Directions Credit Union Loan Payoff Address

Directions Credit Union, a prominent financial institution serving members across Northwest Ohio and Southeast Michigan, has announced a significant change to its loan payoff address. The alteration, effective immediately, impacts all members seeking to settle their loan balances via mail.

This update necessitates careful attention from borrowers to ensure timely and accurate processing of payments. Understanding the specifics of this change is crucial for avoiding potential delays or misapplications of funds.

New Loan Payoff Address: The Details

The new loan payoff address for Directions Credit Union is: Directions Credit Union, PO Box 670483, Dallas, TX 75267-0483. This address supersedes any previously provided address for loan payoffs.

Members are urged to update their records and inform any third-party bill payment services of the new location. Using the incorrect address could lead to processing delays and potential late fees.

Directions Credit Union emphasizes that this change only affects the mailing address for loan payoffs. Other payment methods, such as online transfers, in-branch payments, and automatic withdrawals, remain unaffected.

Why the Change?

According to a statement released by Directions Credit Union, the change in loan payoff address is part of a strategic initiative to streamline payment processing. Consolidating these operations into a specialized processing center is expected to improve efficiency and accuracy.

The credit union stated that this move will allow them to better manage the volume of loan payoff requests and ensure timely crediting of payments. This is particularly important given the increasing volume of electronic payments and the need for robust security measures.

Furthermore, this centralized system is designed to reduce the risk of errors and improve the overall customer experience. The move aligns with industry best practices for payment processing and security.

Impact on Members

The primary impact on members is the need to update their records with the new loan payoff address. While seemingly a small change, neglecting to do so could result in delays in processing payments.

Members who utilize online bill payment services or mail checks should ensure the correct address is reflected in their accounts. Directions Credit Union recommends verifying the address with their service providers to avoid any issues.

To assist members during this transition, Directions Credit Union has implemented several communication channels. These include email notifications, website updates, and in-branch announcements.

Ensuring a Smooth Transition

Directions Credit Union is taking proactive steps to minimize any inconvenience to its members during this transition. They have published a comprehensive FAQ section on their website addressing common questions and concerns.

Additionally, the credit union's member service representatives are available to assist with any inquiries related to the new loan payoff address. Members can contact them via phone, email, or in person at any branch location.

The credit union has also extended grace periods for late fees incurred due to the address change during the initial transition period. This demonstrates their commitment to supporting members through this adjustment.

Alternative Payment Methods

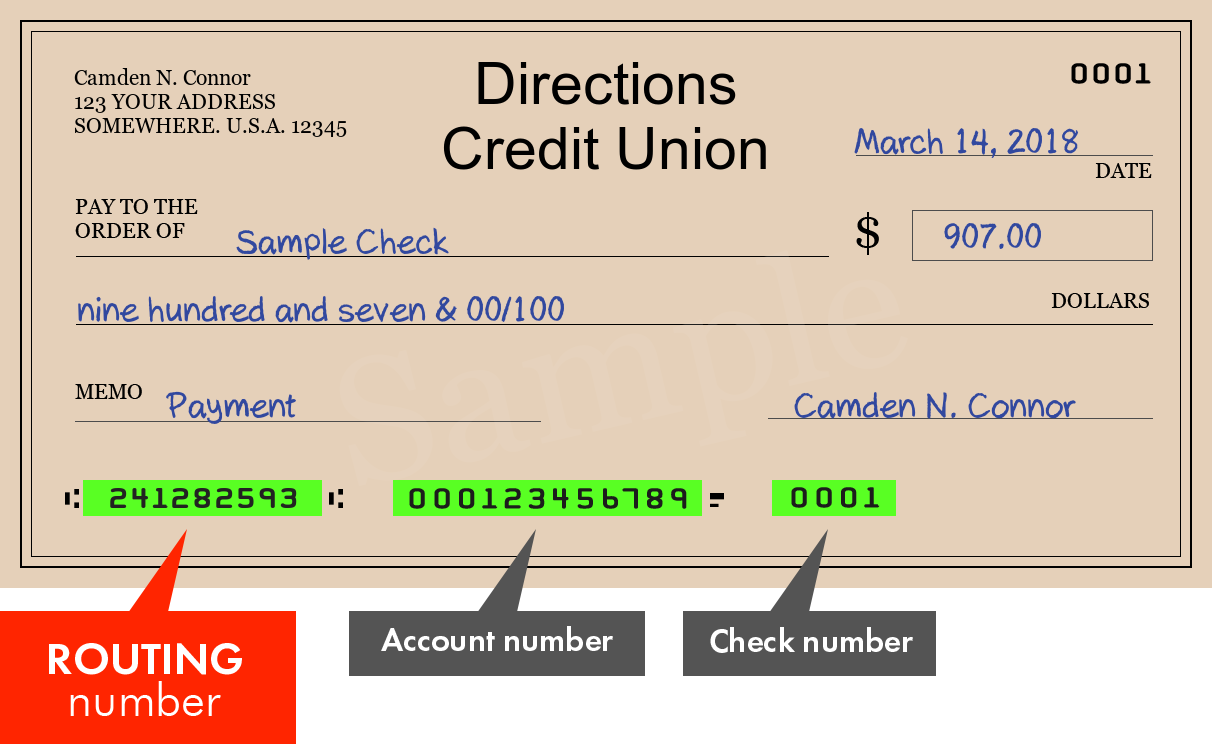

Directions Credit Union offers a variety of convenient payment methods beyond mailing a check. These options provide faster and more secure alternatives for settling loan balances.

Online banking is a popular choice, allowing members to transfer funds directly from their checking or savings accounts. Automatic withdrawals ensure timely payments and eliminate the risk of missed deadlines.

In-branch payments are also available for those who prefer to pay in person. These methods provide flexibility and cater to a wide range of member preferences.

"We understand that changes like this can sometimes be disruptive," said Brian Garwood, CEO of Directions Credit Union. "Our priority is to ensure a smooth transition for our members and provide them with the resources they need to adapt to the new system."

Staying Informed

Directions Credit Union encourages members to stay informed about the change by visiting their website or contacting their member service team. Regularly checking for updates will help ensure a seamless payment process.

Members are also advised to review their loan statements carefully to confirm that payments are being applied correctly. Promptly addressing any discrepancies will help avoid potential issues.

By taking these steps, members can navigate the change in loan payoff address with confidence and maintain a positive relationship with Directions Credit Union.

The change in loan payoff address is a necessary adjustment aimed at improving efficiency and accuracy in payment processing. While it requires members to update their records, the long-term benefits of a streamlined system are expected to outweigh any short-term inconvenience.

Directions Credit Union remains committed to providing exceptional service and supporting its members through this transition. By utilizing the available resources and staying informed, members can ensure a smooth and seamless payment experience.