Discoverpersonalloans Com Apply Personal Invitation Number

Imagine receiving an elegantly designed envelope in the mail, its weight suggesting something more substantial than junk mail. Inside, a personalized invitation beckons, promising financial solutions tailored just for you. It hints at opportunities to consolidate debt, finance a dream project, or simply gain more control over your finances. This invitation, linked to Discoverpersonalloans.com and bearing a unique personal invitation number, represents more than just an offer; it's a potential pathway to achieving personal financial goals.

This article delves into the significance of receiving a personal invitation to apply for a loan through Discover Personal Loans, exploring what it means for consumers and how to navigate the process effectively. We'll unpack the benefits, potential considerations, and the overall landscape of personal loans in today's financial market.

Understanding Personal Loan Invitations

Personal loan invitations, such as those from Discover, are often sent to individuals deemed to have a strong credit profile. These invitations are typically based on pre-screening processes that analyze credit history and other financial factors.

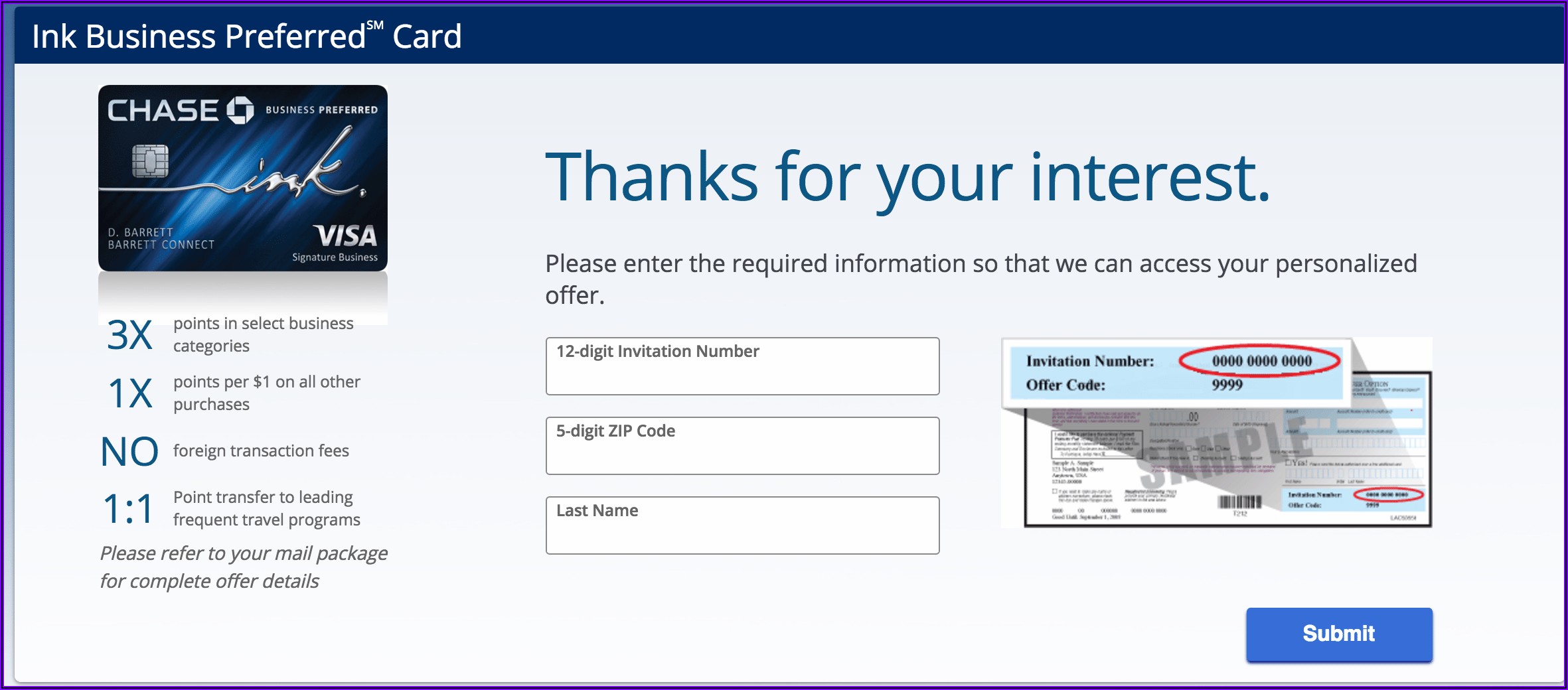

The invitation number serves as a unique identifier, allowing Discover to track the effectiveness of their marketing campaigns and potentially offer customized loan terms based on the recipient's profile. Receiving such an invitation can feel like a validation of one's financial standing.

What Does a Personal Invitation Mean?

A personal invitation doesn't guarantee loan approval, but it does suggest that you meet certain preliminary criteria. Discover, like other lenders, uses these invitations to target individuals they believe are likely to qualify for a loan and repay it responsibly.

It's essential to remember that the terms offered in the invitation are preliminary and subject to change based on a full application review. This includes verifying income, employment, and other financial details.

Why Do Lenders Send Invitations?

Lenders use personal loan invitations as a marketing strategy to attract new customers. These invitations are designed to be more personalized and appealing than generic advertising.

By targeting individuals with specific credit profiles, lenders can increase their chances of acquiring high-quality borrowers. This approach helps them manage risk and grow their loan portfolio.

Discover Personal Loans: A Closer Look

Discover Personal Loans is a well-established player in the personal loan market. They offer unsecured loans, meaning they don't require collateral such as a home or car.

These loans can be used for a variety of purposes, including debt consolidation, home improvement, medical expenses, and other significant life events.

Benefits of Choosing Discover

Discover is known for its transparent terms and no hidden fees. They don't charge origination fees, prepayment penalties, or annual fees.

This transparency can be a significant advantage for borrowers, as it allows them to accurately calculate the total cost of the loan. Discover also provides customer support and resources to help borrowers manage their loans effectively.

Important Considerations

While Discover Personal Loans offer many benefits, it's crucial to compare their rates and terms with those of other lenders. Interest rates on personal loans can vary significantly based on creditworthiness.

Before applying, it's wise to use a personal loan calculator to estimate monthly payments and total interest paid. This can help you determine if the loan is affordable and aligns with your financial goals.

Navigating the Application Process

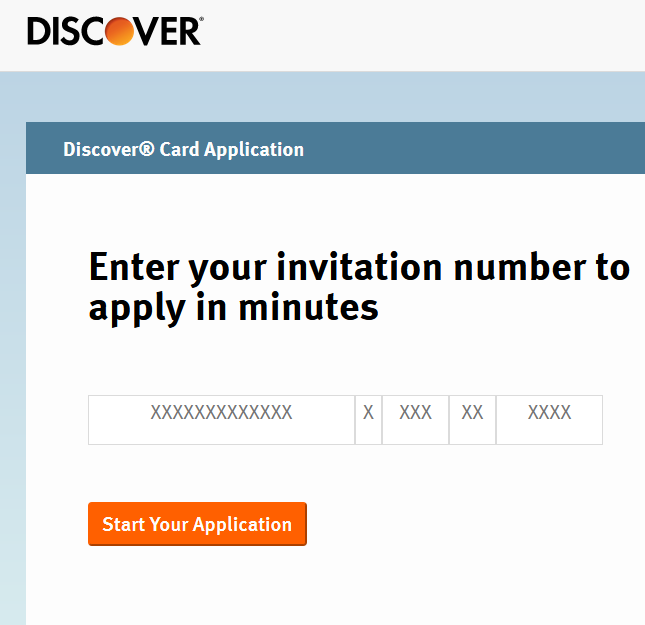

If you receive a personal invitation from Discover and are interested in applying, the process typically involves visiting Discoverpersonalloans.com and entering your personal invitation number. This allows you to access the specific terms and offers tailored to your profile.

The application will require you to provide personal information, including your name, address, date of birth, Social Security number, and employment history. You'll also need to provide details about your income and any existing debts.

Preparing for the Application

Before you start the application, gather all necessary documents, such as your driver's license, Social Security card, and recent pay stubs. Having these documents readily available will streamline the application process.

Be prepared to answer questions about your financial history and current financial situation. Accuracy and honesty are essential throughout the application process.

What Happens After You Apply?

Once you submit your application, Discover will review it to determine your eligibility for a loan. They may check your credit report and verify the information you provided.

If approved, you'll receive a loan offer outlining the interest rate, loan amount, and repayment terms. You'll have the opportunity to review the offer and accept it if it meets your needs.

The Broader Personal Loan Landscape

Personal loans have become increasingly popular in recent years as a flexible financing option. According to data from Experian, the average personal loan balance in the United States has been steadily rising.

This increase reflects the growing demand for personal loans to finance various needs, from debt consolidation to major purchases. The availability of online lenders has also made it easier for consumers to access personal loans.

Understanding Interest Rates

Interest rates on personal loans can vary widely, ranging from single-digit percentages to over 30%. The rate you receive will depend on your credit score, income, and the loan amount.

Borrowers with excellent credit typically qualify for the lowest interest rates. Improving your credit score before applying for a loan can significantly reduce your borrowing costs.

Alternatives to Personal Loans

While personal loans can be a valuable financial tool, it's essential to consider alternative options before applying. For example, if you're looking to consolidate debt, a balance transfer credit card might be a better option.

If you need funds for a specific purchase, such as a home or car, a secured loan might offer lower interest rates than an unsecured personal loan.

Making an Informed Decision

Receiving a personal invitation from Discoverpersonalloans.com can be an exciting opportunity, but it's crucial to approach it with careful consideration. Take the time to research your options, compare rates and terms, and assess your ability to repay the loan responsibly.

By making an informed decision, you can leverage a personal loan to achieve your financial goals and improve your overall financial well-being. Don't let the invitation pressure you; responsible borrowing is key.

Ultimately, the decision to apply for a personal loan should align with your long-term financial strategy. Consult with a financial advisor if you need help evaluating your options and making the right choice for your unique circumstances.