Does Float Me Work With Cash App

The rise of fintech apps has transformed how Americans manage finances, offering quick solutions for everything from budgeting to borrowing. Among these, FloatMe and Cash App have carved out significant niches, promising convenience and accessibility. But a key question lingers for many users: Can these two popular platforms work together seamlessly? The answer is more complex than a simple yes or no, and it significantly impacts users relying on both services for financial stability.

This article delves into the compatibility between FloatMe and Cash App, examining the specific limitations and potential workarounds. We'll analyze official statements, user experiences, and explore why a direct integration remains elusive, offering a comprehensive overview for anyone navigating these financial tools. The information presented is designed to empower readers to make informed decisions regarding their financial strategies.

Understanding FloatMe and Cash App

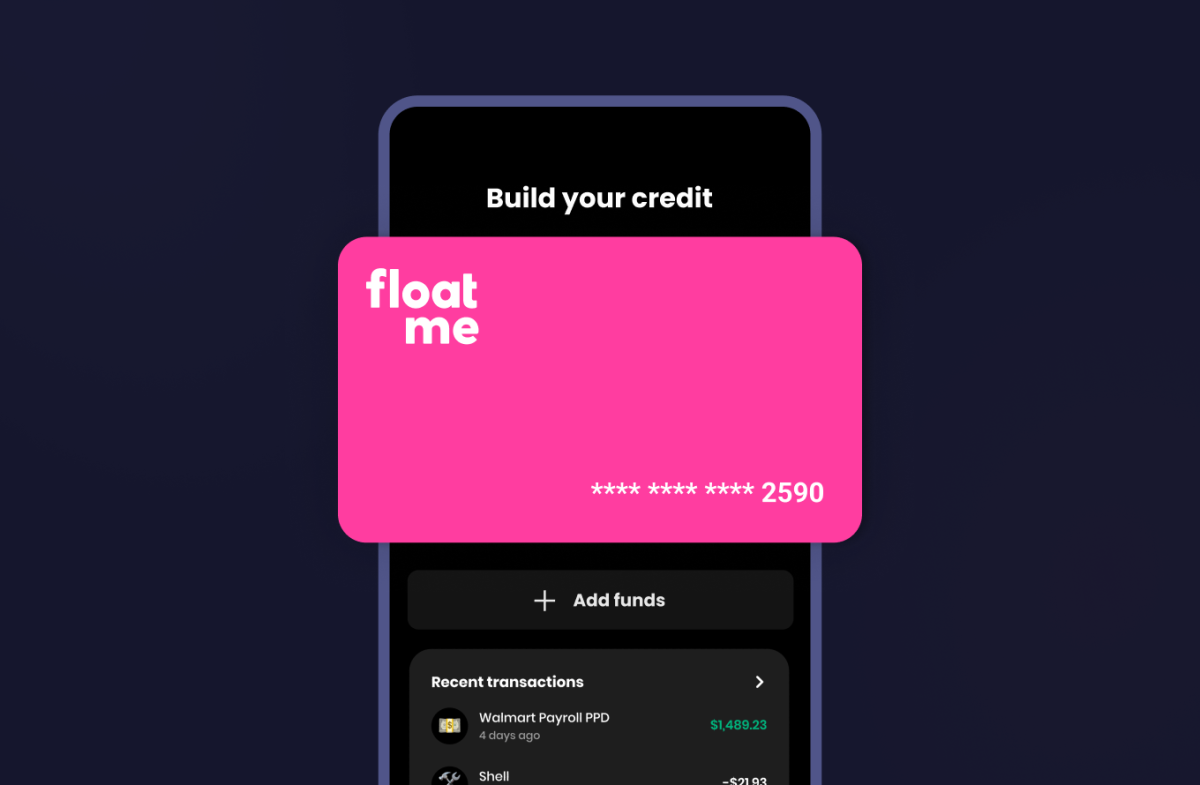

FloatMe is a service designed to provide small, interest-free cash advances to help users avoid overdraft fees. Its core functionality revolves around connecting to a user's bank account to assess their financial standing and offer eligible advances. This helps to mitigate overdraft fees or provide small emergency cash.

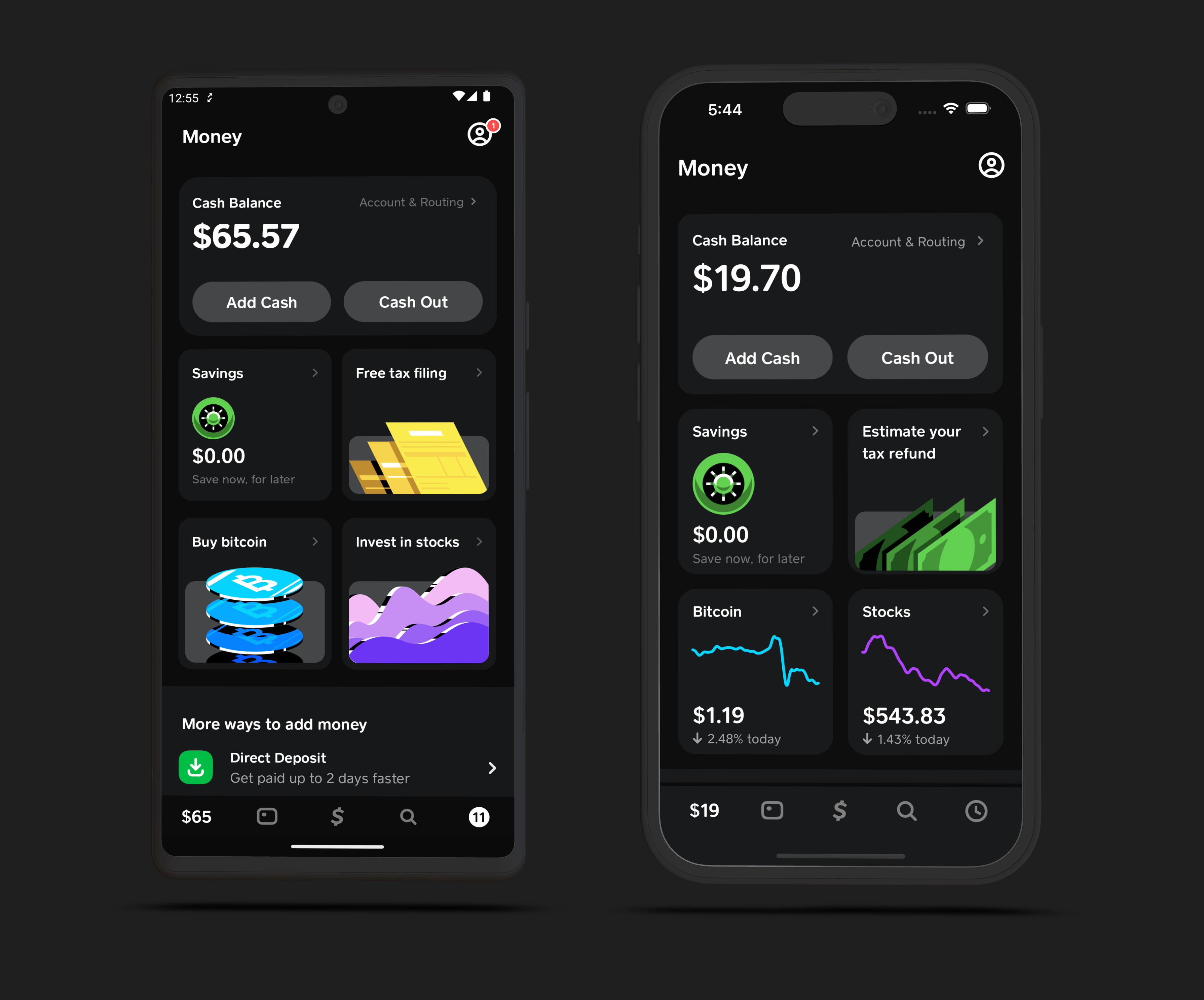

Cash App, on the other hand, functions as a comprehensive mobile payment service developed by Block, Inc. (formerly Square, Inc.). It enables users to send, receive, and invest money, and even offers a debit card for spending funds held within the app. Cash App is used by millions for everyday transactions and is increasingly popular for receiving payments and managing money.

The Compatibility Question: Direct Integration

The primary question at hand is whether users can directly link their Cash App accounts to FloatMe for receiving advances or for repayment purposes. Unfortunately, direct integration between FloatMe and Cash App is not supported. This limitation stems from the way FloatMe verifies accounts.

FloatMe's system relies on connecting to traditional bank accounts to assess factors like account history, income regularity, and spending patterns. Cash App, while offering banking-like features, isn't treated as a traditional bank from the perspective of services like FloatMe.

Workarounds and Alternative Solutions

Despite the lack of direct integration, there are indirect methods users can employ to leverage both platforms. A common workaround involves linking a traditional bank account to both FloatMe and Cash App. This allows for transferring funds between the platforms.

First, you receive your FloatMe advance to the linked bank account. Then, transfer those funds from your bank account to your Cash App account. This allows users to indirectly get funds into Cash App from FloatMe, albeit with an extra step.

Using a Bank as an Intermediary

This workaround necessitates having a bank account that is compatible with both FloatMe and Cash App. Most major banks in the United States support linking with both platforms, but it's advisable to confirm compatibility with your specific bank. Check with your bank's support to confirm the connection to both FloatMe and Cash App.

Bear in mind that transfers between your bank account and Cash App may take a few business days. This delay should be factored into your financial planning, especially when relying on FloatMe to avoid overdrafts.

Considerations Regarding Fees and Limits

When using a bank as an intermediary, it's crucial to be aware of potential transfer fees and limits imposed by both your bank and Cash App. Some banks may charge fees for transferring funds electronically, particularly for instant transfers.

Cash App also has limits on the amount of money you can send and receive, which may vary depending on your verification status. Exceeding these limits could result in delays or restrictions on your account. It is advised to check with Cash App for the most up-to-date transfer limits.

Official Stances and User Experiences

FloatMe's official documentation and support channels clearly state that direct Cash App integration is not currently supported. They encourage users to link a traditional bank account for receiving advances and making repayments.

Online forums and social media platforms are filled with user discussions regarding the compatibility of FloatMe and Cash App. Many users express frustration over the lack of direct integration, highlighting the inconvenience of needing a separate bank account as an intermediary.

These online discussions also reveal instances where users encountered issues with transfers between their bank accounts and Cash App, further complicating the process. Users have also reported delays in transfers and the need to verify banking details.

Why No Direct Integration? Potential Reasons

The absence of direct integration likely stems from a combination of technical and risk-related factors. FloatMe's risk assessment algorithms rely on analyzing detailed transaction data from traditional bank accounts, which Cash App doesn't fully provide in the same format.

There are also regulatory considerations. Fintech companies operate within a complex web of regulations, and integrating with platforms like Cash App may introduce additional compliance challenges. This is why third-party app integrations are carefully vetted and are not always implemented due to complexity.

Moreover, FloatMe may prioritize integrations with larger banking institutions to streamline its operations and minimize potential fraud risks. Prioritizing larger institutions can lead to greater efficiency and reduced fraud. This can explain why smaller apps such as Cash App might not be a priority.

Looking Ahead: Potential for Future Integration

While direct integration is not currently available, the future may hold possibilities for collaboration between FloatMe and Cash App. As fintech evolves, and as Cash App continues to expand its banking-like features, a direct integration could become more feasible. This could involve FloatMe creating an API and integrating with Cash App to work seamlessly.

Changes in banking regulations and advancements in data security could also pave the way for smoother integration between different financial platforms. Should financial platforms adopt a universal data and risk protocol, compatibility could improve.

Until then, users will need to rely on the existing workaround of using a traditional bank account as an intermediary. It is crucial for users to regularly check official announcements from both companies for any updates on potential integrations. Always use caution when linking financial accounts to external platforms.

:max_bytes(150000):strip_icc()/06_Cash_App-fb37676d895347fba391a35b2631f684.jpg)