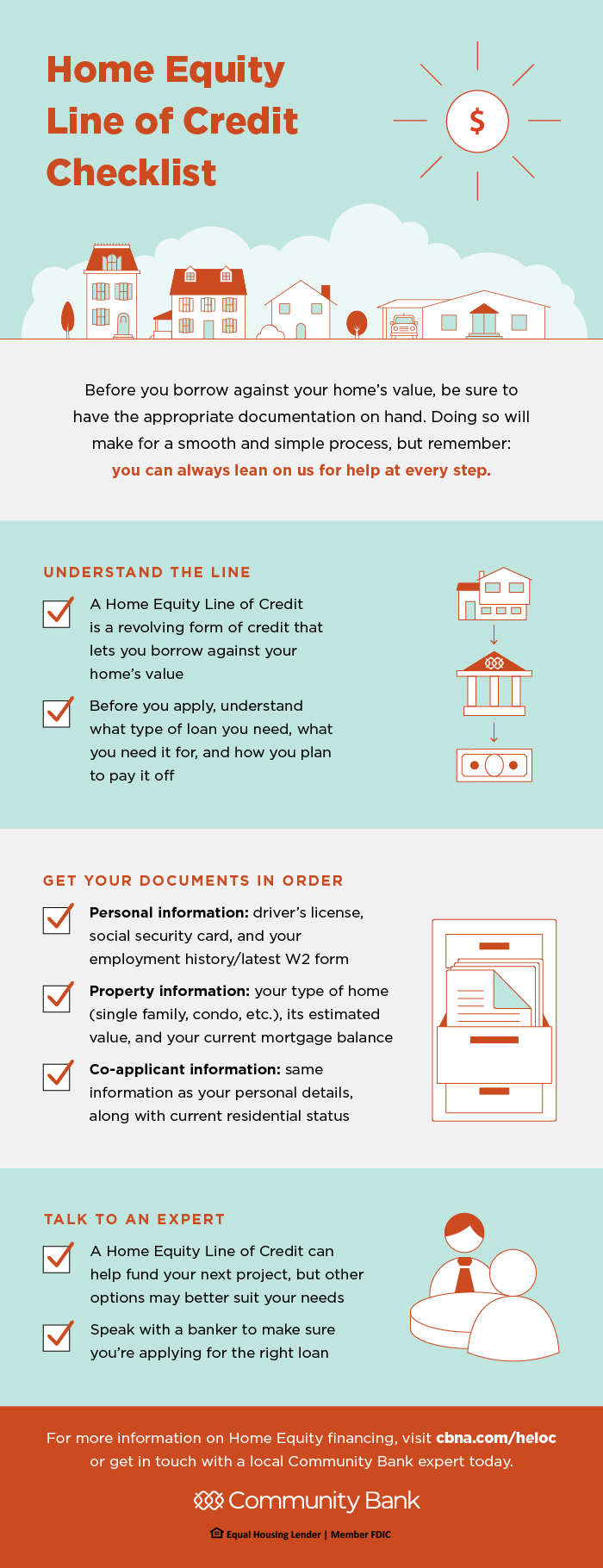

Applicants will now face more stringent income verification processes. Dfcu is requiring detailed documentation of income sources and employment history to mitigate risk associated with lending.

Key Details of the Changes

Who is Affected? Current and prospective Dfcu HELOC holders across Uganda. This includes individuals using HELOCs for home improvements, debt consolidation, or other financial needs.

What are the Specific Changes? Increased interest rates and stricter eligibility criteria. The LTV ratio is down to 70% and stricter income verification are now in effect.

Where does this Apply? All Dfcu Bank branches throughout Uganda. This is a nationwide policy change affecting all Dfcu HELOC products.

When did these Changes Take Effect? Immediately, as of the official announcement date. Borrowers should be aware of these changes immediately.

How will Existing Borrowers be Impacted? Existing borrowers will see their interest rates adjusted on their next billing cycle. Dfcu is sending notifications to affected customers via email and SMS.

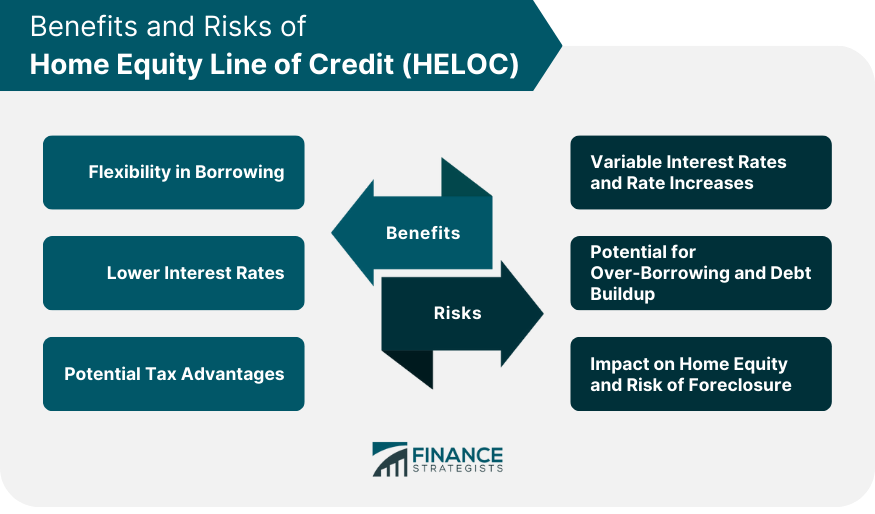

Expert Analysis and Implications

Financial analysts suggest the changes reflect the current economic climate. They point to rising inflation and increased lending risks as potential drivers for Dfcu's decision.

“This move by Dfcu is likely a proactive measure to protect its financial stability,” says Sarah Nakimuli, a leading financial consultant in Kampala. "Higher interest rates and tighter eligibility help manage risk in an uncertain market."

The changes could significantly impact the housing market. Reduced access to HELOCs may slow down home renovations and discourage some homeowners from pursuing large-scale projects.

Borrower Reactions and Concerns

Early reactions from Dfcu customers are mixed. Some express concerns about the increased cost of borrowing and potential financial strain.

“I was planning to use my HELOC for a major home renovation," says David Okello, a Dfcu customer from Jinja. "Now, with the higher interest rates, I'm not sure if I can afford it."

Others acknowledge the need for responsible lending practices. They understand the bank's need to manage risk in the current economic environment.

Dfcu Bank's Official Statement

Dfcu Bank has released an official statement regarding the HELOC program changes. The bank cites the need to align with market conditions and maintain responsible lending standards.

“These adjustments are necessary to ensure the long-term sustainability of our HELOC program,” said Mathias Katamba, CEO of Dfcu Bank, in the statement. "We remain committed to providing access to credit while managing risk effectively."

The bank assures customers that it is committed to providing support during this transition. It urges borrowers to contact their branch representatives with any questions or concerns.

Next Steps for Borrowers

Existing Dfcu HELOC holders should review their loan agreements and assess the impact of the increased interest rates. They should also contact Dfcu to discuss potential options.

Potential borrowers should carefully evaluate their financial situation and explore alternative financing options. They should also compare HELOC offerings from other banks and credit unions.

Stay tuned for further updates and analysis as this situation develops. We will continue to monitor Dfcu's HELOC program and its impact on Ugandan homeowners.