How Do I Add Someone To My Wells Fargo Account

Adding someone to your Wells Fargo account might seem straightforward, but understanding the nuances of joint accounts versus authorized users is crucial for a smooth process and to avoid potential complications.

This article provides a comprehensive guide on how to add someone to your Wells Fargo account, outlining the different options available and the steps involved in each. It also sheds light on the implications of each option, helping you make an informed decision that aligns with your specific needs and circumstances.

Joint Account vs. Authorized User

Before initiating the process, it's essential to understand the difference between adding someone as a joint account holder and designating them as an authorized user. The key distinction lies in the level of ownership and responsibility.

A joint account holder shares full ownership of the account and has equal rights to access and manage the funds. They are also equally responsible for any overdrafts or debts incurred on the account.

An authorized user, on the other hand, is granted permission to use the account, typically with a debit card, but does not own the account or bear responsibility for any debts.

Adding a Joint Account Holder

Adding a joint account holder to your Wells Fargo account typically requires both the existing account holder and the new joint account holder to be present at a Wells Fargo branch.

According to Wells Fargo customer service representatives, the process usually involves completing a new account application and providing identification documents for the new account holder. This includes a government-issued photo ID such as a driver's license or passport, and proof of address.

The new account holder will also need to provide their Social Security number or other tax identification information. Wells Fargo will then conduct a credit check on the new applicant before approving the addition to the account.

Step-by-Step Guide:

Step 1: Schedule an appointment at your local Wells Fargo branch. This ensures that a representative is available to assist you with the process.

Step 2: Gather the necessary documents. Both the existing account holder and the new joint account holder should bring valid photo IDs, proof of address, and the new account holder's Social Security number.

Step 3: Complete the joint account application. The Wells Fargo representative will guide you through the application process, which includes providing personal information and agreeing to the terms and conditions of the joint account.

Step 4: Review and sign the documents. Carefully review all the documents before signing to ensure that all information is accurate.

Adding an Authorized User

Adding an authorized user to your Wells Fargo account is generally a simpler process compared to adding a joint account holder. You can often do this online, by phone, or in person at a branch.

To add an authorized user, you will typically need to provide their name, date of birth, and address. Wells Fargo may also require their Social Security number for verification purposes.

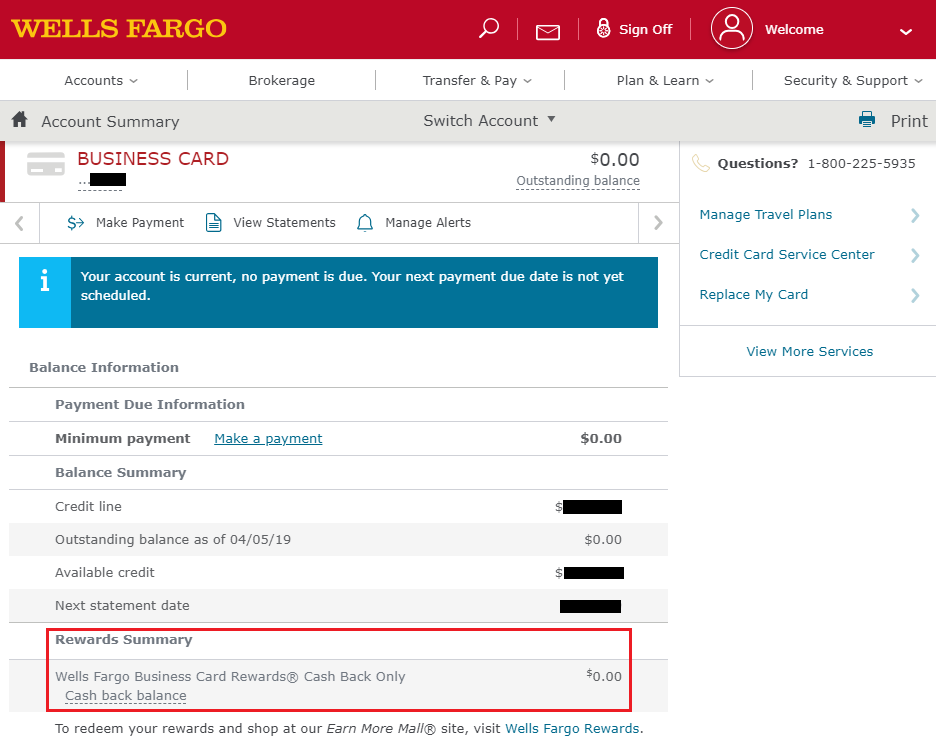

Once the authorized user is added, they will receive a debit card in their name that they can use to make purchases and withdraw cash from the account, within the limits set by the primary account holder.

Step-by-Step Guide:

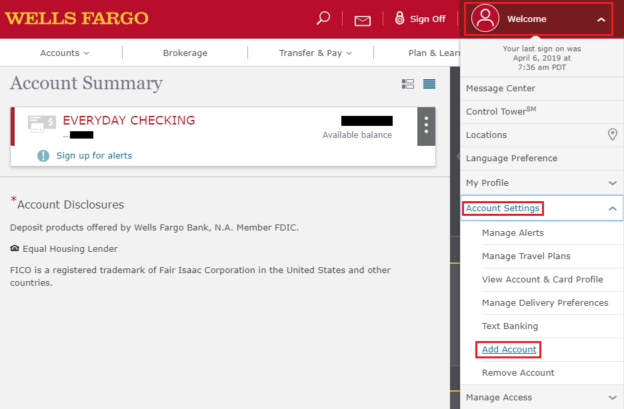

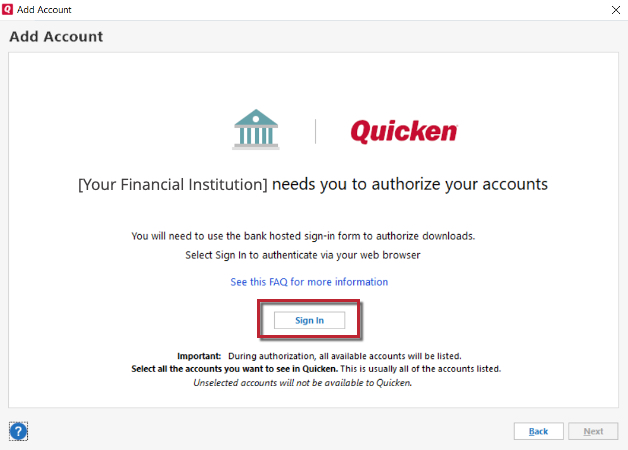

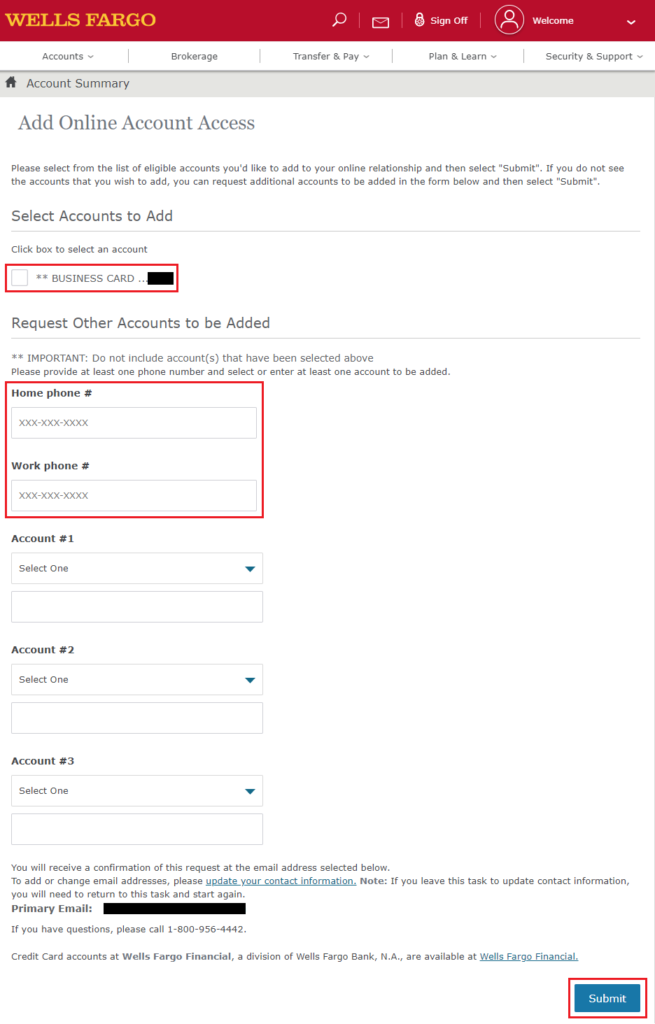

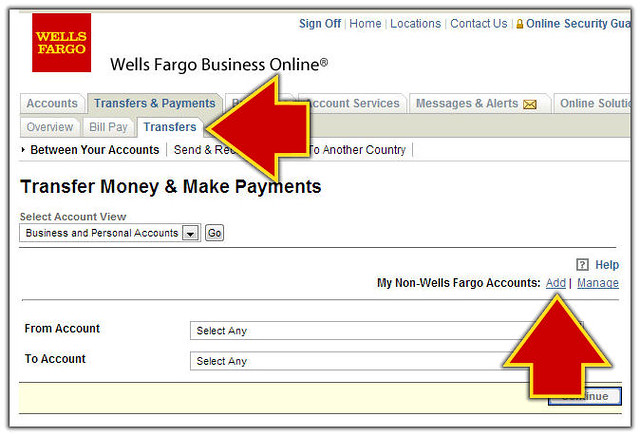

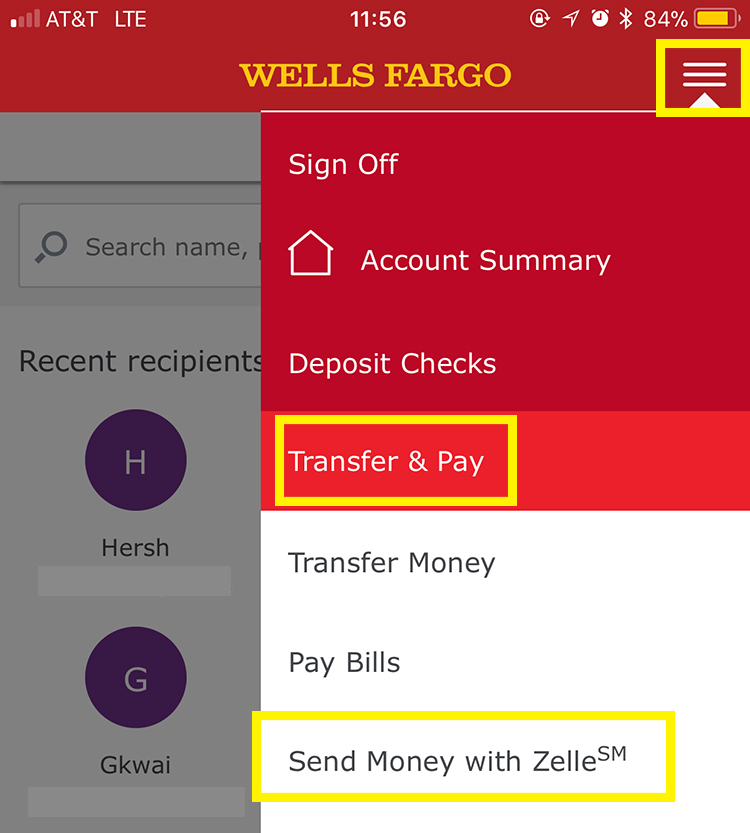

Step 1: Log in to your Wells Fargo online banking account or call Wells Fargo customer service.

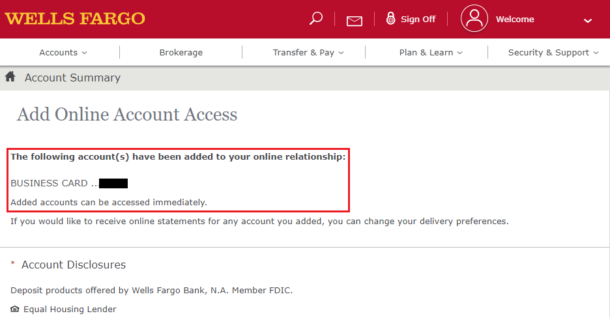

Step 2: Navigate to the "Account Services" or "Profile & Settings" section and look for the option to "Add Authorized User" or similar.

Step 3: Provide the required information for the authorized user, including their name, date of birth, and address.

Step 4: Review the terms and conditions and submit the request. The authorized user's debit card will typically be mailed to the primary account holder's address within a few business days.

Important Considerations

Before adding someone to your Wells Fargo account, it's crucial to carefully consider the implications. Adding a joint account holder grants them full access and responsibility for the account, while adding an authorized user provides them with limited access without ownership.

If you're adding a joint account holder, it's essential to have a high level of trust with that person, as they will have equal rights to manage the account and make withdrawals. It is also important to be aware of the potential impact on your credit score and liability for any debts incurred on the account.

For adding authorized user, establish clear spending limits and regularly monitor account activity to prevent unauthorized transactions.

Conclusion

Adding someone to your Wells Fargo account can be a convenient way to share access to funds or manage finances together. However, it's essential to understand the different options available and the implications of each before proceeding.

By carefully considering your needs and circumstances, and by following the steps outlined in this guide, you can make an informed decision that benefits all parties involved.