Economic Value Creation Is Best Expressed As

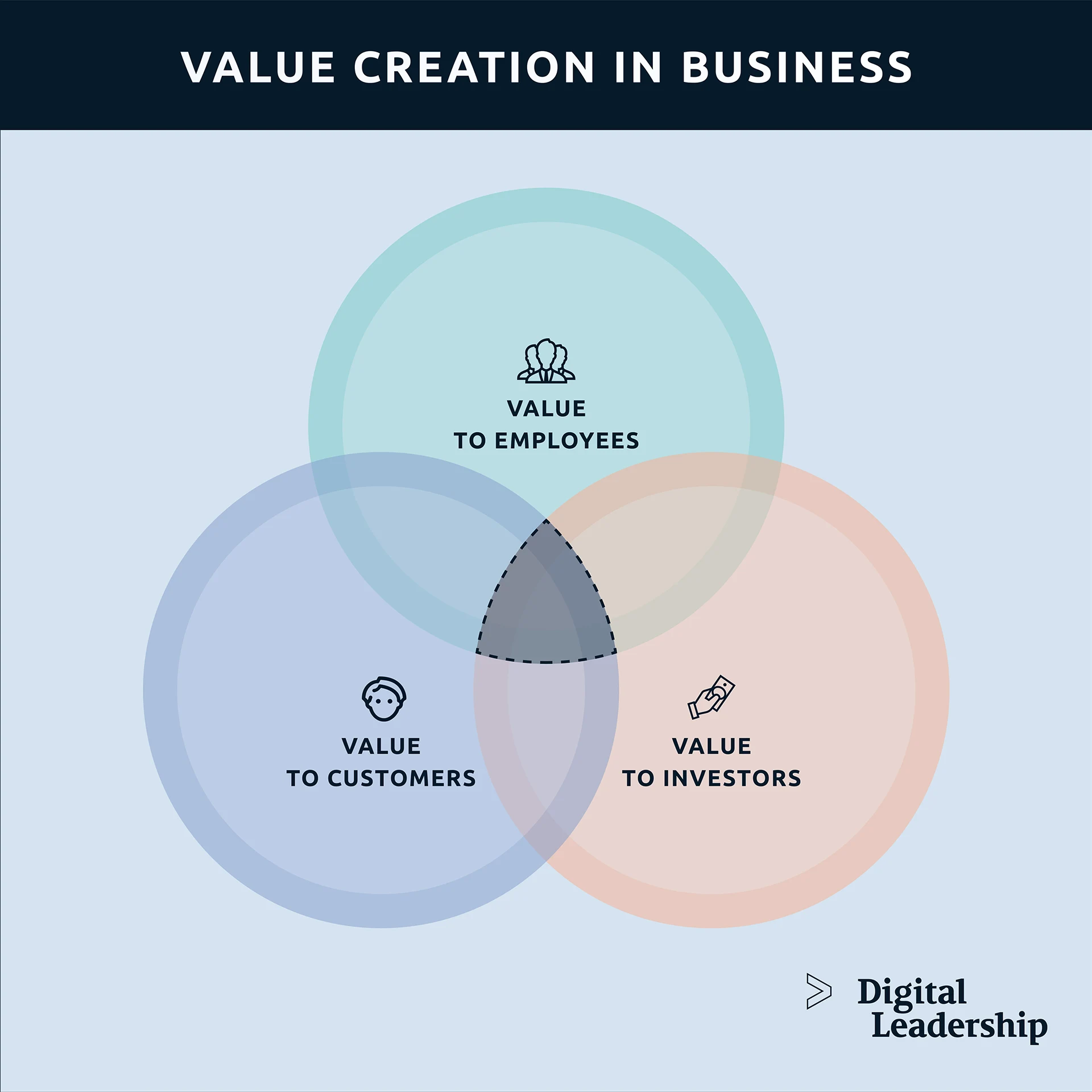

Economists and financial analysts are urgently reassessing traditional metrics, driven by rapid technological advancements and evolving market dynamics. A consensus is emerging: Economic Value Creation (EVC) is best expressed as a holistic, stakeholder-centric model, not merely profit maximization.

This shift recognizes that long-term value stems from benefits accruing to employees, customers, communities, and shareholders alike. Ignoring these interconnected elements risks undermining sustainable growth and profitability.

The Traditional View: Profit Above All

For decades, the dominant paradigm equated EVC with shareholder value. This perspective, championed by economists like Milton Friedman, prioritized maximizing profits as the sole responsibility of a company.

Decisions were often based on short-term gains, potentially neglecting investments in employee development, environmental sustainability, or community engagement. The focus remained squarely on boosting earnings per share.

But, evidence increasingly demonstrates the shortcomings of this narrow definition. Companies that solely prioritize profits often face reputational damage, reduced employee morale, and ultimately, diminished long-term value.

The Emerging Consensus: A Stakeholder-Centric Approach

A new model of EVC is gaining traction: the stakeholder-centric view. This framework acknowledges that a company's success is intertwined with the well-being of all its stakeholders, not just shareholders.

Companies are increasingly measuring their performance beyond financial metrics. Environmental, Social, and Governance (ESG) factors are now critical components of EVC assessments.

Investors, too, are demanding greater transparency and accountability on ESG issues. BlackRock, the world's largest asset manager, has consistently emphasized the importance of sustainable investing and stakeholder engagement.

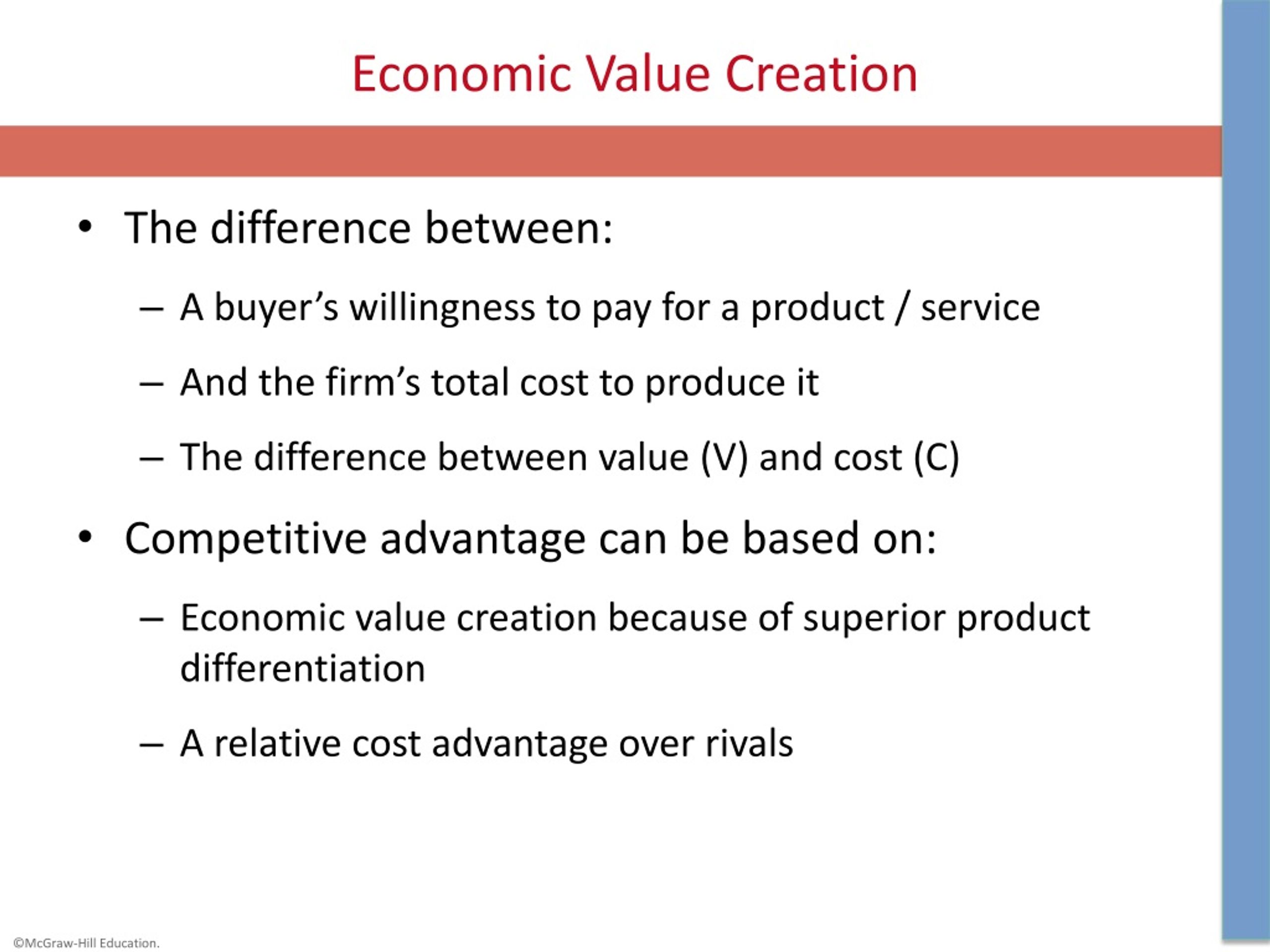

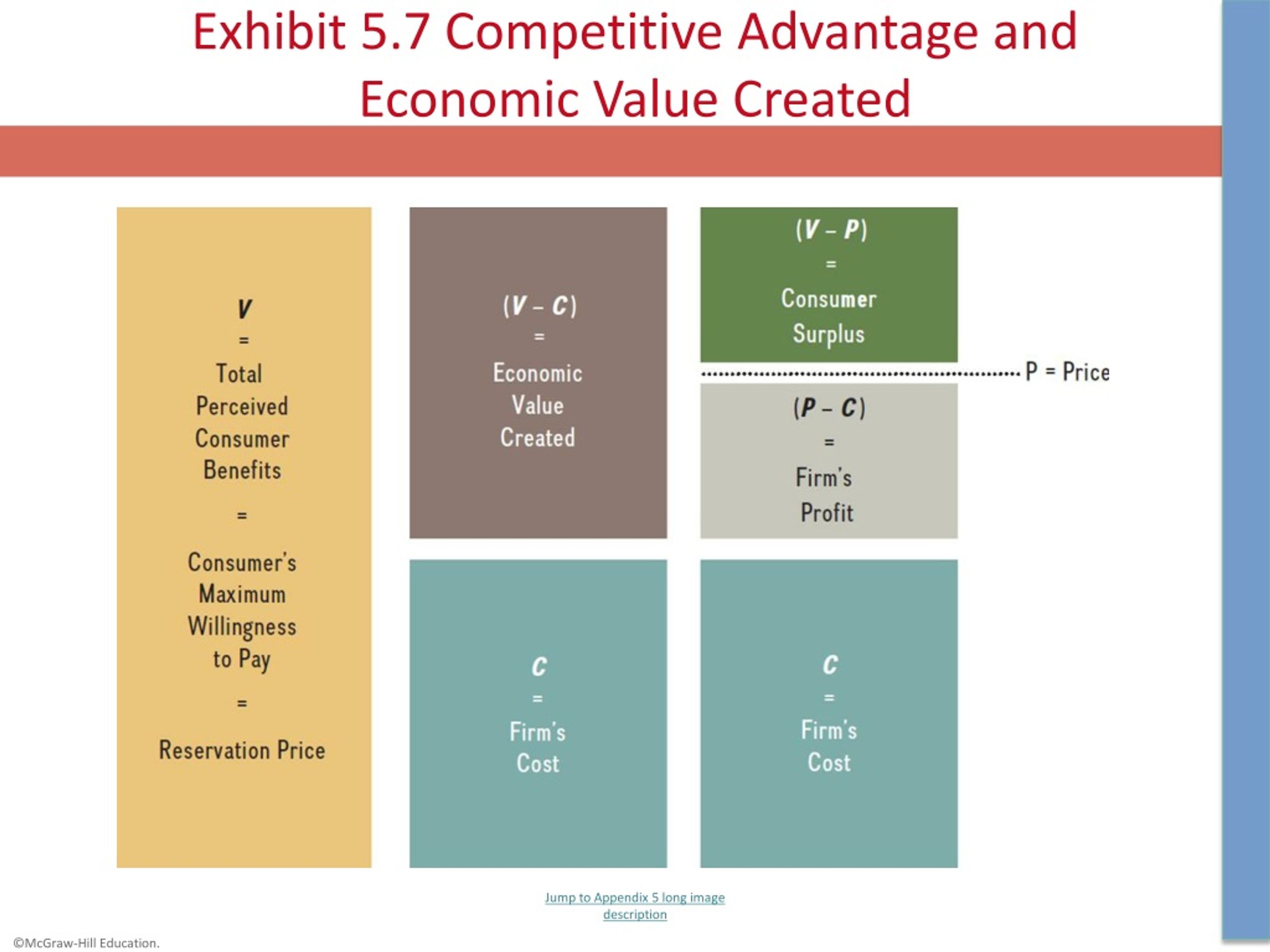

Key Metrics in the New EVC Model

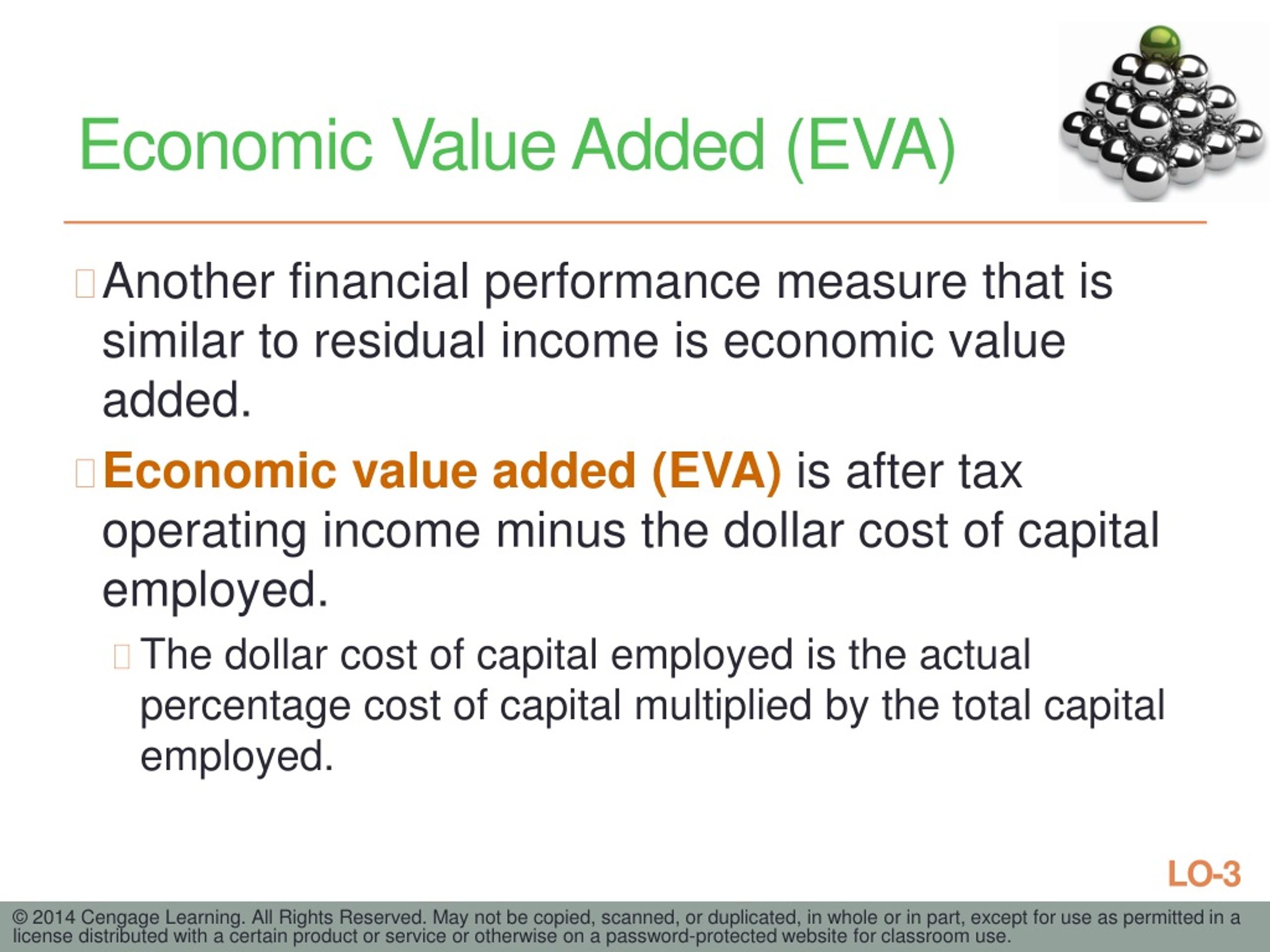

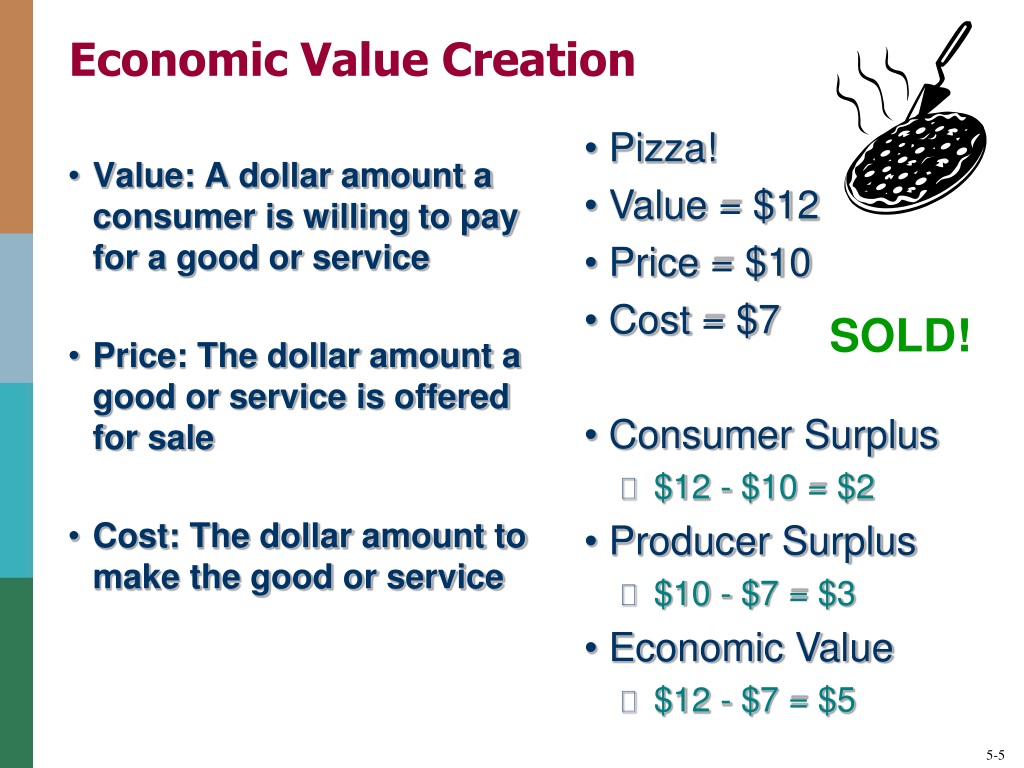

The updated model requires a broader range of indicators. Traditional metrics such as Revenue Growth, Profit Margins, and Return on Invested Capital (ROIC) remain important.

However, they are now supplemented by measures like Employee Satisfaction, Customer Loyalty (Net Promoter Score - NPS), and Carbon Footprint. These indicators provide a more comprehensive picture of a company's overall performance and long-term sustainability.

Furthermore, the Social Return on Investment (SROI) is used to calculate value beyond direct financial gain by incorporating benefits to the community.

Examples of Stakeholder-Centric EVC in Practice

Unilever, for example, has adopted a "Sustainable Living Plan" that aims to decouple growth from environmental impact. They are measuring their success not only by profits, but also by their progress on social and environmental goals.

Patagonia, a clothing company, has long been a champion of environmental activism. Their commitment to sustainability has resonated with consumers and helped build a strong brand reputation.

These examples demonstrate that prioritizing stakeholders can lead to both financial success and positive social impact.

The Data: Quantifying Stakeholder Value

Recent studies underscore the tangible benefits of stakeholder-centric EVC. Research from Harvard Business School, published in 2023, reveals a statistically significant correlation between strong ESG performance and higher long-term financial returns.

Specifically, companies with higher ESG scores experienced an average of 3% higher revenue growth and a 10% reduction in operating costs. These findings provide strong evidence for the financial advantages of prioritizing stakeholders.

Furthermore, data collected by Glassdoor indicates that companies with high employee satisfaction ratings tend to outperform their competitors in terms of market capitalization.

Challenges and Roadblocks

Despite the growing consensus, challenges remain in implementing the new EVC model. Measuring and quantifying stakeholder value can be complex and requires robust data collection and analysis.

Some companies may face resistance from shareholders who are primarily focused on short-term profits. Executive compensation structures also need to be aligned with long-term stakeholder value creation.

There is a risk of greenwashing: where companies overstate the stakeholder value they generate. Independent verification and transparency are crucial to ensure accountability.

Next Steps and Ongoing Developments

The shift towards a stakeholder-centric EVC model is accelerating. Regulatory bodies, such as the Securities and Exchange Commission (SEC), are developing new disclosure requirements for ESG factors.

Investors are increasingly scrutinizing companies' ESG performance and allocating capital accordingly. Companies that fail to embrace this new paradigm risk being left behind.

The ongoing debate and evolution of EVC metrics will continue to refine what constitutes true, sustainable value creation in the modern economy. Further research and collaborative efforts are needed to further refine the model and ensure its effective implementation across all sectors.