How Do You Pay Yourself If You Own An Llc

LLC owners face a crucial question: How do you actually get paid? Navigating the complexities of owner compensation is vital for financial health and legal compliance.

Understanding the nuances of LLC owner pay is essential for both financial security and adherence to legal requirements. This article breaks down the key methods available, helping you make informed decisions about your compensation strategy.

Member Draws: The Most Common Method

The most frequent way LLC owners compensate themselves is through member draws. These aren't salaries but rather distributions of the LLC's profits.

Member draws are typically not subject to payroll taxes. However, the owner is responsible for paying self-employment taxes (Social Security and Medicare) on their share of the company’s profits, regardless of whether those profits are taken as a draw.

Important: Keep meticulous records of all draws. Consult with a tax advisor to understand the specific tax implications for your situation.

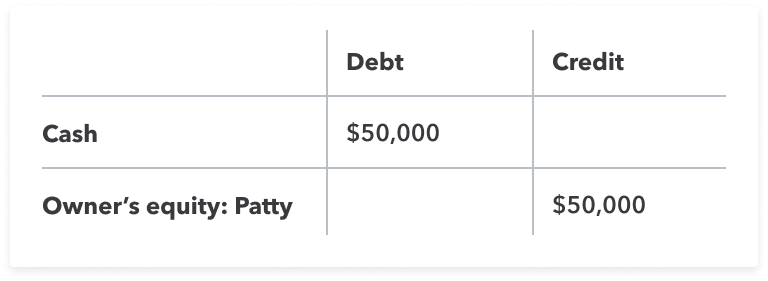

Setting Up a Member Draw System

Establish a consistent schedule for taking draws. Some owners take weekly, bi-weekly, or monthly draws, while others prefer quarterly distributions.

Carefully consider the LLC's cash flow before taking a draw. Avoid depleting the company's funds and ensure sufficient capital remains for operational needs.

Document the draw amounts and dates in your LLC's accounting records. This transparency is crucial for accurate financial reporting and tax compliance.

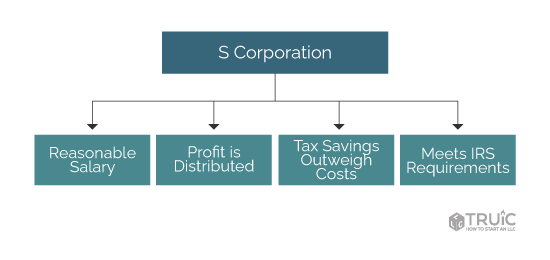

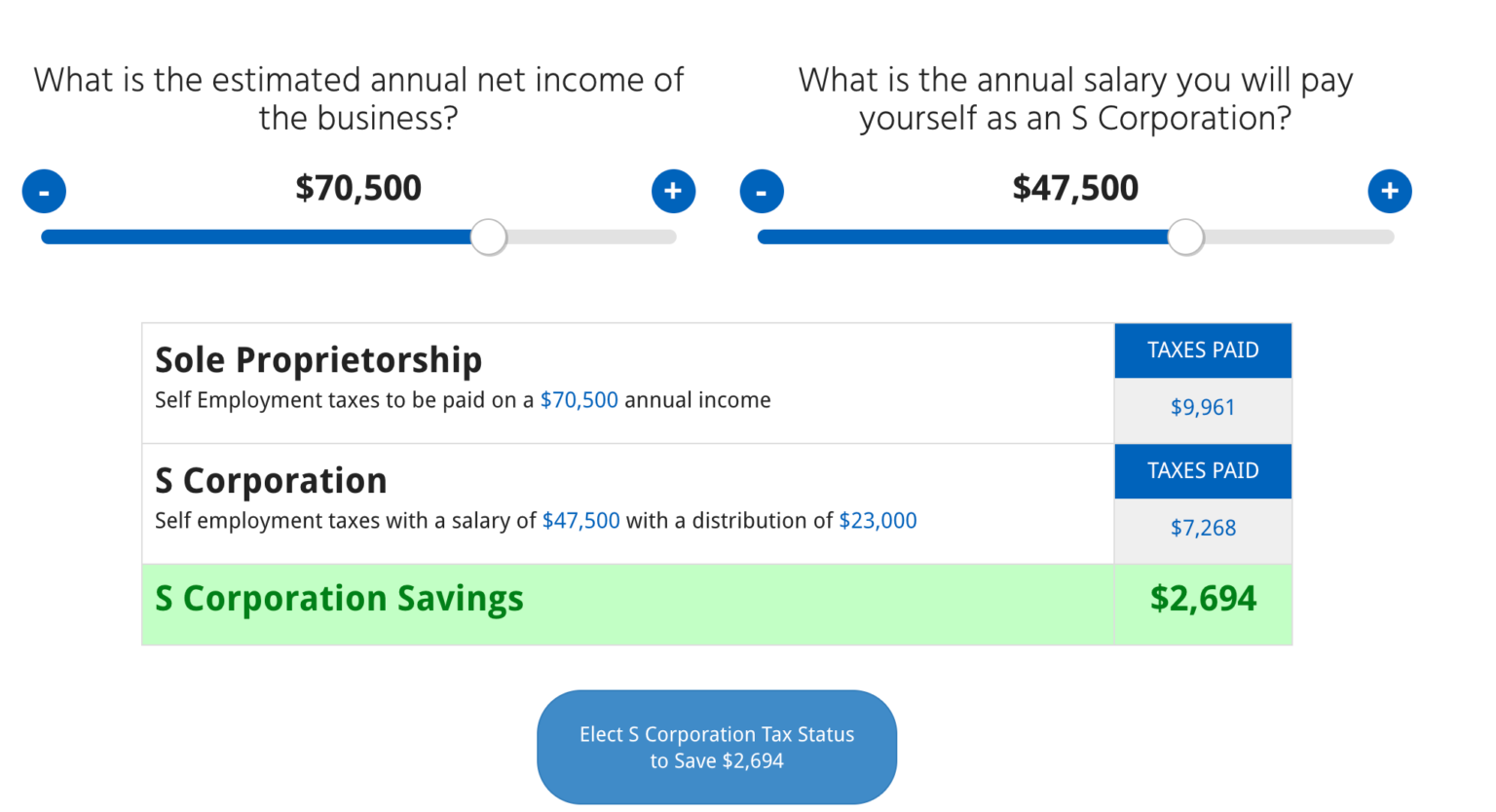

Salary (for S-Corp Electing LLCs)

LLCs that have elected to be taxed as an S-Corporation have another option: paying themselves a salary. This method requires running payroll.

When taking a salary, you're considered an employee of your own company. This means you'll be subject to payroll taxes, including Social Security, Medicare, and unemployment taxes.

The IRS requires that the salary be "reasonable," reflecting the services you provide to the business. An unreasonably low salary can raise red flags.

Benefits of a Salary

One advantage of taking a salary is that it can reduce your overall self-employment tax burden. You only pay self-employment taxes on the salary portion.

A salary can also simplify certain aspects of personal finance, such as qualifying for mortgages or loans. Lenders often prefer consistent salary income.

Setting up payroll can be complex. Consider using payroll software or hiring a payroll service provider to ensure accurate tax withholdings and filings.

Guaranteed Payments (for Partnerships)

While less common for single-member LLCs, guaranteed payments are relevant for multi-member LLCs taxed as partnerships. These are payments to a partner for services or capital contributions.

Guaranteed payments are treated as ordinary income to the partner. The LLC can deduct these payments as business expenses.

Even though guaranteed payments are not subject to self-employment tax at the LLC level, the partners still pay self-employment tax on their distributive share of partnership income. Consult a tax professional to determine the implications for your specific partnership structure.

Tax Implications and Compliance

Regardless of the payment method, accurate record-keeping is paramount. Track all income and expenses meticulously.

Consult with a qualified tax advisor or accountant. They can help you choose the most advantageous compensation strategy for your LLC and ensure you comply with all applicable tax laws.

Failing to properly manage your LLC's finances can lead to penalties and legal issues. Proactive planning and professional guidance are essential.

What's Next? Prioritize understanding your LLC's specific needs and consulting with financial professionals. This will allow you to make informed decisions that safeguard your business and personal finances. Stay informed about changes in tax laws and regulations that may affect your compensation strategy.